Are you struggling with recovering outstanding debts from your suppliers? It's a common challenge in the business world, but with the right strategies and a solid recovery plan, you can turn things around. This article will walk you through crafting an effective letter template specifically designed for bad debt recovery, ensuring you maintain professionalism while asserting your needs. Ready to take charge of your finances? Let's dive in!

Clear Identification of Debt

A well-structured debt recovery plan should begin with a clear identification of the debt, including the total amount owed, invoice numbers, and the specific dates of transactions. The amount may include principal debt and any applicable interest or late fees, reflecting a comprehensive total for the supplier. Invoice numbers corresponding to each transaction, such as INVOICE#12345 and INVOICE#67890, will help trace the debts accurately. Payment due dates, notably the past due date of March 15, 2023, and any previous payment arrangements or communications can establish a timeline of the debt status. A straightforward account of the contractual agreements, including terms of payment, and any breaches thereof will illuminate the reasons behind the outstanding debt. Documenting this critical information creates a robust foundation for pursuing recovery measures effectively.

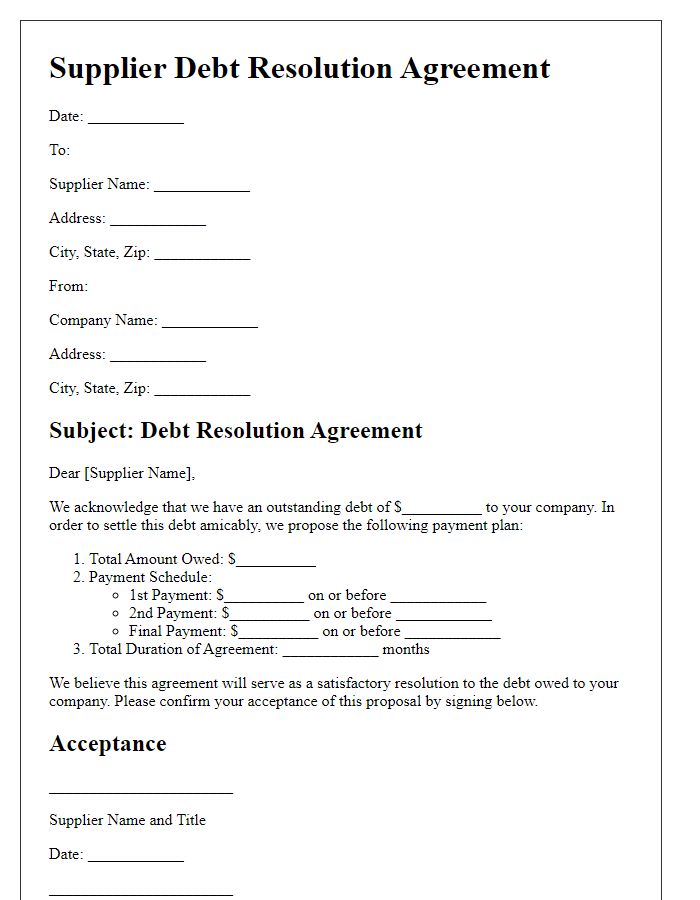

Proposed Repayment Terms

A bad debt recovery plan can significantly improve financial stability for businesses, particularly in the manufacturing sector where raw materials are often supplied on credit. In industries such as construction, companies frequently face challenges with overdue invoices, often exceeding 30 days past due. The proposed repayment terms may involve structured payments over a six-month period, allowing the debtor to repay their outstanding debt of $50,000 in equal monthly installments of $8,333. Additional terms could include a 2% discount for early repayment and a formula for adjusting the payment schedule based upon cash flow projections. Clear communication and documentation are essential, with a formal agreement outlining the repayment terms signed by both parties to ensure accountability.

Consequences of Non-Payment

Non-payment from suppliers can lead to significant consequences impacting business operations. The company's credit rating may decline, resulting in higher interest rates on future loans or difficulty securing financing. Relationships with suppliers can deteriorate, leading to reduced trust and potential disruptions in the supply chain. Legal actions may be pursued to recover debts, incurring additional costs in legal fees and court litigation. Cash flow issues may emerge, limiting the ability to invest in growth opportunities, innovation, or meet operational expenses effectively. Ultimately, persistent non-payment can jeopardize long-term sustainability, threatening the overall viability of the business.

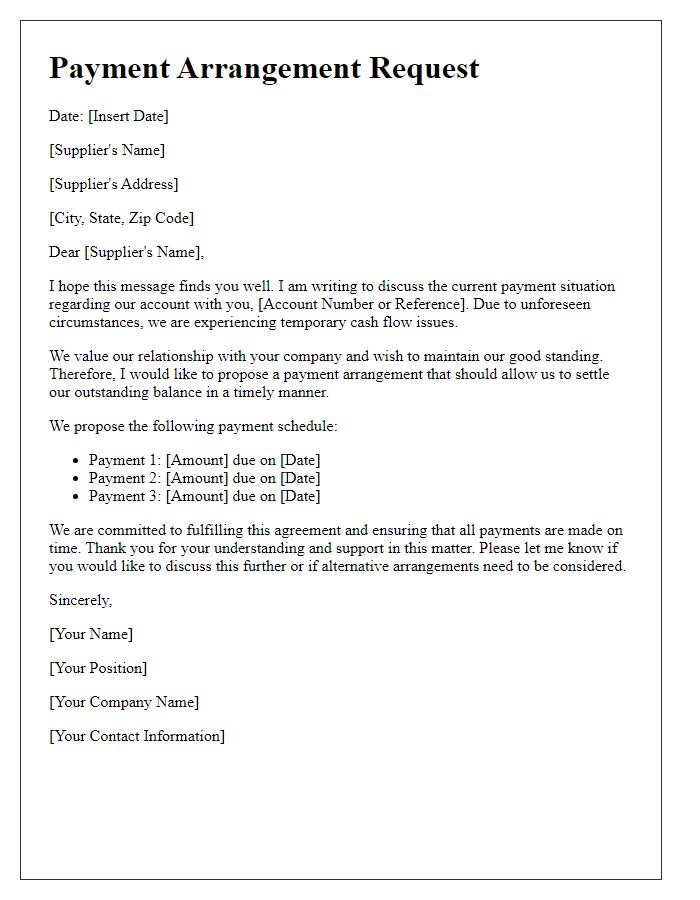

Contact Information for Queries

Supplier bad debt recovery plans significantly impact financial management strategies, especially in competitive industries. These plans require clear lines of communication for addressing queries, which may arise during recovery efforts. Essential contact information should include the name of the designated recovery officer, direct phone number (preferably a local area code), and a dedicated email address to facilitate timely correspondence. Including business hours for availability ensures prompt responses. Additionally, providing a physical mailing address adds an extra layer of professionalism, allowing for formal correspondence when necessary. Ensuring that stakeholders understand this contact information fosters transparency and aids in the recovery process.

Final Acknowledgment and Request for Compliance

In the competitive landscape of finance, comprehensive bad debt recovery plans are essential for managing supplier relationships effectively. A well-structured recovery plan outlines specific measures to address outstanding balances, typically aimed at resolving debts accrued over 30 days. This may involve scheduled communication, setting clear deadlines for payment, and implementing flexible repayment options tailored to the supplier's financial status. Furthermore, adherence to local regulations concerning debt recovery, which vary by region (for example, the Fair Debt Collection Practices Act in the United States), is crucial. Engaging with legal advisors ensures that recovery tactics remain compliant and ethically sound. Ultimately, a proactive approach fosters positive relationships while efficiently recovering owed funds.

Comments