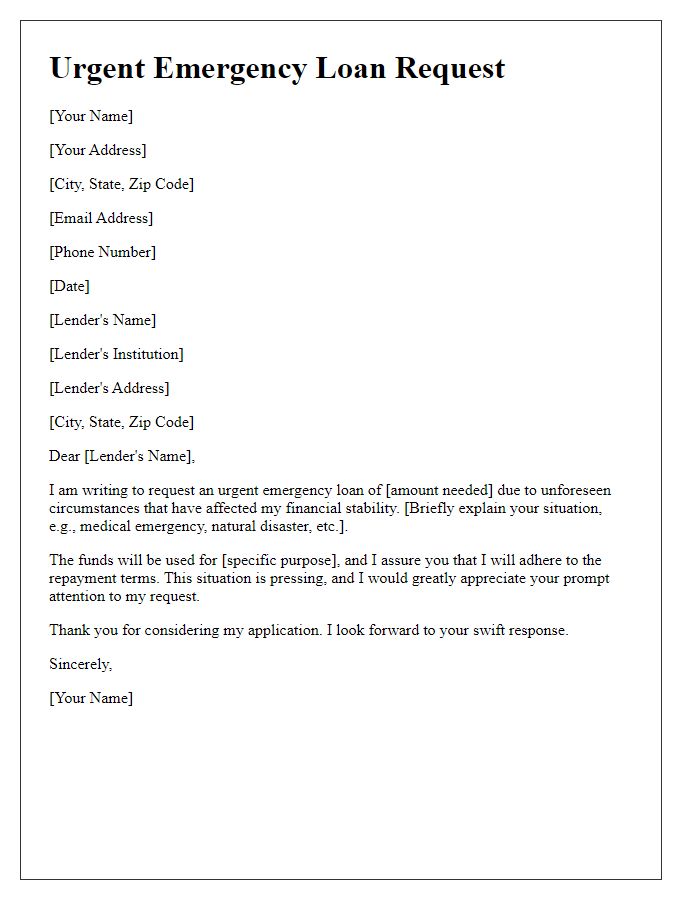

If you find yourself in a tight financial spot, you may be considering an emergency loan to help bridge the gap. Navigating the nuances of a loan application can be overwhelming, but having a clear and structured request letter can simplify the process. In this article, we'll guide you through an effective letter template that clearly outlines your needs, circumstances, and intentions. So, let's dive into the essentials of crafting that perfect emergency loan request!

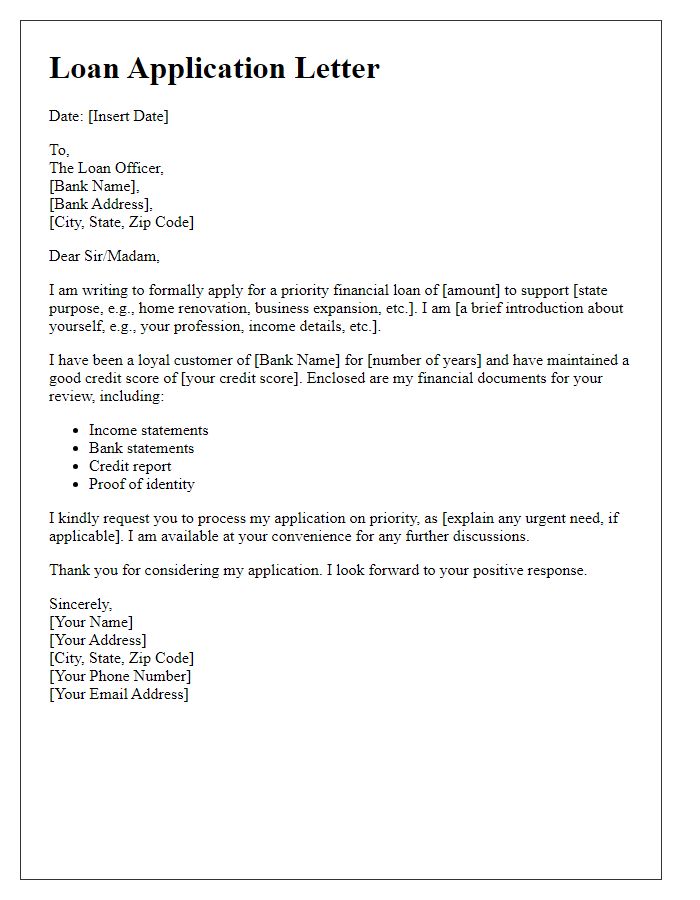

Purpose of the loan

An emergency loan application often serves as a lifeline for individuals facing unforeseen financial crises, such as medical emergencies or unexpected job losses. Applicants typically seek funds to cover urgent expenses, often in amounts ranging from $1,000 to $10,000, depending on the situation. These loans usually feature quick processing times, often within 24 to 48 hours, allowing timely access to necessary resources. Many financial institutions specify that these loans can assist with critical needs like hospital bills, urgent repairs, or utility payments, ensuring clients maintain essential services during challenging times. Emergency loans may come with varying interest rates, often averaging between 5% to 36%, heavily influenced by factors such as the borrower's credit history and the lender's policies.

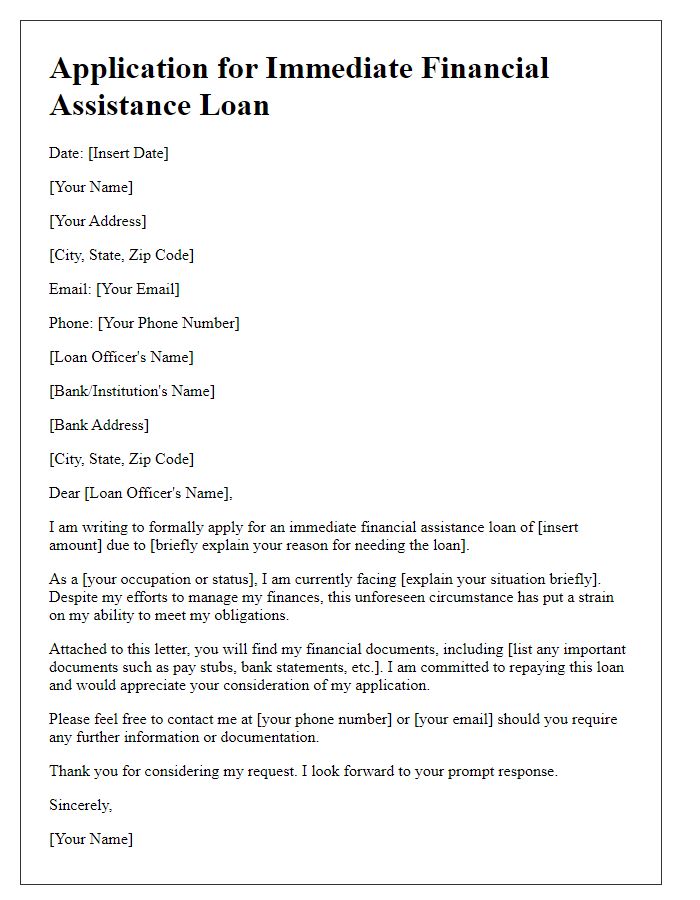

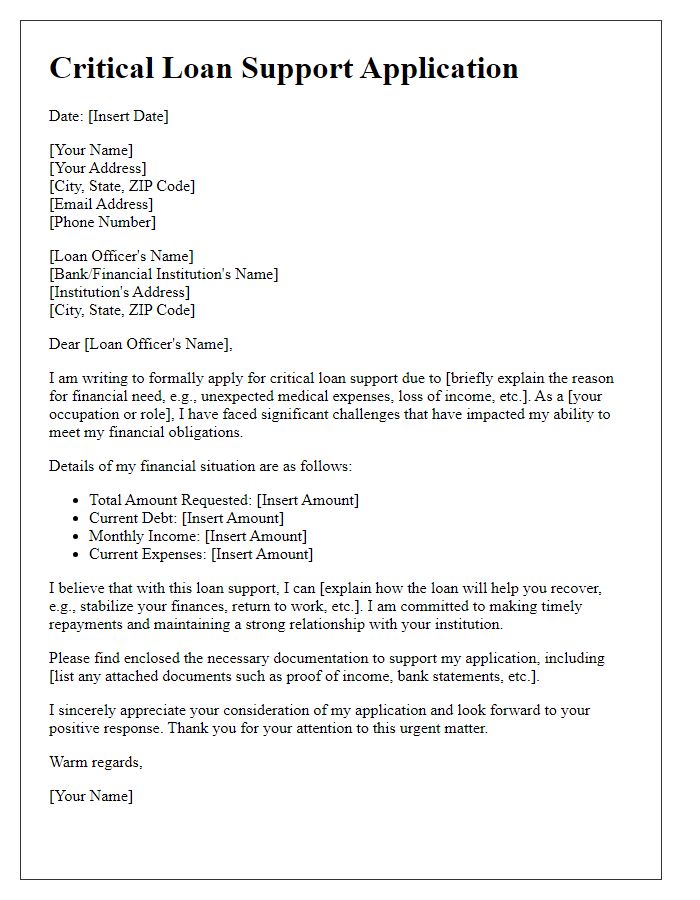

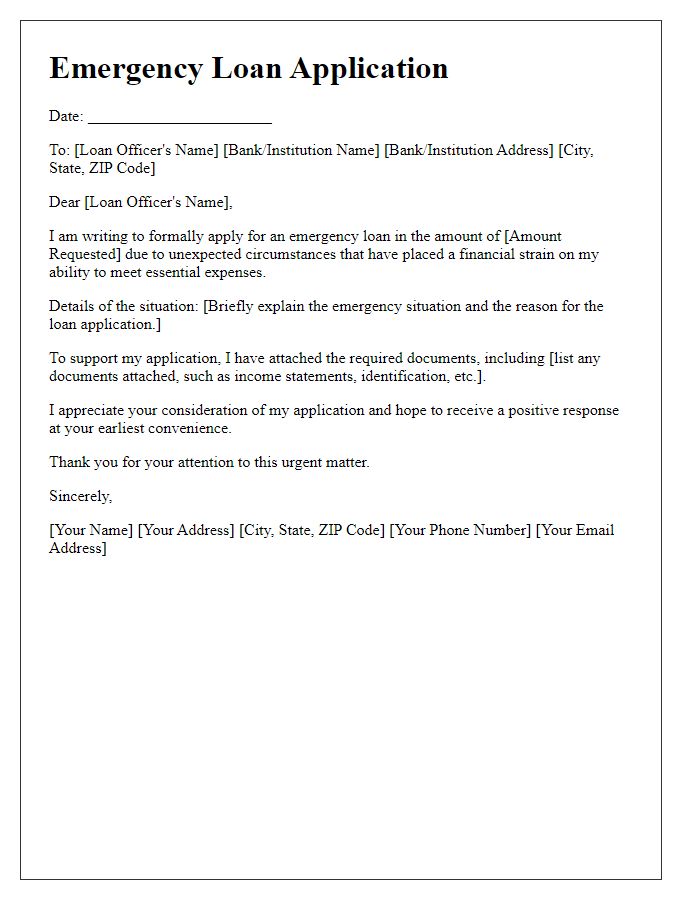

Personal and financial information

The request for an emergency loan application necessitates comprehensive personal and financial information disclosure to facilitate approval. Essential details include a valid identification document, typically a government-issued ID such as a driver's license or passport, confirming identity and residency, often within states like California or New York. Financial documentation must include recent bank statements, showing monthly income, expenses, and account balances, highlighting stability and repayment capacity. Credit history reports from agencies such as Experian or TransUnion, reflecting credit scores and outstanding debts, provide lenders with insight into past financial behavior. The application should also detail the purpose of the loan, whether for unforeseen medical emergencies, urgent home repairs, or unexpected car expenses, emphasizing the urgency behind the request. Supporting documentation, like pay stubs or employment verification letters from employers, further strengthens the case for approval by evidencing steady income.

Emergency situation details

In emergency situations, individuals may seek financial assistance through emergency loan applications tailored to urgent needs. Natural disasters, such as hurricanes (like Hurricane Katrina in 2005) or wildfires (like the California wildfires in 2020), often displace families and require immediate funds for housing and essential supplies. Medical emergencies, like surgeries or hospital stays, can lead to sudden, substantial medical bills, prompting urgent loan requests. Additionally, unforeseen job losses or significant repairs to homes, such as roof replacements after storm damage, can create compelling cases for emergency loans. Many financial institutions, including credit unions and banks, provide streamlined application processes to address these time-sensitive needs, often requiring documentation to verify the emergency and financial status.

Repayment plan or timeline

An emergency loan application necessitates a clear, structured repayment plan to ensure financial accountability. A timeline should outline specific repayment milestones, such as monthly payment amounts, starting date, and final payment date. For instance, if an individual borrows $5,000 with an interest rate of 5%, monthly payments of approximately $100 over 60 months would be reasonable. Including key dates, such as the loan approval date and the first payment due date, creates transparency. Detailing the sources of income designated for loan repayment, along with contingencies in case of unforeseen circumstances, adds credibility to the plan, thus enhancing the likelihood of loan approval.

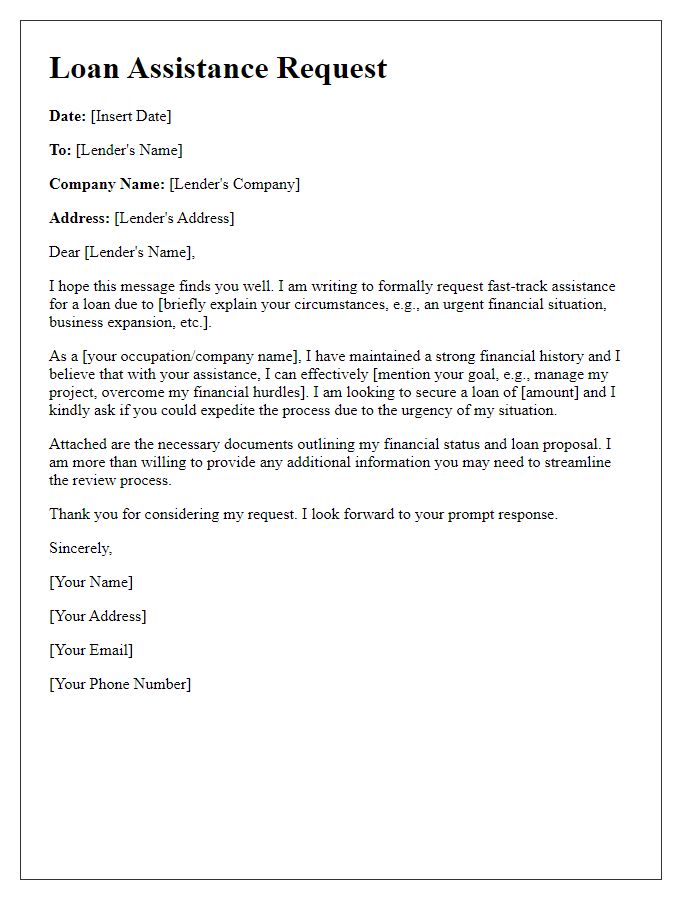

Contact information

An emergency loan application requires precise contact information for processing and communication. Essential details include the applicant's full name, which verifies identity. The permanent address must include street number, street name, city, state, and zip code to establish residency and ensure accurate correspondence. A valid phone number (preferably a mobile number) allows the lending institution to reach the applicant for urgent queries. Additionally, an email address provides a reliable digital communication channel for updates and requests. Providing this information ensures a smooth application process, increasing the chances of loan approval during financial emergencies.

Comments