Are you looking to keep your shareholder records up to date? Accurate information is essential for seamless communication and effective governance within your organization. In this guide, we'll walk you through a simple yet effective letter template for amending shareholder contact details. So let's dive in and ensure your records are currentâread on to discover how to easily update your shareholder information!

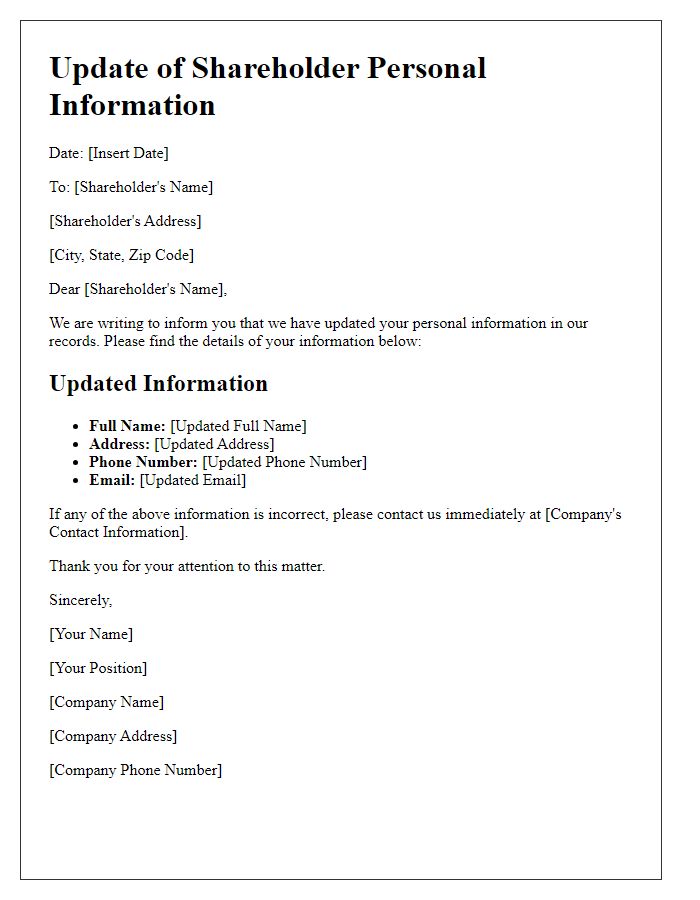

Header with company name and address.

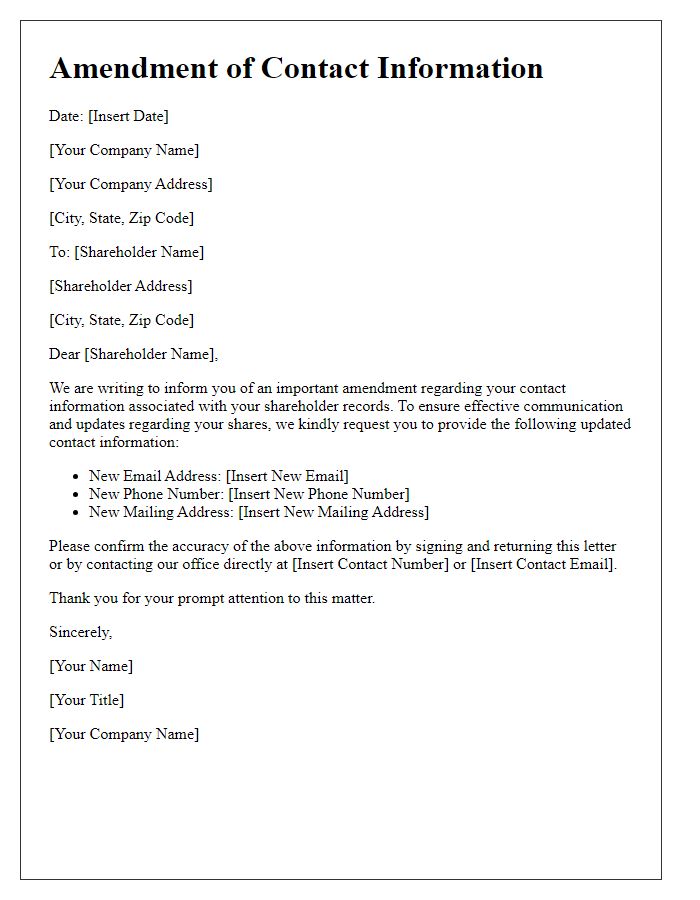

Amending shareholder contact information is essential for maintaining accurate records within a corporation. Updating such information, including addresses and contact numbers, ensures effective communication regarding important events like annual meetings, dividend distributions, or significant corporate announcements. Properly documented changes help in avoiding miscommunication that could arise if shareholders are not informed about their rights or critical developments. Timely amendments also assist in compliance with regulatory requirements set by regulatory bodies, such as the Securities and Exchange Commission in the United States.

Date of the letter.

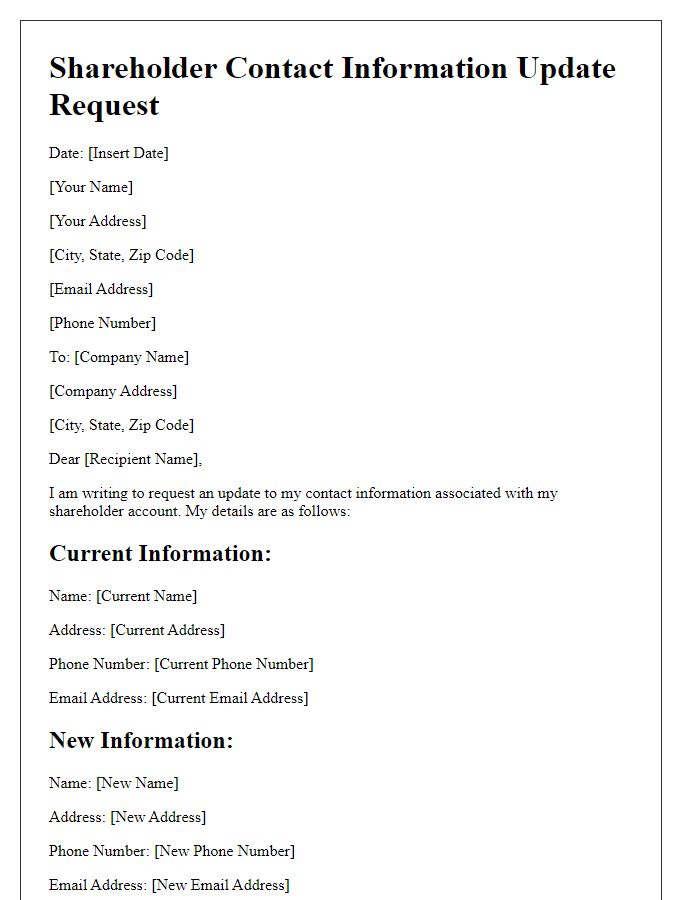

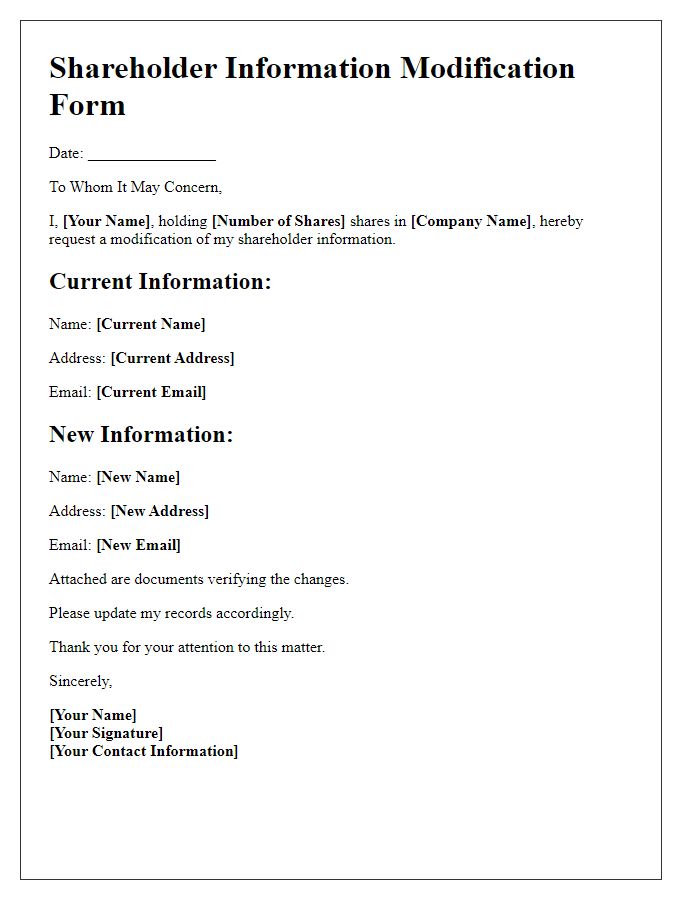

Shareholder contact information amendments are crucial for maintaining accurate communication records, especially for corporations such as ABC Corporation, which filed its annual report on January 31, 2023. The amendment process often requires submitting a formal request, including key details such as the shareholder's full name, registered address, and updated contact information (phone number and email address). For example, an amendment involving change of address from 123 Main Street, Springfield to 456 Oak Avenue, Springfield ensures that important documents such as proxy statements and dividend notifications reach the shareholder without delay. Accurate records also assist in compliance with securities regulations outlined by the Securities and Exchange Commission (SEC).

Recipient's name and current shareholder details.

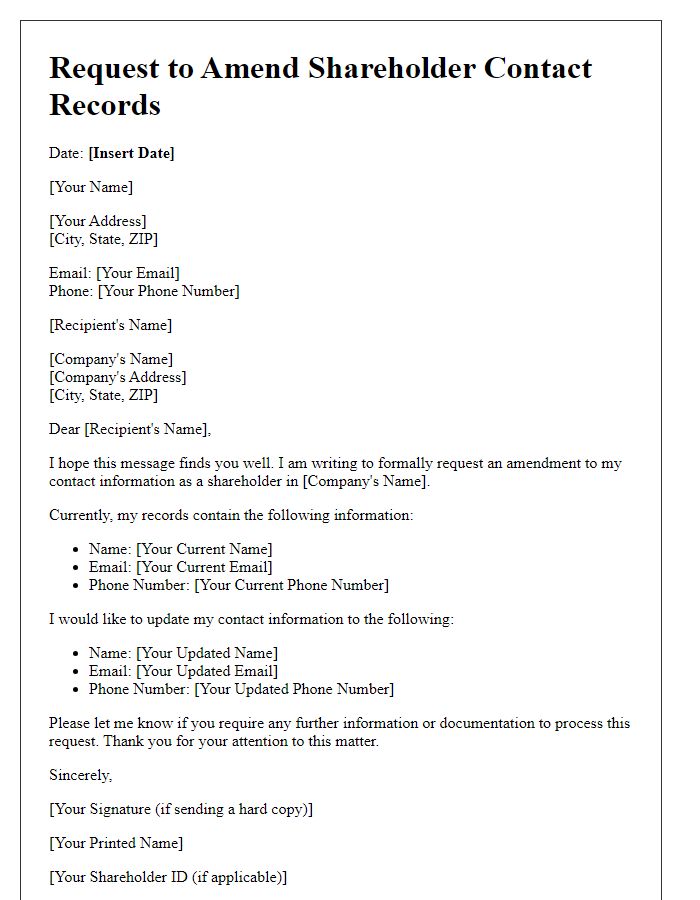

Updating shareholder contact information is essential for effective communication between corporations and their investors. Notably, shareholder records in places like the United States are maintained by registered agents, ensuring compliance with the Securities and Exchange Commission (SEC) regulations. Accurate information includes full name, mailing address, and email address, critical for receiving important documents such as annual reports and proxy statements. Any amendments must be promptly communicated to avoid disruptions in correspondence, especially during significant corporate events like annual meetings or dividend announcements.

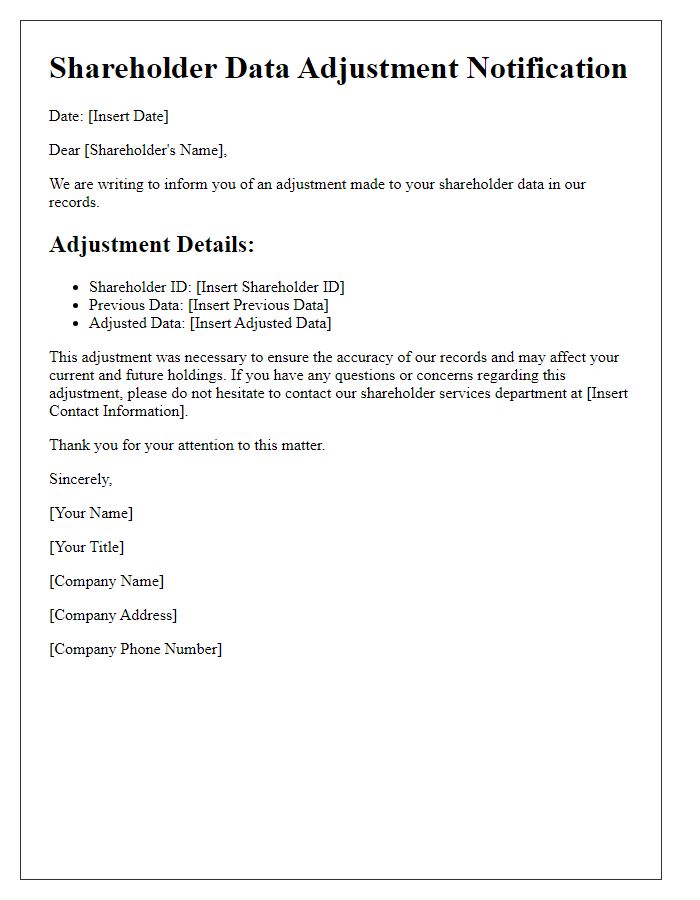

Proposed amendments to contact information.

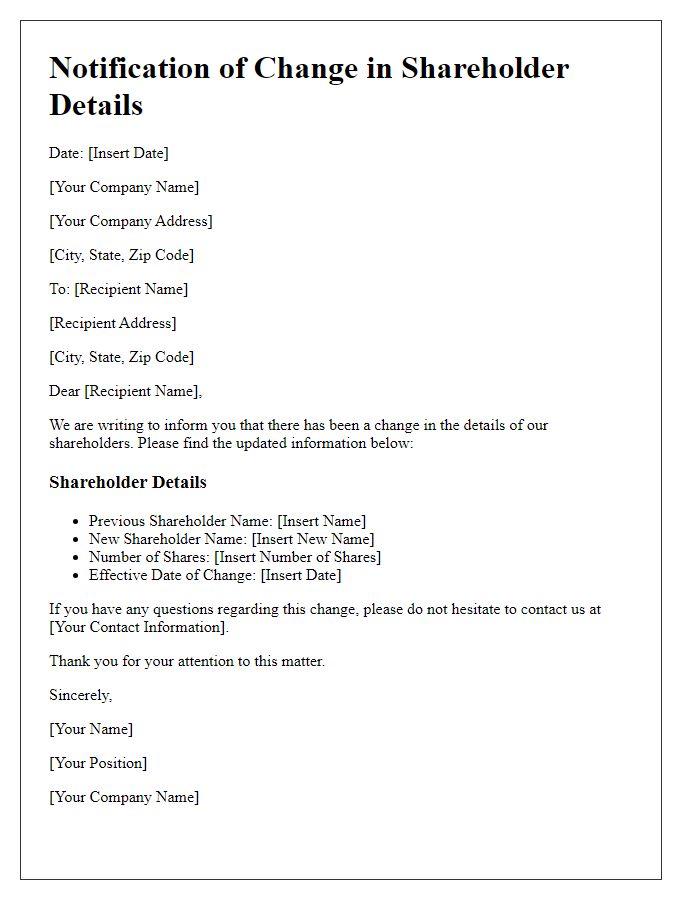

Proposed amendments to contact information are essential for maintaining accurate communication within corporate structures. Updating shareholder records, including names, addresses, and phone numbers, ensures compliance with regulations outlined in the Securities Exchange Act of 1934. Affected shareholders, typically numbering in the hundreds or thousands depending on company size, should receive formal notifications via postal service or electronic mail, especially if significant changes occur. Accurate contact details are critical during events such as annual general meetings (AGMs) or special shareholder meetings, where decision-making processes require timely and transparent communication. Failure to update this information may lead to misunderstandings and disruption in shareholder engagement and voting rights.

Signature and contact details for verification.

Updating shareholder contact information is crucial for maintaining clear communication within the corporate structure. Typically, this involves revision of key details such as the shareholder's name, address, email, and telephone number. Accurate contact data ensures timely delivery of financial statements, meeting notices, and important corporate announcements. For verification purposes, the shareholder may need to provide a signature, confirming the legitimacy of the request, alongside the updated contact information. By ensuring that the shareholder registry is up to date, companies can foster stronger relationships and transparency with their investors.

Comments