Are you considering applying for rental childcare services but unsure where to start? Crafting a solid letter can make all the difference in presenting your application effectively. In this article, we'll guide you through essential components, tips, and best practices to ensure your letter stands out. So, let's dive in and explore how to create a compelling application letter that leaves a lasting impression!

Applicant's Personal Information

Completing the rental application requires a comprehensive breakdown of the applicant's personal information, including vital details such as full name, contact number, and email address for communication purposes. The applicant's current address, including the street name, city, state, and zip code, helps landlords verify residency history. Date of birth provides insight into age, while social security number (if applicable) assists in background checks. Employment information, detailing the name of the employer, job title, and income, illustrates financial stability crucial for rental agreements. Lastly, previous rental history, including names of previous landlords and dates of tenancy, establishes a track record of reliability as a tenant.

Childcare Services Details

Childcare services encompass a variety of crucial support options for families, particularly in urban areas like New York City. Quality childcare programs provide structured environments for children aged six months to five years, focusing on early childhood development. Many centers are licensed by the Department of Health and Mental Hygiene, ensuring compliance with safety regulations. These programs often incorporate educational curricula aligned with the New York State Early Learning Standards, featuring activities designed to enhance cognitive, social, and emotional skills. Parent feedback from sources such as Care.com highlights the importance of staff-to-child ratios, which can be critical for personalized attention, typically ranging from 1:3 for infants to 1:10 for preschoolers. Cost for childcare services varies widely, with average monthly fees between $1,200 and $2,500, influenced by factors like location, facility amenities, and qualification of caregivers.

Employment Verification

Employment verification forms a critical aspect of the rental application process, particularly for those seeking childcare services within an establishment like a daycare or preschool. Employers often require proof of income and position to ensure financial stability of potential tenants. Documents typically requested include current pay stubs, W-2 forms, or employment letters detailing job title, duration of employment, and salary. Frequent employers in this sector may include schools, healthcare facilities, or private companies, each contributing to the applicant's overall qualifications. A thorough verification process serves to protect both the landlord and the child care facility, creating a safer environment for children.

Rental History and References

Rental history plays a crucial role in evaluating potential childcare service locations. Accurate records must include previous addresses (at least three past residences), duration of stay (typically 12 months or longer), and reasons for moving (job relocation, upgrading, etc.). References from past landlords provide insight into responsibility and reliability, covering aspects such as punctual rent payments, property maintenance, and adherence to lease agreements. Documentation often includes contact information for landlords, ensuring that communication can be established. Additional notes about the neighborhood's safety and proximity to schools and parks enhance the application's context, underscoring suitability for children.

Financial Stability and Proof of Income

When applying for rental accommodations for childcare services, financial stability, and proof of income play crucial roles in establishing eligibility. Income sources could include salaries, business profits, or government assistance, with required documentation like pay stubs or tax returns to verify the financial status. Typical income-to-rent ratios accepted by landlords might be 3:1, meaning monthly income should be at least three times the rental cost. Consistent employment records, preferably spanning over two years, enhance credibility, while additional financial documentation such as bank statements or investment account overviews serve to provide a comprehensive picture of financial health. This information reassures landlords regarding the ability to meet rental obligations consistently.

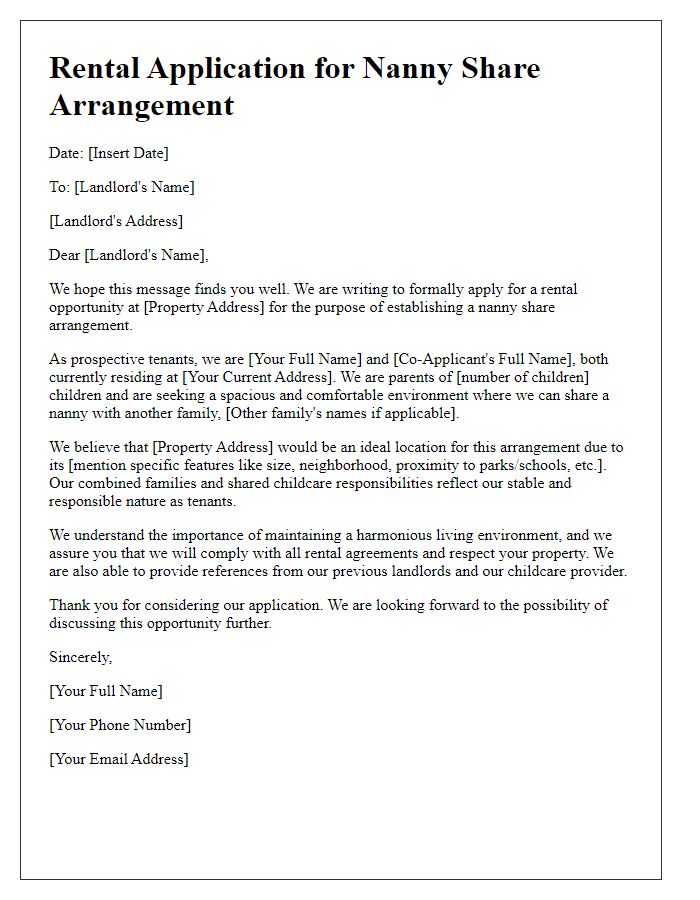

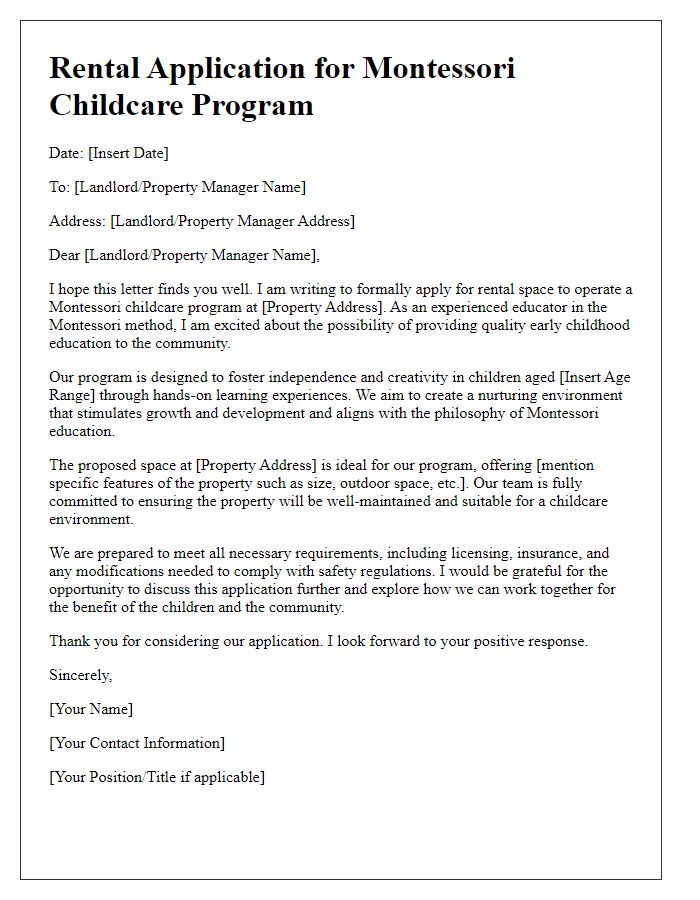

Letter Template For Rental Application Childcare Services Information Samples

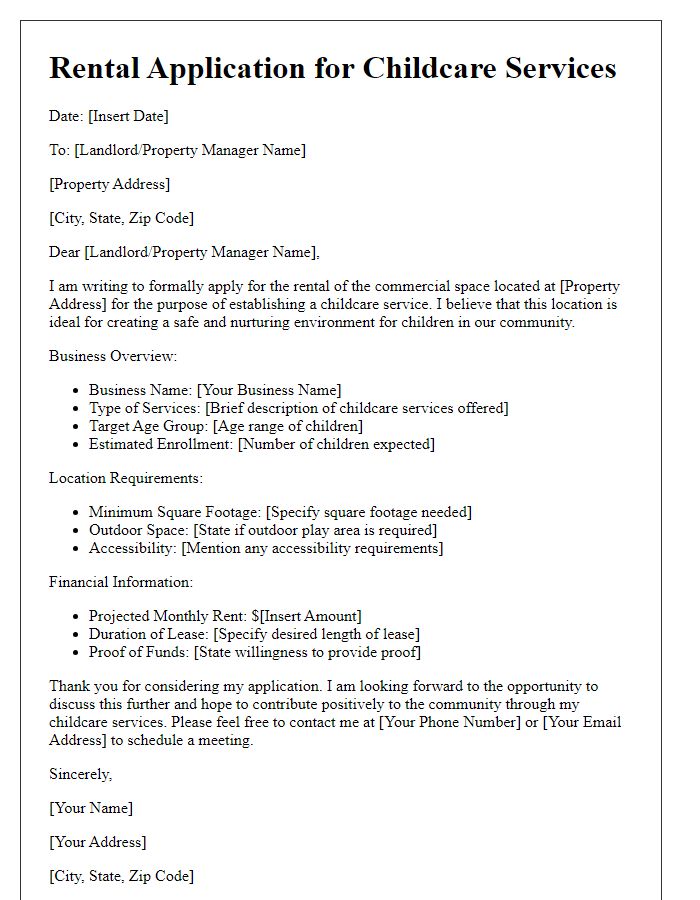

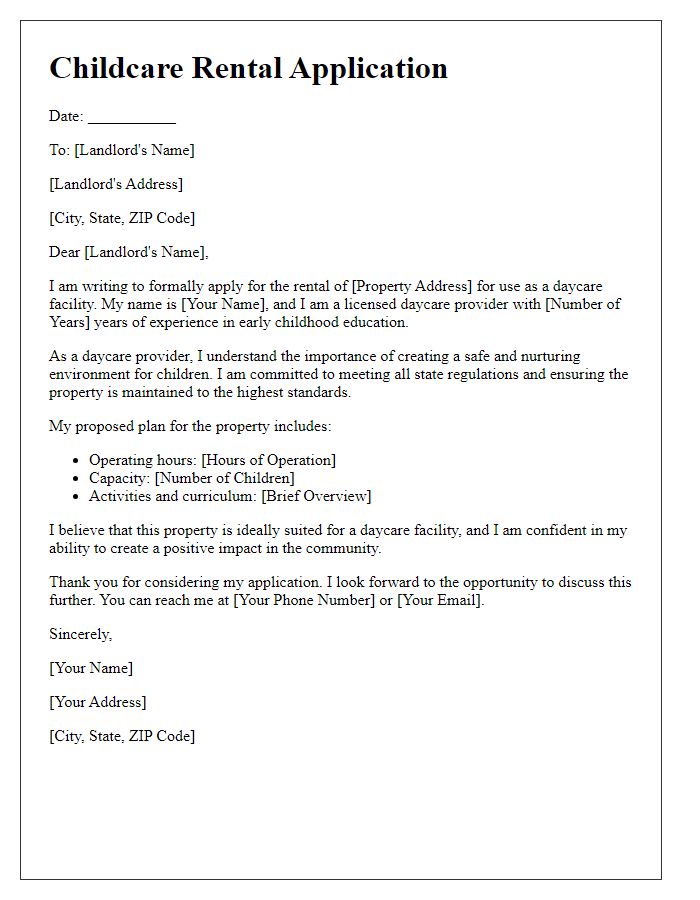

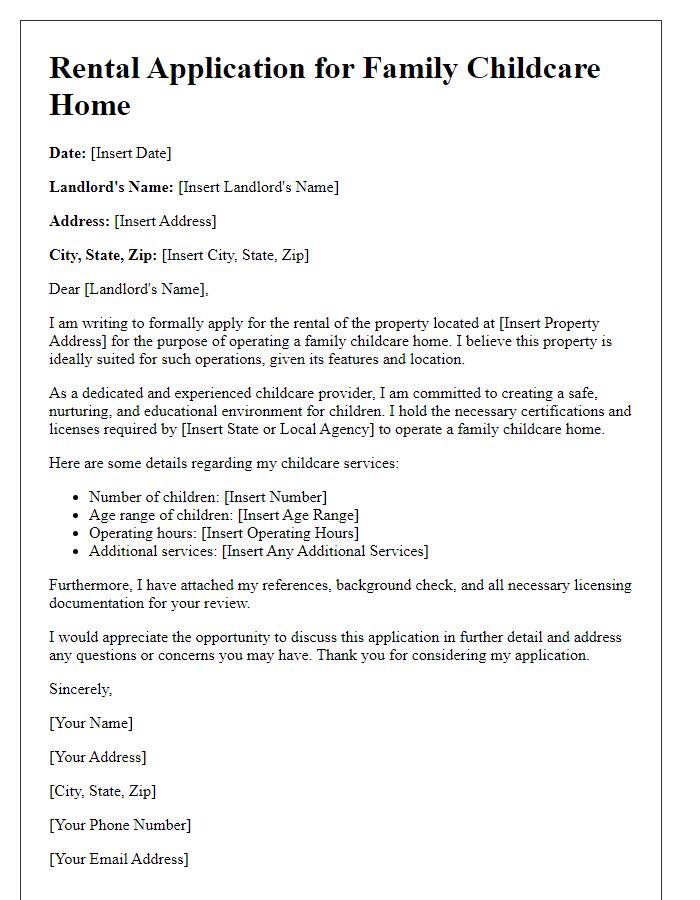

Letter template of rental application for childcare services in commercial spaces

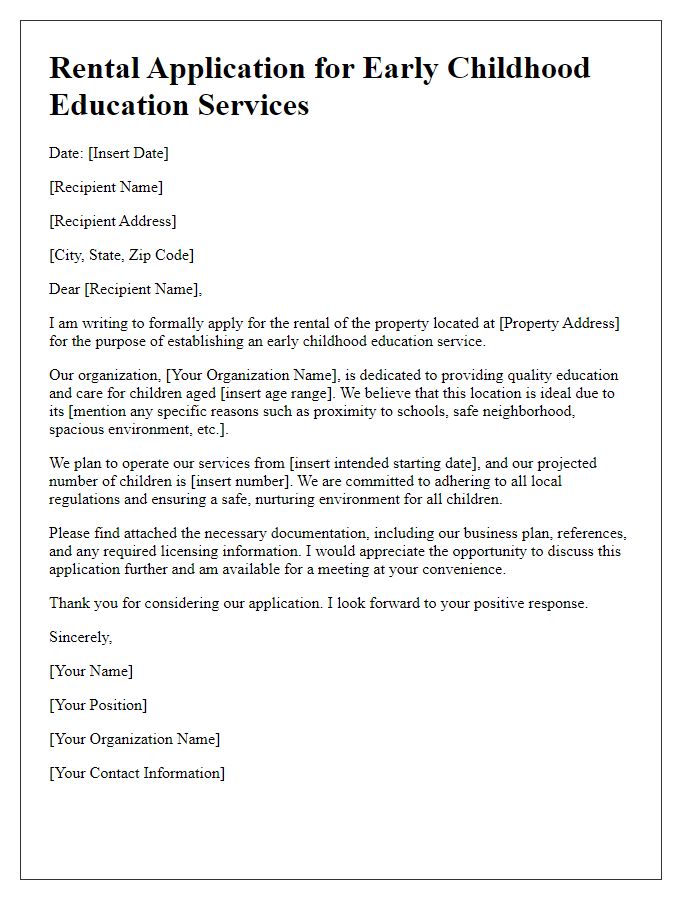

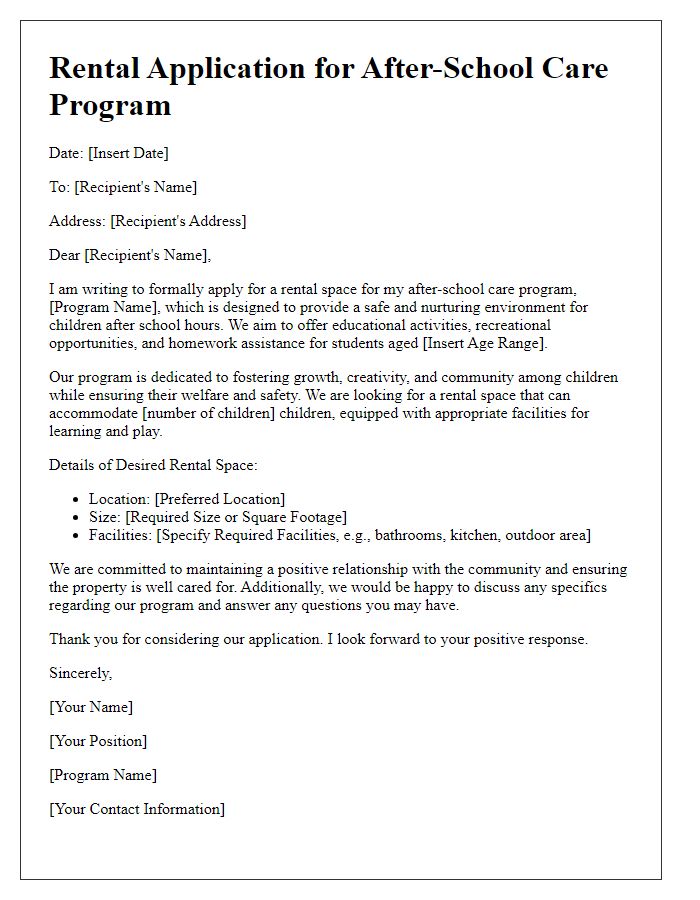

Letter template of rental application for early childhood education services

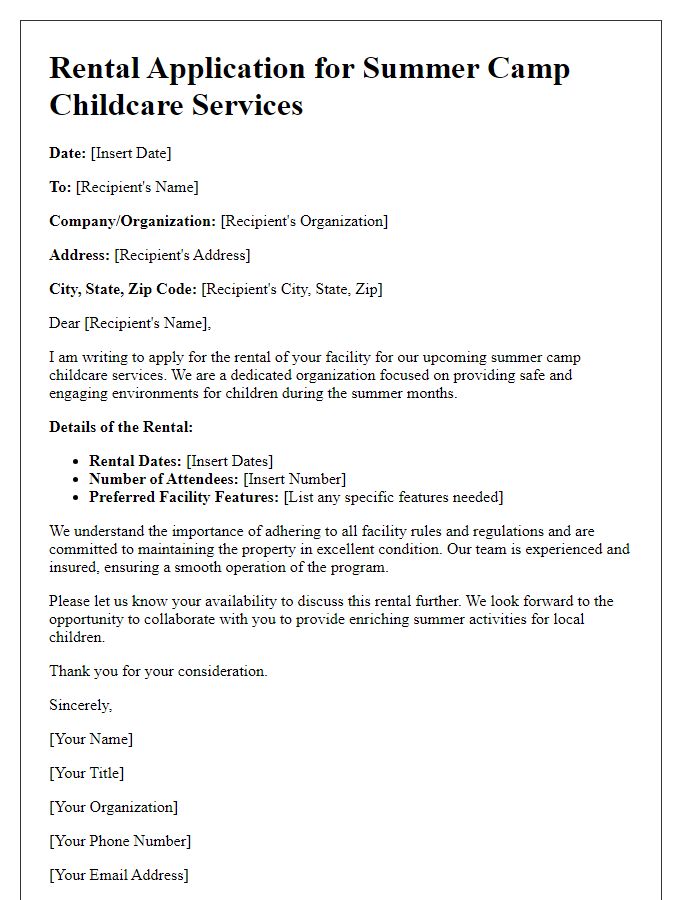

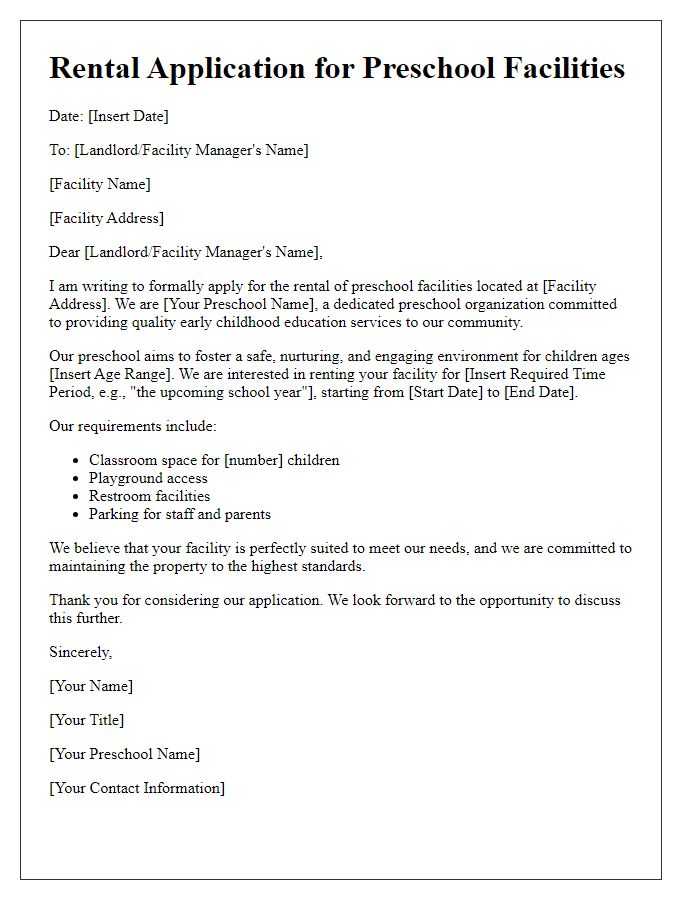

Letter template of rental application for summer camp childcare services

Comments