Have you ever wondered how recurring billing cycles work and why they matter? Understanding the nuances of this payment method can simplify your finances and help you stay on top of your subscriptions. From monthly streaming services to annual memberships, mastering this concept can save you both time and money. So, let's dive deeper into the world of recurring billing and unveil the benefits that await you!

Billing Cycle Duration

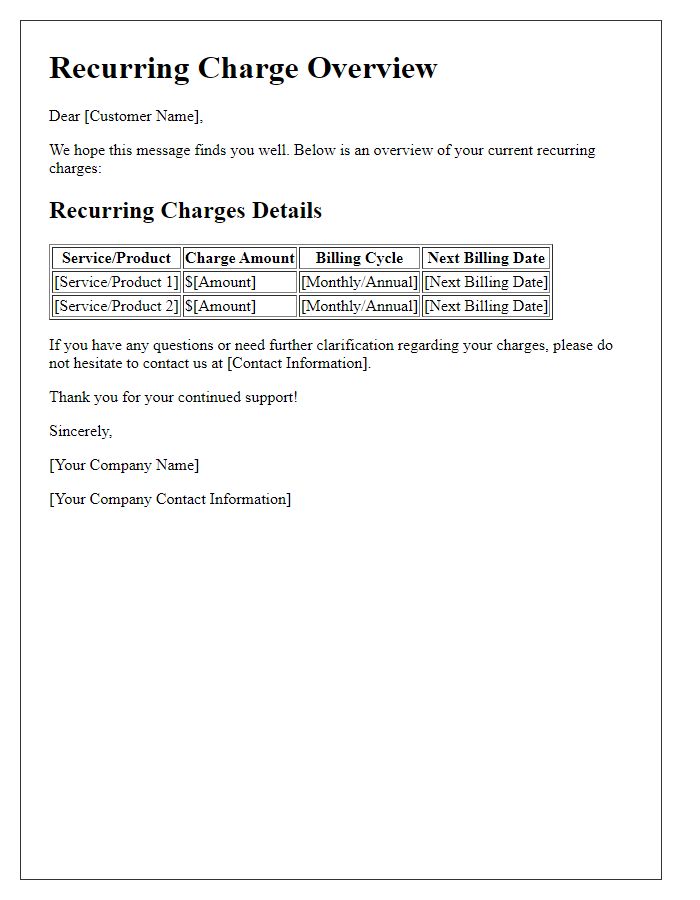

Recurring billing cycles typically span a defined duration, often ranging from monthly to annually. For instance, a monthly cycle repeats every 30 days, charging customers consistently within this timeframe, while an annual cycle occurs once per year on a specified date, such as January 1st or on the anniversary of initial subscription. In subscription services, such as streaming platforms or software applications, billing cycles help in managing payments and service renewals effectively. Automated transactions occur at the beginning or end of each cycle, ensuring uninterrupted access to services for users. Clear communication regarding billing cycles enhances customer satisfaction, preventing confusion and enabling better financial planning for both service providers and customers.

Payment Due Dates

Recurring billing cycles establish systematic payment schedules, providing clarity on payment due dates for subscriptions or services. Typically, these cycles occur monthly (30 days), quarterly (every three months), or annually (once a year). Each billing cycle begins on the subscription start date, triggering the payment process. For example, if a subscription starts on January 1, 2023, the subsequent payment would be due on February 1 for monthly billing. Understanding these due dates enables customers to manage finances effectively, avoiding late fees or service interruptions. Companies often send reminders ahead of due dates, enhancing customer experience and fostering timely payments.

Accepted Payment Methods

Recurring billing cycles primarily utilize accepted payment methods including credit cards, debit cards, and digital wallets. Credit cards, such as Visa, MasterCard, American Express, and Discover, offer convenience and typically support features like automatic payment options and fraud protection. Debit cards, directly linked to bank accounts, facilitate immediate transactions but may have certain limitations based on available funds. Digital wallets like PayPal and Apple Pay streamline the payment process, providing secure, swift transactions often without the need to input card details every time. Setting up a recurring billing cycle generally requires validation of payment method ownership, ensuring all transactions are authorized. Understanding the specifics of these accepted payment methods can greatly enhance the user experience and ensure timely payments in subscription services.

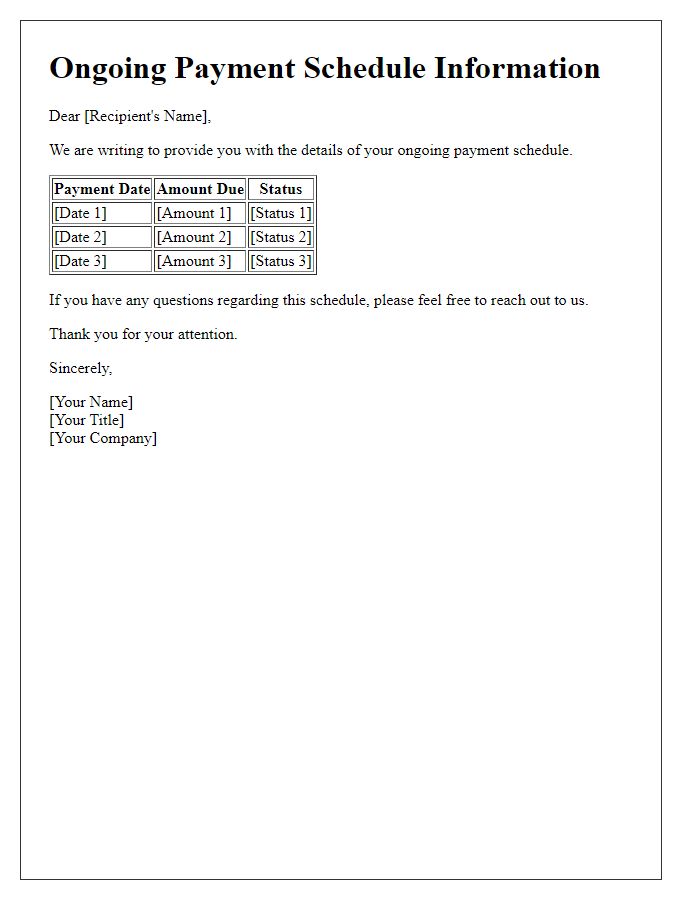

Late Payment Penalties

Recurring billing cycles, typically established for services like subscriptions or memberships, often include structured late payment penalties. These penalties can manifest as additional fees, which may vary in amount, such as a flat rate of $15 or a percentage increase in the total due, often around 5% for overdue payments. Such penalties usually apply after a grace period of 5 to 30 days past the due date, depending on the service provider's terms. It's essential to remain vigilant regarding the payment schedule established in the billing agreement, as multiple late payments can lead to more severe consequences, including service interruption or account suspension. Understanding the specific terms outlined in the user agreement is crucial to avoid unnecessary financial burden and ensure uninterrupted access to services rendered.

Customer Service Contact Information

Recurring billing cycles are an essential feature for subscription-based services, allowing for automatic payments on set intervals (monthly or annually). This process simplifies the management of payments for both businesses and customers by ensuring consistent service delivery without the need for manual intervention. Understanding the billing cycle is crucial; for instance, if a customer subscribes on April 15, the next payment will occur on May 15, and subsequent payments will continue on the 15th of each month. Clear communication regarding billing terms helps to reduce confusion and enhances customer satisfaction. Relevant customer service contact information should always be accessible for inquiries regarding billing questions or subscription changes, ensuring prompt assistance.

Comments