Hey there! We all know how important it is to stay on top of our credit scores, and regularly reviewing your credit report can make a big difference in your financial health. Not only does it help you catch any errors or irregularities, but it can also give you a clearer picture of your financial standing as you make plans for the future. So, don't let those pesky updates slip your mind â take a moment to review your credit report today! Ready to dive deeper into the importance of credit report reviews? Read on!

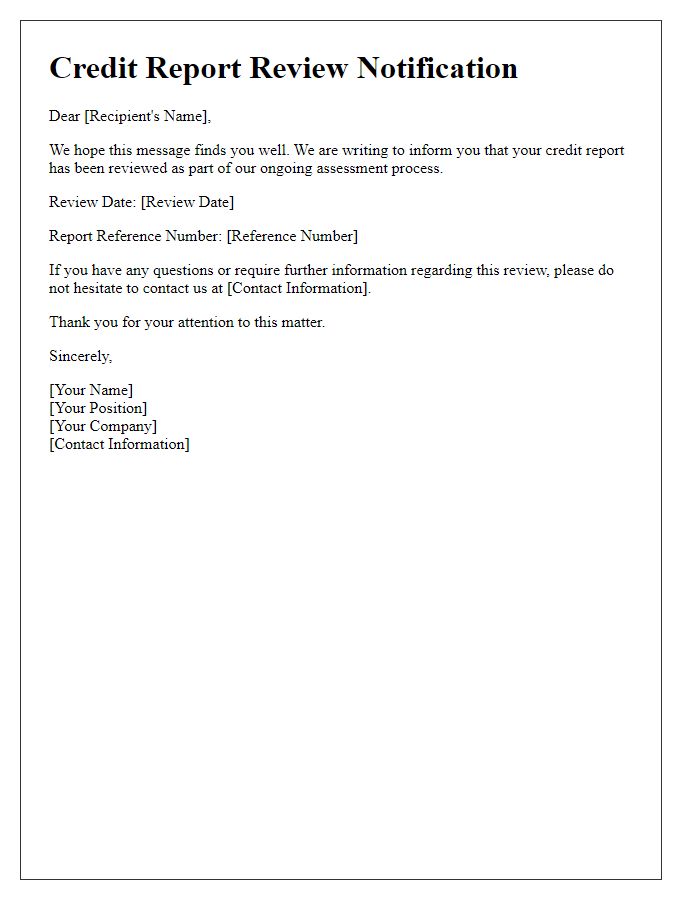

Recipient Information

A credit report review reminder is a crucial tool for ensuring individuals maintain high financial health. This reminder, often sent via email or traditional mail, informs recipients about the importance of regularly reviewing their credit reports, typically provided by agencies like Experian, TransUnion, and Equifax. Monitoring can help identify errors, which affect credit scores (ranging from 300 to 850), and detect potential identity theft incidents, leading to financial loss exceeding thousands of dollars annually. The best practice recommends checking credit reports at least once a year, particularly before significant financial events such as applying for a mortgage or auto loan. Timely assessments can empower individuals to resolve discrepancies, improve their chances for favorable interest rates, and enhance overall financial stability.

Request for Review Details

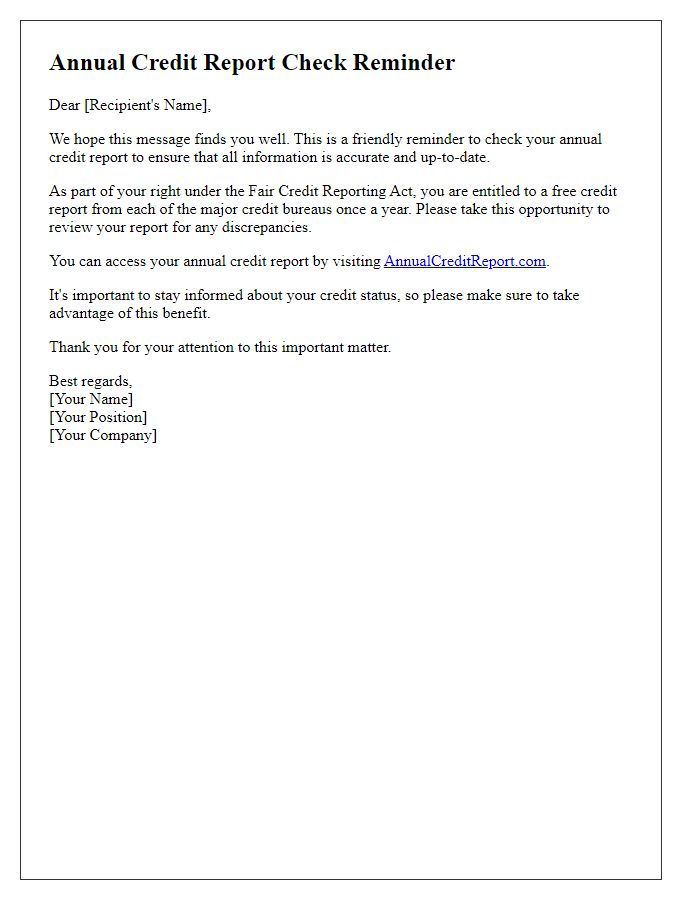

Credit reports play a crucial role in determining an individual's financial credibility, especially when applying for loans or credit cards. The Fair Credit Reporting Act oversees the accuracy of these reports, usually compiled by agencies such as Experian, TransUnion, and Equifax. Regular reviews can uncover inaccuracies, such as incorrect account balances or erroneous late payments, which can significantly impact credit scores. Screening credit reports annually, especially around significant events like major purchases or transitions in employment, ensures that individuals maintain their financial health and takes proactive measures to dispute any discrepancies before they escalate.

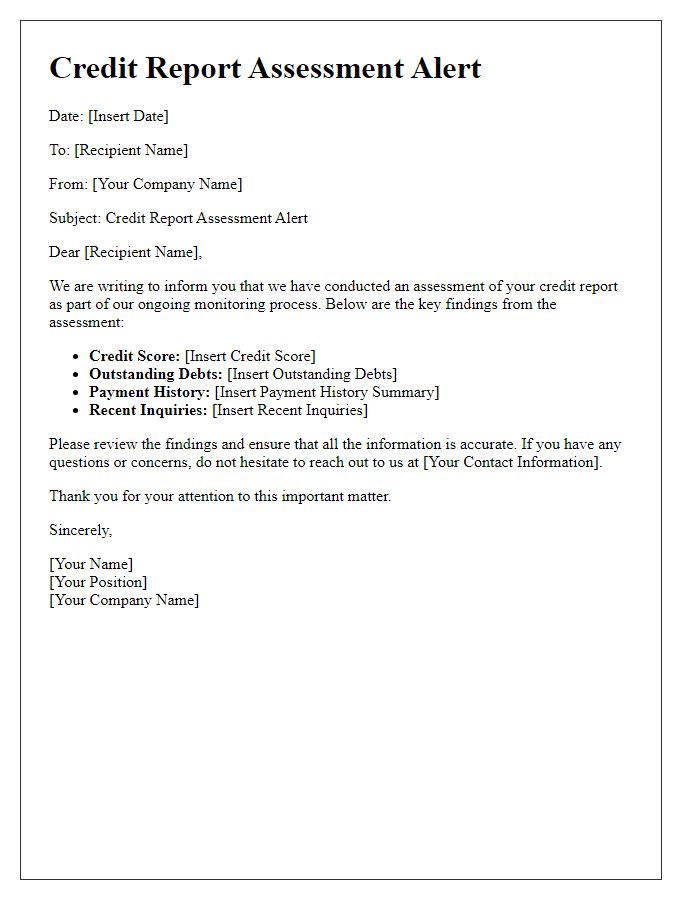

Specific Errors Noted

Inaccurate credit reports can significantly impact financial decisions and loan approvals, often affecting individuals in the United States. Errors, such as incorrect account statuses or misleading payment histories, can lead to lower credit scores, making it more challenging to secure favorable loan terms. For instance, a report may erroneously indicate late payments on a mortgage (which impacts financial health) or may misrepresent credit limits on revolving accounts like credit cards. Timely review of credit reports from major bureaus like Experian, Equifax, and TransUnion ensures any discrepancies are addressed promptly. Consumers have the right to dispute inaccuracies, which can take 30 days for resolution according to the Fair Credit Reporting Act, thereby maintaining their financial standing and improving their overall credit profile.

Supporting Documentation

Credit report reviews require thorough examination of various factors such as payment history, credit inquiries, and outstanding debts. Supporting documentation for this process may include recent credit reports from agencies like Experian, TransUnion, and Equifax, typically containing information on outstanding balances and various credit accounts. Verification of identity may necessitate inclusion of government-issued identification, proof of address like utility bills dated within the last three months, and income verification documents including pay stubs. Accurate assessment relies on updated financial statements reflecting current obligations, ensuring that all entries such as collections or late payments are appropriately justified. The completion of this review process can significantly impact credit score, thus enhancing borrowing potential for significant purchases like homes or automobiles.

Contact Information and Next Steps

Credit report reviews are essential for maintaining financial health, particularly for consumers in the United States facing identity theft issues or inaccuracies. Annual checks, typically conducted in January, help identify discrepancies that may lower credit scores. The three major credit bureaus, Experian, TransUnion, and Equifax, provide free access to credit reports once a year, ensuring consumers can monitor their financial status. After reviewing reports, consumers should verify any outstanding debts or accounts noted, resolving discrepancies directly with the reporting bureau. Moreover, following this review, consumers should take proactive steps, such as considering credit monitoring services for real-time alerts on changes, which can protect against fraudulent activities and enhance overall financial security.

Comments