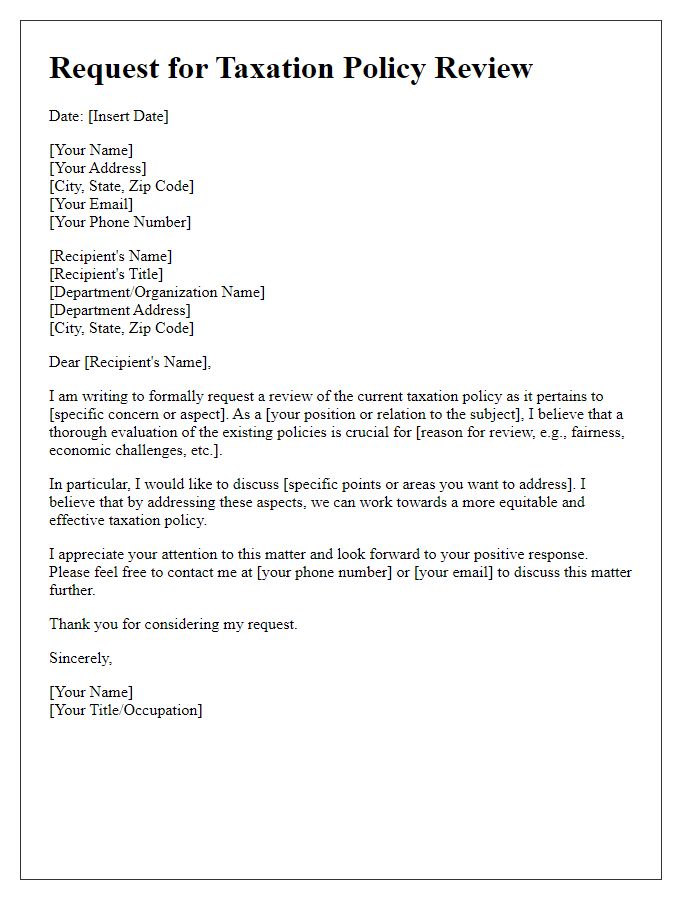

Are you curious about the recent changes in taxation policy? Understanding how these adjustments may impact you and your financial landscape is crucial. In this article, we'll break down the key elements of the new taxation policy changes and what they mean for individuals and businesses alike. Join us as we explore these important updates and their implicationsâread on to learn more!

Clear justification for the policy change

Taxation policy changes can influence economic growth and social equity within nations. Recent studies conducted by the International Monetary Fund (IMF) indicate that progressive tax reform can enhance revenue generation by up to 30% within five years. Furthermore, analyzing the case of Sweden (notable for its robust welfare state) illustrates that higher tax rates on the wealthiest citizens foster accessibility to quality public services, such as healthcare and education. Additionally, incorporating measures for digital currency taxation can address the evolving economic landscape characterized by cryptocurrencies and e-commerce, potentially capturing an estimated $28 billion in lost revenue annually. The policy shift aims to align with global standards, supporting fair taxation practices, while driving investments towards infrastructure development, thus ensuring sustainable growth for future generations.

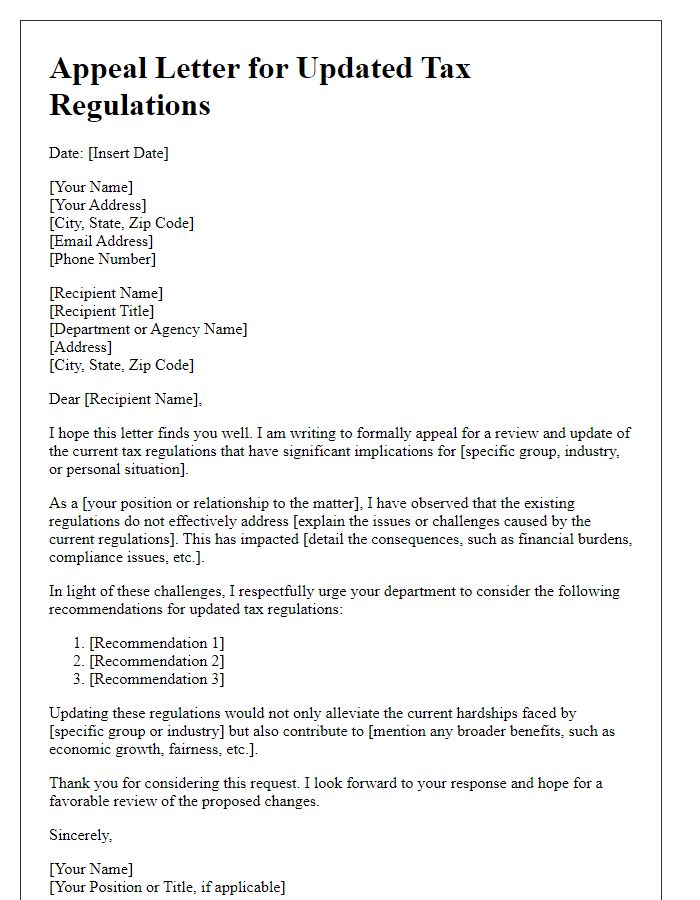

Impact analysis on stakeholders

A taxation policy change significantly impacts various stakeholders, including individuals, businesses, and government agencies. Individuals, especially low and middle-income earners, may face increased financial burdens due to higher tax rates or elimination of deductions, potentially affecting disposable income. For businesses, such as small enterprises and corporations, alterations in corporate tax rates or compliance requirements can influence profit margins and profitability, impacting hiring decisions and investment strategies. Government agencies, including the Internal Revenue Service (IRS) in the United States, may experience increased administrative demands to implement new policies, requiring additional resources and training. The overall economic ecosystem can shift, as changes in taxation influence consumer spending behavior and business investment, potentially leading to fluctuations in economic growth rates and employment levels. Engaging with stakeholders through discussions and consultations can provide valuable insights into the potential ramifications of these changes, fostering a more equitable and informed approach to implementing the new taxation policy.

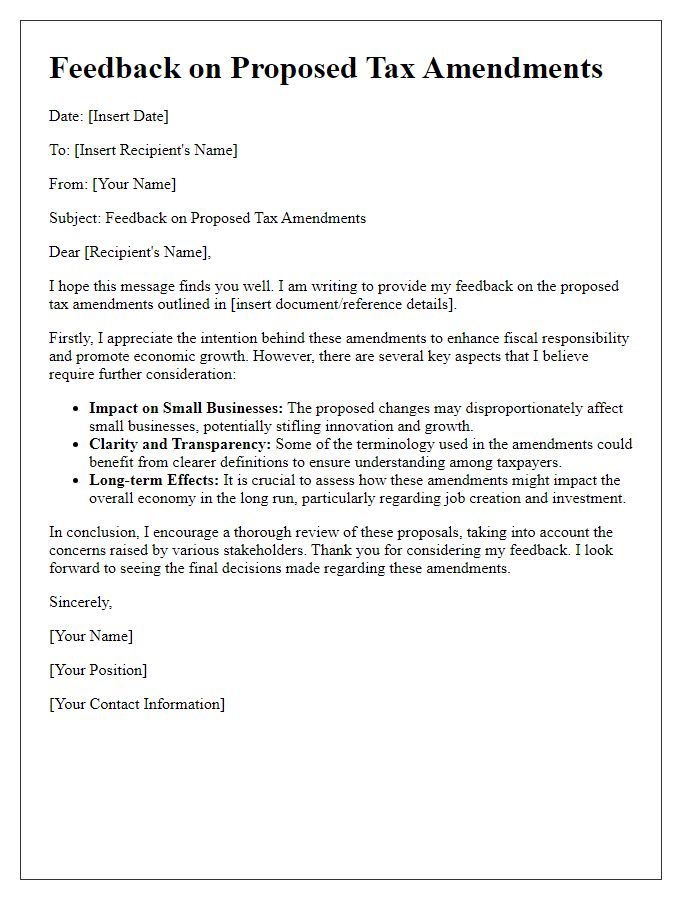

Implementation timeline and transition period

The newly proposed taxation policy change, set to be implemented in phases starting January 2024, aims to reform various aspects of the current fiscal structure in the United States, particularly concerning income tax brackets and corporate tax rates. The transition period, lasting until December 2025, allows individuals and businesses to adjust to the new regulations while ensuring a smoother shift for taxpayers. Key elements of the policy include an increase in the standard deduction from $12,550 to $15,000 for individuals, affecting approximately 30 million taxpayers, and a reduction of the corporate tax rate from 21% to 18%, impacting around 1.5 million corporations. Comprehensive educational programs and online resources will be available throughout the transition period to assist taxpayers in understanding their new obligations and optimizing their financial strategies. Additionally, regional workshops will take place across major cities, including New York, Chicago, and Los Angeles, ensuring widespread access to information and support throughout this significant fiscal adjustment.

Contact information for inquiries

The Department of Revenue (DOR), established to oversee taxation regulations and compliance within the state, provides essential contact information for inquiries regarding taxation policy changes. Interested parties can reach the DOR at their main office located at 1000 Taxation Avenue, Suite 200, Springfield, with a postal code of 62701. For direct communication, the phone number (217) 555-0199 is available during business hours, Monday through Friday from 8 AM to 5 PM CST. Additionally, taxpayers can submit queries via email to inquiries@dor.state.il.us for clear responses or guidance. The DOR encourages taxpayers to stay informed on upcoming policy shifts and their implications on local tax laws and personal financial responsibilities through their official website, accessible at www.dor.state.il.us.

Legal and regulatory references

Proposed changes to taxation policy in the United States may significantly impact various economic sectors. Recent legislation, such as the Tax Cuts and Jobs Act of 2017, altered corporate tax rates and deductions, reshaping the fiscal landscape for businesses. Regulatory guidelines established by the Internal Revenue Service (IRS) further define compliance parameters for taxpayers. The Office of Management and Budget (OMB) also plays a critical role in assessing the economic impact of proposed tax reforms, ensuring alignment with federal budgetary goals. Legislative hearings, public comments, and studies from the Congressional Budget Office (CBO) contribute to the development of these policies, underscoring the importance of stakeholder engagement. Furthermore, the implications of international agreements, such as the OECD's Base Erosion and Profit Shifting (BEPS) framework, must be considered in any taxation policy changes.

Comments