Are you navigating the maze of rental applications and wondering how to effectively declare your insurance? It can be daunting, but with the right letter template, you'll be able to present yourself as the ideal tenant. In this article, we'll break down the essential elements for drafting a clear and concise rental application insurance declaration. So, let's dive in and simplify the process together!

Applicant's Full Name and Contact Information

The rental application insurance declaration includes the applicant's full name, providing a unique identifier for processing. It also requires contact information such as phone number and email address, ensuring reliable communication channels. This data is essential for landlords or property management companies to verify the applicant's identity and facilitate correspondence during the screening process. Accurate contact details greatly enhance the efficiency of the rental application, influencing the approval timeline and overall tenant experience.

Rental Property Address and Landlord's Contact Details

A rental application typically requires an insurance declaration that includes critical information about the property and landlord. Specifically, the rental property address should include details like the street number, street name, city, state, and zip code. For example, 123 Main Street, Springfield, IL, 62704. Correspondingly, the landlord's contact details must encompass the full name of the landlord, their phone number (preferably a mobile number for immediate communication), and an email address for sending documents and correspondence. This information ensures that both the applicant and landlord are accountable during the rental process while formalizing the insurance requirements pertaining to the lease agreement.

Insurance Provider's Name and Policy Number

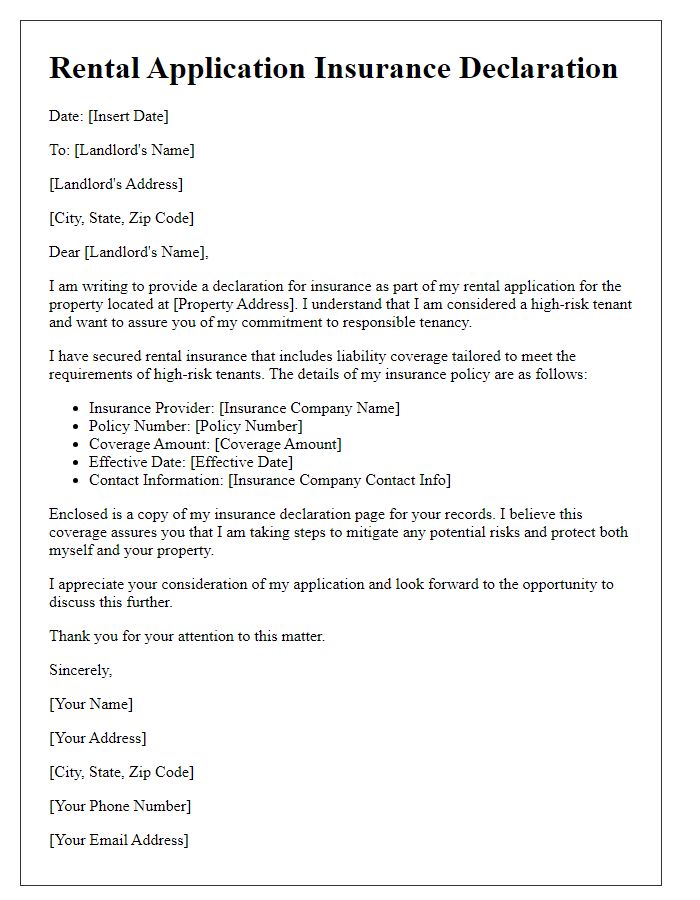

A comprehensive rental application insurance declaration outlines critical details essential for landlords. Insurance Provider's Name, like Farmers Insurance or State Farm, represents the institution offering the coverage. Policy Number indicates a unique identifier for verification, crucial for assessing coverage specifics, including liability and personal property protection. A well-documented declaration assures landlords that tenants possess adequate insurance, mitigating risks associated with property damage or personal injury. Including details such as coverage limits, effective dates, and contact information for the insurance provider enhances transparency and trust in the landlord-tenant relationship.

Coverage Details and Effective Dates

Rental application insurance declarations require comprehensive information detailing coverage specifics and effective dates. Typically, renters should provide details regarding personal property coverage, liability limits, and any additional endorsements related to personal injury or loss of use. Coverage limits often vary, with common amounts being $10,000 to $100,000 for personal property and $100,000 for liability protection. Effective dates should specify the start of coverage, commonly set from the date of the tenant's lease signing, and may extend annually unless renewed. Ensuring these details are accurately reported assists landlords in understanding the financial protections afforded to them and the tenant within the rental agreement.

Applicant's Signature and Date

Rental application insurance declarations require detailed information to ensure coverage and protection for both landlords and tenants. An applicant's signature authenticates the document, providing a legal acknowledgment of the terms within the agreement. The date marks the formal submission of the application, which may influence the consideration process. Accurate details about the applicant, such as full name, current address, and rental history, enhance clarity in identifying the individual. Furthermore, including specific information about the type of insurance, coverage amounts, and provider can solidify trust and transparency in the transaction.

Letter Template For Rental Application Insurance Declaration Samples

Letter template of rental application insurance declaration for first-time renters.

Letter template of rental application insurance declaration for families.

Letter template of rental application insurance declaration for students.

Letter template of rental application insurance declaration for professionals.

Letter template of rental application insurance declaration for long-term tenants.

Letter template of rental application insurance declaration for commercial leases.

Letter template of rental application insurance declaration for pet owners.

Letter template of rental application insurance declaration for short-term rentals.

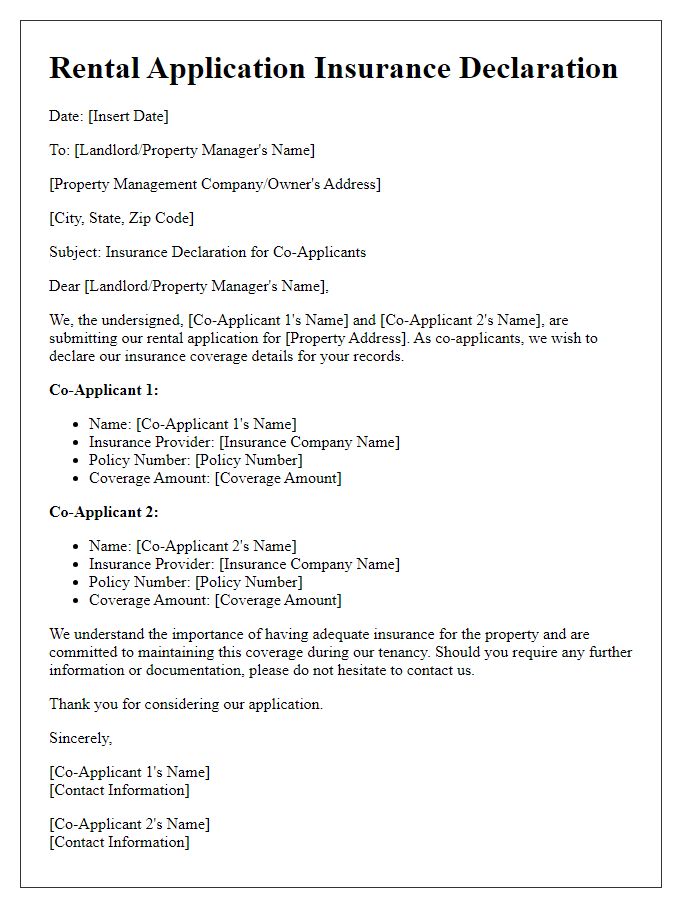

Letter template of rental application insurance declaration for co-applicants.

Comments