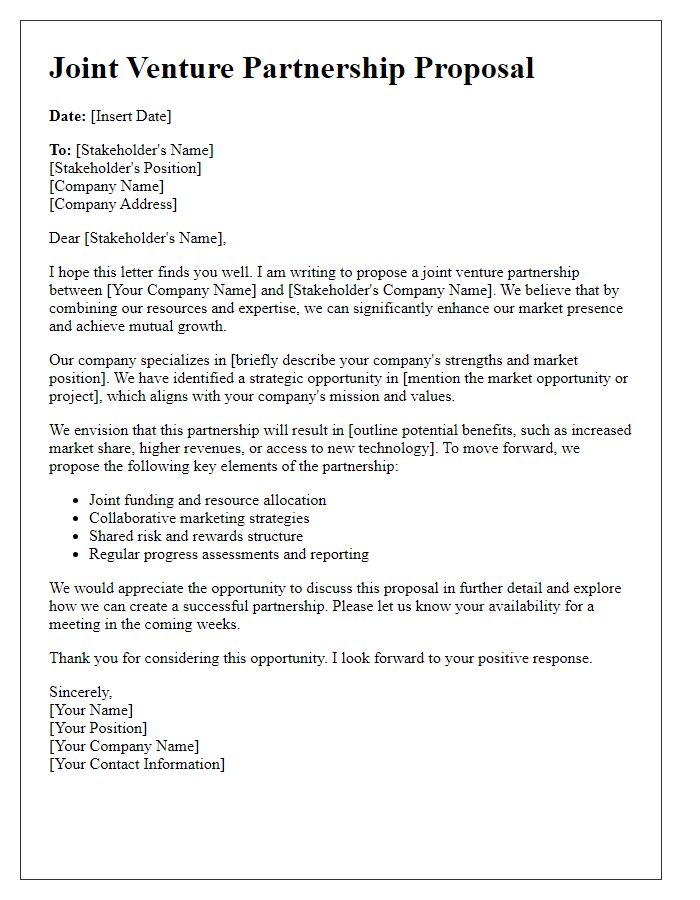

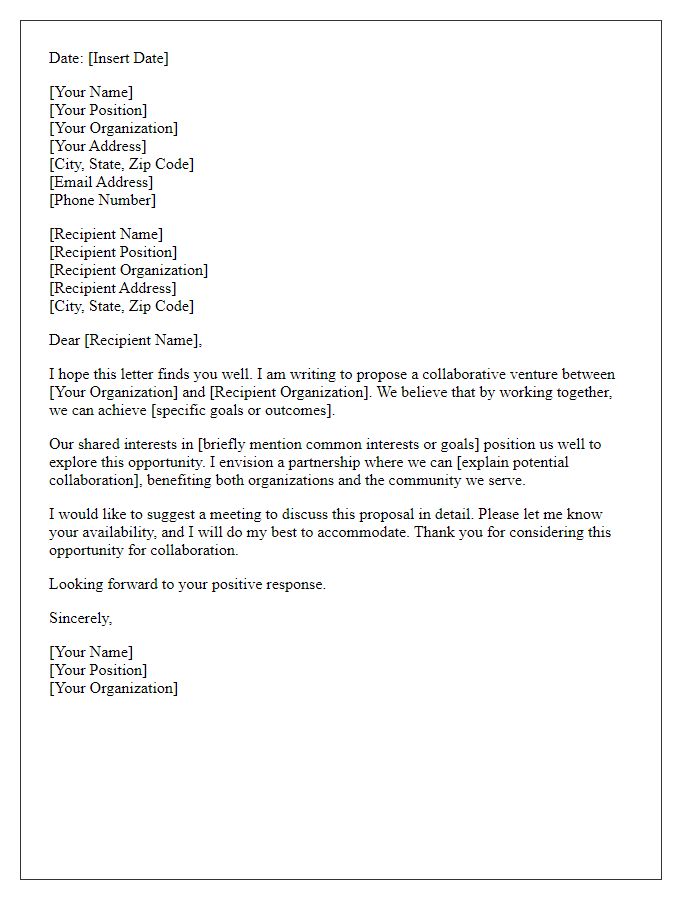

Are you looking to take your business to the next level by exploring a joint venture? Crafting the perfect proposal is essential for capturing the attention of potential stakeholders. In this article, we'll guide you through the key components of an effective letter template that not only outlines your vision but also demonstrates the mutual benefits of collaboration. So, let's dive in and discover how to make your proposal stand outâkeep reading to learn more!

Clear value proposition

A well-defined value proposition is crucial in joint venture proposals, outlining the mutual benefits for all stakeholders involved. This proposal highlights enhanced market access through combined resources, particularly targeting lucrative segments within the renewable energy market, projected to grow by 20% annually. The collaboration leverages shared technological advancements, specifically in solar energy solutions characterized by efficiency improvements of up to 30%. Additionally, this joint effort aims to reduce operational costs by an estimated 15% through resource pooling and streamlined processes. The partnership's geographical expansion includes strategic entry into emerging markets in Southeast Asia, where renewable energy adoption is rising sharply, especially in countries like Vietnam and Thailand. Overall, this joint venture is positioned to advocate for sustainable practices, aligning with global trends towards green energy, benefiting both organizations' brand equity and social responsibility objectives.

Mutual benefits and contributions

A joint venture proposal between two companies can unlock numerous mutual benefits, enhancing growth and market reach. The partnership combines resources, such as financial capital, expertise, and technology (like proprietary software or specialized machinery), facilitating innovation and efficiency. Shared goals align strategic interests, leading to increased market share (which could rise by 20% or more), cost savings through pooled resources, and improved competitive positioning against industry rivals. Collaborative marketing efforts can enhance brand visibility, potentially doubling customer outreach. Contributions from each stakeholder, whether in the form of research and development capabilities, distribution networks, or human resources, create a robust framework for achieving shared objectives, driving long-term success for both parties involved in the joint venture.

Detailed project scope and objectives

A joint venture proposal outlines the collaboration between two or more entities, aiming to achieve specific project goals. The detailed project scope includes objectives such as market expansion, which targets a 25% increase in market share within the first two years. The stakeholders involved may include Company A and Company B, both established entities in the renewable energy sector. The geographical focus involves operations based in California, where there is a growing demand for solar energy solutions driven by state incentives. Specific tasks comprise the establishment of a manufacturing facility projected to produce 10,000 solar panels annually and develop a joint marketing strategy scheduled for rollout in Q3 2024. Furthermore, the financial objectives involve an initial investment of $5 million, with anticipated annual revenue growth of 15% within three years of operation. Risk management measures will be implemented to address potential regulatory challenges in the fast-evolving energy sector. The timeline for this project spans 36 months, establishing key milestones for production, sales, and operational efficiency.

Financial considerations and funding

A joint venture proposal's financial considerations outline the investment requirements, potential returns, and funding strategies pivotal for ensuring the partnership's success. Initial capital investment, typically ranging from $500,000 to $5 million, is crucial for operational expenses, marketing initiatives, and infrastructure development. Revenue projections based on market analysis (for example, a projected annual growth rate of 10%) demonstrate the venture's financial viability. Funding options may include private equity, venture capital, and bank loans, each offering different levels of investment risk and return. Additionally, a detailed breakdown of profit-sharing ratios (e.g., 60/40) ensures transparent distribution of financial gains among stakeholders. The financial plan should also address contingency strategies to mitigate potential losses, thus enabling sustained growth and collaborative success in the joint venture's targeted markets.

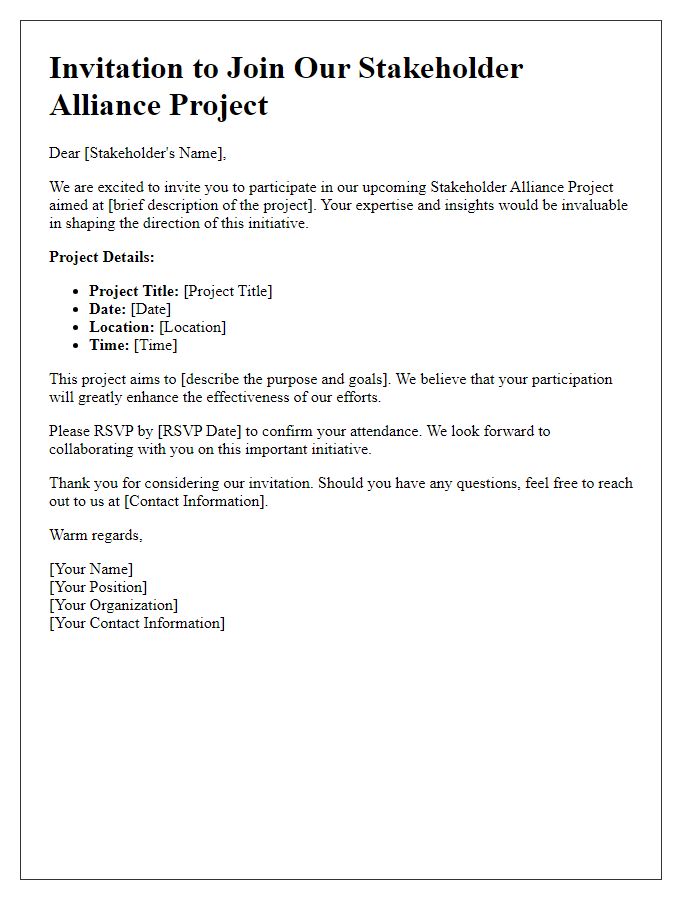

Roles and responsibilities of stakeholders

In a successful joint venture, the delineation of roles and responsibilities among stakeholders is crucial for achieving strategic objectives and operational efficiency. Stakeholders, including entities like Company A (the manufacturing partner) and Company B (the marketing partner), must clearly define their respective contributions to the venture. For instance, Company A may be responsible for production processes, ensuring quality control under industry standards such as ISO 9001, while Company B could focus on market analysis and promotional activities, leveraging digital marketing channels like social media for brand visibility. Financial responsibilities must also be clarified; stakeholders should agree on shared investments and profit-sharing models, potentially detailed in a formal agreement. Regulatory compliance, especially concerning local laws in jurisdictions such as the European Union or the United States, is another critical area where responsibilities need to be explicitly assigned. Regular communication protocols should be established to facilitate reporting and updates among stakeholders, fostering accountability and alignment with the joint venture's goals.

Comments