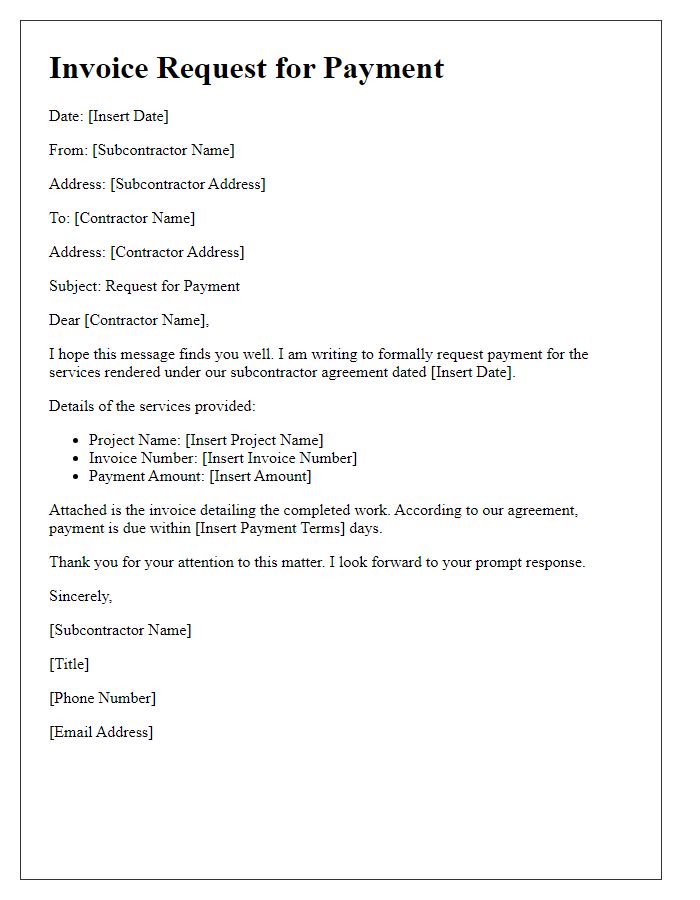

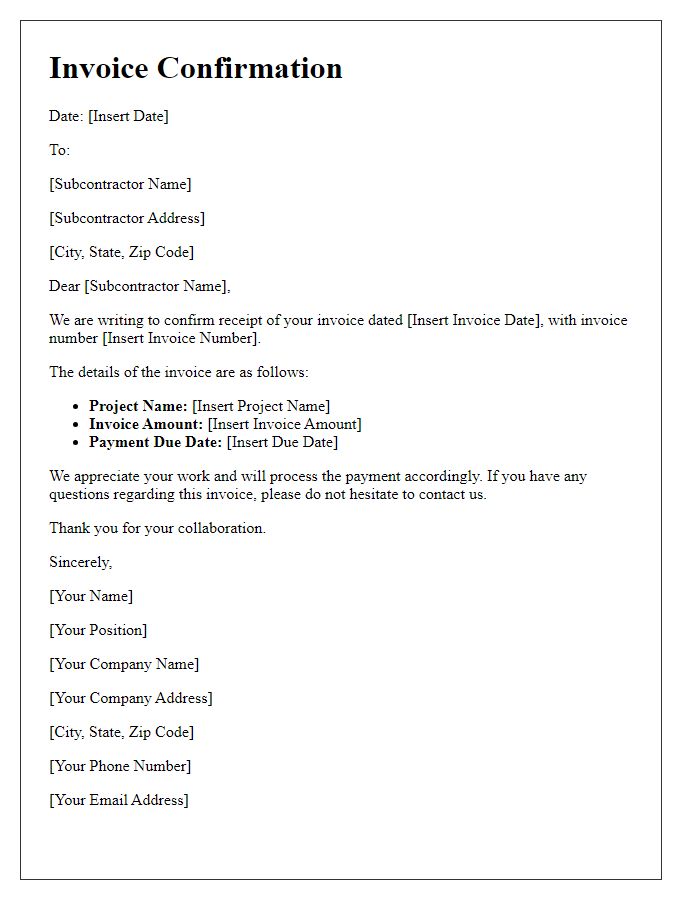

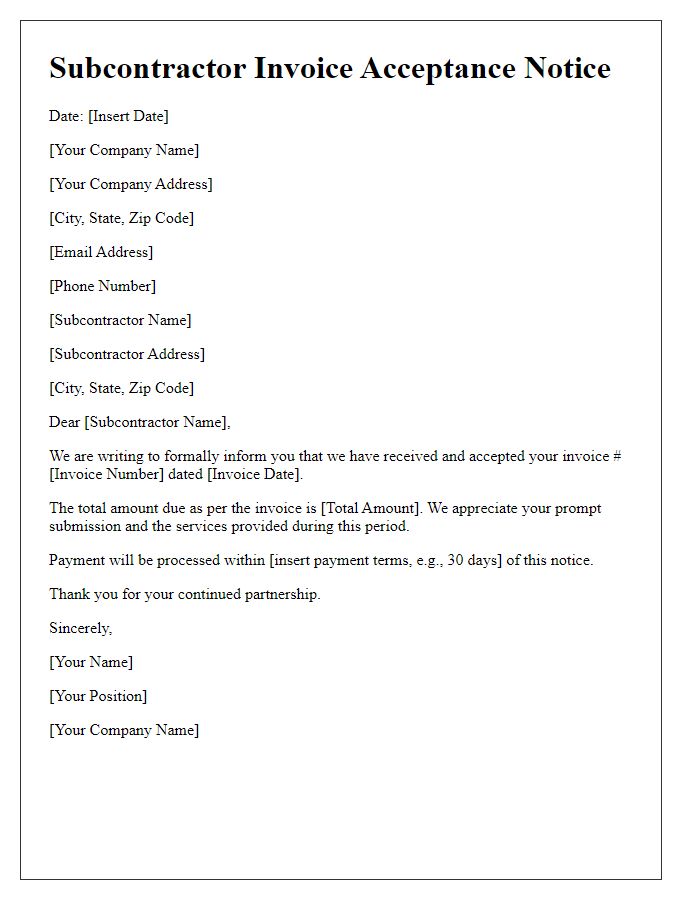

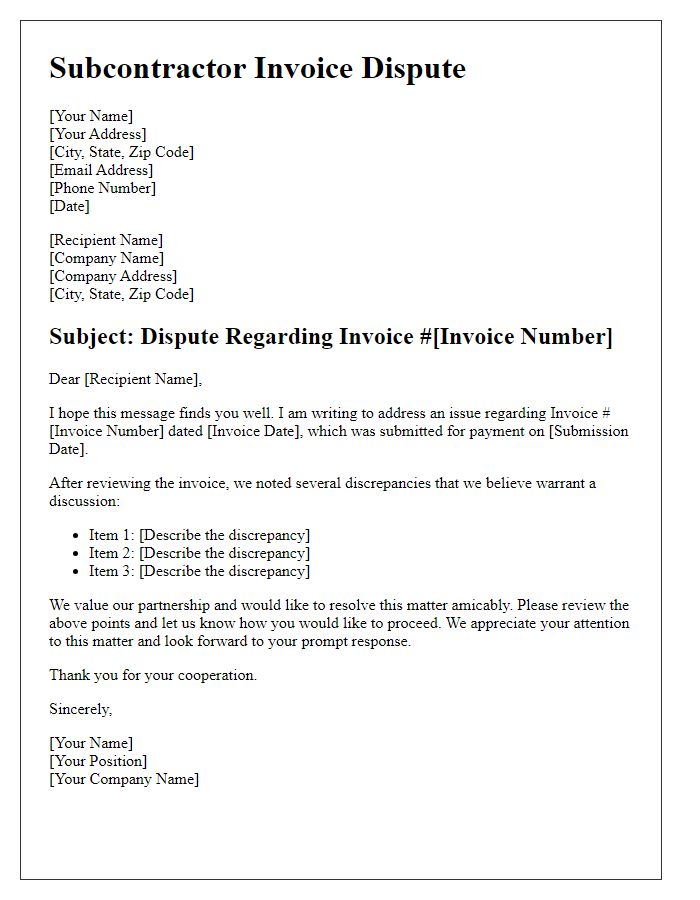

Hey there! If you're a subcontractor looking to streamline your invoice submission process, you're in the right place. Crafting a clear and concise invoice is key to ensuring timely payments and maintaining good relationships with your clients. In this article, we'll explore effective letter templates that can help you present your invoices professionally. So, let's dive in and discover some handy tips for your invoicing journey!

Clear invoice number and date.

Subcontractor invoices must include a clearly identifiable invoice number to ensure proper tracking and processing. The date of invoice issuance should be prominently displayed, typically at the top right corner, to indicate when the services were rendered and the invoice was prepared. This information facilitates timely payment and proper financial record-keeping for both the subcontractor and the contracting entity. Ensure that the format adheres to industry standards, with adequate spacing and alignment for enhanced readability.

Detailed description of services provided.

Subcontractors often provide specialized services that require clear documentation for invoicing. Services rendered might include electrical installation (e.g., wiring, circuit setup) for a residential project in Austin, Texas, completed during September 2023. Labor hours worked totaled 40, reflecting installation of fixtures and troubleshooting of existing systems. Materials supplied, such as 200 feet of copper wire and 10 LED fixtures sourced from local suppliers, are itemized with unit costs. Safety compliance inspections were also conducted, requiring certification under local code (e.g., the National Electrical Code). Detailed descriptions of tasks completed, including date of service and location, are essential to ensure timely payment and transparency during the invoicing process.

Breakdown of costs and payment terms.

Subcontractor invoices must include a detailed breakdown of costs and payment terms to ensure clear communication and prompt processing. Cost categories should encompass labor hours (billable rate multiplied by total hours worked), materials (specific items with quantities and unit costs), equipment rental (daily or project rental rates), and any additional expenses (travel or miscellaneous costs). Payment terms need to clearly outline the due date (such as 30 days from the invoice date), any early payment discounts (e.g., 2% off if paid within 10 days), and the preferred payment method (bank transfer, check, or credit card). This structure fosters transparency and expediency within the billing process, minimizing discrepancies and streamlining the payment cycle.

Contact information for both parties.

Subcontractor invoices require clear communication to ensure prompt payment and smooth operations. Essential contact information includes the subcontractor's name, business address, phone number, email address, and the client or contractor's details, such as the company name, billing address, contact person, and their associated phone number and email. Specific invoice details include the invoice number, date of issue, payment terms, and a detailed breakdown of services rendered or hours worked. Ensuring all contact information is accurate enhances the efficiency of the invoicing process, facilitating timely communication and expediting payment.

Attachments or supporting documents if necessary.

Subcontractor invoices typically require comprehensive documentation to ensure timely processing. Submissions should include the invoice itself, clearly detailing services rendered, hours worked, and agreed-upon rates. Supporting documents such as purchase orders (POs), receipts for materials, and timesheets are crucial for validation purposes. Additionally, correspondence outlining project scope or contract agreements help avoid discrepancies. Properly itemized lists of labors and materials, along with any required tax information, must accompany submissions. Attention to detail in these documents expedites approval within the accounts payable process.

Comments