As the year draws to a close, it's the perfect time to reflect on your financial decisions and plan for a successful tax filing. With tax regulations constantly evolving, a proactive approach can help maximize your deductions and minimize any last-minute surprises. Understanding the nuances of tax strategies can empower you to take charge of your finances and ensure you're making the most of available opportunities. Join me as we explore essential end-of-year tax planning tips that could save you moneyâread on for more insights!

Tax brackets and rates

Understanding tax brackets and rates is essential for effective end-of-year tax planning. The United States employs a progressive tax system, with seven tax brackets ranging from 10% to 37%, based on taxable income levels. For the 2023 tax year, single filers face a 10% rate on income up to $11,000, a 12% rate on income between $11,001 and $44,725, and further escalating rates for higher income thresholds. Married couples filing jointly have different brackets, with the 10% rate applicable on the first $22,000 of combined income. Certain strategies, like accelerating deductions or deferring income, can help optimize tax liability within these brackets. Awareness of changes to tax laws, such as those enacted by the Tax Cuts and Jobs Act or adjustments for inflation, is crucial since they can significantly impact tax obligations and overall financial planning for the upcoming year.

Deductible expenses

As December approaches, it is essential to review deductible expenses to optimize your tax return for the year 2023. Business-related expenditures, including office supplies (such as paper and ink), travel costs (airfare and accommodation), and utility bills (electricity, water) can significantly reduce taxable income. Charitable contributions to qualified organizations (like local food banks or nonprofits) are also deductible, providing both a financial benefit and a chance to contribute to the community. Additionally, individuals might consider medical expenses (over the stipulated threshold of 7.5% of adjusted gross income) and mortgage interest payments, which can also offer substantial deductions. Keeping accurate records and receipts will be crucial for substantiating these deductions in case of an audit.

Tax credits eligibility

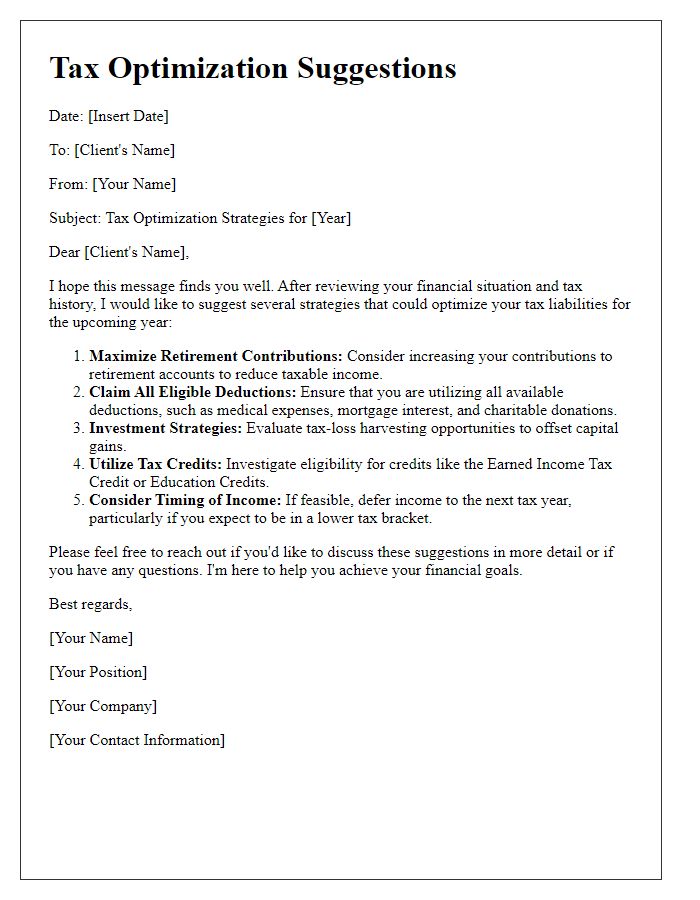

Tax credits can significantly reduce overall tax liability, providing opportunities for financial relief during end-of-year tax planning. Eligibility for various tax credits such as the Earned Income Tax Credit (EITC, designed for low to moderate-income workers) and the Child Tax Credit (CTC, providing financial support for families with dependent children) often depends on specific income thresholds and filing statuses. Important factors include Adjusted Gross Income (AGI), which can affect the amount of eligible credits. Reviewing tax documentation from sources like W-2 forms and 1099s ensures accurate calculations. Additionally, tax software or consultations with certified tax professionals can guide individuals in optimizing their tax credits, maximizing potential savings come filing time.

Retirement account contributions

Retirement account contributions play a crucial role in end-of-year tax planning, especially for individuals considering accounts like 401(k)s and IRAs. For the tax year 2023, the contribution limit for 401(k) plans is set at $22,500 for individuals under 50, while those aged 50 and above can contribute up to $30,000 due to catch-up provisions. Traditional IRAs allow contributions of up to $6,500 for individuals under 50 and $7,500 for those 50 and above. Maximizing contributions to these retirement accounts can lead to significant tax deductions, potentially reducing taxable income and enhancing long-term financial growth. By December 31, 2023, individuals should consider evaluating their contributions to ensure they are on track to meet these limits and optimize their tax situation as they prepare for the upcoming tax season.

Capital gains and losses

End-of-year tax planning involves crucial considerations regarding capital gains and losses, particularly for individuals and businesses within the United States. Capital gains, profit earned from asset sales, must be reported if they exceed $40,400 for single filers or $80,800 for married couples filing jointly. Conversely, net capital losses can offset gains, allowing taxpayers to reduce taxable income; a maximum of $3,000 can be deducted annually against ordinary income. Taxpayers should conduct a thorough review of their investment portfolio before December 31 to identify opportunities for realizing these gains and losses effectively. Consulting with a tax professional can aid in strategizing the timing and execution of transactions to optimize tax liabilities, especially in relation to the IRS tax code, which mandates specific holding periods to determine the long-term or short-term classification of capital gains.

Comments