Are you navigating the rental application process and feeling overwhelmed by the paperwork? A well-crafted letter can make a significant difference in presenting your financial stability to landlords. By including your pay stubs and relevant information, you can showcase your reliability as a tenant while simplifying the process for both parties. Dive into our article to learn how to create the perfect rental application letter that sets you apart!

Personal Information

A comprehensive rental application should include essential personal information to ensure proper evaluation by landlords or property management companies. Key details such as full name (John Smith), current address (123 Maple Street, Springfield, IL), phone number (555-0123), and email address (johnsmith@email.com) create a clear identity. Additionally, applicants must provide employment information, including job title (Software Engineer), company name (Tech Innovations Inc.), and annual salary ($85,000). Important documents like pay stubs, typically from the last three months, serve as proof of income, demonstrating financial stability. Furthermore, including references, previous rental history, and social security number (XXX-XX-1234) can enhance credibility.

Landlord's Contact Details

Providing pay stubs as part of a rental application can help demonstrate financial stability to prospective landlords. When submitting your application, including essential information such as the landlord's name, phone number, and email address is crucial for efficient communication. For example, Landlord John Smith, located at 123 Main Street, Apartment 4B, Springfield, can be contacted at (555) 123-4567 or johnsmith@email.com. Clear and complete contact details ensure the landlord can verify employment and income information, facilitating the application process and enhancing the potential for approval.

Statement of Income Verification

A rental application often requires proof of income, such as pay stubs, to demonstrate financial stability. Pay stubs, typically provided by employers, detail the gross wages, taxes withheld, and net income for each pay period. Most pay stubs include key information such as the employee's name, employer's name (including company address), and the pay date. Landlords may request the most recent pay stubs, usually covering a minimum of the last two to three months, to assess a potential tenant's ability to pay rent consistently. Accurate documentation is essential for validating income, ensuring it aligns with rental requirements, typically set at a minimum income threshold of three times the monthly rent, thereby fostering a smooth application process and enhancing trust between parties.

Consent for Financial Background Check

When applying for a rental property, applicants often must provide pay stubs as proof of income. This documentation typically includes recent pay stubs from employment, showing consistent income levels, which is essential for landlords evaluating financial stability. A consent form for a financial background check allows landlords to verify the applicant's financial history, creditworthiness, and rental payment history. This step is critical for ensuring that the applicant can meet rental obligations. It is common practice for property management companies in urban areas (like New York City or Los Angeles) to require this information for tenant screening, as it helps mitigate risks associated with non-payment of rent.

Signature and Date

A rental application often includes critical financial documents such as pay stubs, which demonstrate the applicant's income stability. Providing recent pay stubs, typically covering the last two months, allows landlords to assess the applicant's financial reliability. Including a signature line and date line at the end of the application signifies the applicant's acknowledgment and understanding of the information provided. This process ensures transparency and trust between landlords and prospective tenants, establishing a foundation for the rental agreement.

Letter Template For Rental Application Pay Stubs Samples

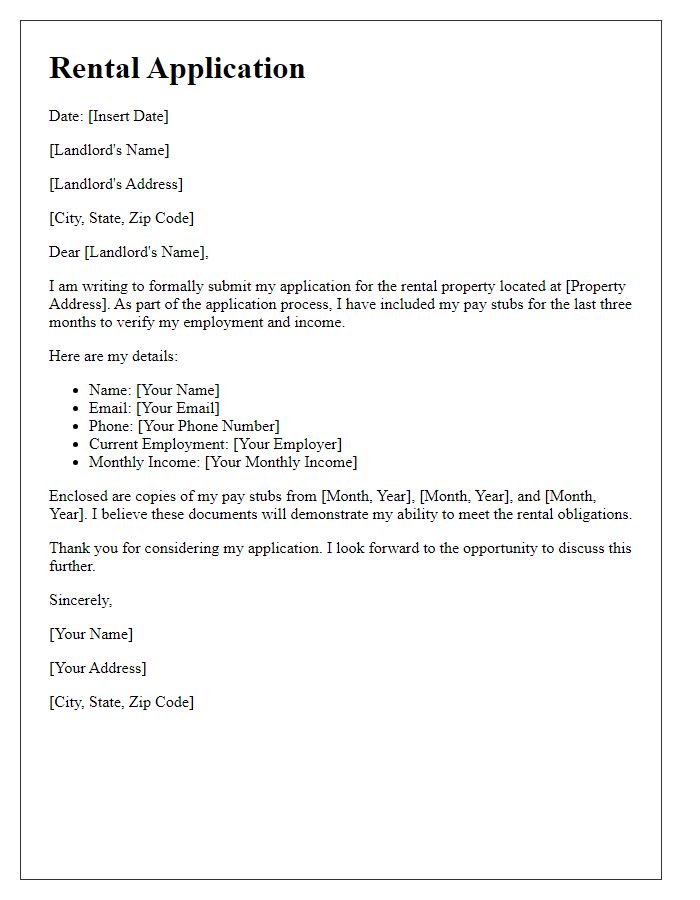

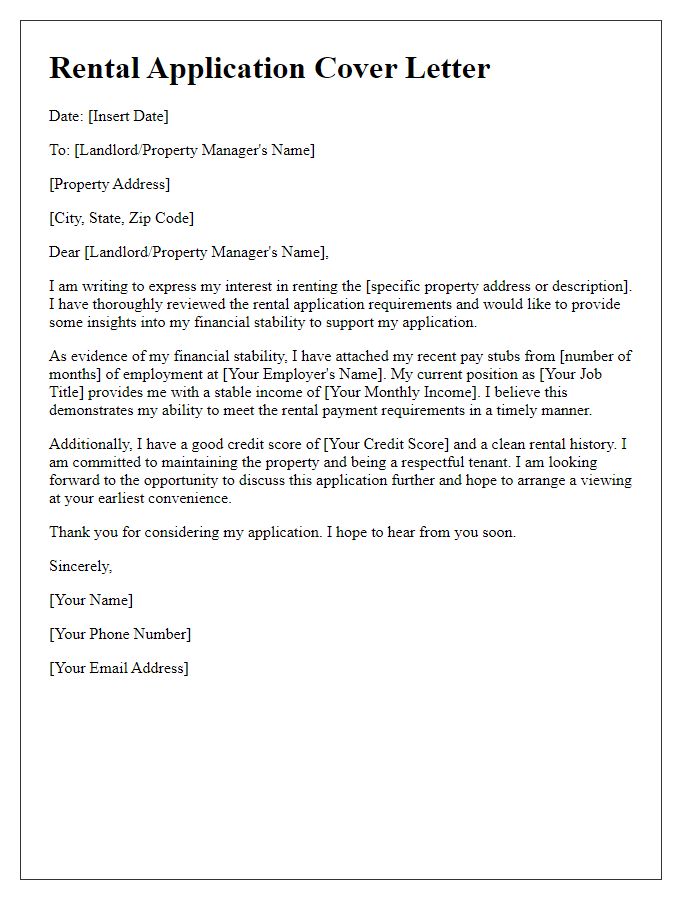

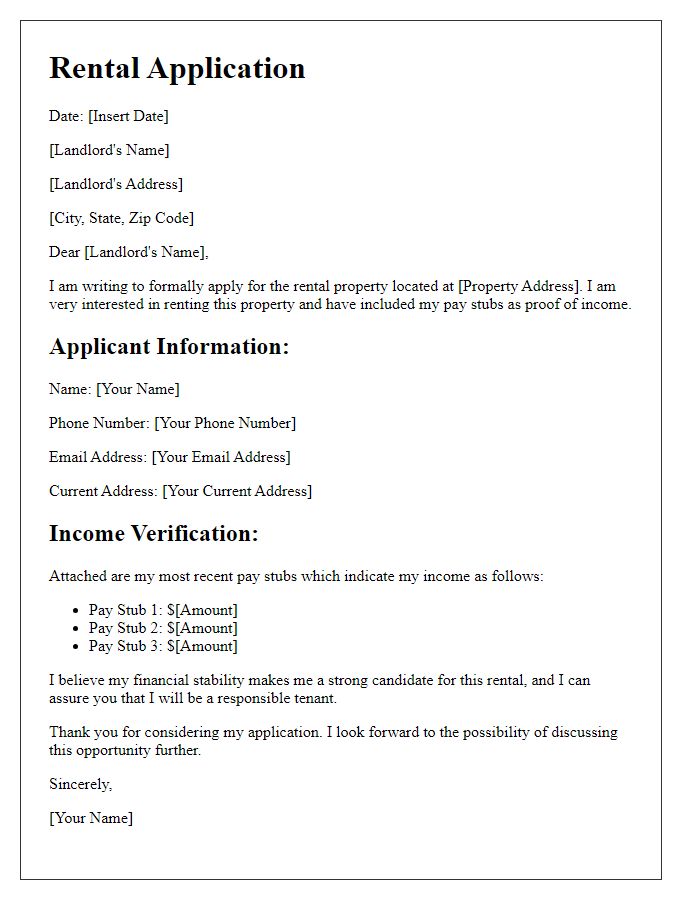

Letter template of rental application highlighting pay stub documentation

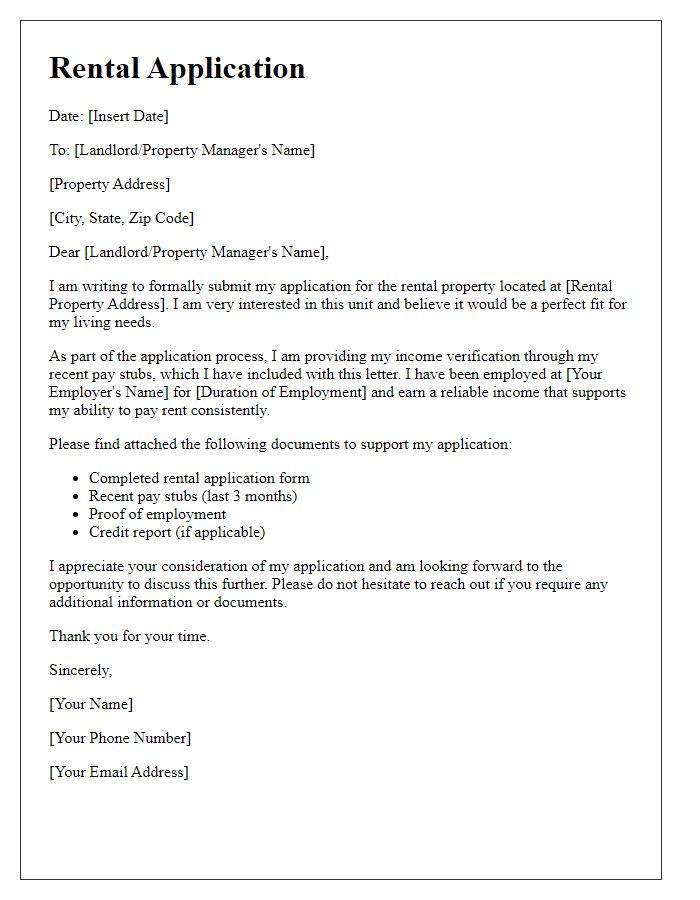

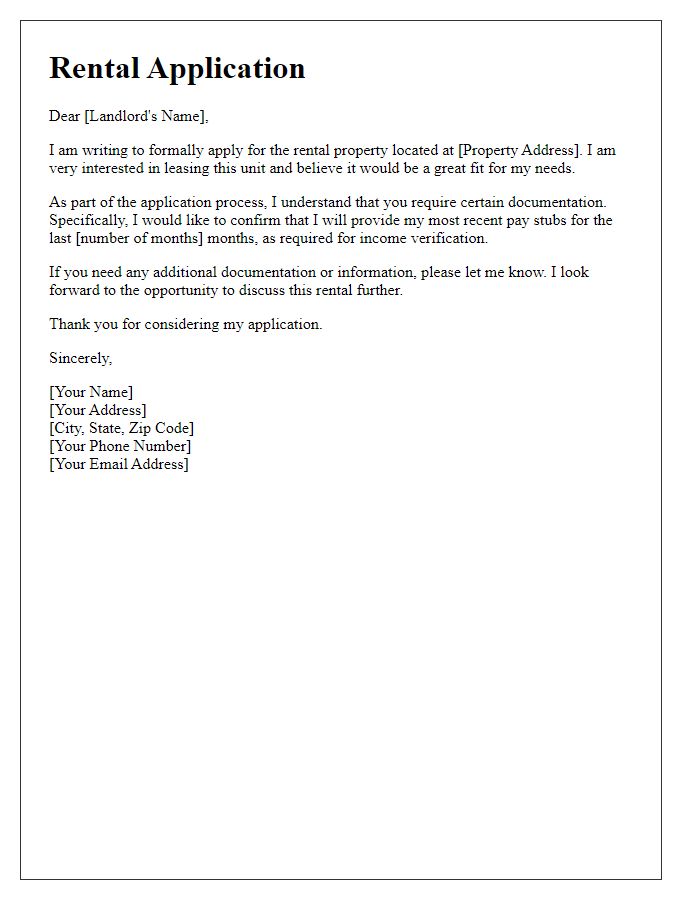

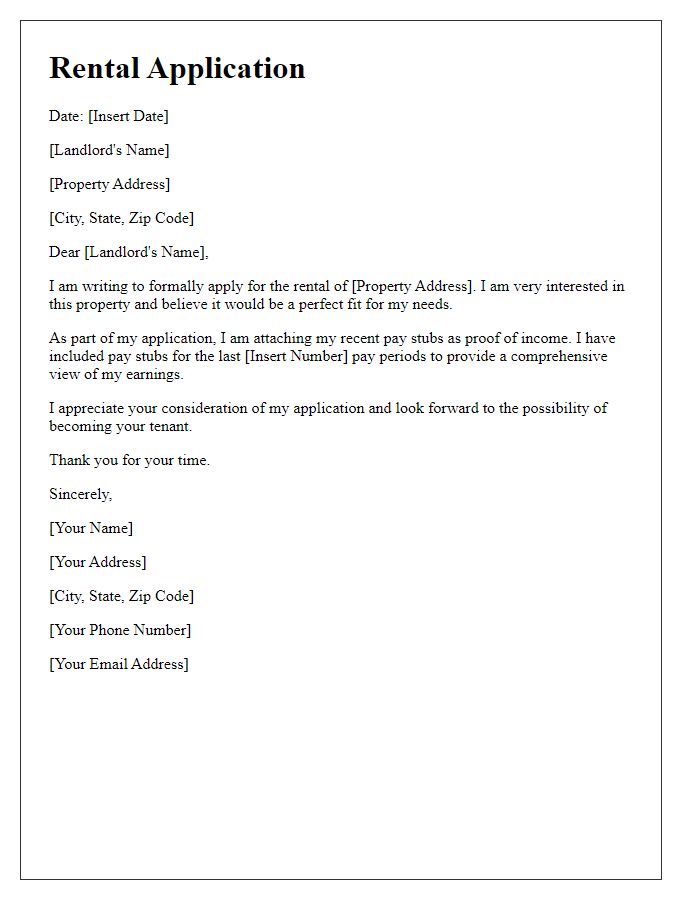

Letter template of rental application emphasizing income verification with pay stubs

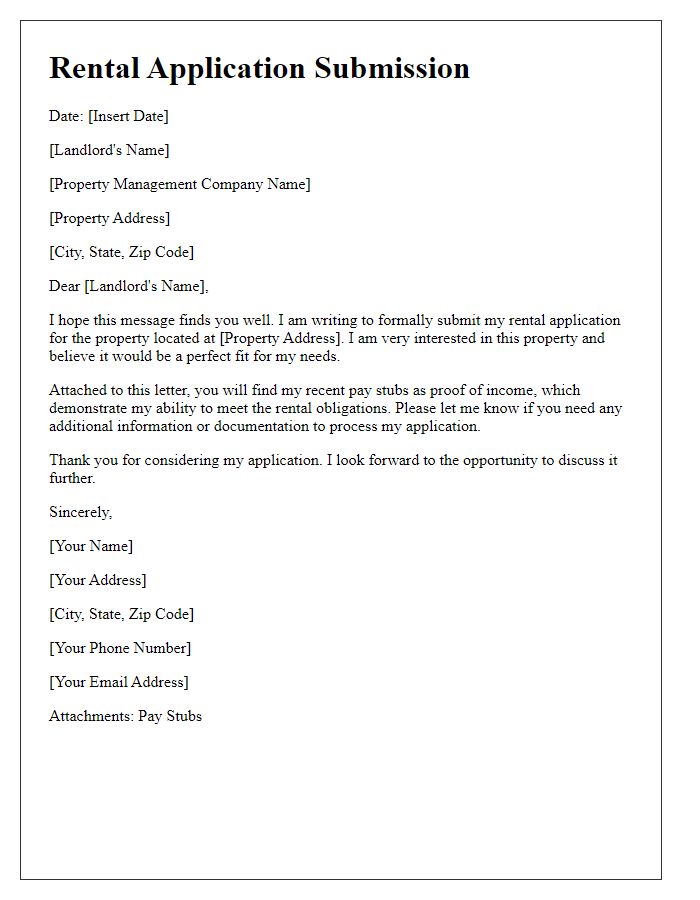

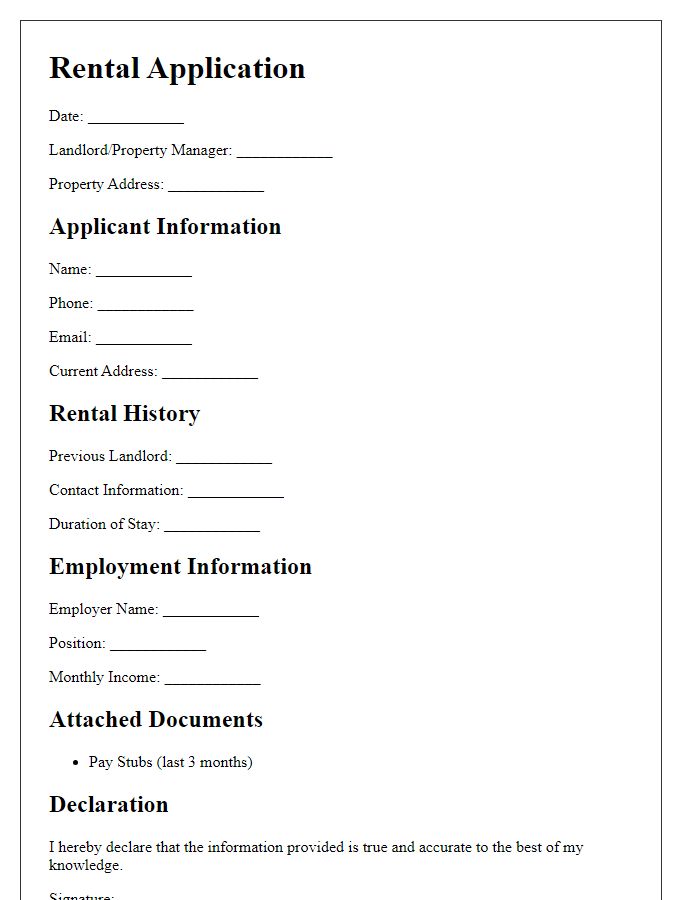

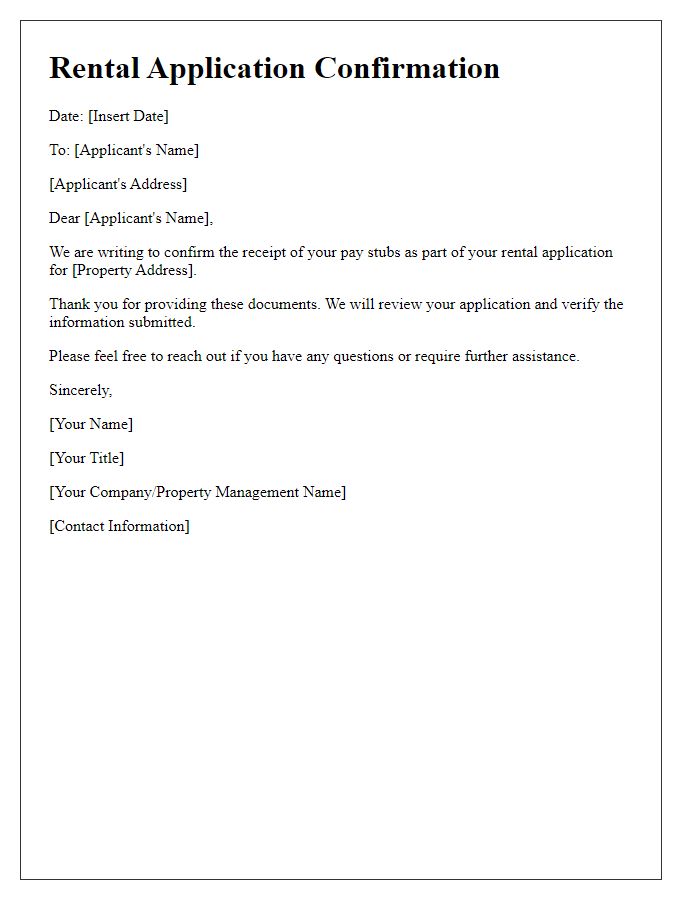

Letter template of rental application submission with attached pay stubs

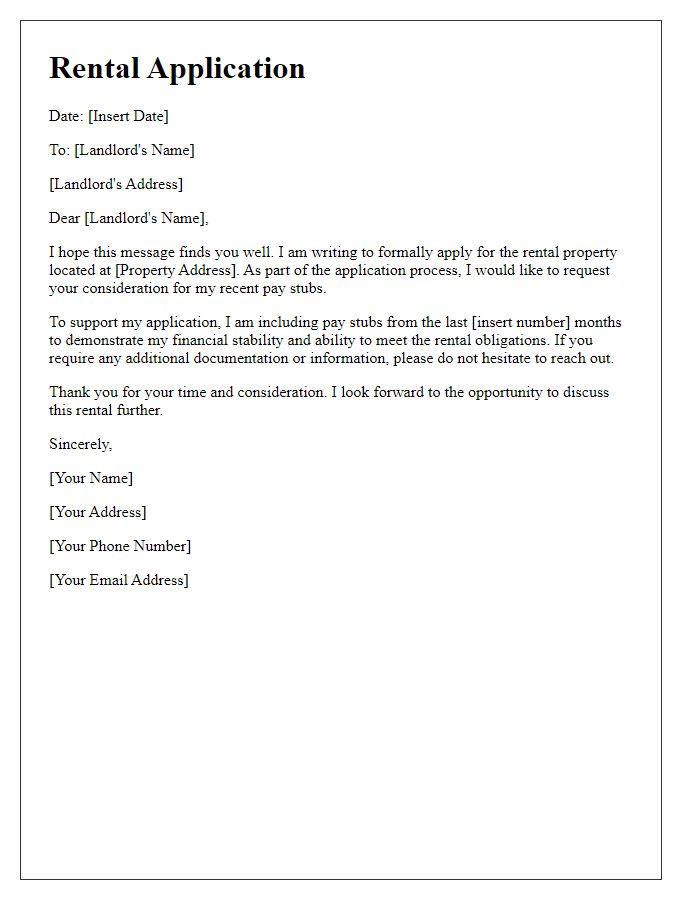

Letter template of rental application detailing financial stability through pay stubs

Letter template of rental application specifying required pay stubs for processing

Comments