Hey there! If you're looking to understand the ins and outs of shipping insurance coverage, you're in the right place. Navigating the world of shipping can be tricky, especially when it comes to protecting your valuable items during transit. Let's dive into the key details that will help you make informed decisions and ensure your packages arrive safely. Ready to learn more? Let's get started!

Contact Information

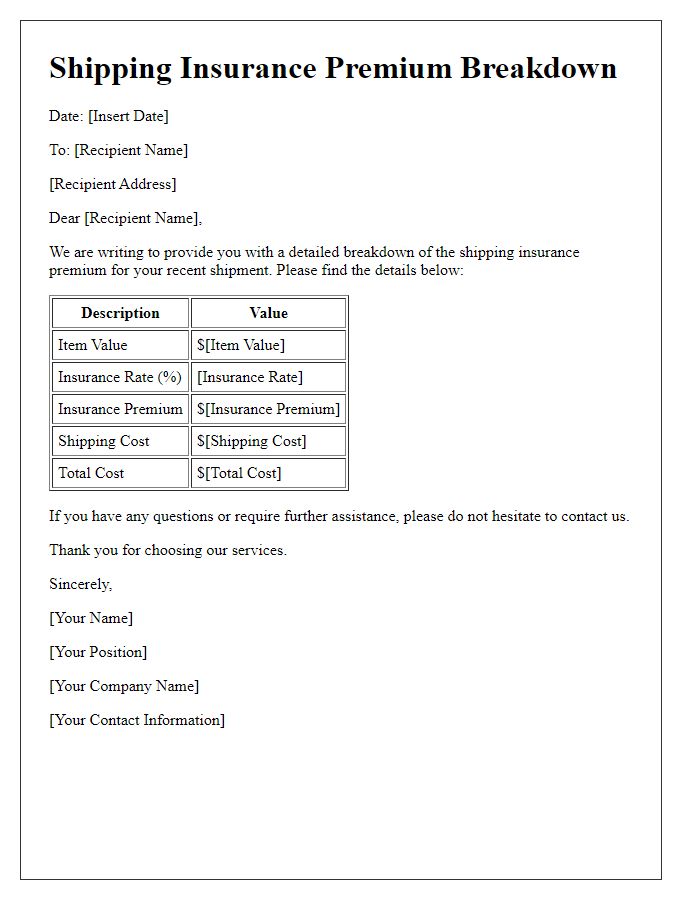

Shipping insurance provides financial protection for items during transit, covering potential loss or damage. Insurers often require detailed contact information, including a valid email address and phone number, to facilitate communication regarding claims. Additionally, providing the shipping address (specific location such as a street address, city, and postal code) is crucial for accurate policy documentation. Important terms include policy number, coverage limits, and deductible amounts, which determine the extent of protection. A comprehensive understanding of the claims process, along with necessary documentation like photographs of the item and receipts, is essential for filing an effective claim.

Policy Number

Shipping insurance provides coverage for lost, damaged, or stolen items during transit. Essential details include the policy number (a unique identifier for the insurance agreement), coverage limit (maximum amount paid in a claim), deductible (the out-of-pocket expense before coverage begins), and eligible items (specific categories covered under the policy). Policies can vary by provider, so reviewing terms and conditions is vital. For example, items valued over $5,000 may require additional documentation or specific endorsements. Always confirm the policy number for tracking claim status or inquiries efficiently.

Coverage Description

Shipping insurance provides protection for goods during transit, ensuring financial compensation in case of loss, damage, or theft. Standard coverage typically includes loss of items, accidental damage, and theft, with limits depending on the total declared value. Various carriers, such as FedEx and UPS, offer policies ranging from $100 to $50,000. Specific items like electronics and fragile goods may require additional coverage or specialized insurance due to their higher risk. Submitting a claim involves providing shipping documentation, photographs of damage, and a detailed description of the circumstances surrounding the incident. Timely filing of claims, often within 60 days of the loss, is crucial for successful recovery.

Claims Process

Shipping insurance claims can vary depending on the provider, but usually involve specific steps to ensure that your claim is processed efficiently. First, document any damage with clear photographs and comprehensive descriptions, which should detail the extent of damage and container conditions upon arrival. Next, file your claim within the specified period, typically 30 days from the incident date, by submitting your documentation to the insurance provider, such as a major carrier or specialized insurer. Keep track of your claim number for future reference. Additionally, an adjuster may contact you for further clarification or to inspect damaged items, which can include expensive electronics or fragile glassware. Expect a settlement decision within a predetermined timeframe, often around 15 to 30 days, based on the complexity of your claim.

Terms and Conditions

Shipping insurance coverage provides protection against loss or damage to goods during transit. Coverage typically includes specific terms, such as monetary limits (often ranging from $100 to $1,000), exclusions for certain items (like fragile goods or perishables), and requirements for claim documentation (including receipts and photographs of damage). The carrier name, such as FedEx or UPS, may impose its own stipulations regarding filing timelines (usually within a specified number of days post-delivery). Understanding the details of the insurance policy, including deductibles and payout limits, is crucial for consumers, ensuring adequate protection for valuable shipments.

Comments