As we journey through our careers, there are moments that prompt us to reevaluate our financial futures, and adjustments to retirement plans can be pivotal. Whether you're eyeing new investment options or seeking greater flexibility, it's essential to stay informed about the changes that could affect your retirement. Understanding these updates not only helps you plan effectively but also ensures that you're on track to meet your long-term goals. Ready to dive into the details of your retirement plan changes? Let's explore more!

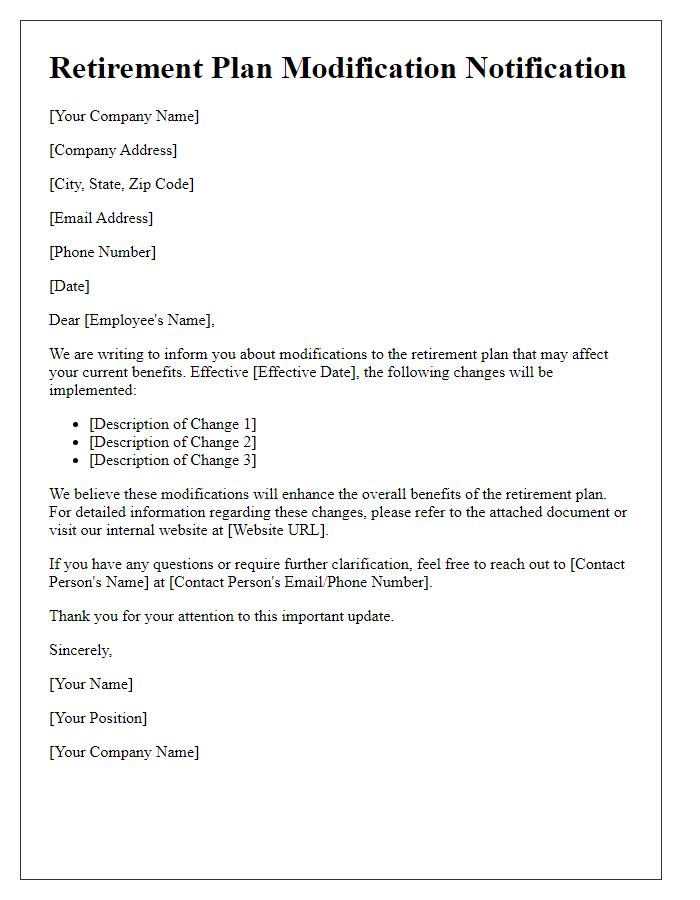

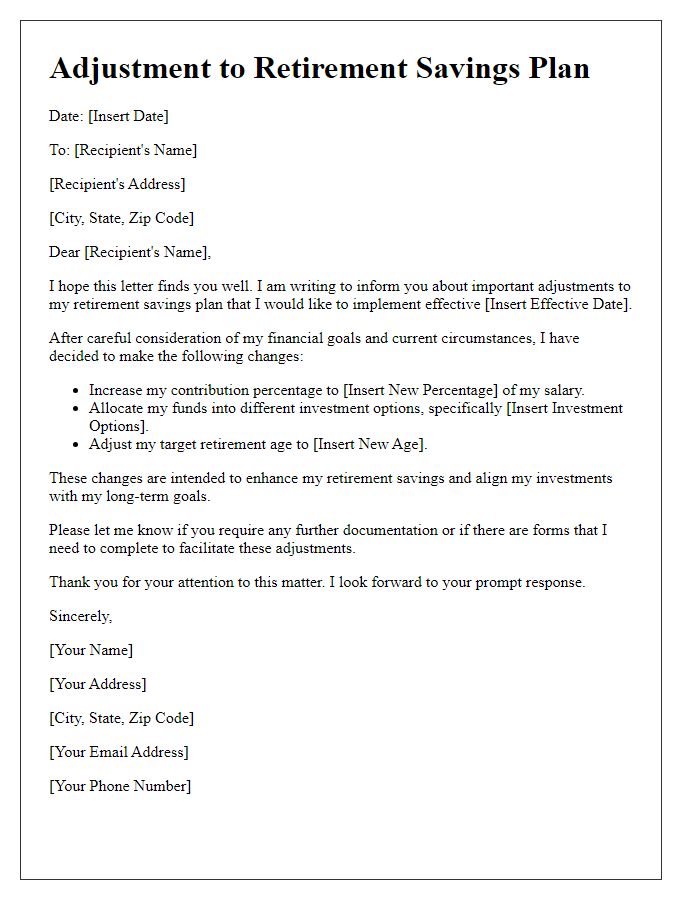

Personalization and recipient details

Employees approaching retirement may encounter changes in their retirement plans, particularly concerning 401(k) contributions. For instance, the new guidelines effective January 2024 will allow a maximum contribution of $22,500 for individuals under 50 years old, while individuals aged 50 and above enjoy a catch-up provision raising their limit to $30,000. Additionally, plan administrators such as Fidelity Investments and Vanguard are adopting personalized retirement planning tools aimed at enhancing participant engagement and providing tailored investment strategies. Furthermore, employees should be aware of the tax implications associated with these changes, including potential increases in taxation based on income brackets. Understanding these updates can empower retirement planning decisions to ensure financial stability in post-work life.

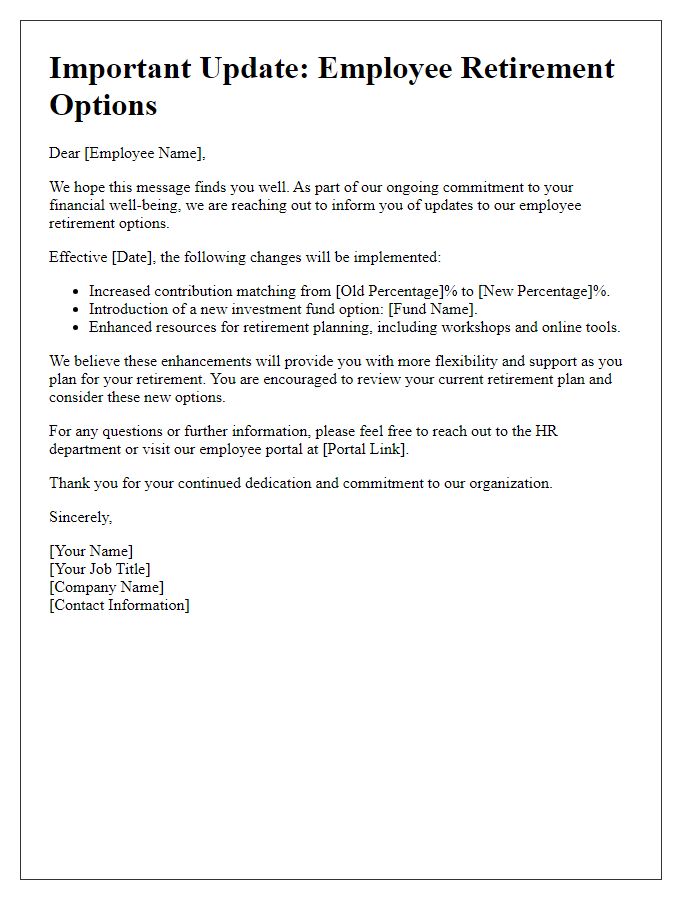

Clear explanation of changes

Recent adjustments to retirement plans can significantly affect employees' financial futures, particularly for those enrolled in 401(k) plans and pension schemes. Effective January 1, 2024, contribution limits for 401(k) plans will increase to $23,000 annually, up from the previous limit of $20,500, allowing employees to save more for retirement tax-deferred. Additionally, the introduction of a new automatic enrollment feature mandates employers to enroll eligible employees at a minimum contribution rate of 3%, enhancing participation rates. Employees aged 50 and older will benefit from a catch-up contribution option, allowing an additional $7,500 in savings each year. These changes, implemented by the Employee Retirement Income Security Act (ERISA) guidelines, aim to strengthen retirement security for workers nationwide.

Benefits and implications

Retirement plan changes significantly impact financial security for individuals approaching retirement age. These adjustments can include alterations to contribution limits, such as the IRS limit of $22,500 for 401(k) plans in 2023, which can affect long-term savings. Policy updates may also introduce new investment options, influencing portfolio diversification. Additionally, changes in employer matching contributions can alter overall retirement benefits, with employers typically matching a portion of employee contributions. Understanding tax implications is crucial, as strategies may shift from traditional pre-tax contributions to Roth accounts, which could affect future taxable income. Awareness of these factors enables individuals to make informed decisions regarding their retirement planning.

Action steps and deadlines

The recent revisions to retirement plan guidelines require immediate attention from all employees in the organization. Essential actions include reviewing updated benefits packages, attending mandatory informational meetings scheduled for March 15 and March 22, and submitting requisite forms by April 10 to ensure compliance. Participants must also monitor their individual account balances and adjust investment allocations accordingly by April 30. Failure to meet these deadlines could result in potential loss of benefits or delays in processing changes. It is crucial to familiarize oneself with new policies outlined in the Employee Benefits Handbook, which will be distributed via email by March 1.

Contact information for inquiries

Contact information for inquiries regarding retirement plan changes includes a dedicated phone line for immediate assistance, available at 1-800-555-0199, operational Monday through Friday from 8 AM to 6 PM Eastern Standard Time (EST). Additionally, a detailed email address for questions is provided: retirementplan@companyname.com, ensuring prompt responses within 48 hours. For in-person discussions, the company's headquarters located at 123 Main Street, Suite 400, New York, NY, is open for consultations during regular business hours. Comprehensive resources are also accessible on the company's website under the "Retirement Services" section, offering FAQs and detailed plan descriptions.

Comments