Navigating the end of a corporate partnership can feel daunting, but it's also an opportunity for a fresh start. A clear, respectful communication is key to ensuring a smooth dissolution process, and a well-crafted letter can pave the way for positive future relations. Whether it's due to shifting business strategies or changing market conditions, the right tone can help maintain goodwill. Ready to learn how to draft a compelling letter for your corporate partnership dissolution? Read on for some helpful tips!

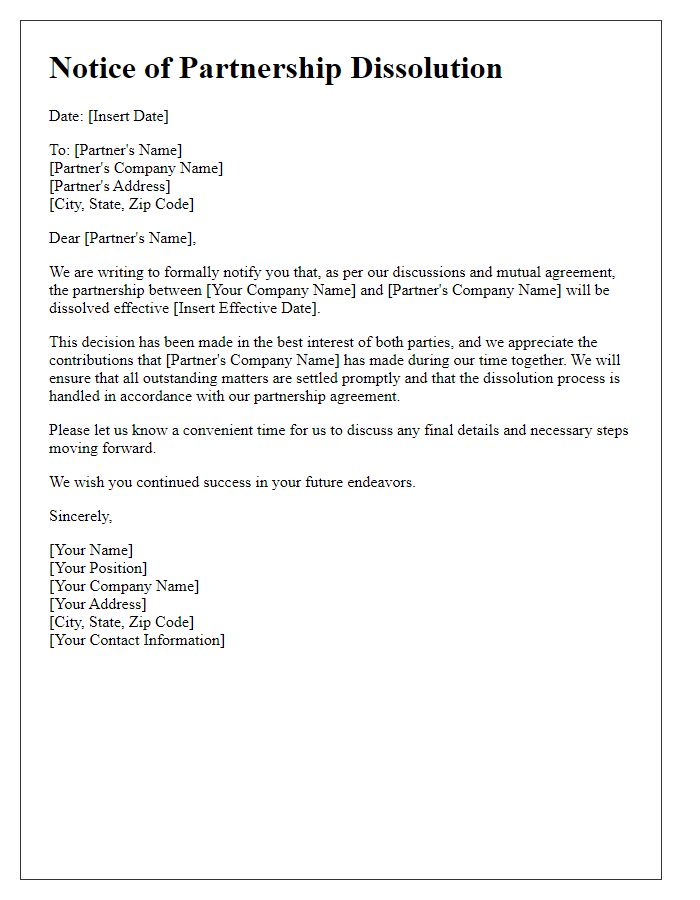

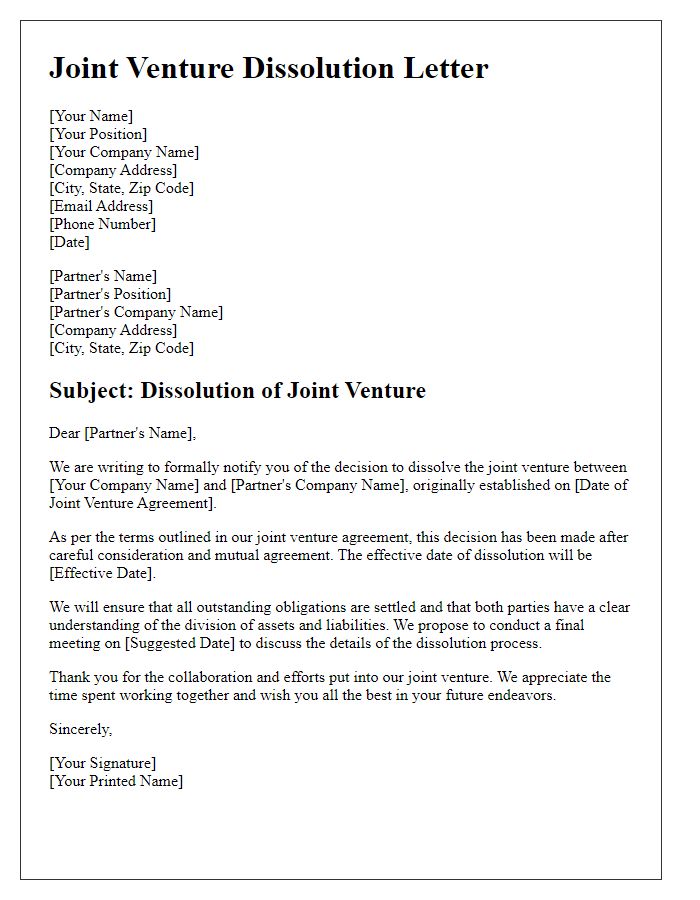

Formal Salutation

A corporate partnership dissolution often involves complex legal and logistical considerations. When formalizing such dissolution, it is important to address key elements, including the timeline of disbandment, asset distribution, and outstanding liabilities. Noteworthy events leading to this decision, such as board meetings or shareholder approvals, must be documented thoroughly. Relevant parties, such as stakeholders in the 2023 fiscal year, and their roles during the process should be clearly specified. Legal requirements will vary by jurisdiction, emphasizing the way different states handle business dissolutions, which may include filing specific forms with the Secretary of State's office.

Statement of Dissolution

The dissolution of corporate partnerships can occur for various reasons, such as financial discrepancies or strategic realignments. A statement of dissolution outlines the formal conclusion of agreements between entities, highlighting the effective date, legal obligations, and asset distribution. It is essential to document this process accurately to ensure compliance with state laws and to safeguard the interests of all parties involved. In the United States, the dissolution must adhere to specific statutes, which vary by state, ensuring an orderly cessation of partnership activities. This document serves as a critical record to mitigate potential disputes and clarify the responsibilities of each party post-dissolution.

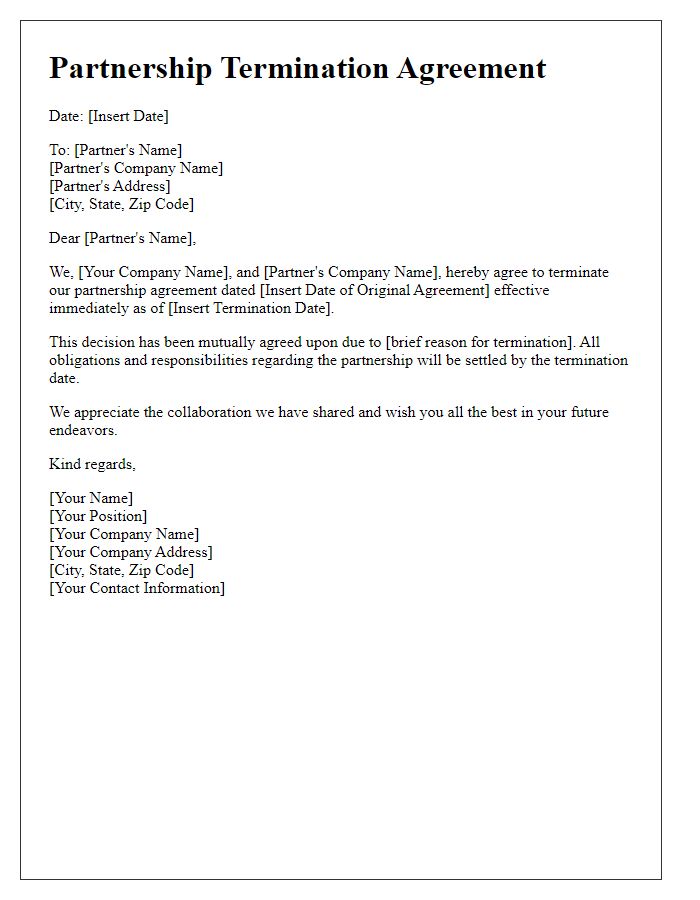

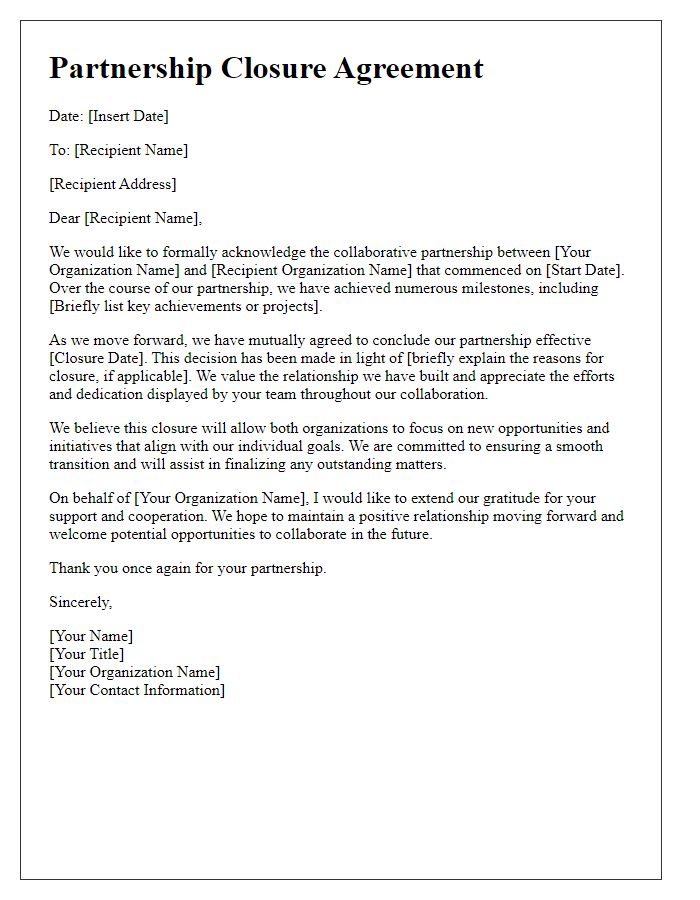

Explanation of Reasons

Dissolving a corporate partnership often arises from various factors, such as differing business objectives, changes in market conditions, or financial disagreements. For instance, a strategic divergence might occur when one partner aims to expand into international markets while the other prefers to focus on local development, leading to misaligned priorities. Additionally, external pressures like economic downturns, where sales figures decline significantly (by over 20% in some cases), may force partners to reevaluate their alliance. Disputes regarding financial distributions or operational control often exacerbate tensions. Such scenarios necessitate the reassessment of partnership agreements to minimize future complications and potential litigation, ensuring a smoother transition for both parties involved in the dissolution process.

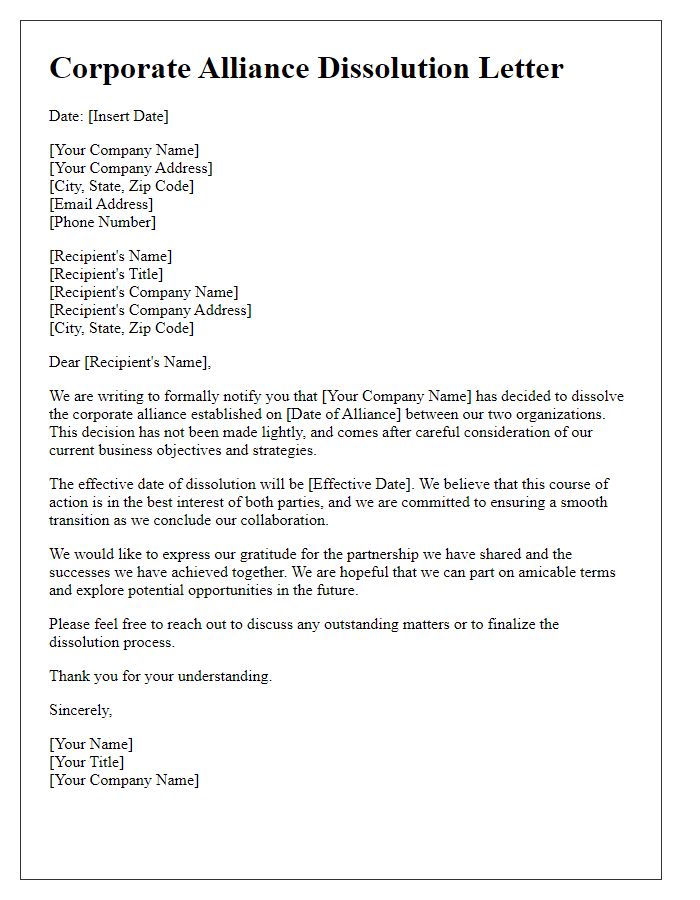

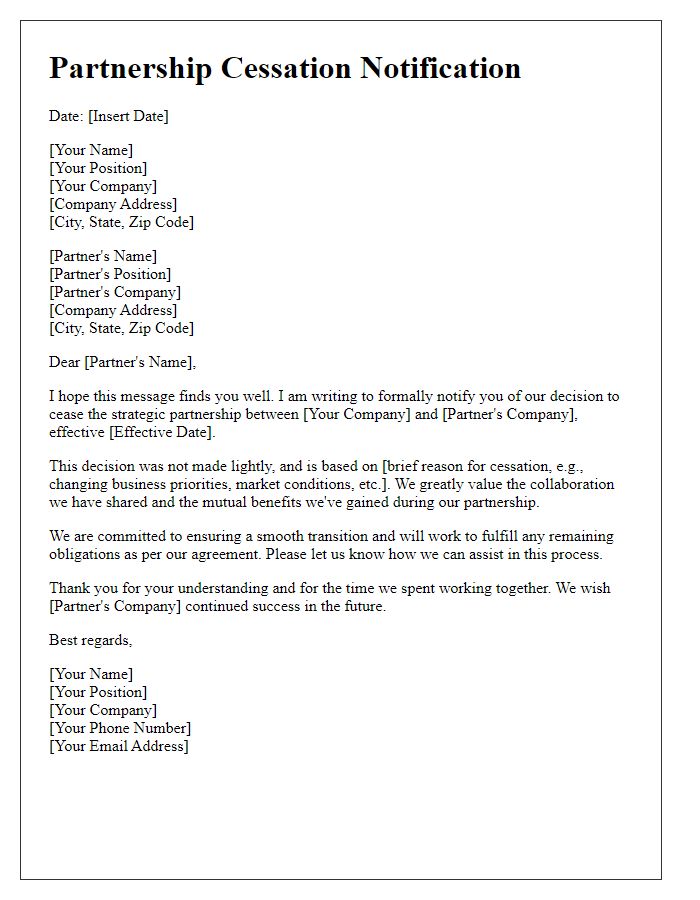

Transition Plan Details

A comprehensive transition plan outlines the protocol for dissolving a corporate partnership, including specific steps, timelines, and responsibilities assigned to stakeholders. Key components comprise asset distribution, highlighting significant resources such as proprietary technology or physical inventory. Legal obligations demand attention, particularly the dissolution document filed with the respective state's Secretary of State, typically requiring signatures from both parties. Communication strategies must be developed to inform employees, customers, and suppliers, ensuring clarity regarding changes affecting operations and potential impacts on supply chains. Financial settlements must be addressed, detailing payment schedules or outstanding debts, and it could involve audits of financial records to ensure transparency. Furthermore, a post-dissolution support system may be established, allowing for ongoing collaboration or service provisions to facilitate a smoother transition for all affected parties.

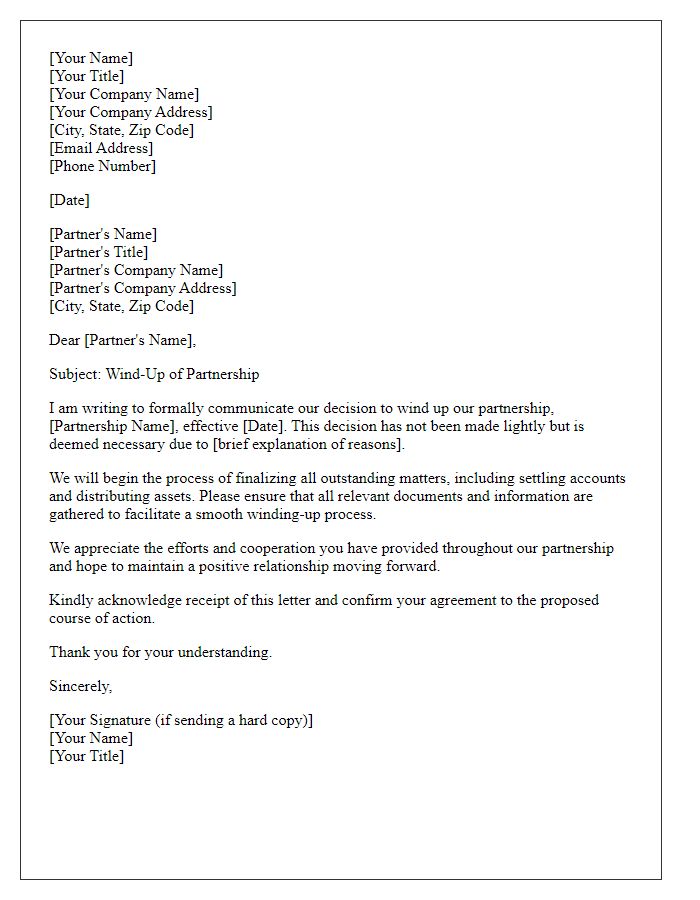

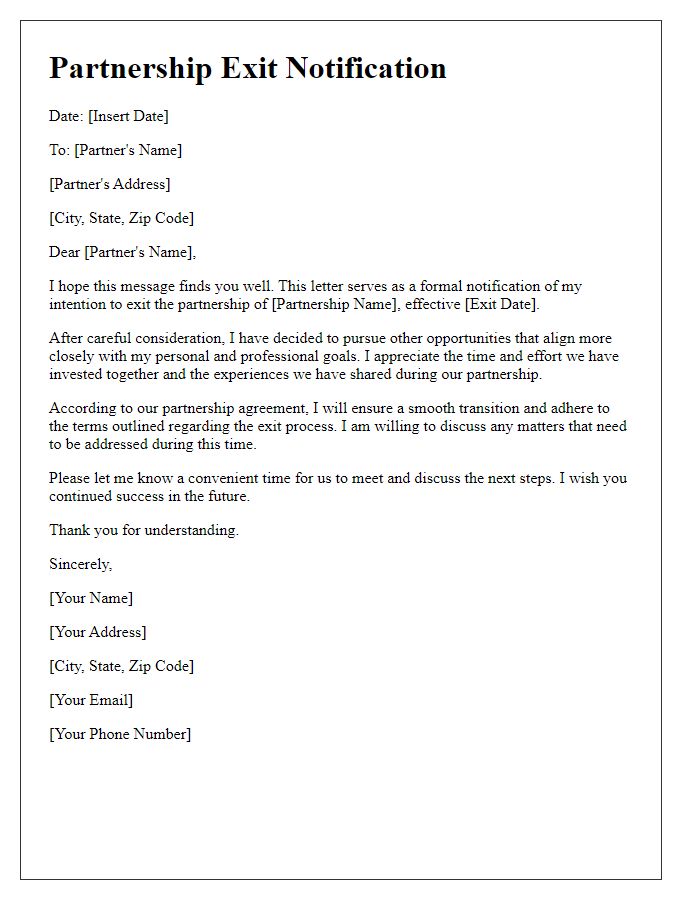

Closing and Contact Information

Corporate partnership dissolution requires clear communication regarding the closure process and contact points for further inquiries. Both parties must ensure all legal obligations are met, including settling financial matters and distributing assets. Define timelines for the cessation of business operations, final audits, and any outstanding obligations. Contact information, including designated representatives from both parties, is vital for addressing queries or resolving disputes. Maintaining transparency during this process can facilitate a smoother transition and help preserve professional relationships for potential future collaborations.

Comments