When it comes to maintaining smooth business operations, having the right tax information from your suppliers is crucial. A simple request for this information can help ensure compliance and avoid any unexpected complications down the road. In this article, we'll guide you through crafting the perfect letter template to request tax information from your suppliers in a polite and efficient manner. Curious to learn how to make this process seamless? Read on!

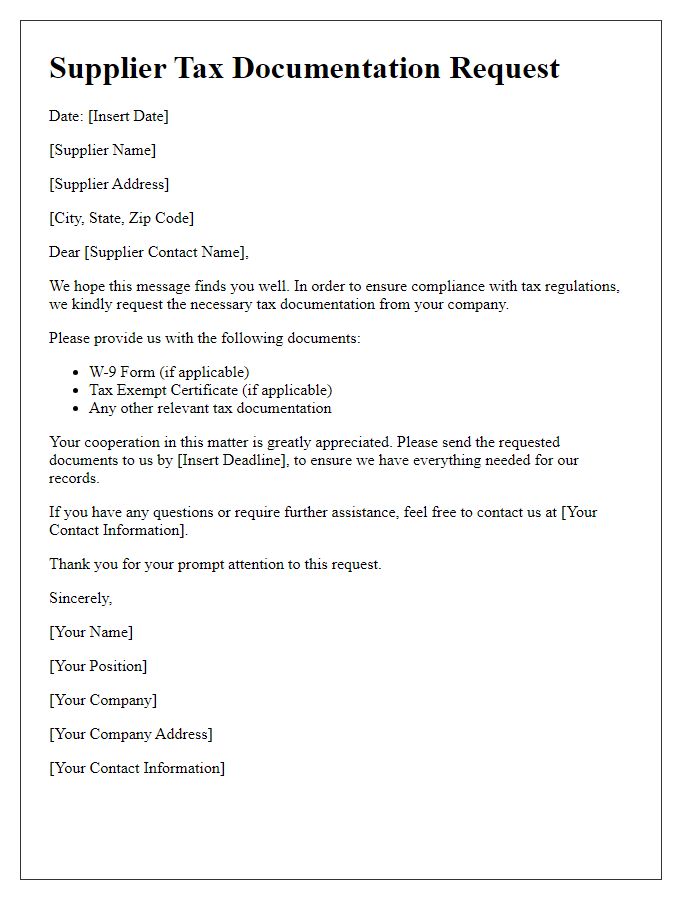

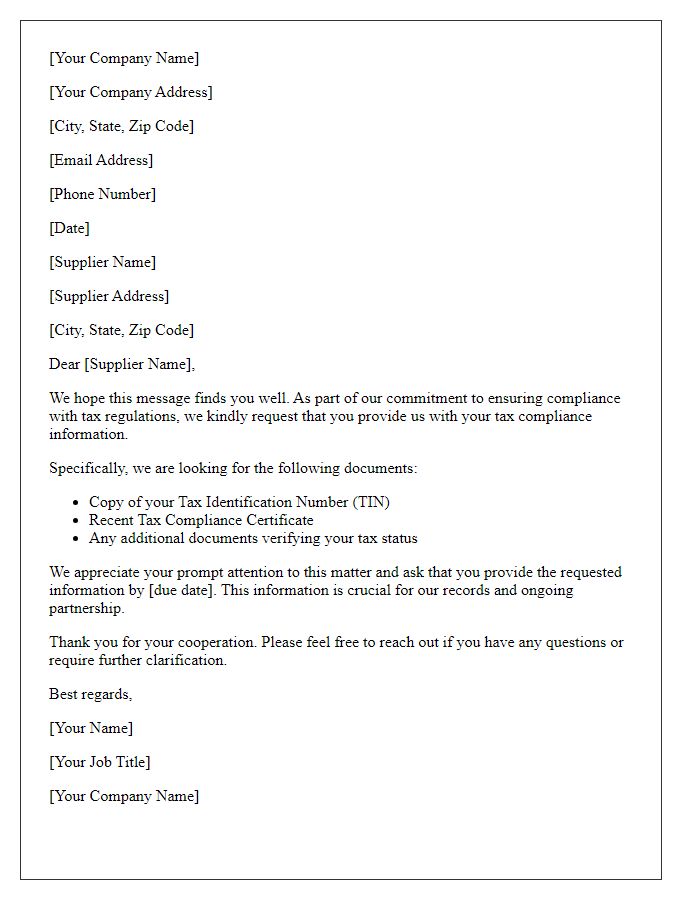

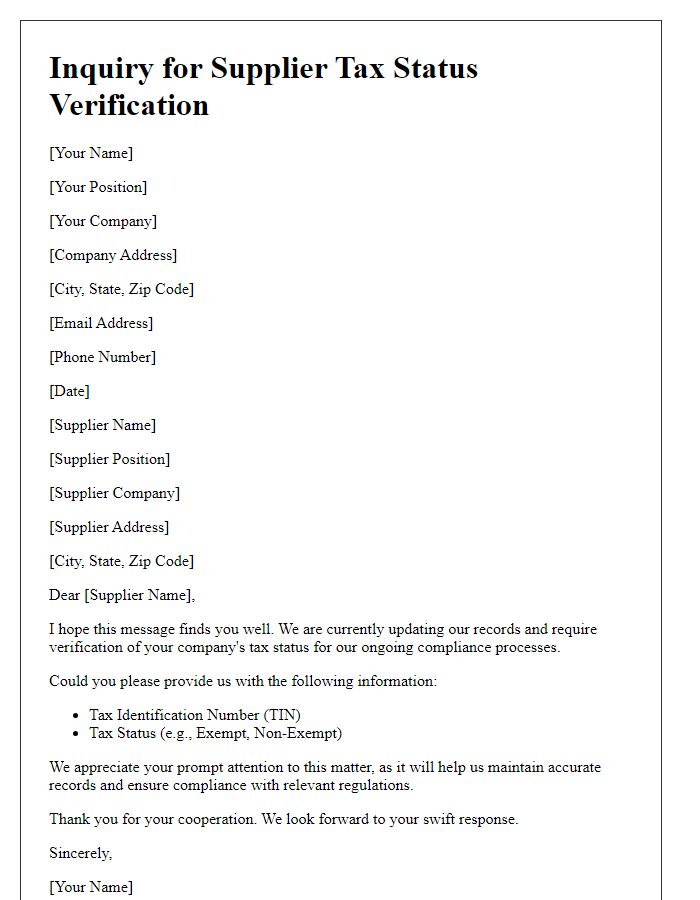

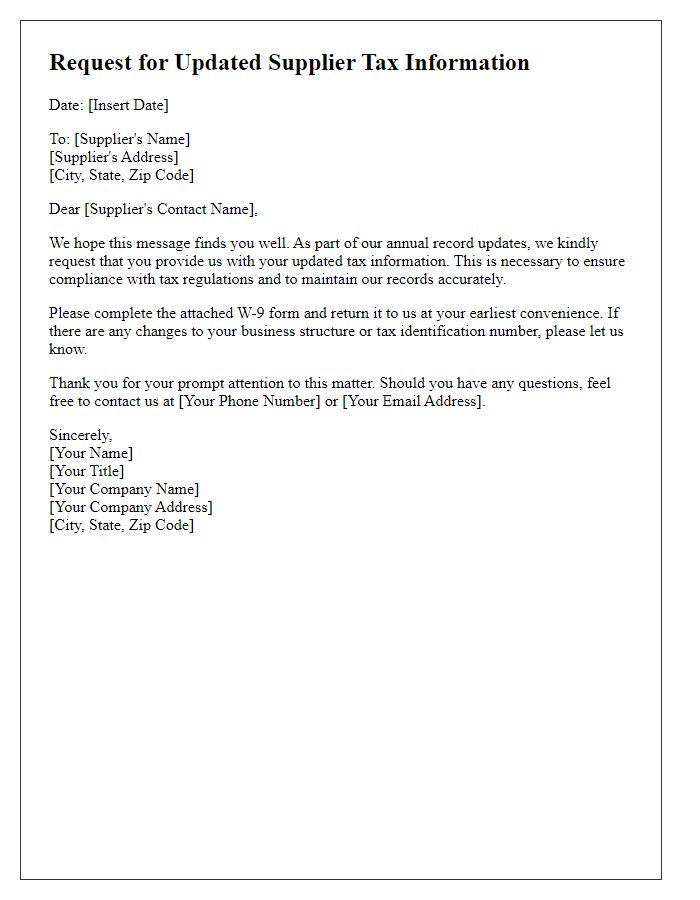

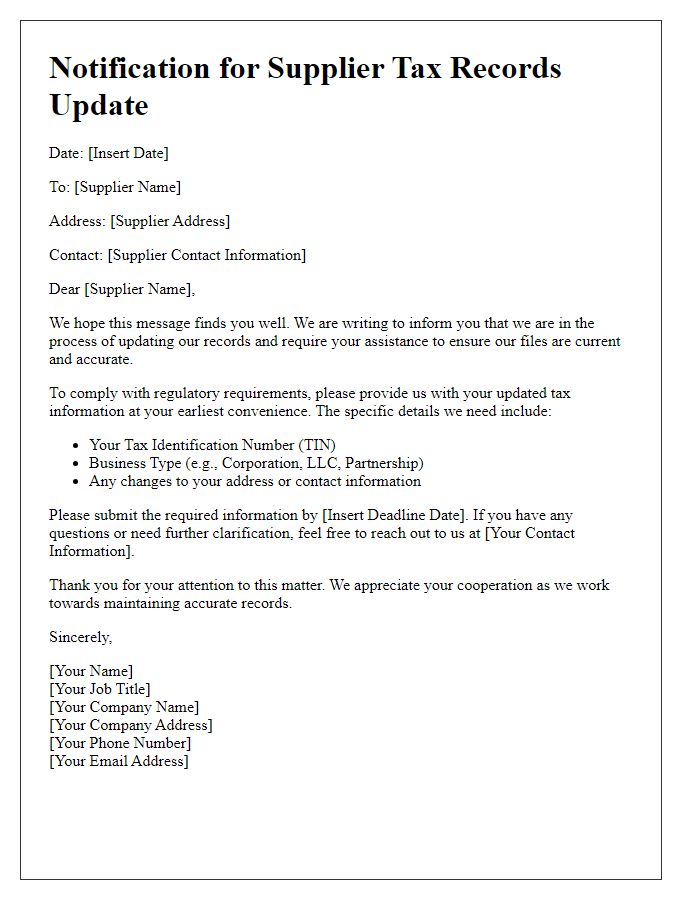

Supplier's Contact Information

Suppliers must provide accurate contact information for tax purposes. This includes the supplier's full legal name, registered address, and primary contact person's name. Important tax identification numbers, such as Employer Identification Number (EIN) or Unique Taxpayer Reference (UTR), should also be included. Additionally, current email addresses and phone numbers for direct communication enable efficient handling of queries related to tax documentation, ensuring compliance with regulations in jurisdictions such as the United States or the United Kingdom. Properly documented supplier contact information supports accurate tax reporting and minimizes the risk of penalties due to misinformation.

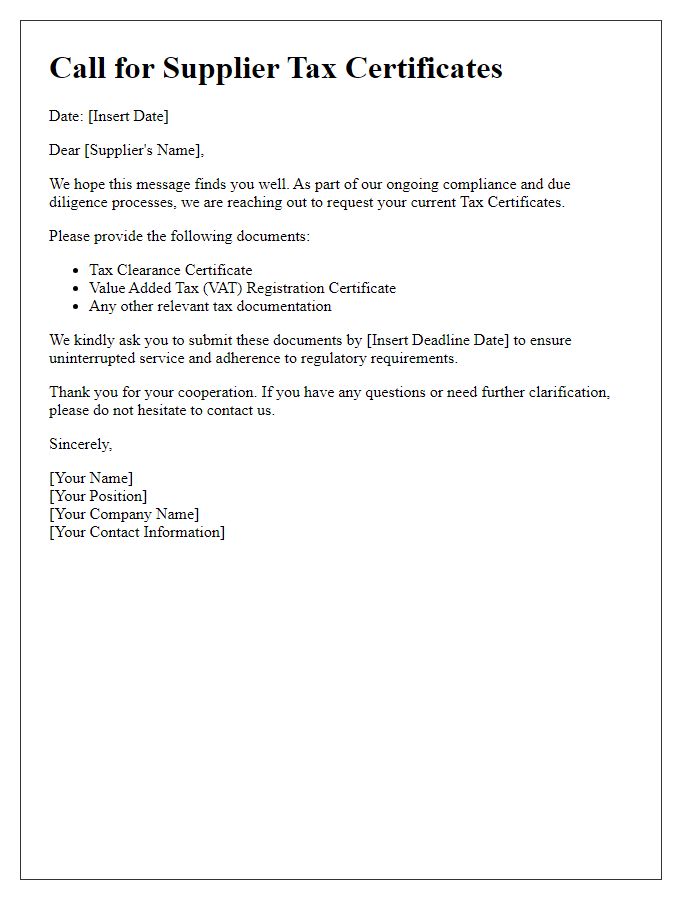

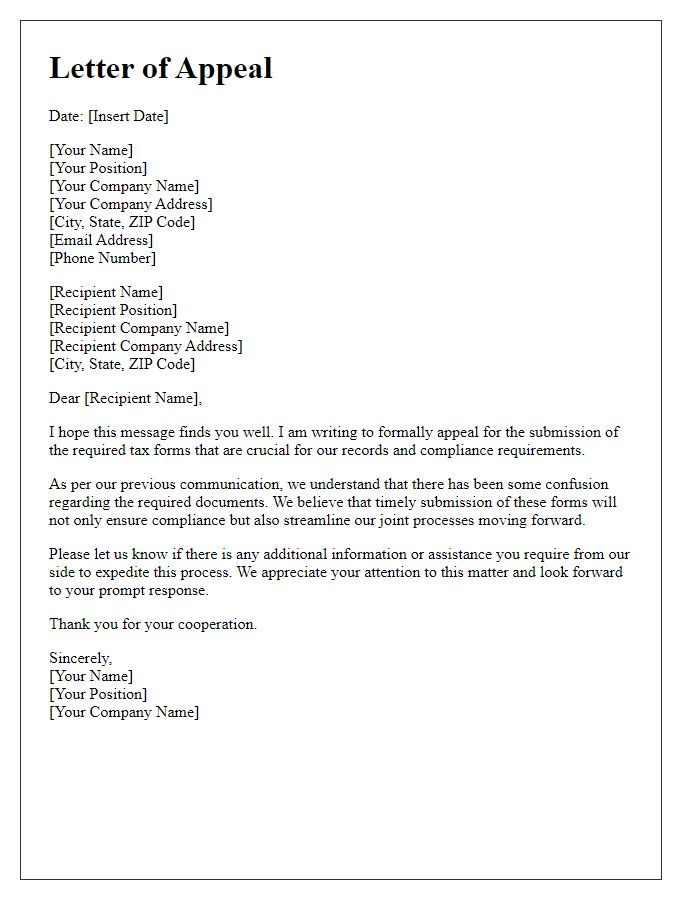

Purpose of Request Statement

Requesting vital supplier tax information ensures compliance with financial regulations. Accurate tax information, such as Employer Identification Numbers (EIN) or Taxpayer Identification Numbers (TIN), is essential for IRS reporting in the United States. This information facilitates proper documentation for audit trails and enables smooth processing of transactions, preventing potential penalties. Ensuring that suppliers, whether small businesses or large corporations, provide updated and correct tax information helps maintain transparency in financial dealings. This proactive approach not only safeguards the organization against tax-related issues but also fosters a trustworthy supplier relationship.

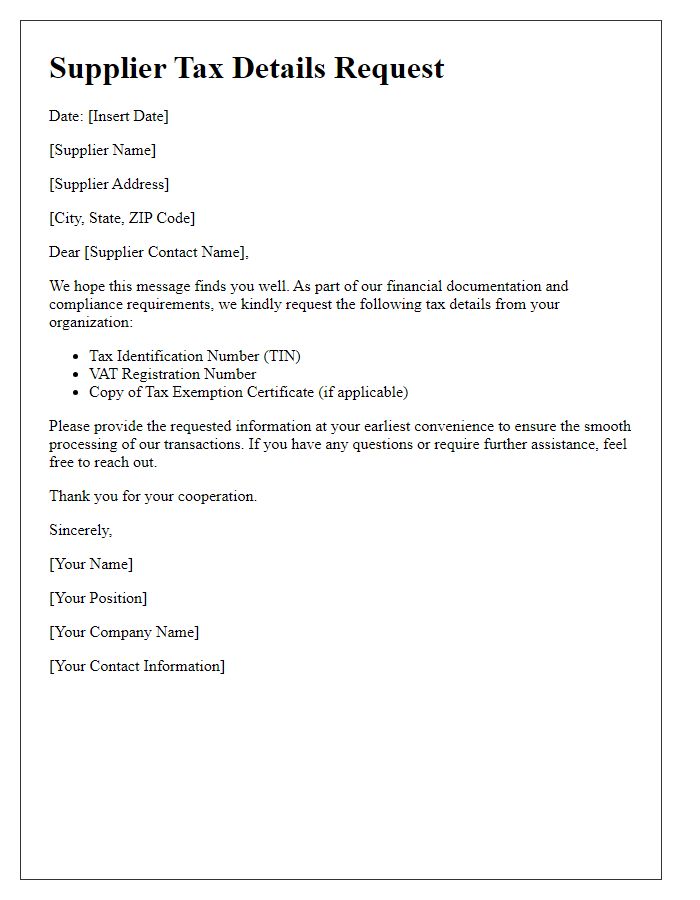

Specific Tax Information Required

Suppliers often need to provide specific tax information, such as Tax Identification Numbers (TIN) and certifications of tax status. Accurate documentation, like W-9 forms for U.S. suppliers, ensures compliance with Internal Revenue Service (IRS) regulations. This information assists companies in reporting payments correctly at the end of the fiscal year. Tax-related inquiries should highlight deadlines, like the IRS tax filing date of April 15, affecting timely and accurate processing of supplier transactions. Regular updates and verification of suppliers' tax information are essential to maintain compliance and reduce potential penalties for tax misreporting.

Deadline for Submission

A supplier tax information request involves gathering necessary documentation from vendors to ensure compliance with local tax regulations. Key documents may include W-9 forms, tax identification numbers, and proof of tax-exempt status. The deadline for submission is typically set in accordance with the fiscal year-end, often around December 31st, to facilitate timely processing by accounting departments. This deadline allows for verification and integration of the tax data into financial systems prior to annual reporting, ensuring compliance with the Internal Revenue Service (IRS) regulations. Proper compliance helps avoid fines and promotes transparency in business transactions.

Contact Details for Further Inquiries

Supplier tax information requests often require precise details to ensure compliance and efficient processing. Key elements include the supplier's name (for example, ABC Supplies LLC), address (such as 123 Main Street, Anytown, USA), Tax Identification Number (TIN), and contact information. Essential contacts may include the tax compliance officer or finance representative, including their phone number (e.g., +1-555-123-4567) and email address (e.g., finance@abcsupplies.com). Responses should specify any required documents, such as W-9 forms or tax exemption certificates, which facilitate transparency and accountability in financial transactions. Detailed inquiries enhance accuracy and foster ongoing collaboration between businesses.

Comments