Are you looking to navigate the often complex world of export documentation as a reseller? Understanding the ins and outs of this process is crucial for ensuring that your products reach international markets smoothly and efficiently. From customs declarations to shipping invoices, it can feel overwhelming at times, but it doesn't have to be. Dive into our comprehensive guide to streamline your export documentation journey and empower your businessâread more to unlock expert insights!

Recipient information and contact details

Accurate recipient information is crucial for successful export documentation. Addresses should include the recipient's full name, company name, street address, city, state or province, postal code, and country. Contact details must consist of the recipient's email address and phone number for any shipping inquiries. Relevant information such as tax identification numbers (TIN) helps in customs clearance. Understanding the destination country's specific regulations and requirements is essential for compliance. Failure to provide complete recipient information may lead to shipment delays, additional fees, or returns. Utilizing a standardized template can help streamline the process for efficient communication.

Purpose and scope of the document

The reseller export documentation guide aims to clarify the specific requirements and procedures for exporters in the reselling industry. This guide addresses critical aspects such as customs regulations, necessary forms (like commercial invoices), product classification codes (HS codes), and compliance with trade agreements. The scope includes details relevant to different regions, highlighting the unique documentation practices enforced by countries such as the United States, Canada, and those within the European Union. It serves as a comprehensive resource to ensure that resellers meet legal obligations while optimizing their export processes, ultimately facilitating smooth international trade transactions.

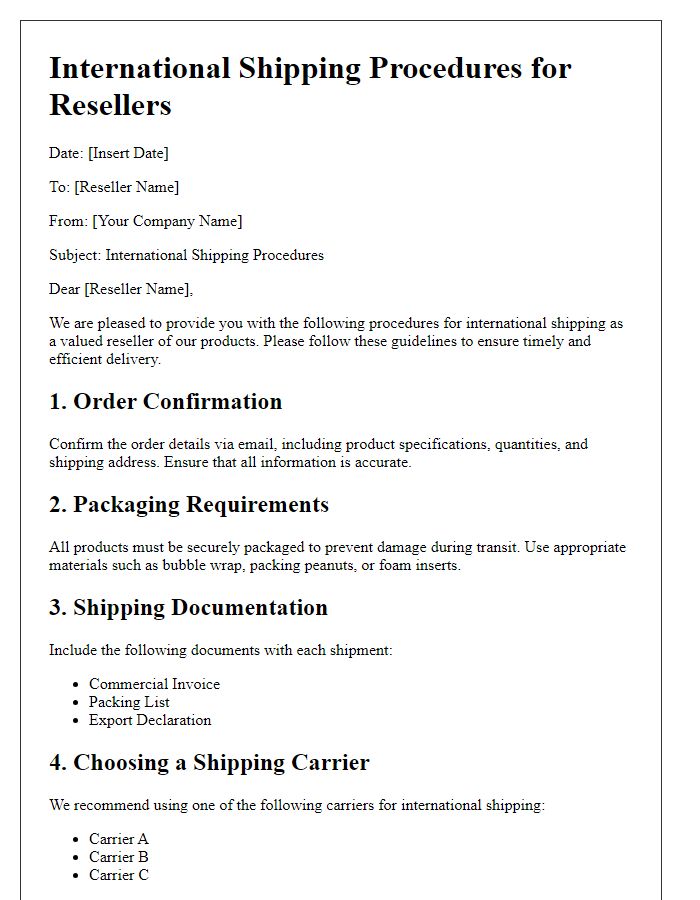

Step-by-step export process outline

The export process for resellers involves several critical steps, ensuring compliance with international trade regulations. First, resellers must obtain an Export License, a government-issued document permitting the export of specific goods to particular countries. Next, the reseller should prepare required documentation, which may include a Commercial Invoice detailing the transaction, a Packing List itemizing shipment contents, and a Bill of Lading serving as the contract between the shipper and carrier. Once documentation is secured, the reseller should arrange for freight transportation, typically choosing between air freight for speed or ocean freight for cost efficiency. After selecting a carrier, they must determine the proper Harmonized System (HS) codes, which classify goods for tariff purposes. Upon shipment, customs clearance is necessary, where the exporter provides the customs broker with the necessary paperwork to facilitate the goods' entry into the destination country. Finally, the reseller must track the shipment until it reaches the receiver, ensuring successful delivery and compliance with all aspects of the export regulation.

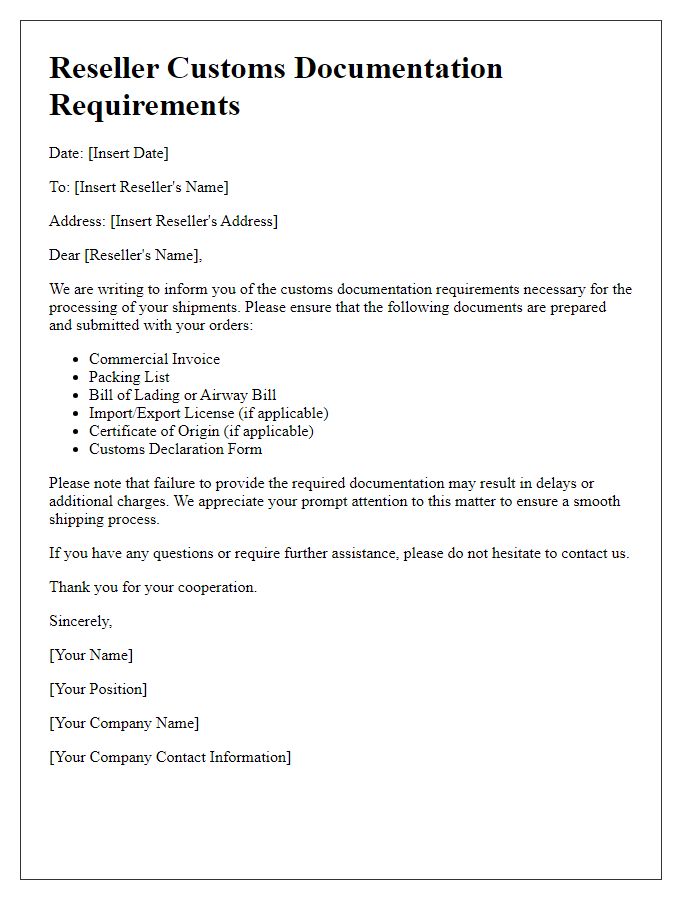

Required documentation checklist

A reseller export documentation guide is crucial for navigating international trade effectively. Key documentation includes a commercial invoice, detailing transaction specifics, such as prices, quantities, and terms of sale. An export license may be mandatory based on the product's nature and destination, particularly for sensitive items governed by the Bureau of Industry and Security (BIS) regulations. Additionally, a packing list itemizes the contents of each shipment, aiding customs clearance. Certificates of origin, required by the importing country, verify the product's country of manufacture. Bill of lading serves as a contract between the carrier and the shipper, outlining the shipment details and ownership transfer. Finally, customs declarations ensure compliance with local and international laws, with varying requirements based on the destination country's regulations. For instance, the European Union has specific customs procedures that must be followed meticulously to avoid penalties.

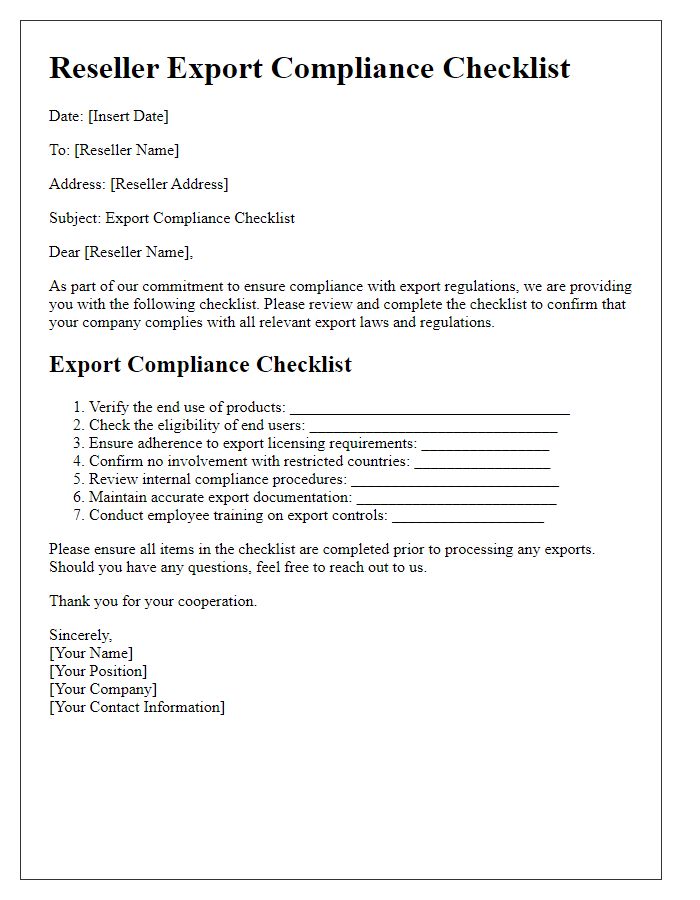

Compliance and regulation guidance

Exporting goods as a reseller requires adherence to various compliance and regulatory guidelines to ensure legality and smooth transactions. Key elements include understanding the Harmonized System (HS) codes for specific products, which classify goods for international shipping, impacting taxation and duties. Also, resellers must obtain relevant export licenses, which differ by country; for example, the Export Administration Regulations (EAR) in the United States dictate requirements for controlled items. Additionally, compliance with the International Traffic in Arms Regulations (ITAR) may be necessary for certain military-related products. A thorough understanding of destination country regulations, such as the European Union Customs Code, ensures all imports meet local standards and duties. Accurate and complete documentation, including commercial invoices, packing lists, and certificates of origin, is crucial to prevent delays at customs. Failure to comply can result in fines, delays, or even the seizure of goods, highlighting the importance of meticulous attention to regulatory details.

Comments