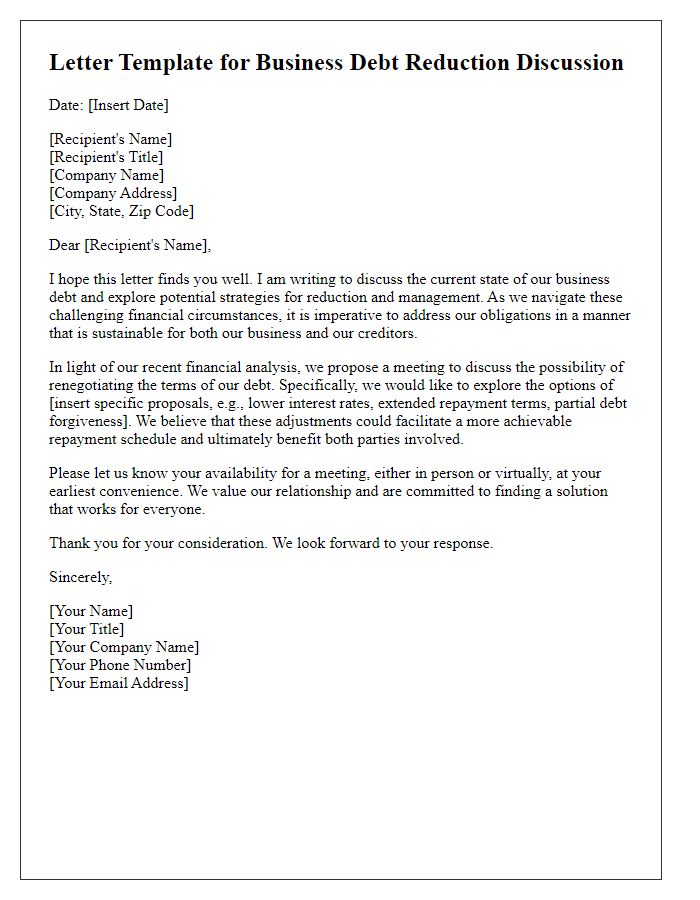

Are you finding yourself in a challenging situation with business debt and unsure of how to approach your creditors? Negotiating a repayment plan can feel daunting, but it doesn't have to be. With the right letter template, you can communicate your intentions clearly and professionally, opening the door to a more manageable solution. Let's dive into the essential elements of drafting a compelling letter that can help you navigate your negotiation process effectively.

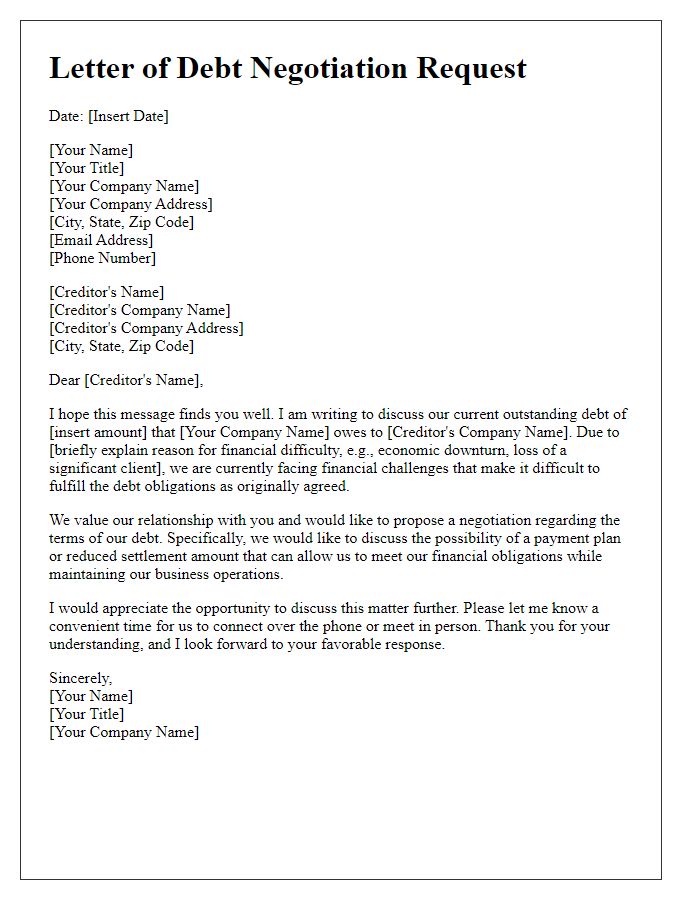

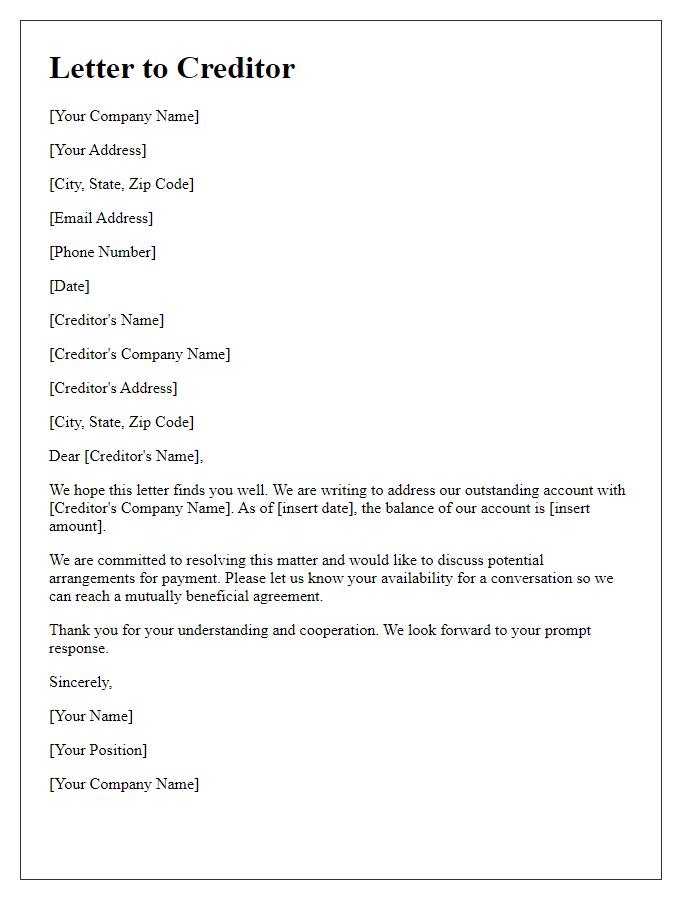

Clear identification of debtor and creditor

A clear identification of the debtor and creditor is essential in any business debt repayment negotiation. The debtor, typically an entity like ABC Corporation, located at 123 Main Street, Suite 400, Cityville, State, ZIP, operates within the manufacturing sector, providing specialized machinery. The creditor, XYZ Financial Services, situated at 456 Investment Avenue, Financial District, Cityville, State, ZIP, specializes in corporate financing, with a portfolio that includes various small to medium-sized enterprises (SMEs). Establishing these identity details ensures that all parties involved have a mutual understanding of the responsibilities and obligations that exist within the context of the financial agreement, helping to facilitate a smoother negotiation process.

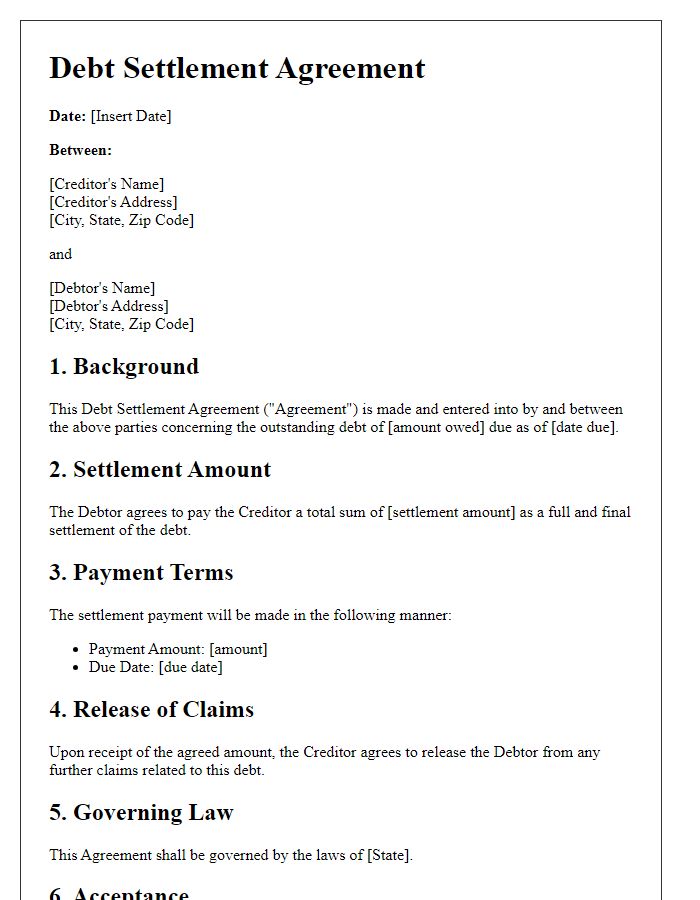

Current outstanding debt details

Current outstanding debt details reveal a total of $50,000 owed to XYZ Corporation, stemming from invoices dated between January 2022 and September 2023. These invoices represent services rendered, including consulting and project management fees related to the implementation of software systems in various departments. The payment terms originally stipulated a net 30-day period, with late fees accruing at 1.5% monthly after the due date. As of now, balances range from $1,000 to $10,000 across five separate invoices, two of which are over 90 days past due. Recent financial challenges, including decreased client acquisition and market fluctuations, have impacted cash flow, prompting the need for negotiation regarding favorable repayment terms.

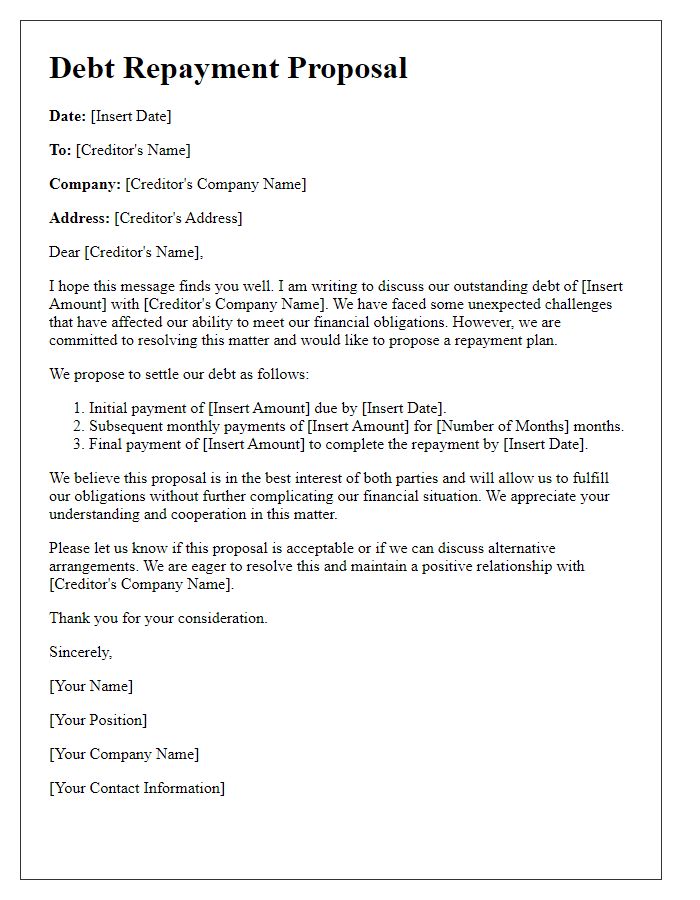

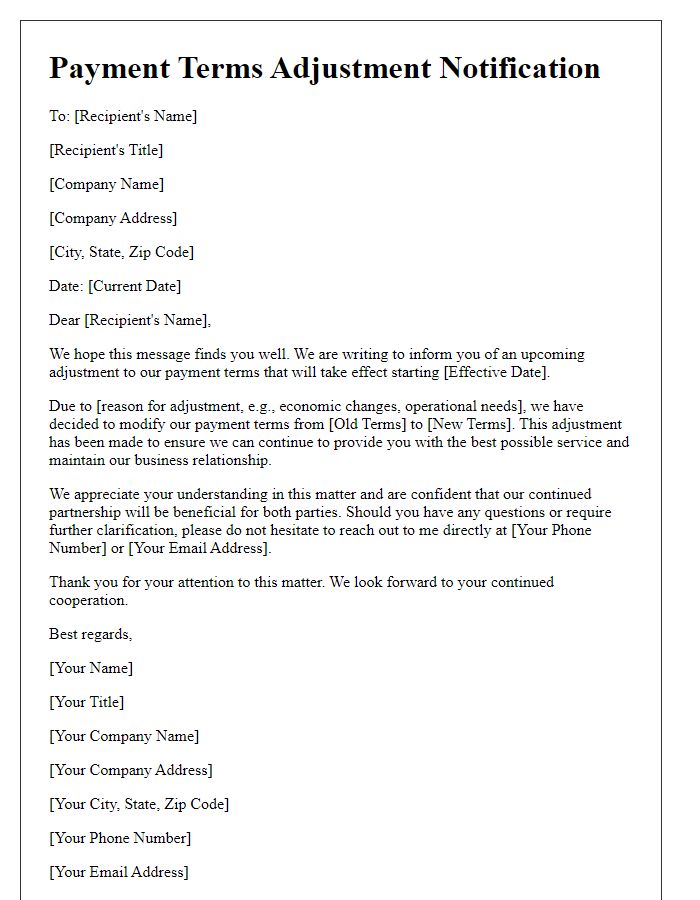

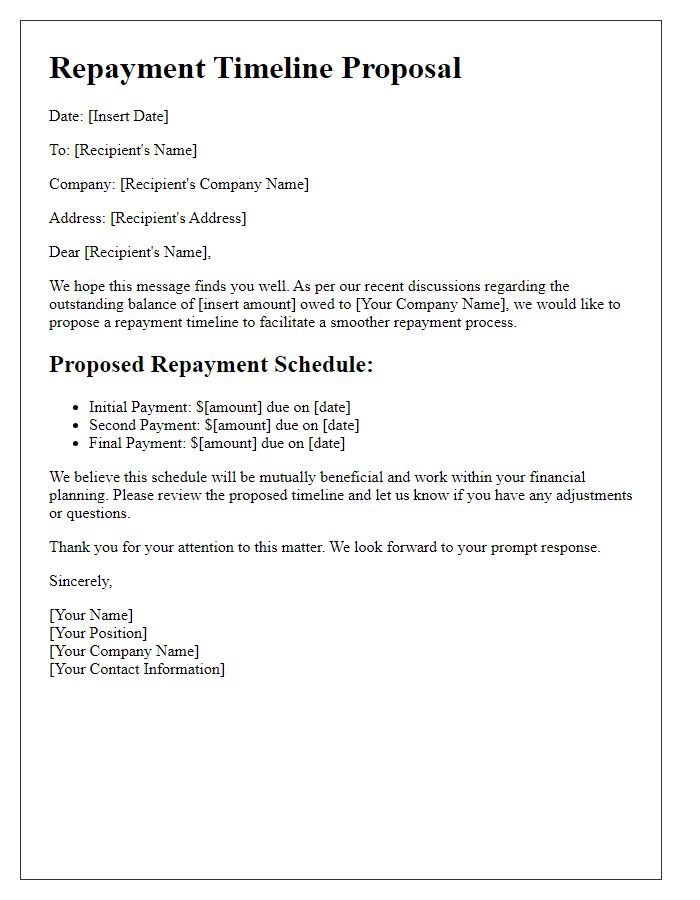

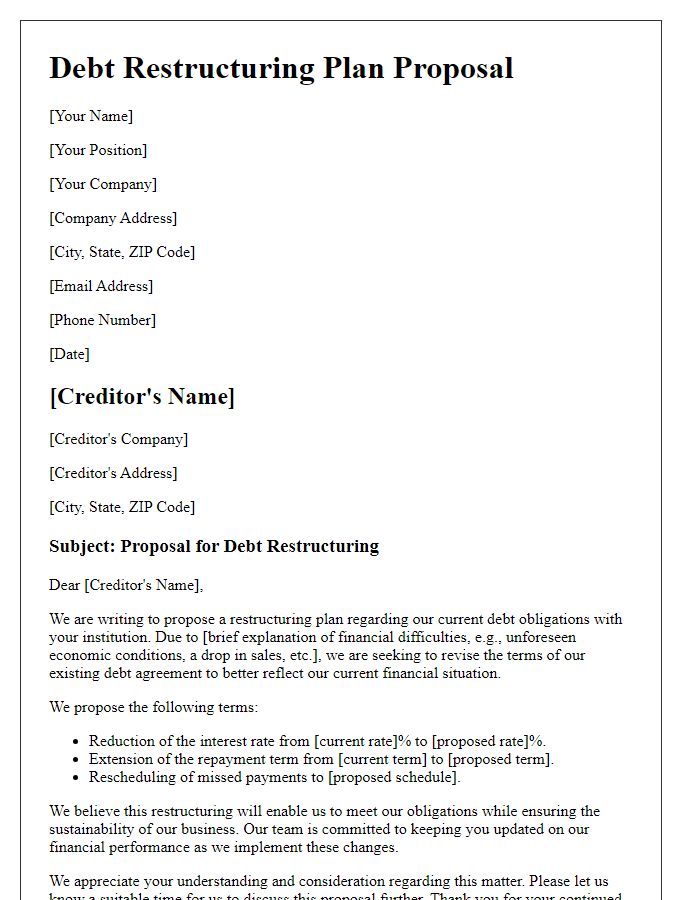

Proposed repayment terms and timeline

Business debt repayment negotiations often require clear communication regarding proposed terms and timelines. Structured repayment plans typically encompass detailed elements such as principal amounts, interest rates, and duration of repayment. For instance, a proposal might suggest a payment of $5,000 monthly over a period of 12 months to clear a total debt of $60,000, underpinning the importance of a mutually agreeable interest rate, which could be set at 5% annually. Additionally, stipulated timelines are crucial for both parties, possibly outlining an initial payment due within 30 days of agreement, with subsequent monthly installments clearly defined to ensure accountability. Establishing points of contact and documenting the entire negotiation process is essential for transparency and better legal compliance.

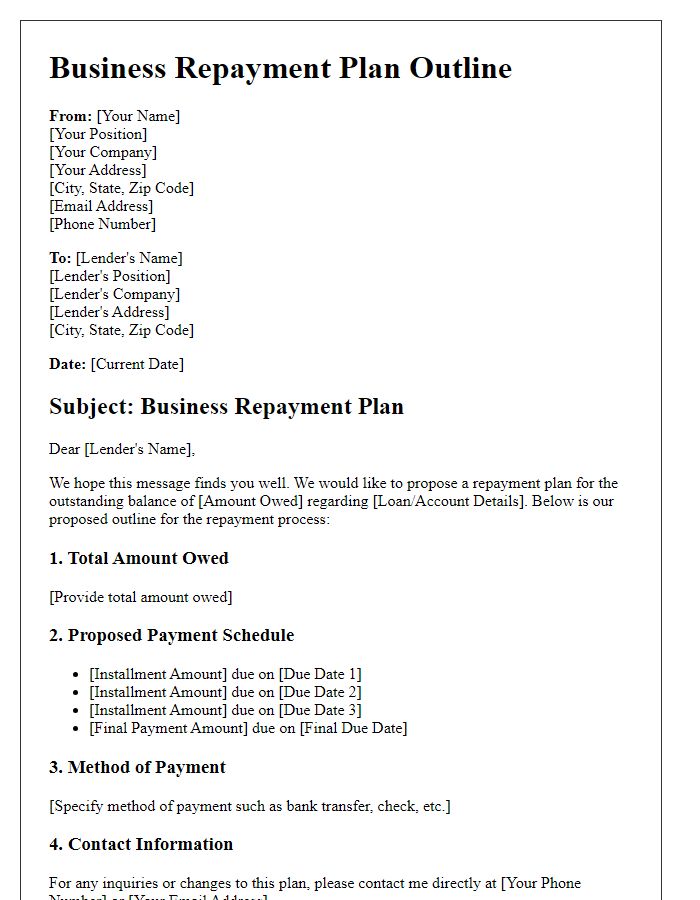

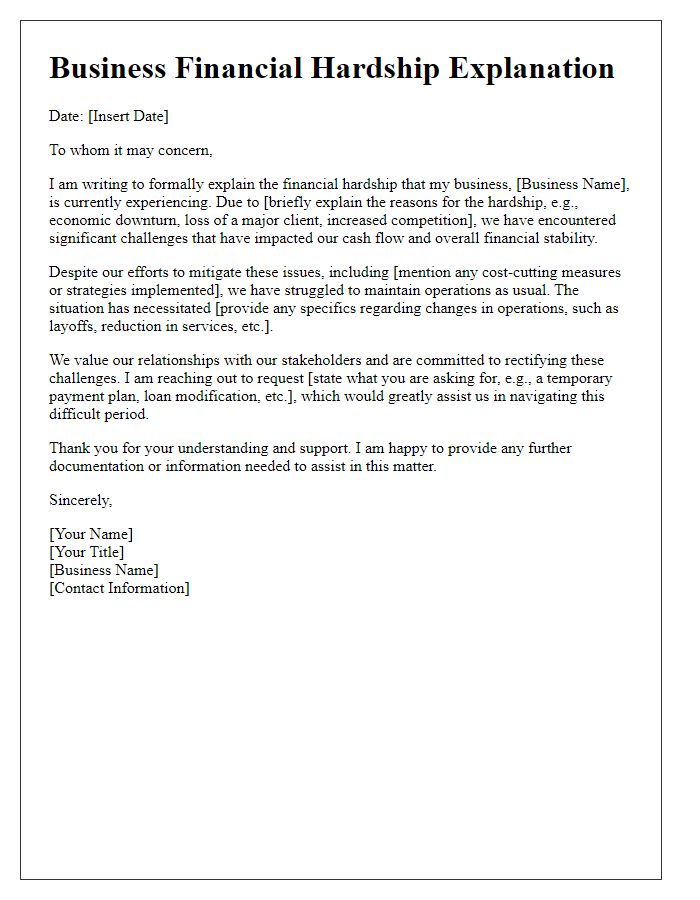

Justification for revised terms

Businesses facing financial challenges often seek negotiated terms for debt repayment. Establishing a revised payment structure can ensure sustainability while safeguarding relationships with creditors. Factors influencing justification include current cash flow discrepancies, unforeseen operational costs, and market fluctuations impacting revenue. For instance, a company may cite a 25% decline in sales due to a recessionary period impacting economic activity. Additionally, pointing out fixed expenses such as rent and salaries, which continue unabated, underscores the need for flexibility. Concrete proposals may include extended repayment periods, reduced interest rates, or customizable payment schedules, aimed at fostering long-term viability for both the business and the creditor. These strategies enhance the likelihood of successful negotiations, ultimately promoting mutual interest in the repayment process.

Contact information for further discussion

Business debt repayment negotiations require clear communication and understanding of terms. A collaborative approach can facilitate productive discussions between involved parties. Key elements include detailed contact information--such as names, phone numbers, and email addresses--ensuring accessibility for follow-up conversations. Additionally, specifying a preferred time for contact increases the likelihood of prompt responses. Providing relevant documentation related to the debt, including original agreements, payment history, and any amendments can bolster the negotiation process, enhancing clarity and trust between creditors and debtors. Establishing a friendly yet professional tone encourages cooperation and mutual benefits in resolving outstanding balances.

Comments