Are you gearing up to negotiate payment terms with your subcontractor? It can be a tricky process, but with the right approach, you can ensure that both parties feel valued and informed. Understanding the nuances of payment schedules, invoicing clarity, and potential adjustments can streamline your collaboration and foster a positive relationship. Ready to dive into the essential tips and strategies? Let's explore how to effectively navigate this vital aspect of your project!

Clear payment schedule

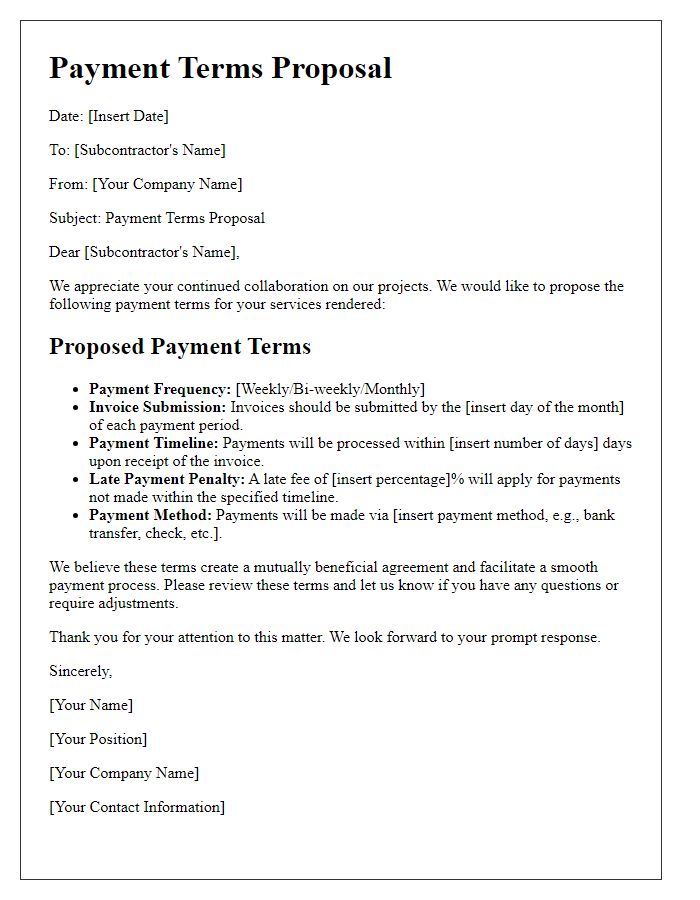

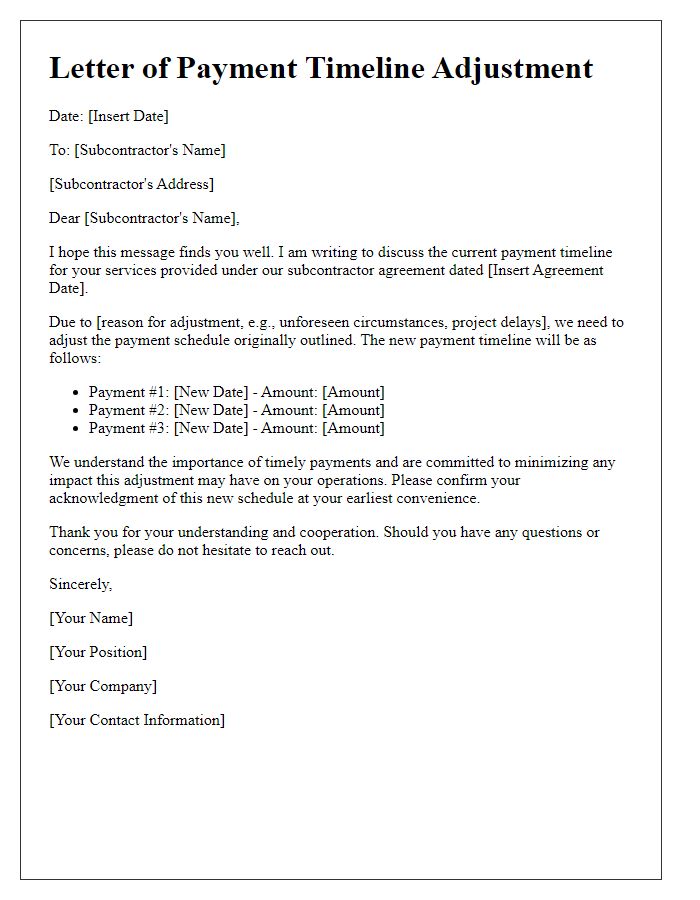

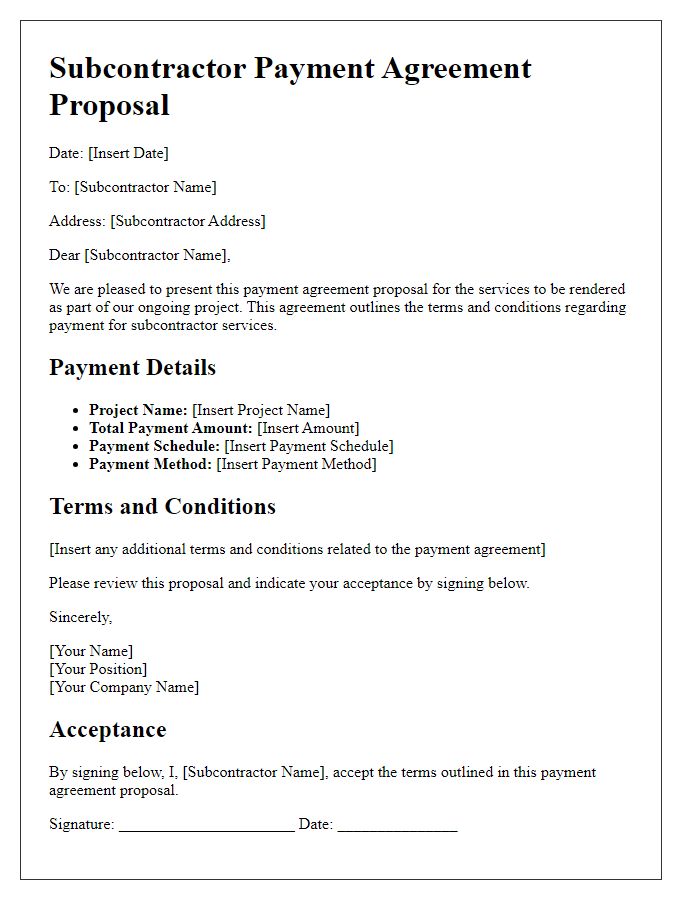

Negotiating payment terms with subcontractors is essential for ensuring smooth cash flow and project completion. Establishing a clear payment schedule helps define expectations for both parties. Payment milestones may be set based on project phases, such as completion of design, structural work, or final inspection. For instance, a 20% payment may be due upon completion of the design phase, followed by 30% after framing, and the remaining balance upon project completion. Milestone dates should be aligned with project timelines to avoid delays. Including details such as stipulated payment methods, invoicing procedures, and potential penalties for late payments ensures transparency. Creating a clear payment schedule fosters a collaborative working relationship, establishing trust and accountability between the contractor and subcontractor.

Defined scope of work

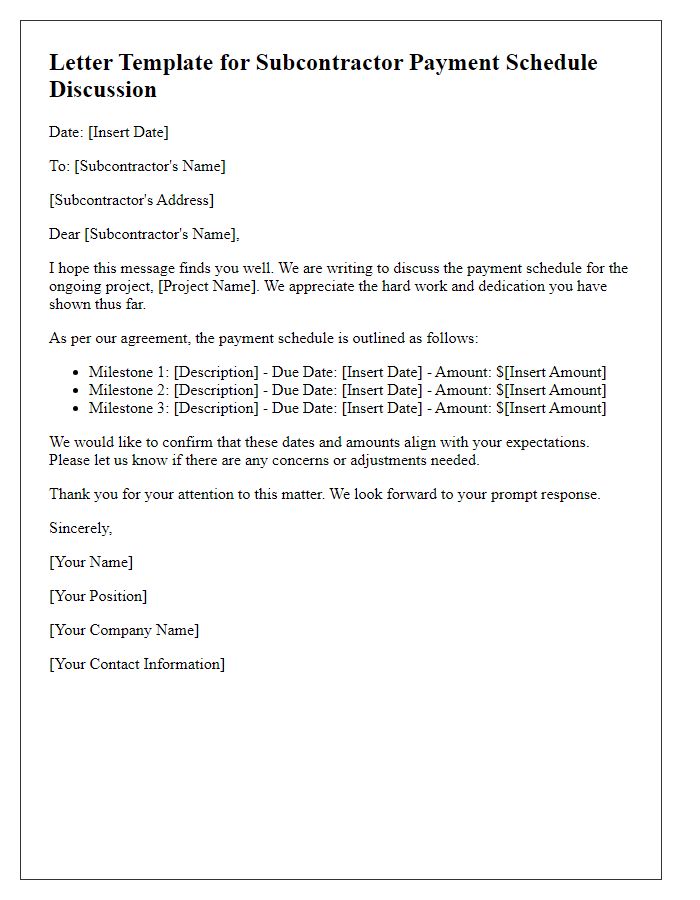

In a subcontractor payment terms negotiation, clearly defined scope of work (SOW) is crucial for establishing expectations and responsibilities. The SOW typically includes deliverables, timelines, specific tasks (such as installation or fabrication), and quality standards, which ensure all parties are aligned. For instance, a construction project at a recognized site like the Grand Central Terminal in New York City may involve intricate tasks such as electrical wiring or structural reinforcement. Payment terms might then include schedule milestones linked to completed phases of work, ensuring payment occurs upon the satisfactory completion of defined tasks. Utilizing a detailed SOW helps mitigate misunderstandings, fosters transparency, and creates a solid foundation for financial agreements, benefiting both the primary contractor and the subcontractor in projects across diverse industries.

Penalties for late payment

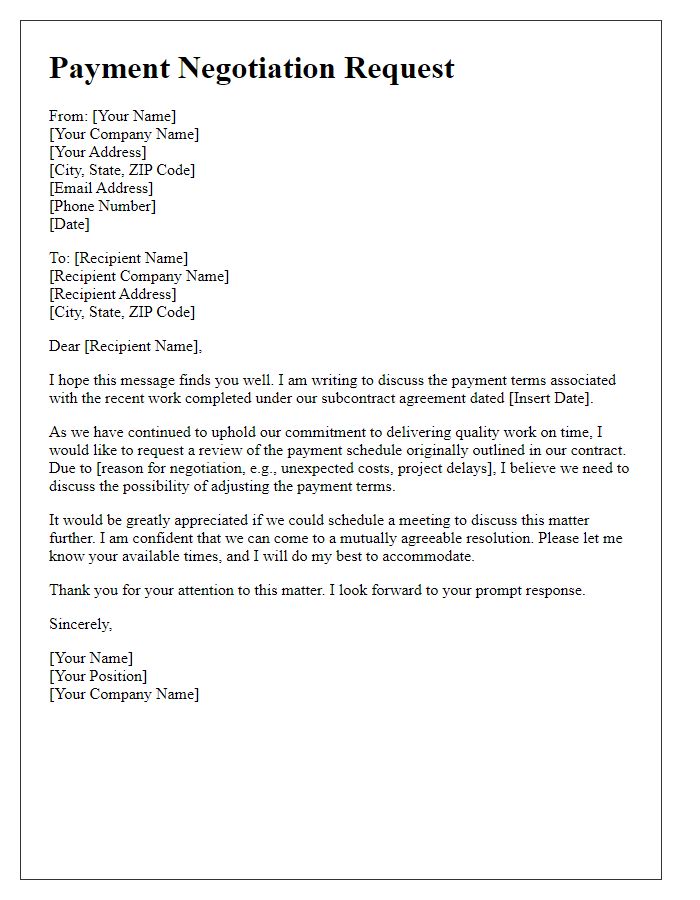

In subcontractor agreements, late payments can lead to significant penalties. Standard penalties may include a predetermined percentage (often 1.5% per month) charged on overdue amounts, which becomes due after the agreed payment period (commonly 30 days post-invoice date). These penalties serve to incentivize prompt payment, ensuring that subcontractors maintain cash flow for ongoing projects. Additionally, late penalties can also include the suspension of work until payments are settled, impacting project timelines and deliverables. It's essential for both parties to clearly define and agree upon these terms to minimize disputes and ensure compliance throughout the contract's duration.

Discount for early payment

Negotiating subcontractor payment terms can optimize cash flow for both parties. Offering a discount for early payment can incentivize prompt payments. Common structures include a 2% discount if paid within 10 days, applicable to contracts over $10,000, fostering financial fluidity. This arrangement can improve relationships, ensuring timely project progression. Additionally, clear communication of payment timelines, such as net 30, enhances transparency. Collaboration on these terms can lead to mutually beneficial agreements while minimizing late payment penalties, ultimately promoting stability in project execution.

Dispute resolution process

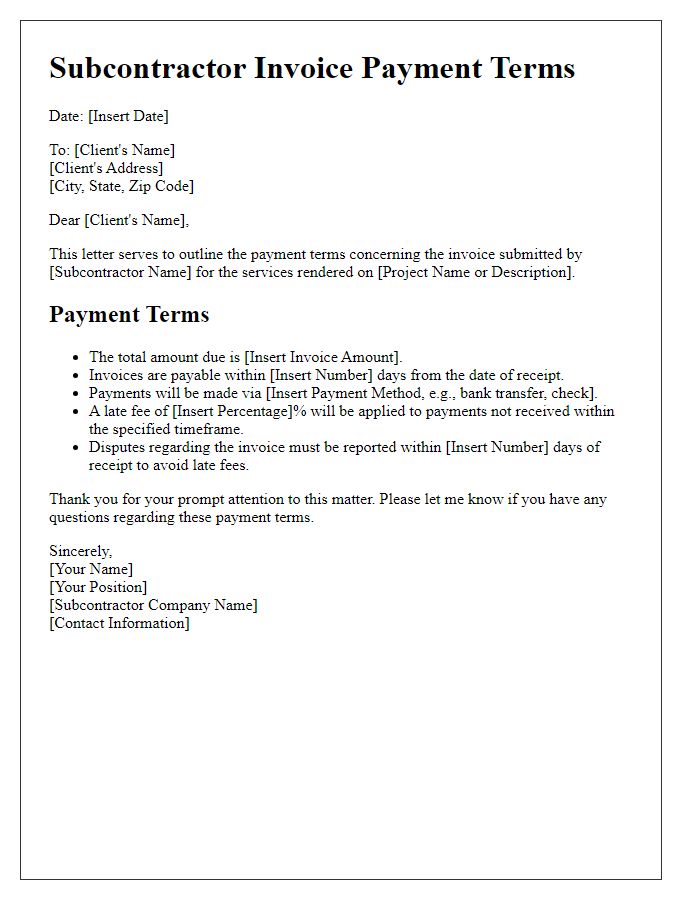

Navigating subcontractor payment terms requires a clear dispute resolution process to ensure timely and fair negotiations. A mutual agreement on initial steps can include informal discussions to address grievances, allowing each party to present their concerns transparently. Should these discussions prove ineffective, mediation may be employed, involving a neutral third party who can facilitate dialogue and propose solutions. If mediation fails, binding arbitration may be the next step, wherein an arbitrator reviews the case and issues a enforceable decision. Establishing a detailed timeline for each phase of the dispute resolution process can help prevent delays, keeping the project on track and maintaining healthy working relationships. Regular reviews of the process and updates on progress should be communicated clearly to ensure all parties remain informed and engaged throughout the negotiation.

Comments