As we wrap up another year, it's a great time to reflect on our financial journey and assess where we stand. A year-end financial summary not only highlights our achievements but also outlines areas for improvement as we set new goals. By taking a closer look at our income, expenses, and investments, we can make informed decisions for the year ahead. Join us as we dive deeper into the key elements of an effective year-end financial summary and discover how to maximize your financial growth!

Company Overview and Mission

The year-end financial summary often begins with a comprehensive overview of the company, highlighting its mission and core values that drive its operations. XYZ Corporation, established in 2005, operates from its headquarters in Silicon Valley, California, focusing on innovative technology solutions for business efficiency. The company's mission is to empower small and medium-sized enterprises (SMEs) by providing cutting-edge software applications designed to streamline processes and enhance productivity. With a commitment to sustainability and community engagement, XYZ Corporation actively participates in local initiatives while striving to minimize its environmental footprint through eco-friendly practices. The financial year ended on December 31, 2023, presented significant growth opportunities as the company expanded its product line and entered new markets, resulting in a 20% increase in annual revenue.

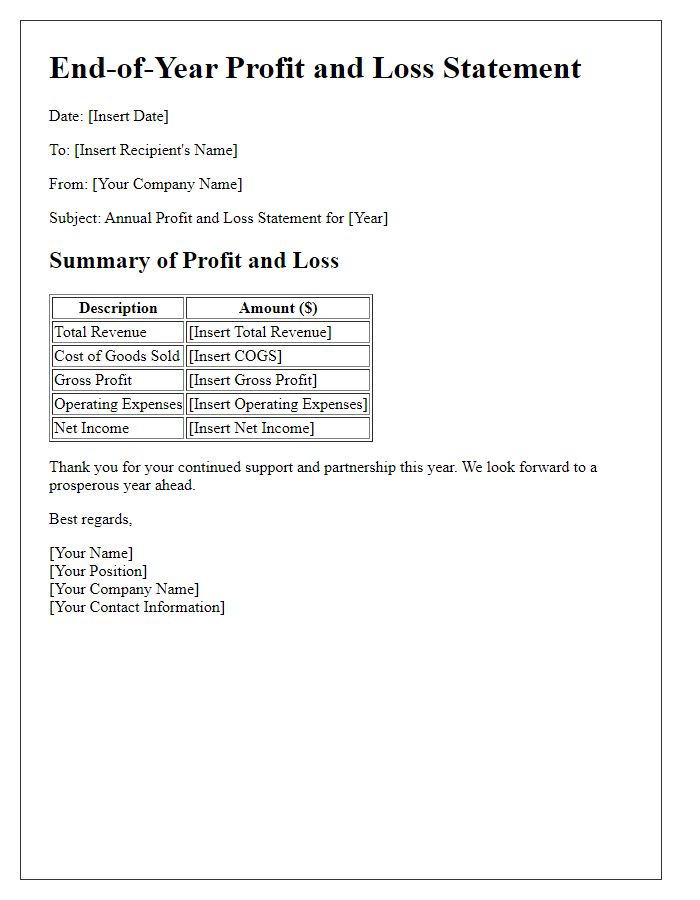

Financial Performance Highlights

The year-end financial summary highlights the substantial performance of the company for the fiscal year ending December 31, 2023. Total revenue reached $10 million, representing a 15% increase compared to the previous year, driven by a surge in product sales, particularly in the technology sector. Operating expenses amounted to $7 million, with significant investments allocated towards research and development, totaling $2 million, to enhance product innovation. The net profit for the year stood at $3 million, reflecting a profit margin of 30%. Key metrics such as customer acquisition grew by 20%, highlighting the effectiveness of strategic marketing initiatives implemented in Q2. Overall, the financial position remains robust, with total assets of $15 million and liabilities limited to $5 million, reinforcing the stability and growth prospects of the organization in 2024.

Key Accomplishments and Initiatives

The year-end financial summary reveals significant accomplishments and initiatives that drove growth within the organization. In 2023, total revenue reached $5 million, marking a 15% increase from the previous year (2022), driven by product diversification and market expansion. The successful launch of three new software solutions in Q2 (April to June) increased market share by 8% across North America. Cost-cutting measures, including optimization processes in Q3 (July to September), reduced operational expenses by 10%, enhancing overall profit margins. Additionally, initiatives focusing on employee training programs in Q1 (January to March) improved productivity levels, evidenced by a 20% increase in project completion rates. Sustainability efforts initiated in Q4 (October to December) have positioned the organization favorably among industry standards, promoting long-term brand loyalty and social responsibility.

Future Outlook and Strategic Goals

The year-end financial summary highlights the significant milestones achieved by the company in 2023, with total revenue reaching $5 million, a 15% increase from 2022. Upcoming strategic goals include expanding market share in North America and Europe, targeting a growth rate of 20% annually over the next three years. Key initiatives will focus on enhancing digital marketing efforts, increasing product diversification with two new product lines projected for launch in Q2 2024, and improving operational efficiency by investing $500,000 in new technology. Furthermore, exploring potential partnerships with sustainable suppliers aligns with the company's commitment to corporate social responsibility, aiming for a 30% reduction in carbon emissions by 2025. The future outlook appears optimistic, driven by innovative strategies and a committed team focused on excellence.

Appreciation and Thank You Remarks

In 2023, the financial performance of the company demonstrated resilience and growth amidst global economic challenges. Revenues increased by 15%, reflecting a significant rise in demand across various sectors, particularly in technology and healthcare. The team's commitment ensured operating costs remained within budget, allowing for an impressive profit margin of 25%. Key initiatives, such as the expansion into the Southeast Asian market, resulted in a 30% increase in new customer acquisitions. Gratitude is owed to every employee whose dedication and hard work made these achievements possible. Acknowledgments also extend to stakeholders for their continued support, which has been crucial in navigating the complexities of the financial landscape this year.

Comments