Are you feeling a bit confused about your mortgage deed? You're not aloneâmany homeowners find the intricacies of mortgage agreements tricky to navigate. Clarifying the details of your mortgage deed is essential to understanding your rights and responsibilities as a borrower. If you want to demystify these important documents and ensure you're fully informed, keep reading!

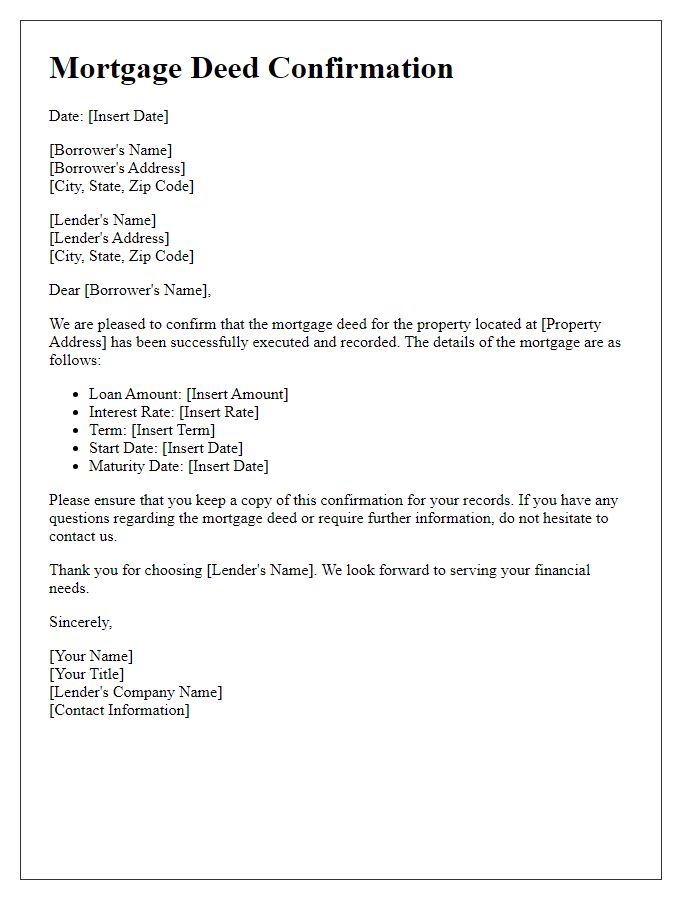

Clear Subject Line

Mortgage deeds serve as essential legal documents in real estate transactions, outlining the borrowing terms and securing the loan through collateral, typically the property in question. A mortgage deed includes critical information, such as the names of the lender and borrower, the principal amount borrowed (often totaling thousands, if not millions), interest rates (possibly 3-5% annually), property description (including address and legal identifiers), and the repayment schedule (often spanning 15 to 30 years). It serves to protect the lender's interest, ensuring they can repossess the property (through foreclosure) if the borrower defaults on payments. Understanding these facets can facilitate more informed and responsible homeownership decisions.

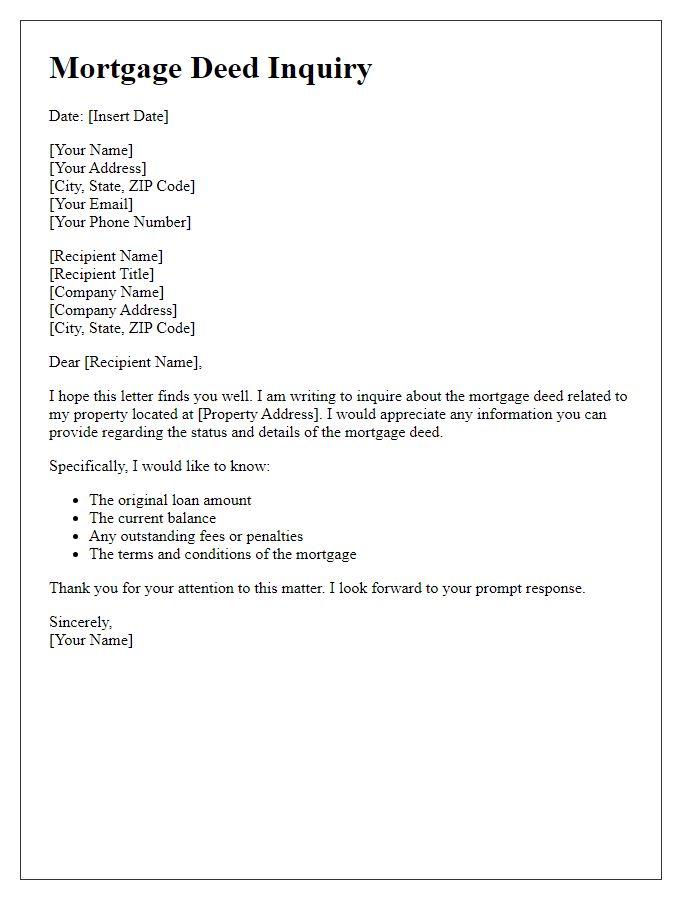

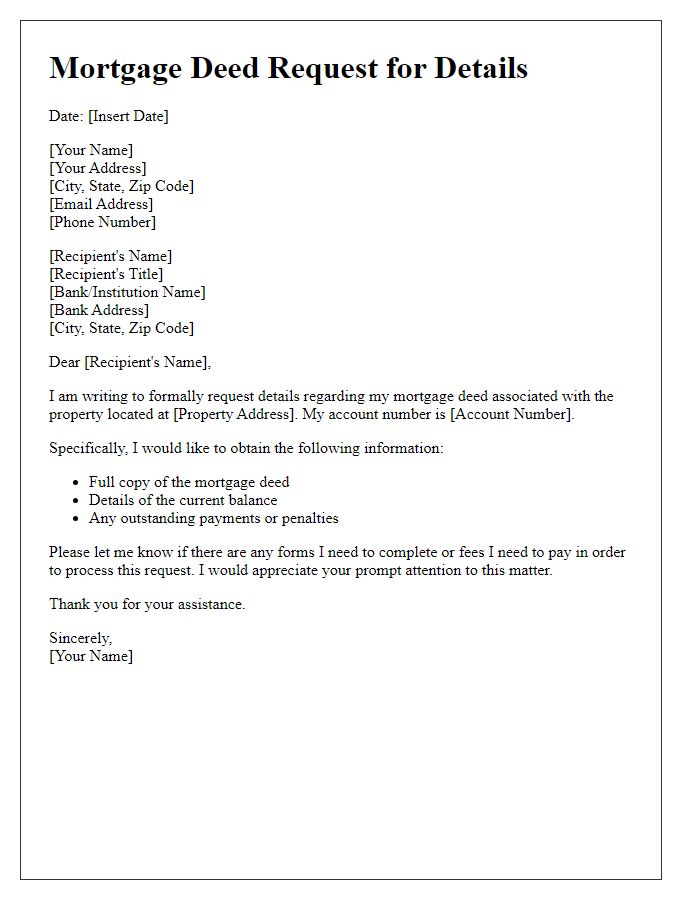

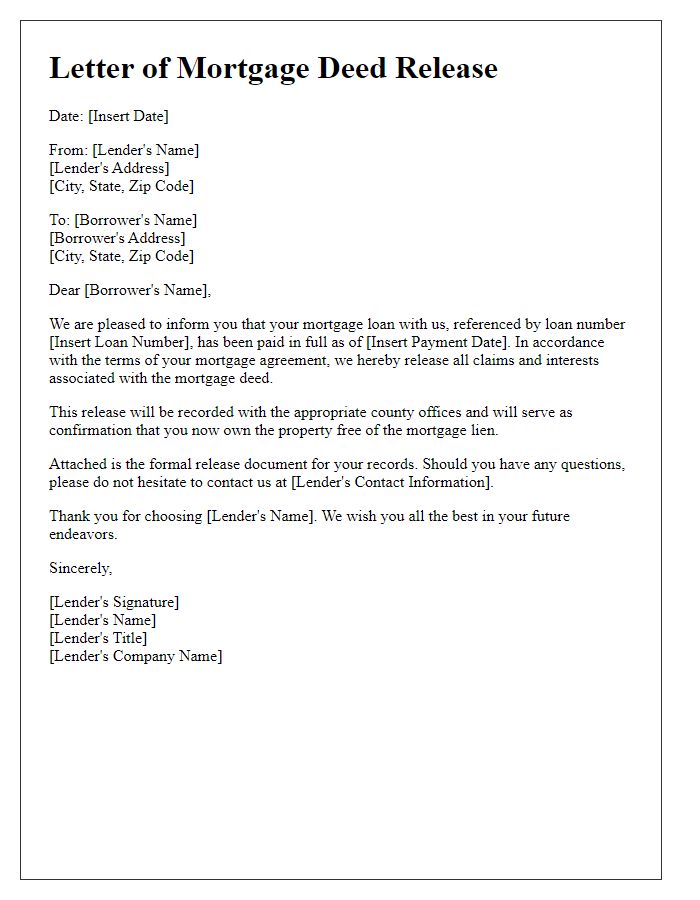

Borrower and Lender Information

A mortgage deed requires precise borrower and lender information to ensure legal clarity. The borrower, often an individual or couple, typically includes their full name, current address, and Social Security number (or Tax Identification Number) for verification purposes. The lender, usually a financial institution such as Bank of America or Wells Fargo, must provide their legal name, business address, and National Lender Identification Number to facilitate tracking and accountability. This information is critical during transactions, particularly for loans exceeding amounts like $400,000 which may involve specific state regulations and require additional documentation, ensuring compliance with real estate laws pertinent to the specific locality, such as laws in California or New York. Accurate representation enhances the legitimacy of the mortgage deed, providing a clear record for future reference and dispute resolution.

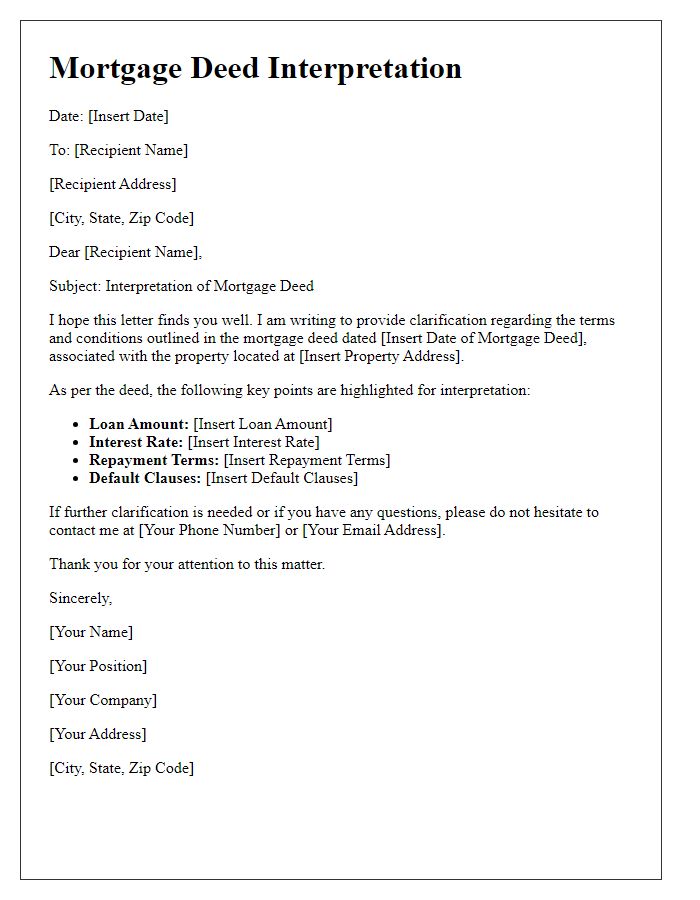

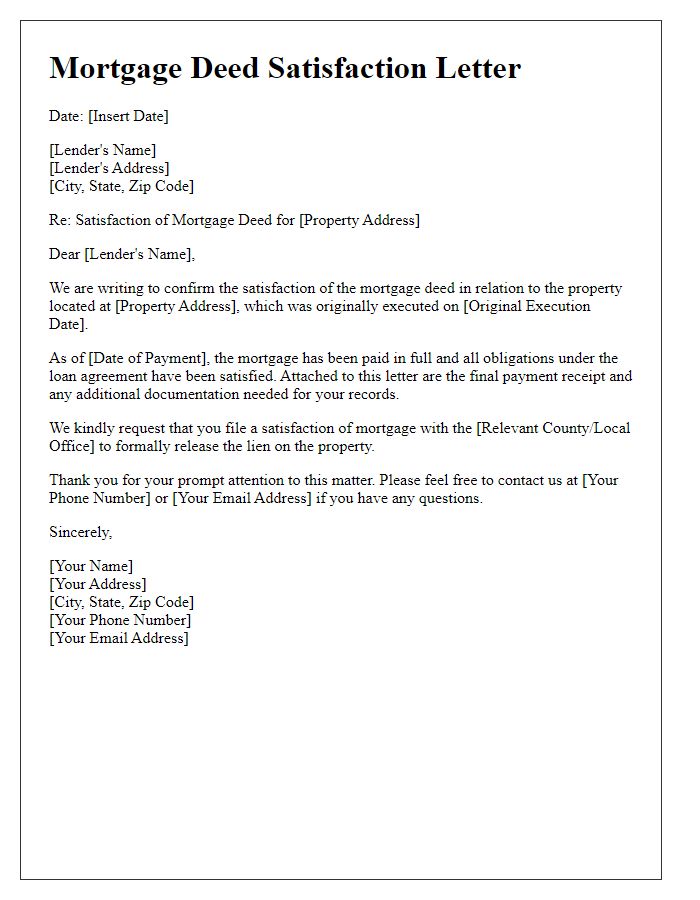

Detailed Loan Terms

The mortgage deed represents a legal agreement between lenders and borrowers detailing the loan terms. Key elements include the loan amount, often ranging from tens of thousands to millions of dollars, interest rate percentages, typically fixed or variable, and repayment schedule duration, usually spanning 15 to 30 years. The property address serves as collateral, ensuring lenders can claim the property in case of default. Additionally, conditions such as property taxes, insurance requirements, and potential prepayment penalties play crucial roles in monitoring borrower obligations. Important dates, including closing date and first payment date, are vital for understanding the loan process timeline. This deed serves to clarify responsibilities and rights, ensuring both parties comprehend their commitments in the financial transaction.

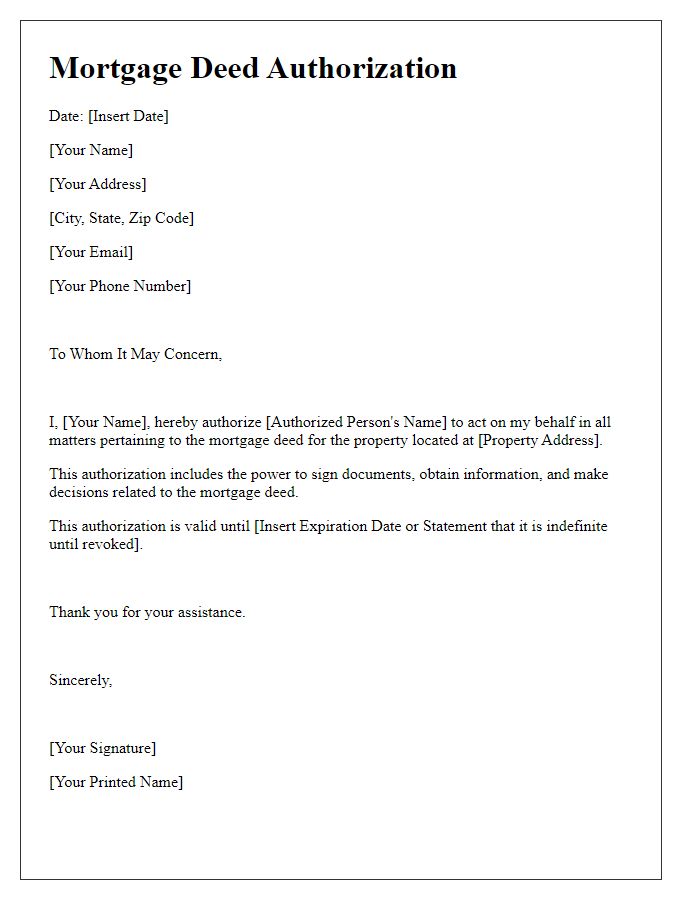

Property Description

A mortgage deed is a legal document, critical in real estate transactions, that secures a loan by pledging property as collateral. The property description within this document plays an essential role, outlining the specific details of the real estate being mortgaged. This description should include the full legal address, including street number, street name, city, and state, as well as additional identifiers such as parcel number or lot number, often found in public records. Accurate property descriptions prevent future disputes by clearly defining the boundaries and characteristics of the property, including its size (square footage or acreage), zoning information, and any unique features or encumbrances. These details establish the precise property involved in the mortgage agreement, ensuring clarity for all parties involved in the transaction.

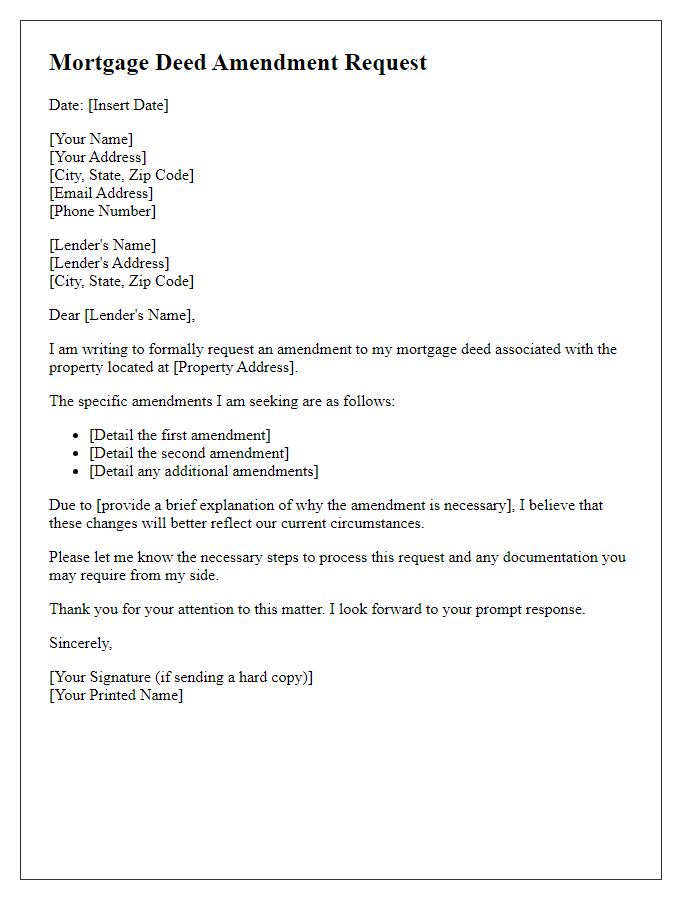

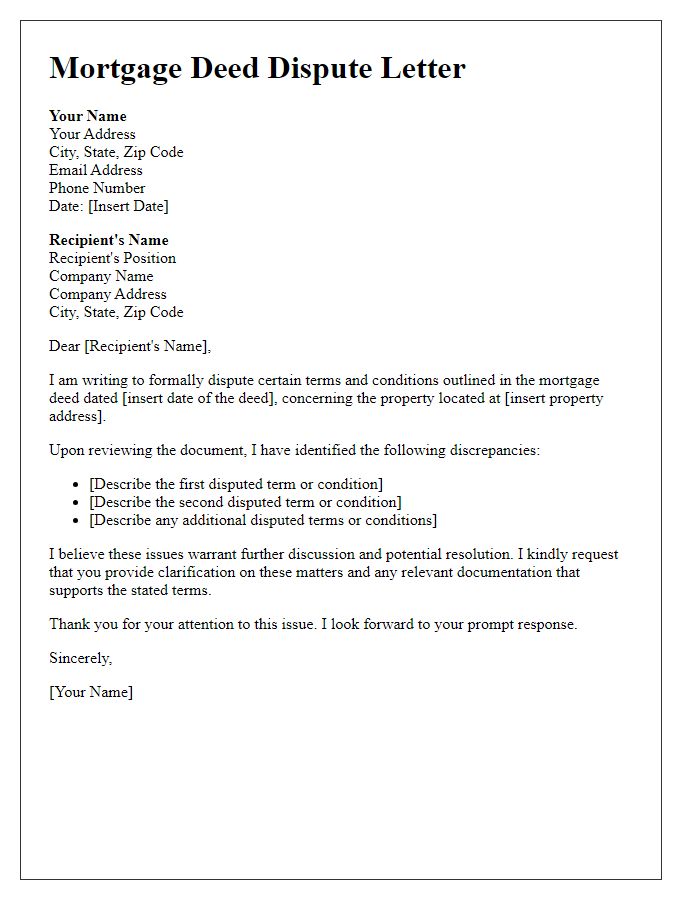

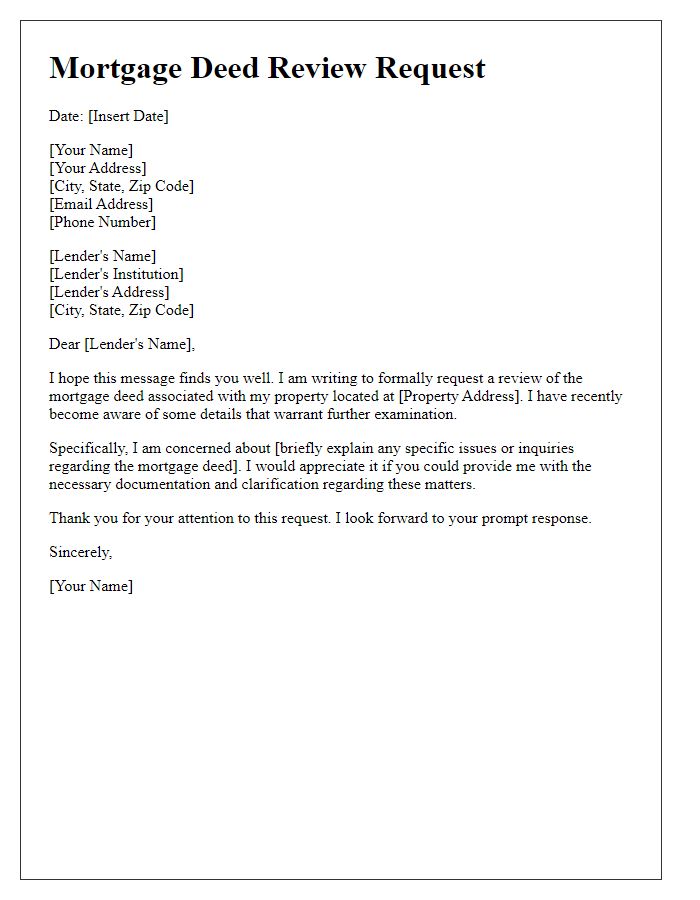

Clarification Request on Specific Clauses

Mortgage deeds often contain complex legal terms that can be difficult to interpret. A clarification request is essential to ensure all parties understand specific clauses regarding interest rates, payment schedules, and property rights. Key sections may include default clauses (which outline consequences of missing payments), the prepayment penalty clause (which varies by lender), and the escrow account requirements (ensuring funds for property taxes and insurance are collected in advance). Clear understanding of these elements fosters transparency and prevents future disputes between homeowners and lenders.

Comments