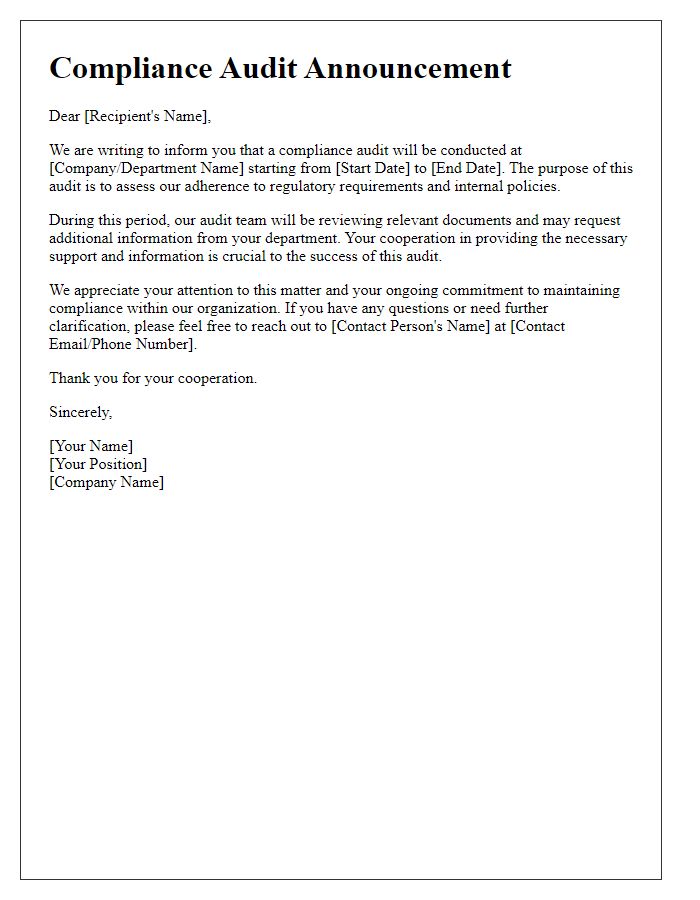

Are you gearing up for a regulatory compliance audit and feeling a bit overwhelmed? You're not alone; many organizations find themselves navigating the complexities of compliance requirements. This article will break down the essential components of a comprehensive letter template that can streamline your audit preparation process. Whether you're new to audits or looking to refine your current practices, we encourage you to read on for valuable insights and tips!

Regulatory compliance guidelines

Regulatory compliance audits are essential in ensuring that organizations adhere to industry-specific regulations and standards, such as those outlined by the Occupational Safety and Health Administration (OSHA) in the United States. These audits typically evaluate various aspects, including environmental regulations, labor laws, financial practices, and data protection standards like the General Data Protection Regulation (GDPR) in Europe. Key components of the audit process involve reviewing documentation, conducting interviews, and assessing compliance with statutory requirements, which can vary by sector. For instance, the healthcare sector must comply with the Health Insurance Portability and Accountability Act (HIPAA), while financial institutions are subject to the Sarbanes-Oxley Act. Effective audits identify gaps in compliance, mitigate risks, and enhance overall organizational governance, ultimately fostering a culture of accountability and ethical practice.

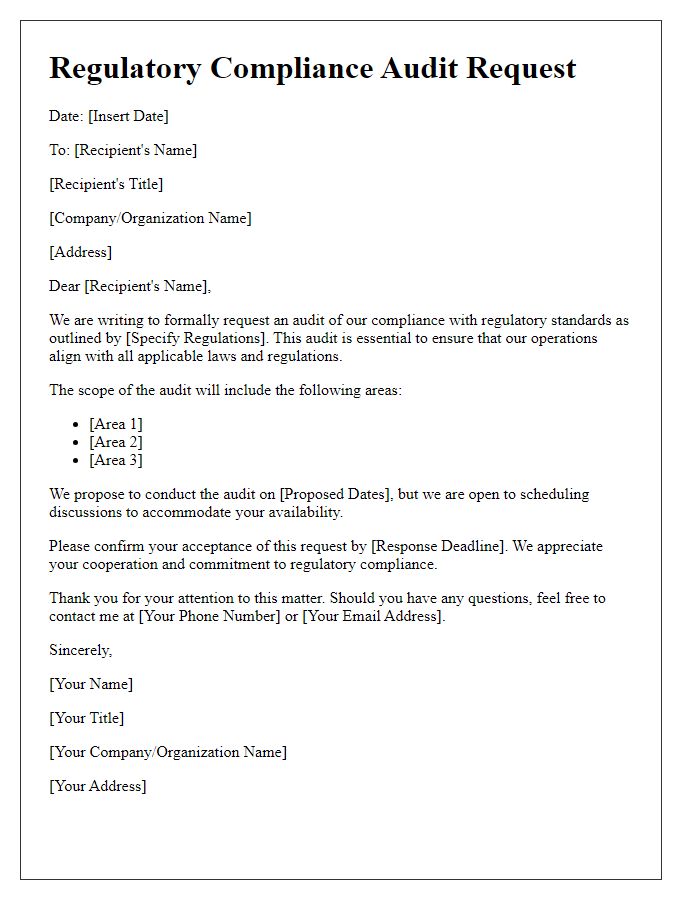

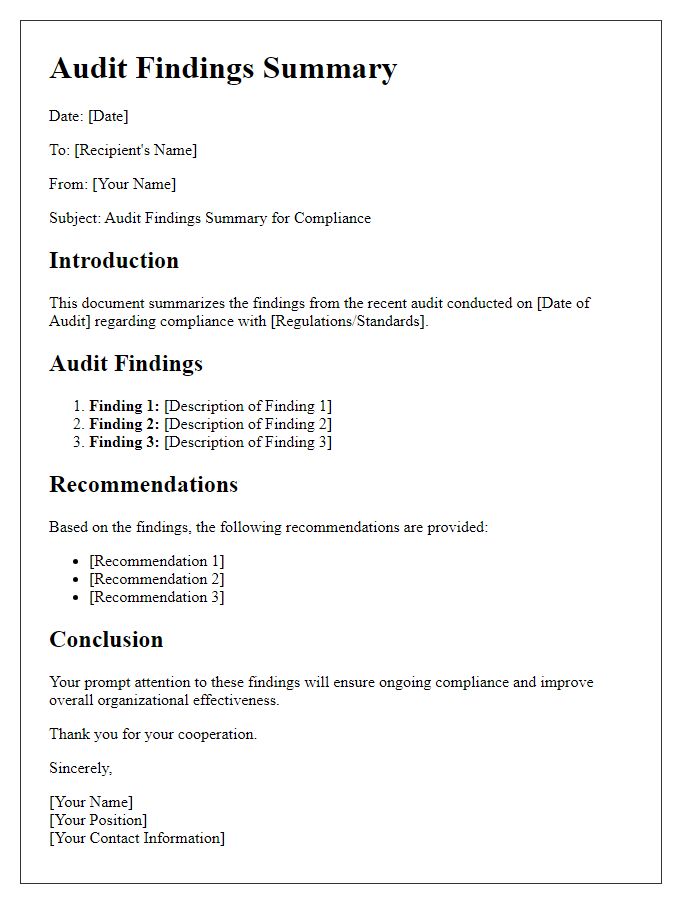

Audit scope and objectives

A regulatory compliance audit encompasses a comprehensive examination of a company's adherence to applicable laws and regulations, focusing on areas such as financial reporting, workplace safety, and environmental regulations. Explicit objectives include evaluating the effectiveness of internal controls, identifying areas of non-compliance, and assessing risk management practices to mitigate potential legal repercussions. The audit often scrutinizes documentation related to policy adherence, training records, and operational procedures. Outcomes of the audit can inform management decisions, enhance compliance programs, and ensure alignment with industry standards set by governing bodies such as the Securities and Exchange Commission (SEC) or the Environmental Protection Agency (EPA), promoting overall organizational integrity.

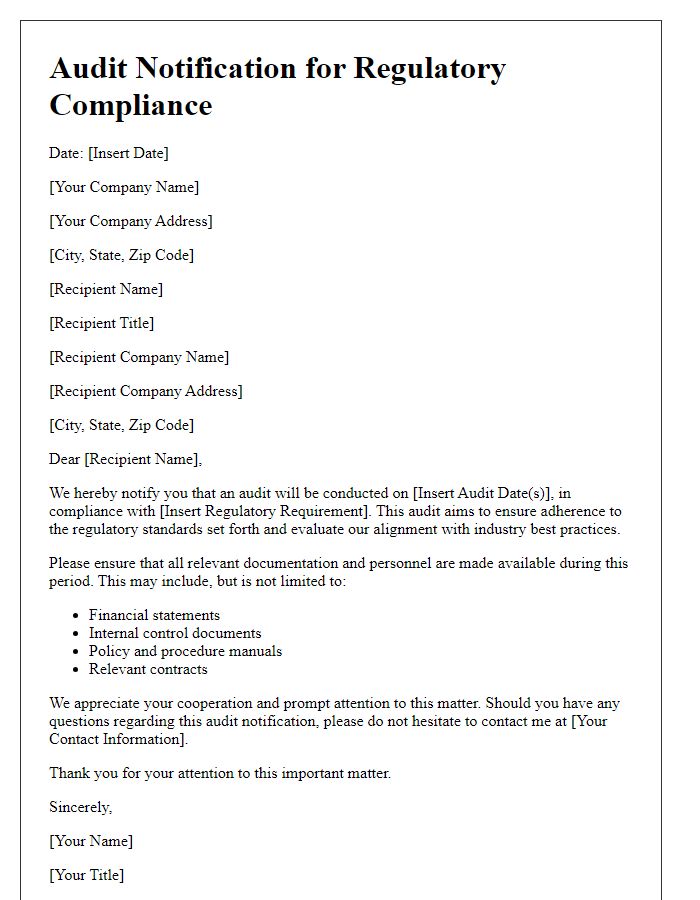

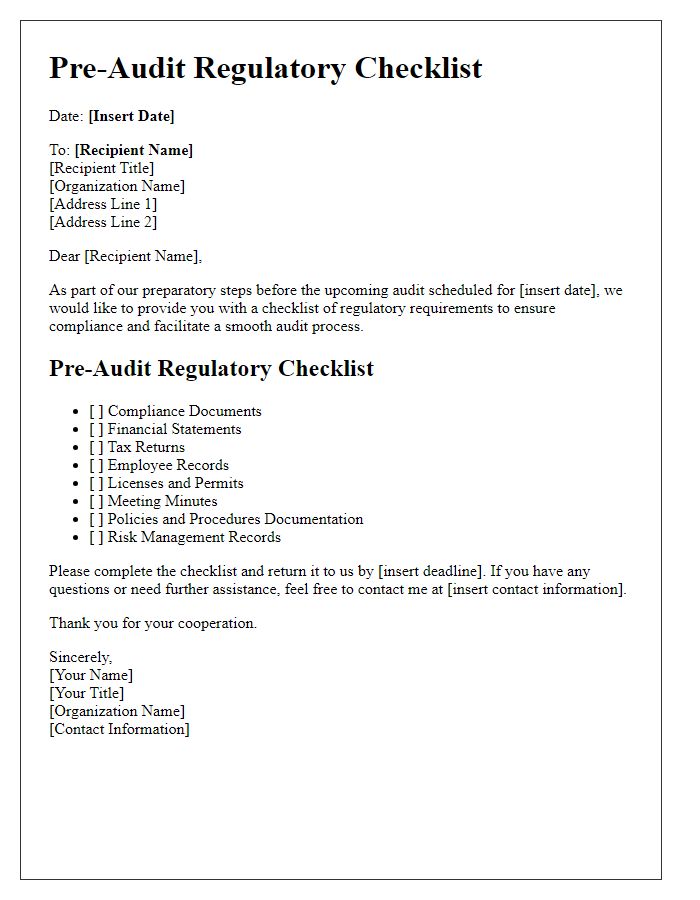

Document submission requirements

Regulatory compliance audits often require comprehensive document submission to ensure adherence to established guidelines. Required documents may include the Compliance Manual, outlining procedures and policies for adherence to regulations; Training Records, demonstrating that all staff have received necessary compliance training, particularly for industries like finance or healthcare; Financial Statements, providing a transparent overview of the organization's financial status; Incident Reports, detailing any non-compliance or operational incidents that have occurred; Risk Assessments, identifying potential compliance risks and mitigation strategies; and External Audit Reports, which offer insights into previous evaluations by third-party auditors. Timely submission of these documents, typically within 30 days of the audit notification, is crucial to maintaining regulatory standing and avoiding penalties.

Timeline and deadlines

A regulatory compliance audit timeline includes several key phases. Initial planning stages often begin four to six weeks before the audit date, allowing for document collection and staff training. Setting deadlines is crucial; for instance, policy reviews and necessary updates should be finalized by two weeks prior to the audit. The actual audit may take place over a defined period, typically ranging from one to three days, depending on the organization's size and complexity of operations. Following the audit, the final report is usually delivered within two weeks, allowing management to address any compliance gaps promptly. Ongoing follow-up actions may involve regular status meetings, scheduled quarterly, to discuss progress on implementing corrective measures before the next compliance cycle begins.

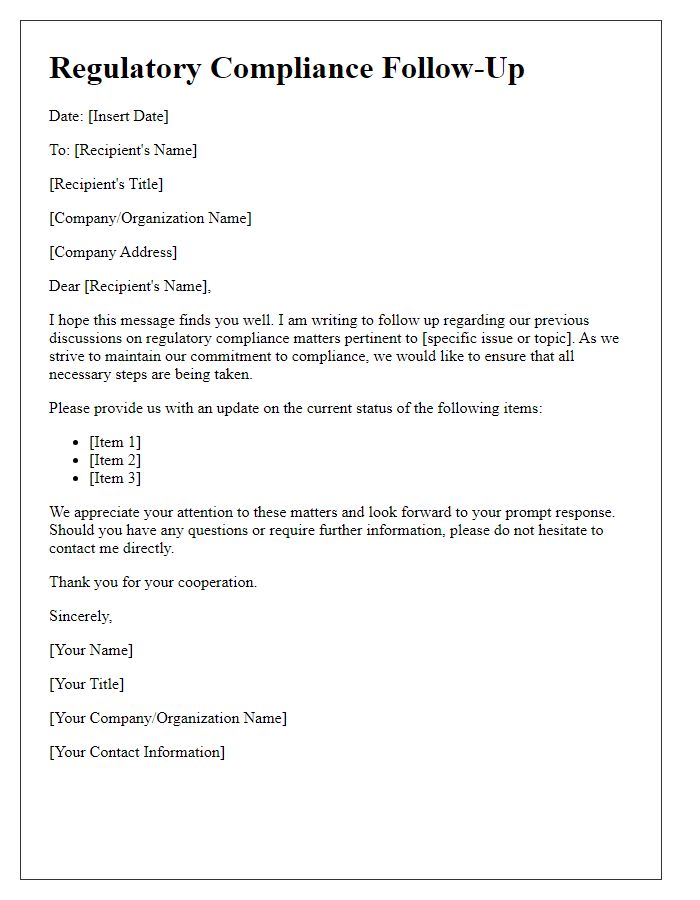

Contact information for queries

Regulatory compliance audits require thorough documentation and clear communication channels. For inquiries regarding specific compliance standards, stakeholders can reach out to the designated compliance officer. This includes the officer's name, title, and direct phone number (e.g., 555-0123) for immediate assistance. Additionally, an official email address (like compliance@companyxyz.com) should be provided for detailed correspondence. The office location, often situated at 123 Corporate Ave, Suite 456, City, State, enables face-to-face discussions during regular business hours (typically 9 AM to 5 PM). A dedicated compliance webpage may also offer FAQs and downloadable resources to assist in addressing common queries efficiently.

Comments