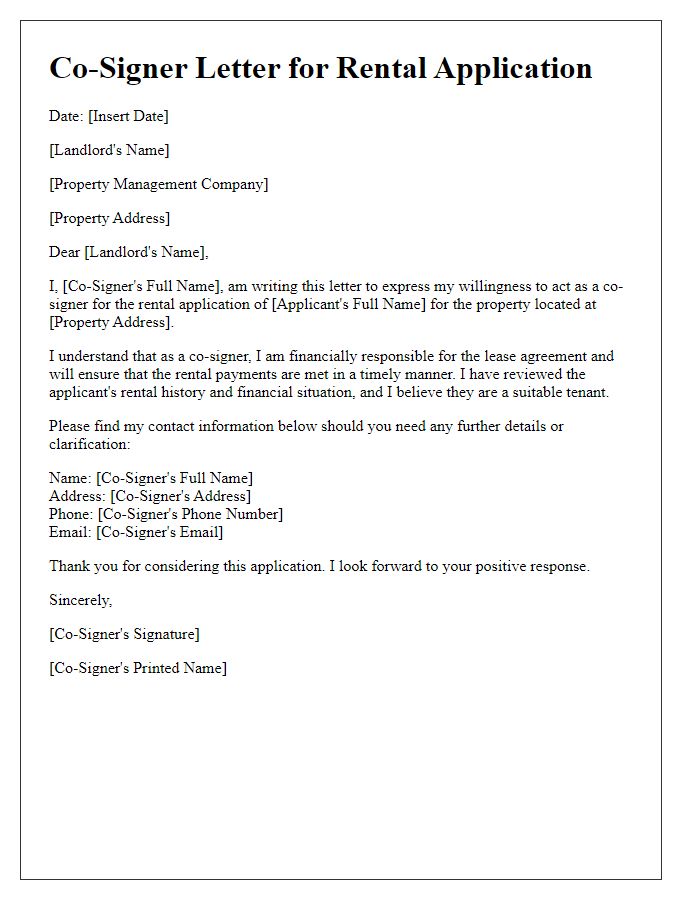

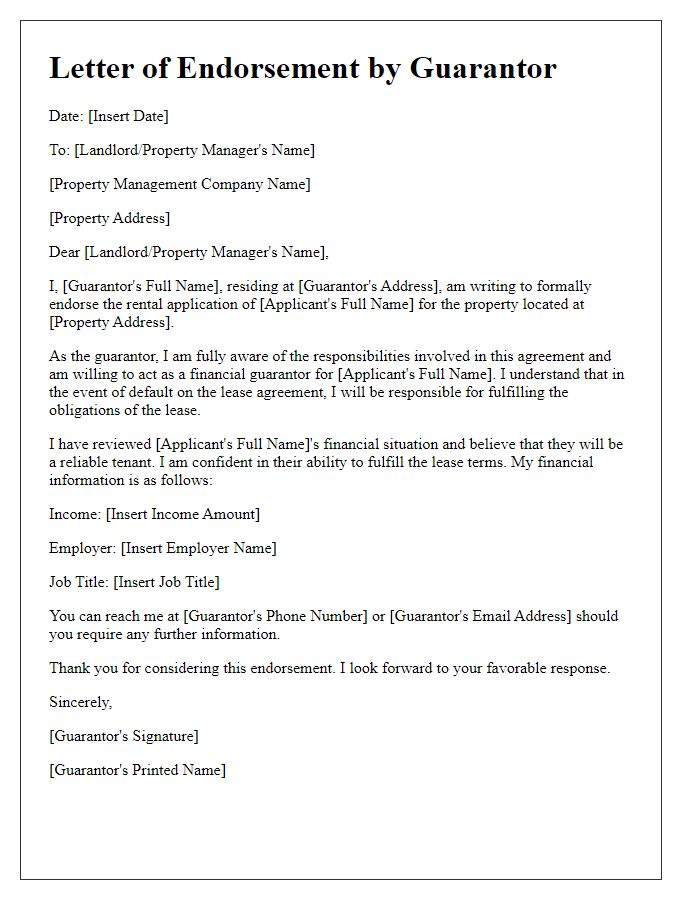

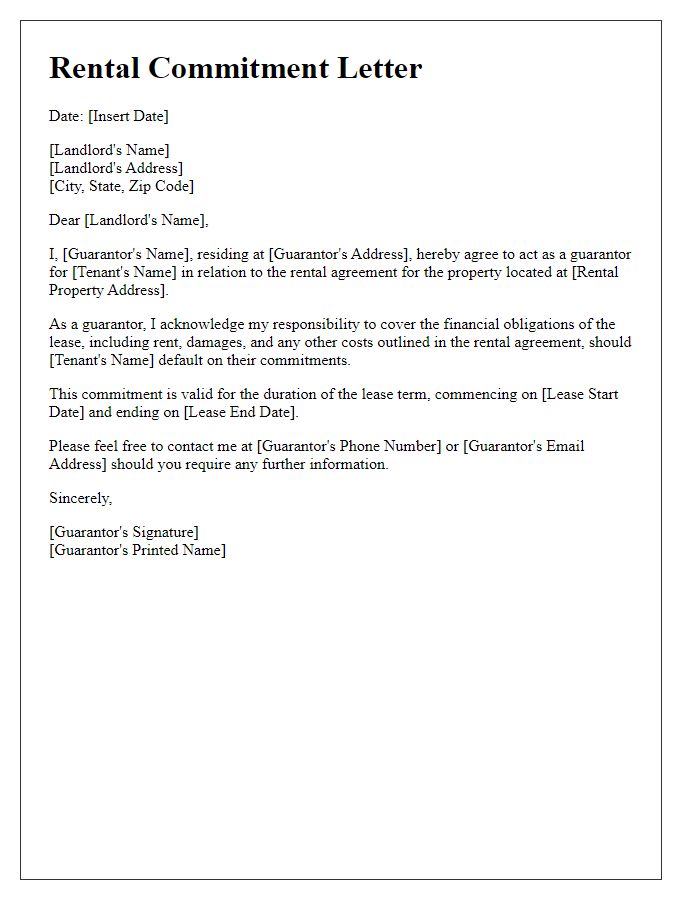

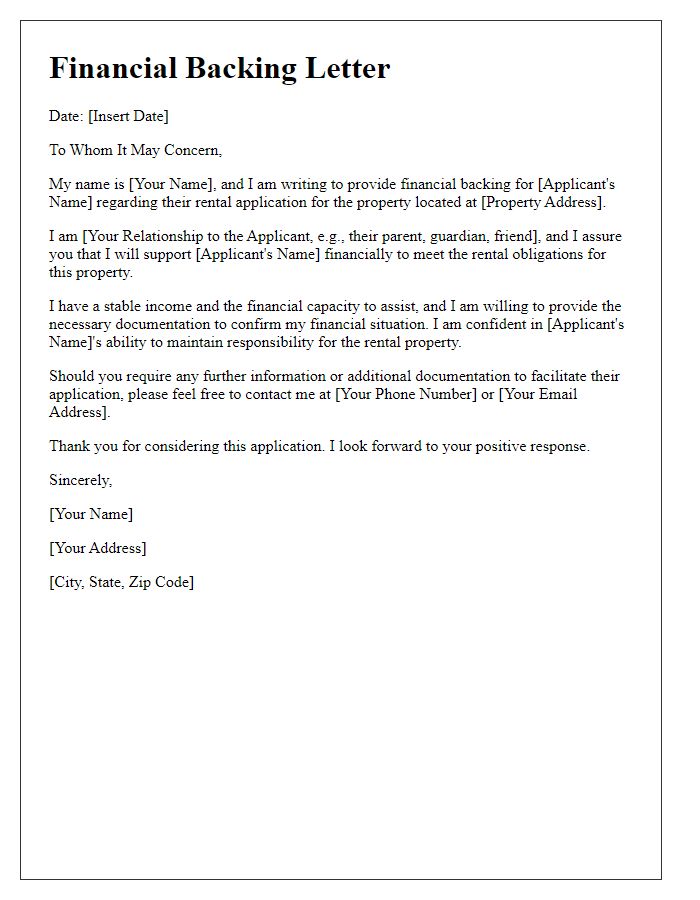

Are you looking to secure a rental property but need a guarantor? Understanding the requirements and responsibilities of a rental application guarantor can make a significant difference in your application process. A well-written letter can not only convey your commitment but also make a strong case for why your financial backing is reliable. Join us as we explore effective letter templates and tips to help you craft the perfect guarantor letter for your rental application!

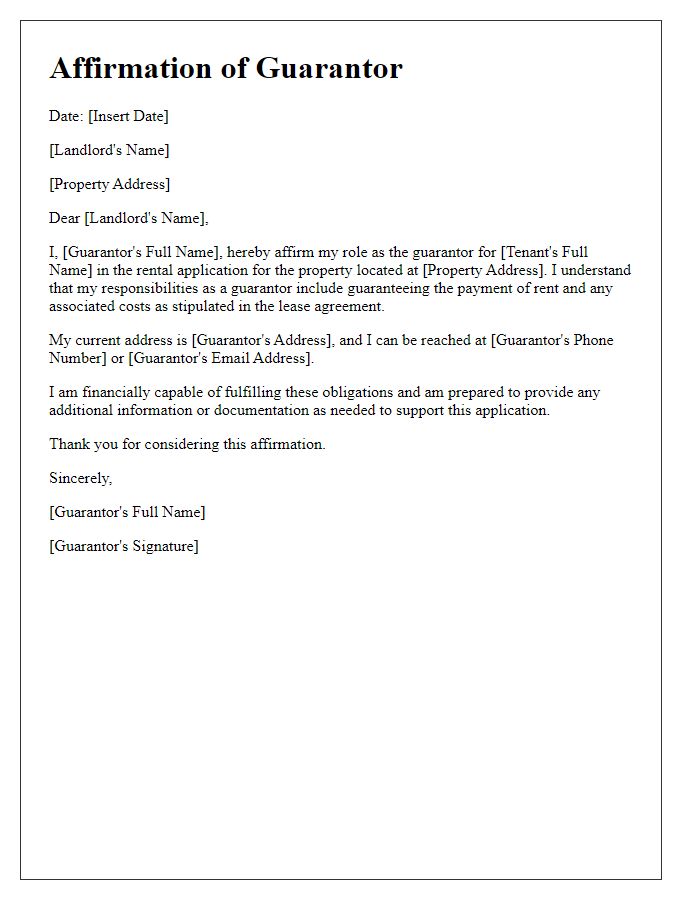

Guarantor's Full Name and Contact Information

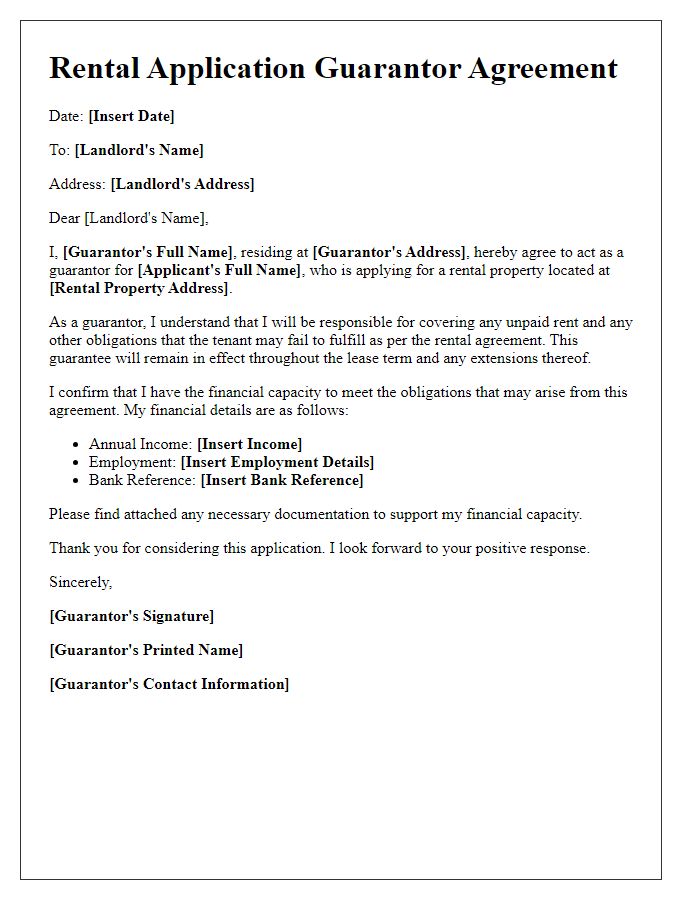

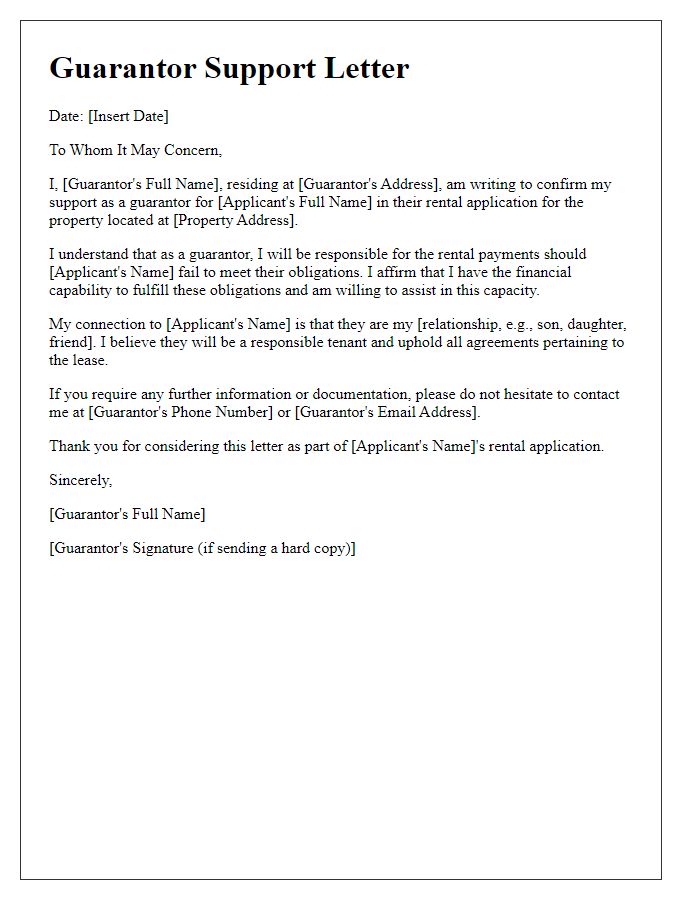

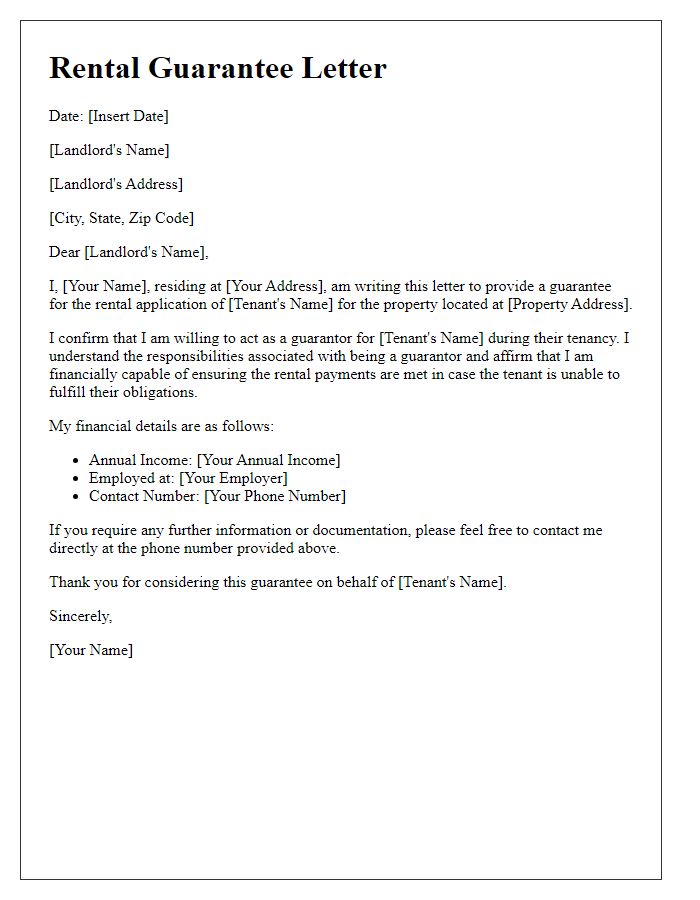

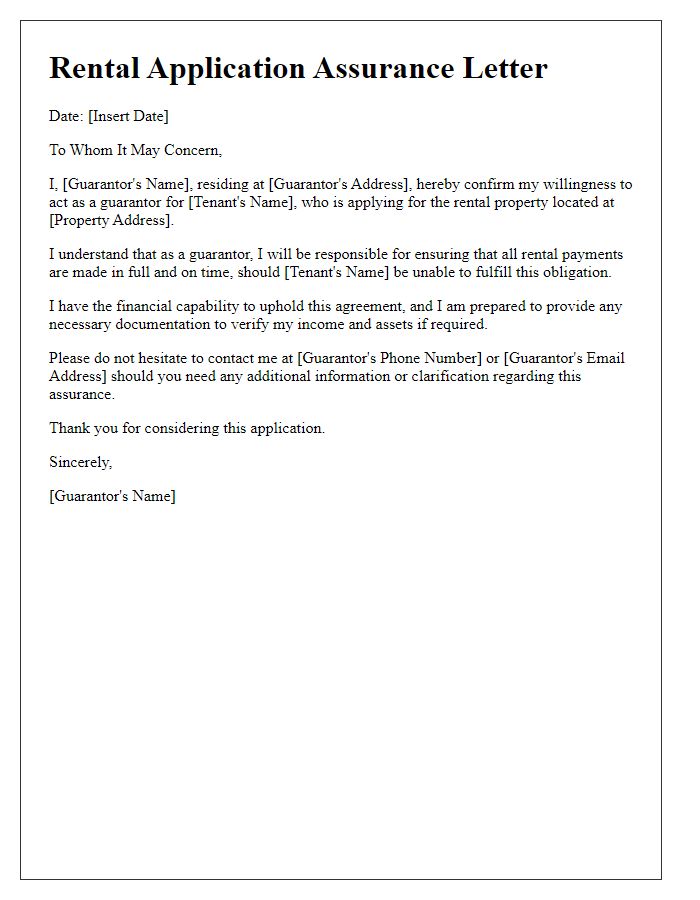

A rental application often requires a guarantor to ensure financial security for landlords, especially in cases where tenants may not have sufficient credit history or income. The guarantor's full name serves as a formal identifier, crucial in legal documents, while their contact information, including telephone numbers and email addresses, facilitates communication between the landlord and the guarantor. Moreover, verifying the guarantor's identity is essential for both parties and strengthens the agreement's validity. Adequate documentation, such as proof of income and a credit report, can further enhance the application process, ensuring all parties involved feel secure and informed about the rental agreement.

Applicant's Name and Details

A rental application guarantor serves as a financial safety net for landlords, ensuring rent payment in case the tenant defaults. Typically, the guarantor's name, contact details, and relationship to the applicant are essential. Financial stability is crucial; thus, information about employment status, annual income, and credit history is often required. Additionally, the guarantor may need to provide proof of assets, such as bank statements or property ownership, to demonstrate their capacity to cover the rent--often ranging from $1,000 to $3,000 monthly, depending on the rental market of the specific location, such as New York City or Los Angeles. Clear communication and an understanding of the responsibilities involved are vital for both the applicant and the guarantor during this process.

Rental Property Address

A rental application guarantor is a crucial part of securing a rental agreement, especially for properties where landlords require additional financial assurance. Such applications often include comprehensive details about the rental property address, which might include city names like San Francisco, California, or neighborhood identifiers such as Brooklyn, New York. The guarantor's financial stability is essential, typically demonstrated through documents showing a minimum income ratio of 3:1 compared to the monthly rent. A solid guarantor ensures timely payments for the lease term, possibly spanning 12 months or longer, alleviating landlords' concerns regarding tenant reliability. Proper documentation includes identification verification, proof of employment, and credit reports, creating a robust profile that affirms the guarantor's capability to cover potential rent defaults.

Guarantor's Financial Stability and Employment Information

A guarantor's financial stability significantly impacts the rental application process. Employment information, such as job title, annual salary (ideally above $50,000), and length of employment (at least two years) is crucial. Stability can be demonstrated through consistent paycheck deposits in a checking account and verified by bank statements. Credit scores in the range of 700 or higher indicate reliability. Additional income sources, such as investments or side jobs, enhance financial security. Landlords often require proof of assets, such as savings accounts, property ownership records, or investment portfolios, to ensure the guarantor can cover potential rent defaults.

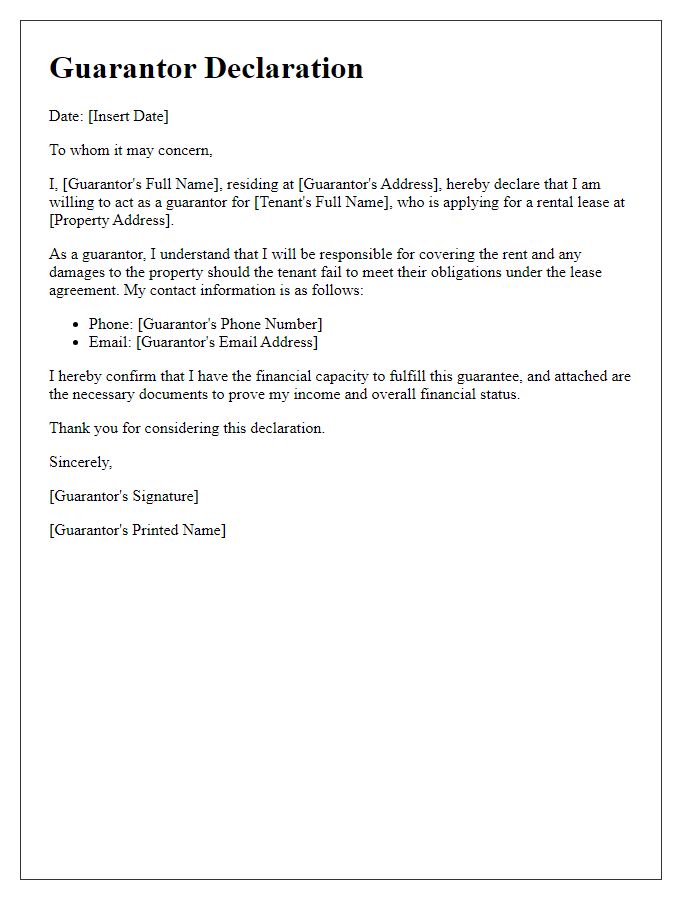

Statement of Responsibility and Commitment

The rental application process often requires guarantors to provide a Statement of Responsibility and Commitment. This document serves as a formal agreement where the guarantor pledges to assume financial liability for the lease obligations if the tenant cannot fulfill them. Relevant details include the address of the rental property, often in urban areas like New York City or San Francisco, and the monthly rent amount, typically ranging from $1,500 to over $3,000. The guarantor must also provide personal identification, such as a government-issued ID or Social Security number, to verify their identity and financial standing. This commitment not only protects landlords but also signifies accountability, ensuring that obligations such as timely rent payments and property upkeep are met.

Comments