In the world of finance, ensuring compliance with anti-money laundering (AML) regulations is crucial for maintaining the integrity of institutions and safeguarding the economy. As businesses grow and evolve, understanding the nuances of AML compliance can often feel complex and daunting. However, with the right approach and resources, you can navigate these waters effectively while protecting your organization from potential risks. Join us as we delve deeper into the essential components of AML compliance and how you can implement them seamlessly into your operations.

Purpose and Importance of Compliance

Anti-money laundering (AML) compliance plays a critical role in safeguarding financial institutions, such as banks and investment firms, against illicit activities including money laundering and terrorism financing. Maintaining compliance with regulations, such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act, ensures the integrity of the financial system while protecting against substantial fines and reputational damage. AML compliance programs encompass rigorous customer due diligence (CDD) processes, including Know Your Customer (KYC) procedures, which require institutions to verify the identity of clients through government-issued identification or biometric data. Additionally, compliance involves ongoing transaction monitoring systems designed to detect suspicious activities indicative of money laundering, which may include unusually large deposits or rapid movement of funds across international borders. Effective AML practices foster trust and accountability within the marketplace, ensuring compliance with international standards set by organizations such as the Financial Action Task Force (FATF) and reinforcing the overall resilience of the global financial infrastructure.

Regulatory Framework and Requirements

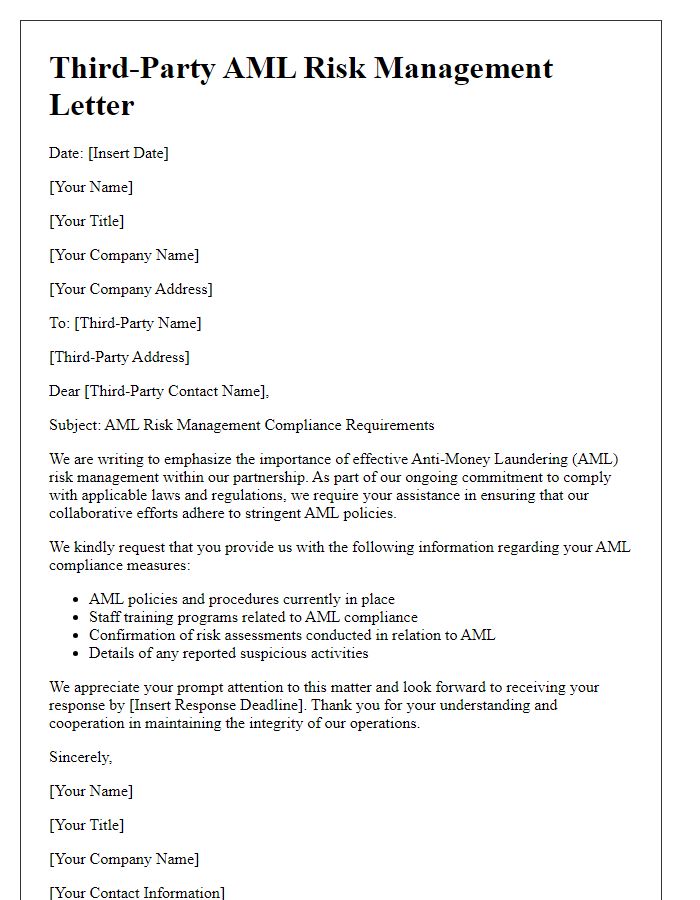

Anti-money laundering (AML) compliance plays a crucial role in the financial services sector, ensuring that institutions adhere to laws and regulations designed to detect and prevent money laundering activities. The regulatory framework established by authoritative bodies, such as the Financial Action Task Force (FATF) and the U.S. Treasury Department's Financial Crimes Enforcement Network (FinCEN), mandates institutions to implement robust Know Your Customer (KYC) protocols, monitor suspicious transactions, and report any suspected illicit activities. Strict requirements also demand regular employee training to recognize potential red flags (such as large cash deposits or unusual account activity), maintain detailed records of transactions, and conduct risk assessments to identify vulnerabilities. Failure to comply may lead to severe penalties, including substantial fines and damage to the institution's reputation, making it imperative for organizations to stay informed and proactive in their AML strategies.

Identification and Verification Procedures

Identification and verification procedures are crucial components of anti-money laundering (AML) compliance strategies, particularly in financial institutions such as banks, credit unions, and investment firms. These procedures involve collecting comprehensive personal information, including full name, date of birth, address, and government-issued identification numbers, such as Social Security Numbers in the United States or National Insurance Numbers in the United Kingdom. Customers are subjected to rigorous checks against established databases, including the Office of Foreign Assets Control (OFAC) list, to identify potential risks associated with money laundering activities. Moreover, the implementation of Know Your Customer (KYC) protocols requires ongoing monitoring of account activities, ensuring any suspicious transactions exceeding set thresholds, like $10,000, are promptly reported to appropriate authorities, including the Financial Crimes Enforcement Network (FinCEN). Accurate record-keeping, including transaction history and customer identification documentation, is mandatory and must be retained for a period of five years to comply with regulatory requirements.

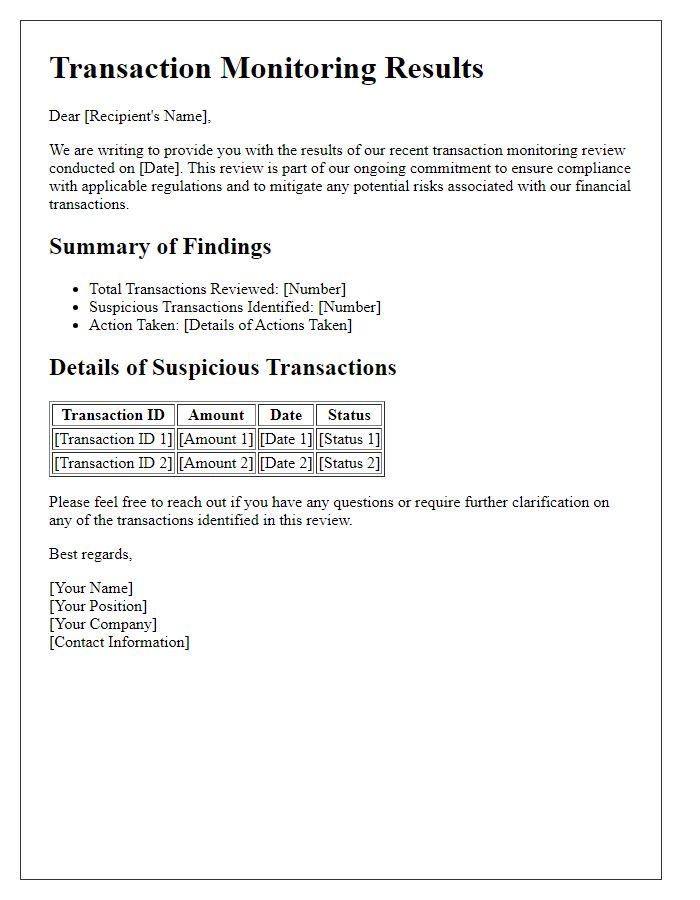

Monitoring and Reporting Obligations

Anti-money laundering (AML) compliance encompasses essential monitoring and reporting obligations mandated by regulatory authorities. Financial institutions, like banks and credit unions, must implement robust systems to detect suspicious activities that may indicate money laundering. Transaction monitoring systems utilize algorithms to flag unusual patterns, such as large cash deposits exceeding $10,000 or frequent international wire transfers, particularly to high-risk jurisdictions. Additionally, the USA PATRIOT Act requires the filing of Suspicious Activity Reports (SARs) within 30 days of detecting suspicious behavior, ensuring timely communication with the Financial Crimes Enforcement Network (FinCEN) in the United States. Maintaining thorough records of transactions and customer identification, as mandated by the Bank Secrecy Act (BSA), is crucial for demonstrating compliance during audits and investigations. Regular training for employees on AML regulations and best practices further strengthens an institution's defenses against financial crimes.

Training and Awareness Programs

Anti-money laundering (AML) compliance is crucial for financial institutions, especially in light of the Financial Action Task Force (FATF) guidelines. Effective training and awareness programs should be developed to educate employees about the risks associated with money laundering and terrorist financing. Training sessions should cover relevant laws, such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act, alongside practical case studies showcasing real-world examples of suspicious activities. Regular workshops should be organized, aiming for a frequency of at least quarterly, to ensure employees remain informed about the evolving regulatory landscape. An e-learning platform can provide accessible resources and quizzes to enhance understanding. The establishment of a dedicated compliance officer role, oftentimes reporting to the Chief Compliance Officer (CCO), is essential for ongoing support. Regular assessments of employee knowledge and understanding should be conducted to ensure a robust culture of compliance within the organization.

Comments