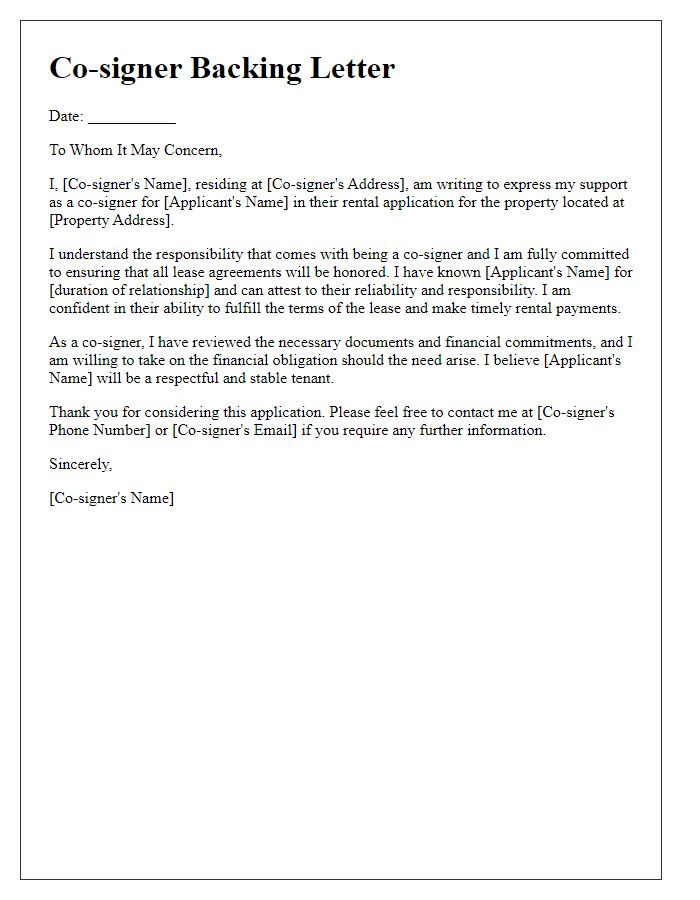

Are you considering renting a new place and need a co-signer for your rental application? A co-signer can provide that extra layer of assurance for landlords, especially if you're a first-time renter or have a limited rental history. Crafting a compelling letter to introduce your co-signer can make your application stand out and ease landlord concerns. Read on to discover useful tips and a template that will help you create an effective co-signer letter!

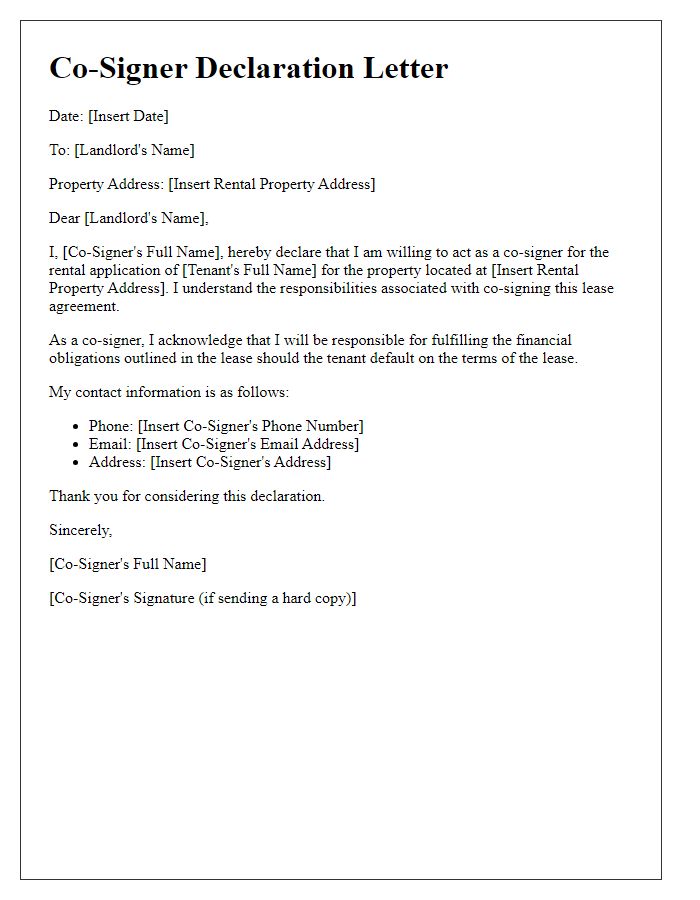

Co-signer's Personal Information

Co-signers play a crucial role in rental applications, especially when the primary applicant may have limited credit history. Essential details include the co-signer's full name, social security number for identification purposes, and current address to establish residency. Employment history also matters, encompassing job title, company name, and length of employment to demonstrate financial stability. Additionally, providing monthly income figures, such as salary or other sources, supports the co-signer's ability to cover rent obligations. Inclusion of banking information, like account type and balance, can further assure landlords of financial reliability. Lastly, contact information, such as phone number and email address, facilitates direct communication between the landlord and the co-signer.

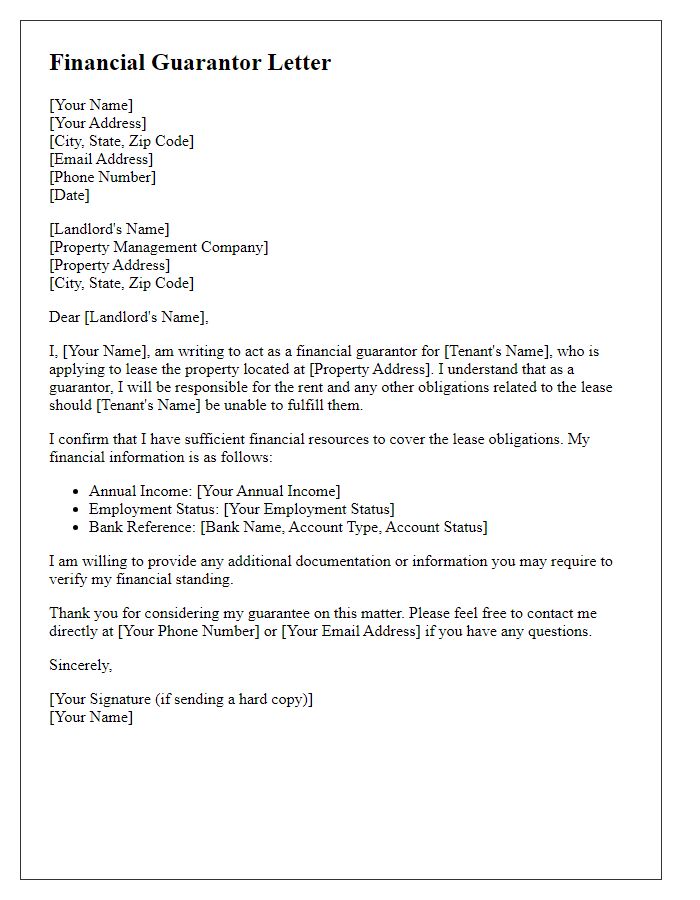

Financial Stability and Employment Details

A rental application co-signer provides essential support to potential tenants, especially those without established credit histories. Providing financial stability and employment details is crucial in this context. For example, if the co-signer works at a reputable company such as Google in Mountain View, California, highlighting a stable salary of $85,000 annually can significantly enhance the application. Moreover, detailing other financial assets, such as savings accounts with balances exceeding $20,000, can further assure landlords of reliability. Additionally, mentioning a solid employment history, including ten years at the current job, underscores stability. Providing personal references from past landlords, along with proof of income, may bolster trustworthiness, making the co-signer an attractive asset in securing rental properties.

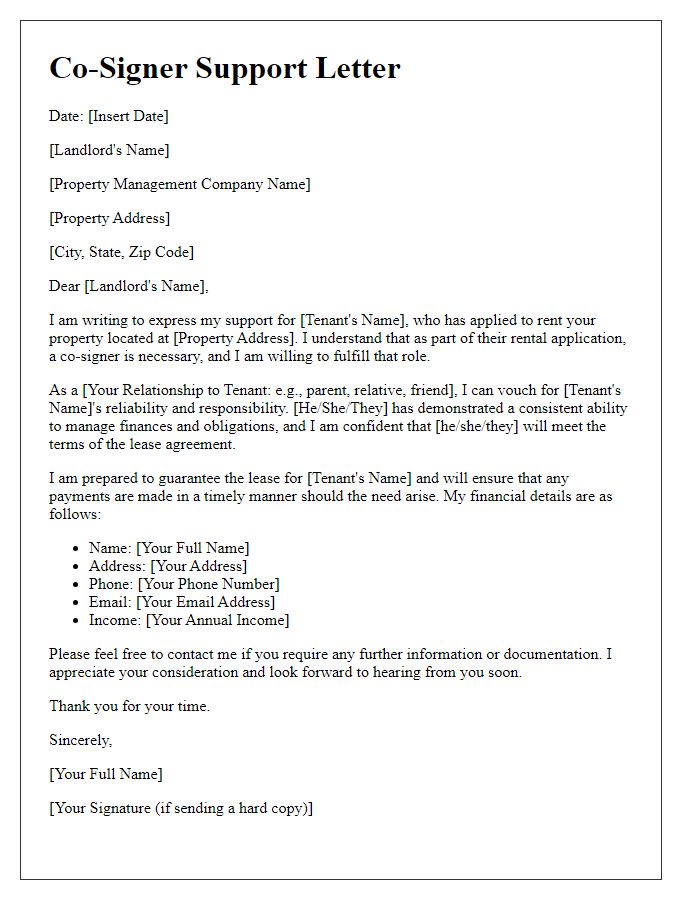

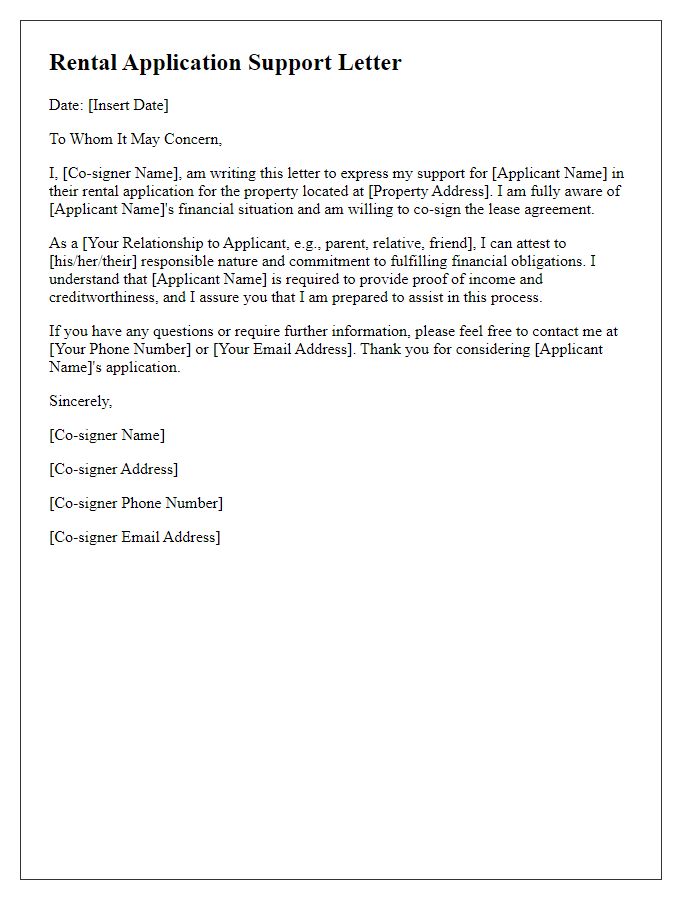

Relationship to the Applicant

A co-signer plays a critical role in rental applications by providing financial backing and assurance to landlords. This individual is often a close family member or a trusted friend, ensuring that rental payments are guaranteed even if the primary applicant faces financial difficulties. The relationship can significantly influence the co-signer's willingness to support the applicant. Common relationships include parents, siblings, or long-term family friends, who have a vested interest in the applicant's well-being and financial stability. This bond establishes a level of trust, which landlords appreciate, as it enhances the reliability of future rental payments and reduces the risk of lease violations.

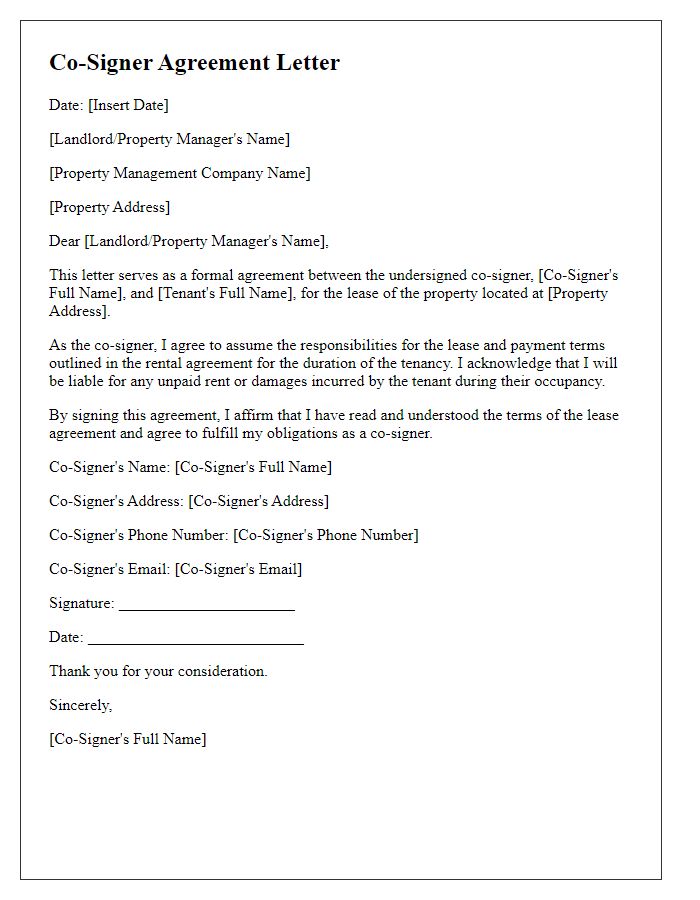

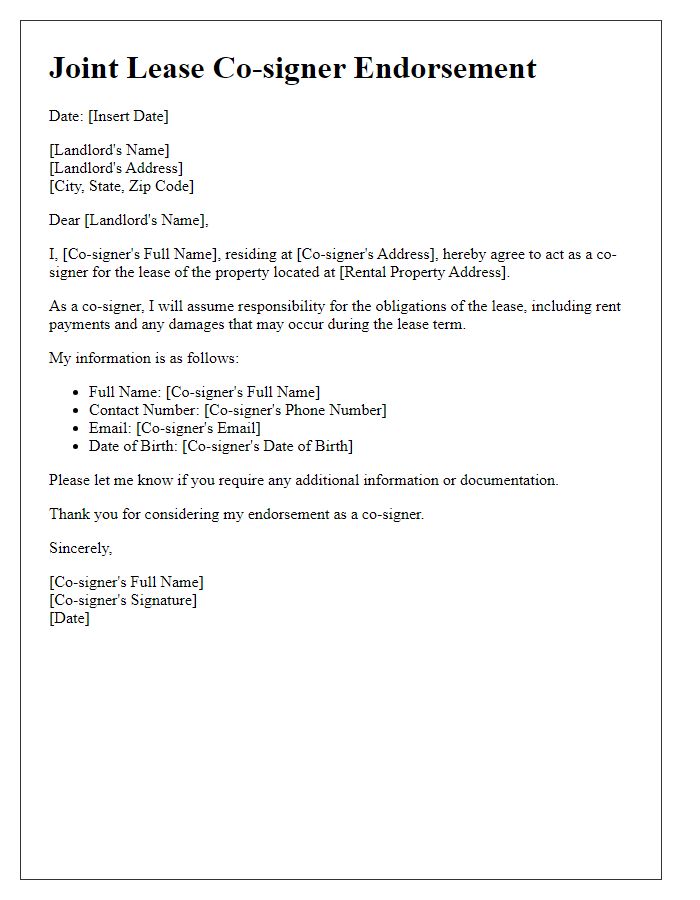

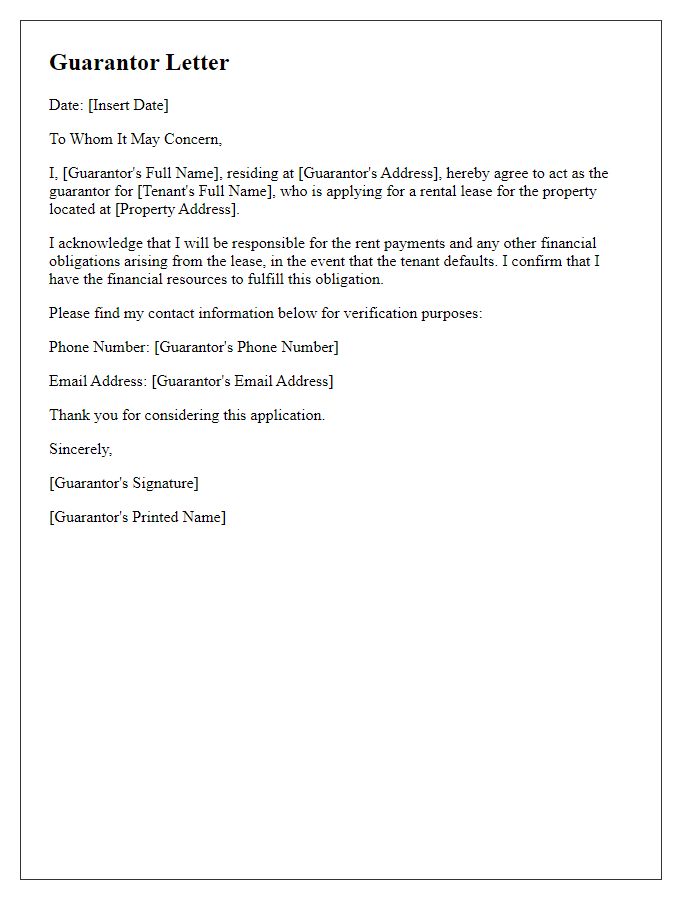

Acknowledgment of Co-signing Responsibility

Co-signing a rental application entails significant financial responsibility in housing agreements, particularly in urban areas such as New York City or Los Angeles. A co-signer guarantees the lease, enabling the primary applicant to secure the property despite potential credit issues or insufficient income. This legal commitment includes covering monthly rent obligations, often exceeding $2,000 for a one-bedroom apartment in metropolitan regions, should the primary signer default. Additionally, a co-signer may face credit score impacts if the lease is not maintained, with missed payments potentially affecting scores in the range of 300 to 850. Understanding these responsibilities is crucial for any individual considering co-signing a lease, especially in high-demand rental markets.

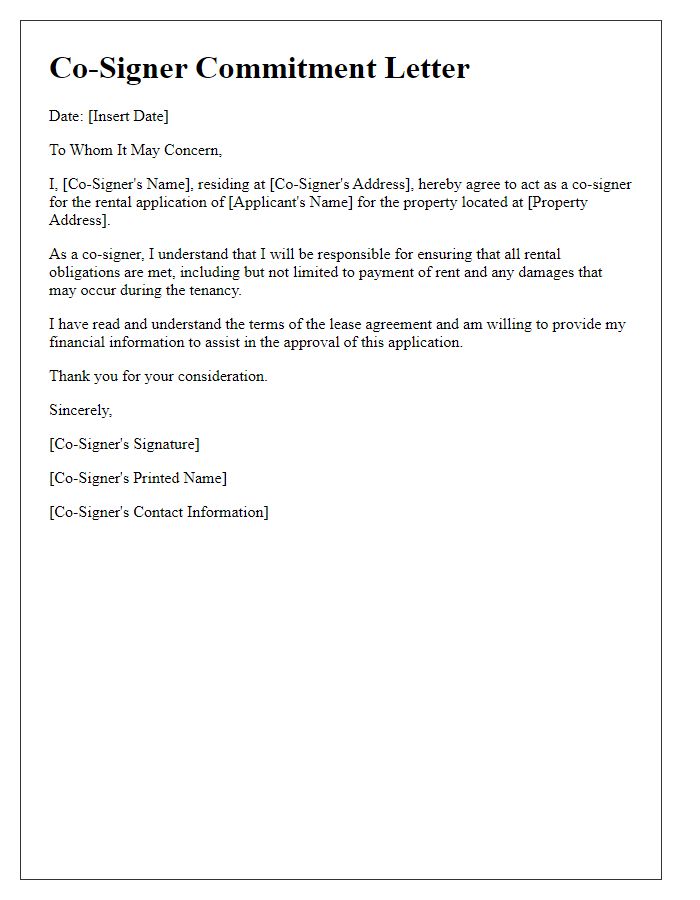

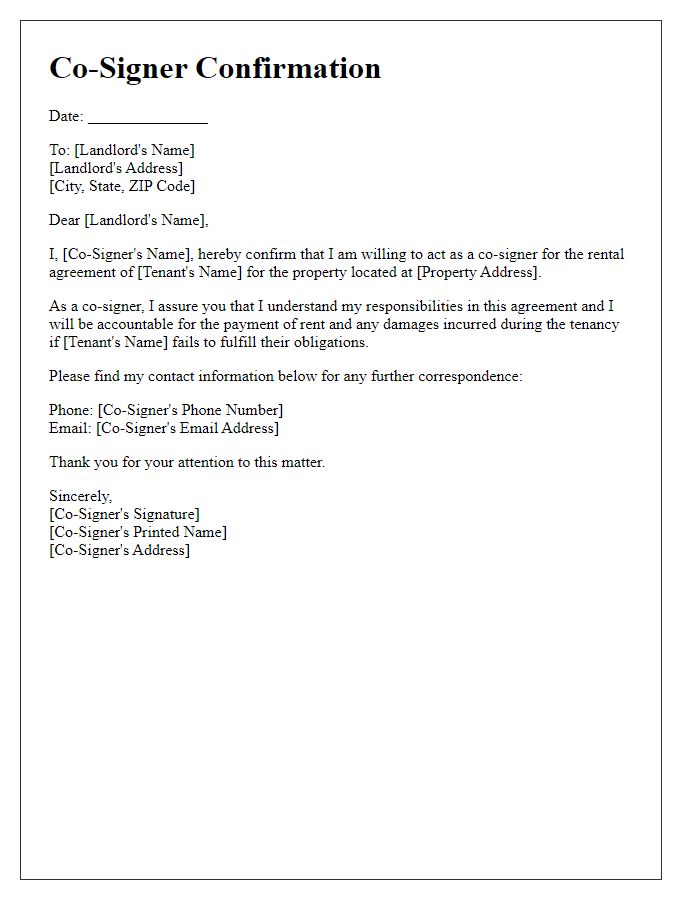

Contact Information and Signature

In rental applications requiring co-signers, precise contact details play a crucial role in establishing trust and accountability. The co-signer's full name provides legal identification, while a complete address, including street name, city, and zip code, ensures accurate communication. A reliable phone number enables swift contact if any issues arise regarding rent payment or lease terms. Additionally, an email address offers a practical alternative for correspondence, often preferred for formal communication. Finally, an official signature, hand-written or digital, validates the agreement and confirms the co-signer's commitment, signifying legal responsibility to cover the lease obligations if the primary tenant defaults or fails to comply with the rental terms.

Comments