Hello there! If you're considering an international transfer, you're not aloneâmany people are seeking new adventures abroad for work or study. Crafting the perfect request letter can be a game-changer in this process, as it sets the tone for your intentions and showcases your eagerness for the transition. In this article, we'll guide you through the essential components of a compelling international transfer request letter that not only captures attention but also opens doors to exciting opportunities. So, let's dive in and explore how you can make your transfer request stand out!

Clear recipient's details and address

An international transfer request requires careful attention to the recipient's information and specific details regarding the transfer process. For the recipient, ensure to include their full name, identifying any relevant titles or designations that clarify their role. Include the complete address, specifying the street number, street name, city, postal code, and country to avoid any potential delays in processing. If applicable, provide additional identifying information such as the bank name, account number, and any necessary reference codes essential for the transaction. This precise information will facilitate a smooth and efficient transfer, ensuring that funds reach the intended recipient without complications or misunderstandings.

Precise purpose and amount of transfer

An international transfer request must contain specific details for clear communication between the sending and receiving banks. The crucial elements include the precise purpose of the transfer, such as payment for services, loan repayment, or personal remittance. Additionally, the amount of the transfer should be stated clearly, along with the currency type (for example, USD, EUR, or GBP), to avoid any confusion. In instances of transferring funds for business transactions, providing descriptions of the goods or services involved could further enhance clarity. Incorporating recipient details, including bank name, account number, and SWIFT/BIC code, ensures that funds arrive accurately at the intended financial institution. Transparency in the subject matter of the transfer fosters trust and compliance with international banking regulations.

Beneficiary bank's details and SWIFT/BIC code

For an international money transfer, accurate beneficiary bank details are crucial for a smooth transaction. The beneficiary bank details typically include the bank's name, address, and account number. The SWIFT/BIC (Society for Worldwide Interbank Financial Telecommunication/Bank Identifier Code) code, a standard format of Bank Identifier Codes used to identify banks globally, usually consists of 8 to 11 characters. This code is essential for international wire transfers as it ensures that funds are sent to the correct financial institution. Additionally, it is important to provide the recipient's full name, the currency to be transferred, and any reference notes indicating the purpose of the transaction, facilitating a more straightforward processing by the receiving bank.

Any reference identifiers or account numbers

An international transfer request typically involves various key identifiers that facilitate the smooth transfer of funds across global banking systems. Essential components include the International Bank Account Number (IBAN), which standardizes account identification in various countries, and the Society for Worldwide Interbank Financial Telecommunication (SWIFT) code, which uniquely identifies the recipient's bank, ensuring the accurate routing of funds. In addition, reference identifiers such as transaction reference numbers may be assigned to individual transfers, providing a means to track the transfer status and resolve any potential issues. Details regarding the sender's account number with the originating bank alongside the beneficiary's account information are crucial in ensuring the transfer is processed efficiently and correctly.

Specific instructions or conditions for the transfer

International transfer requests involve several specific instructions that must be adhered to for successful processing. First, ensure the recipient's bank account information is complete, including the International Bank Account Number (IBAN) and Bank Identifier Code (BIC or SWIFT code), which can vary by country. Next, verify the amount to be transferred, taking into account foreign exchange rates that might influence the final amount received. It's important to include any necessary documentation, such as proof of identity or reason for transfer, if required by the financial institution or regulatory authorities. Additionally, be aware of any fees associated with the transfer, which can differ based on the service provider, including banks or online platforms like PayPal or TransferWise. Adhere to the timeline provided by the institution for processing times, which can range from a few hours to several business days depending on the destination country's banking system. Lastly, always keep a record of the transaction reference number for tracking purposes and future inquiries.

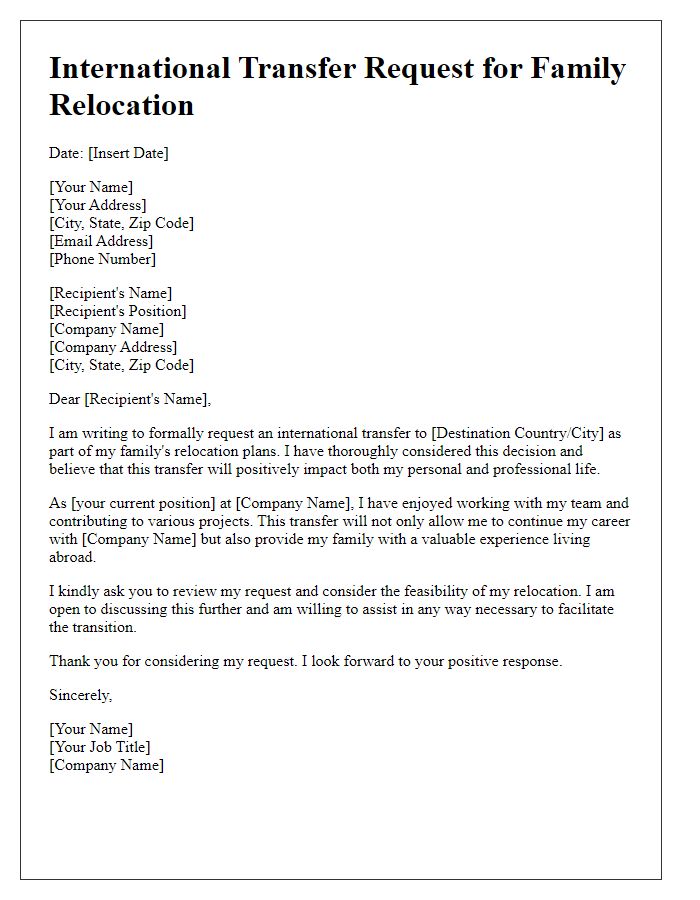

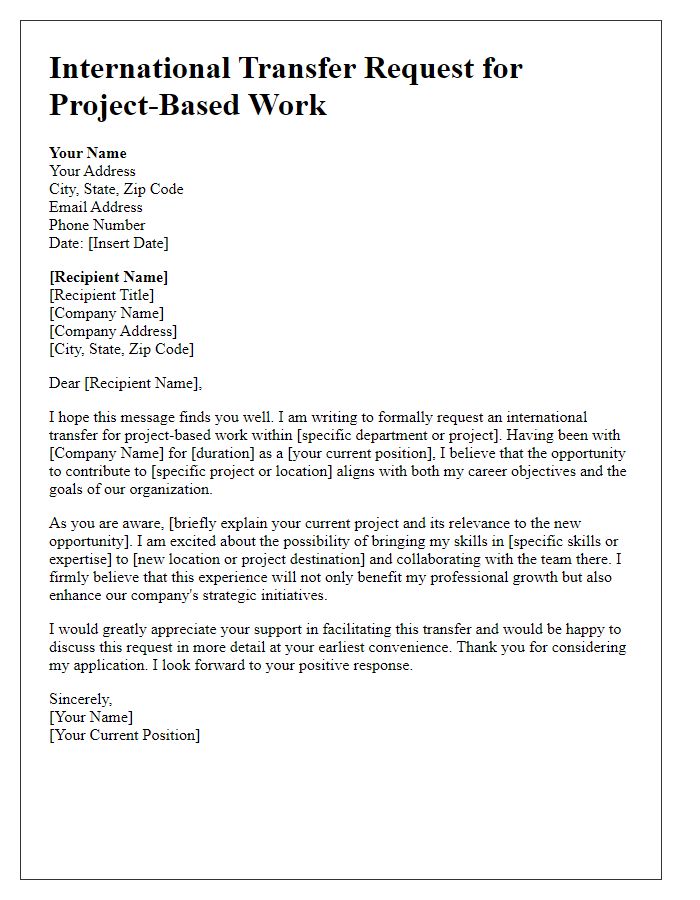

Letter Template For International Transfer Request Samples

Letter template of international transfer request for employee relocation

Letter template of international transfer request for a temporary assignment

Letter template of international transfer request for employee promotion

Letter template of international transfer request for educational purposes

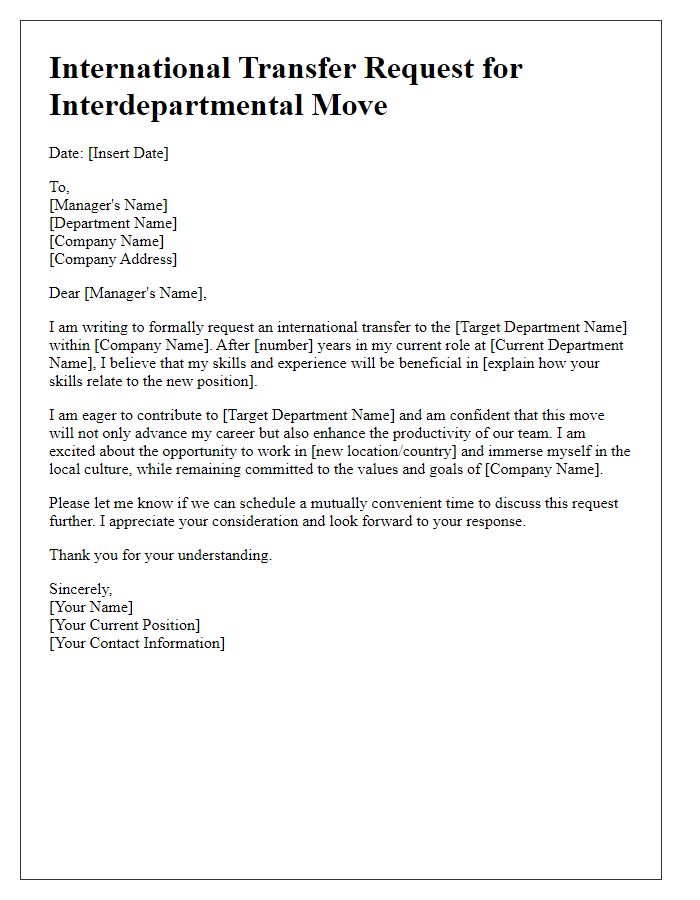

Letter template of international transfer request for interdepartmental move

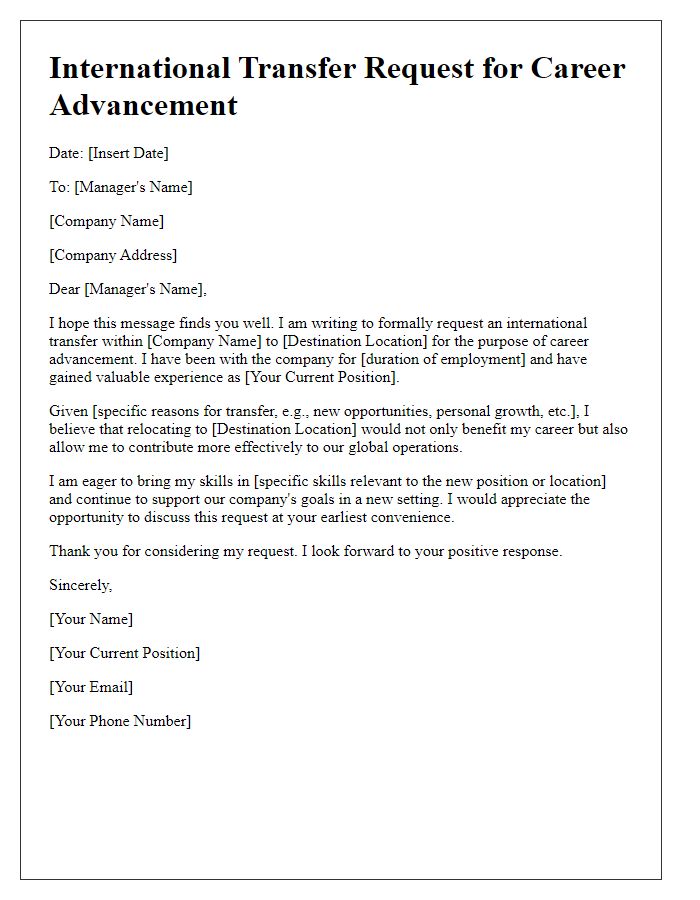

Letter template of international transfer request for career advancement

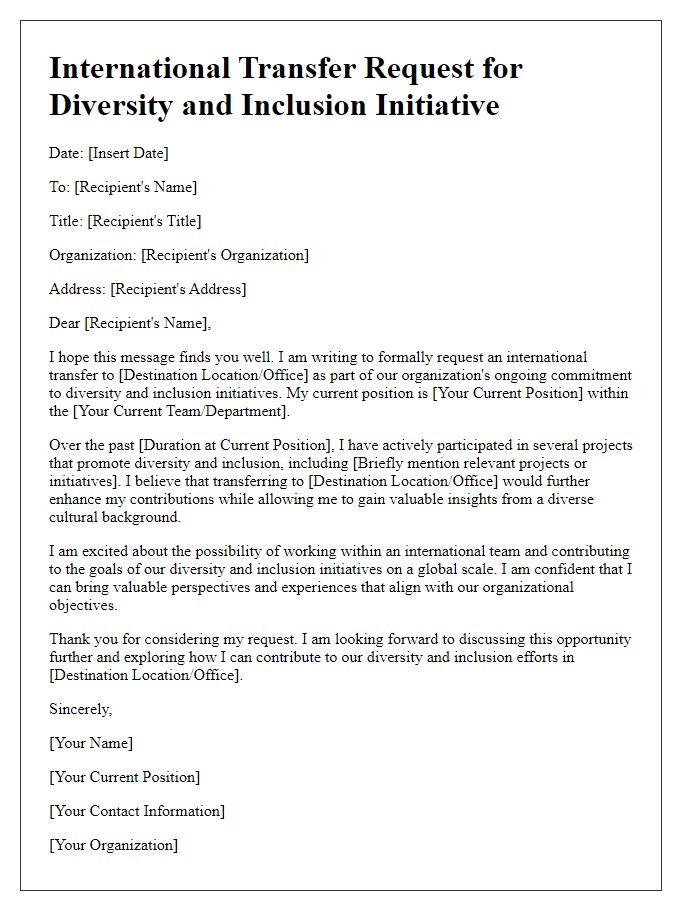

Letter template of international transfer request for diversity and inclusion initiative

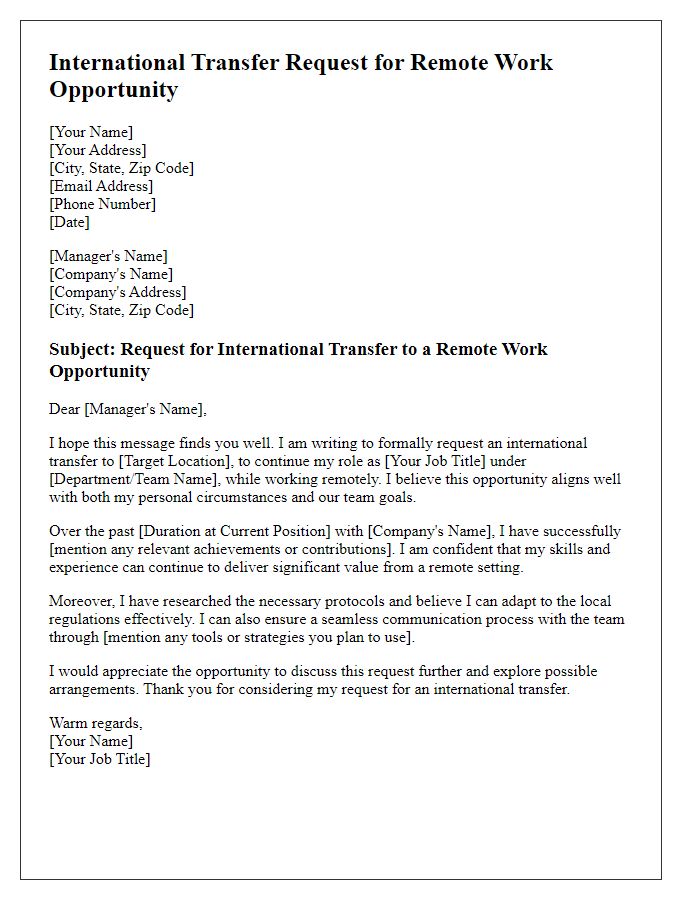

Letter template of international transfer request for remote work opportunity

Comments