Closing a business account can feel like a daunting task, but it doesn't have to be. Whether you're shifting banks or simply streamlining your finances, knowing the right steps can make the process smoother. It's essential to communicate clearly with your bank, ensuring all your transactions are settled before making the final move. Ready to navigate the ins and outs of closing your business account? Keep reading for a comprehensive guide!

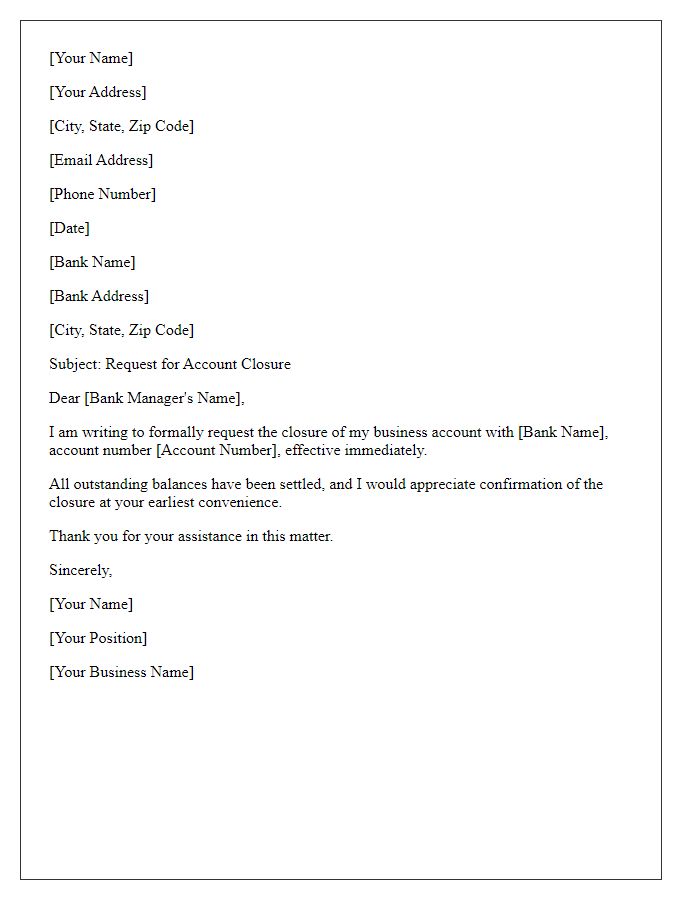

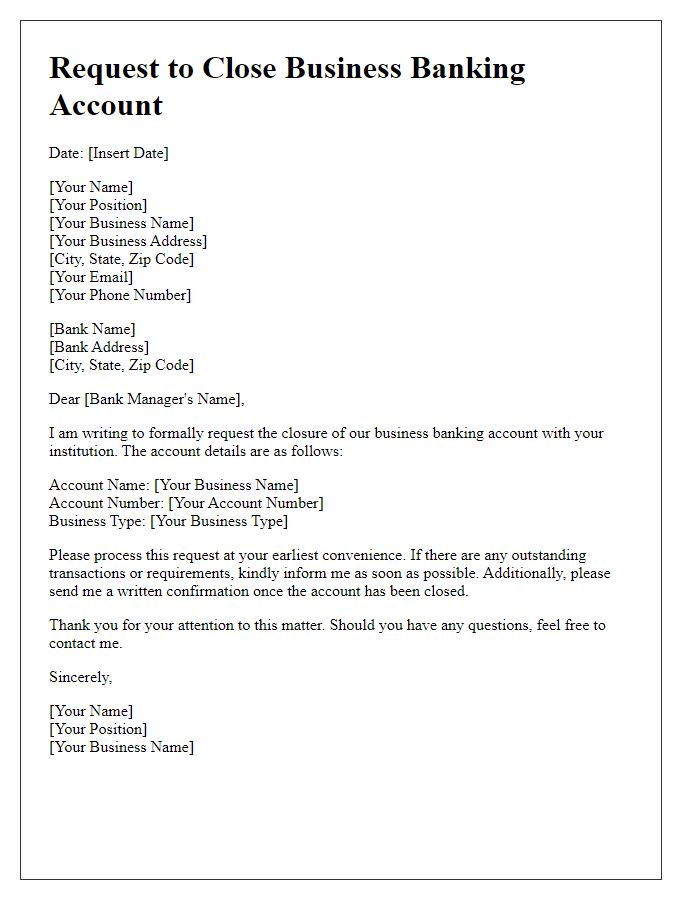

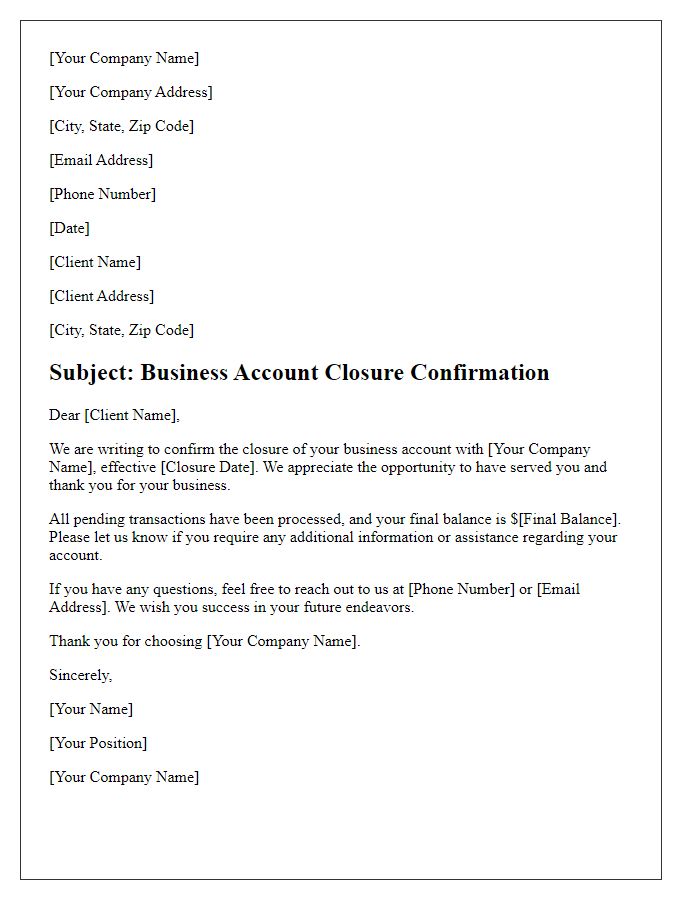

Account Information

When closing a business account, ensure to provide detailed account information which includes the bank's name (e.g., First National Bank), account holder's name (your company name), account number (usually a 10 or 12-digit alphanumeric code), and contact information (email and phone number). Clearly indicate the reason for closure (e.g., business restructuring, lack of use). Request confirmation of account closure via email or postal service. It is vital to inquire about any final transactions that might affect the account balance (e.g., outstanding checks, pending deposits). Additionally, specify the desired closure date (e.g., by the end of the current month) to facilitate a smooth transition. Keep records of all correspondence for future reference.

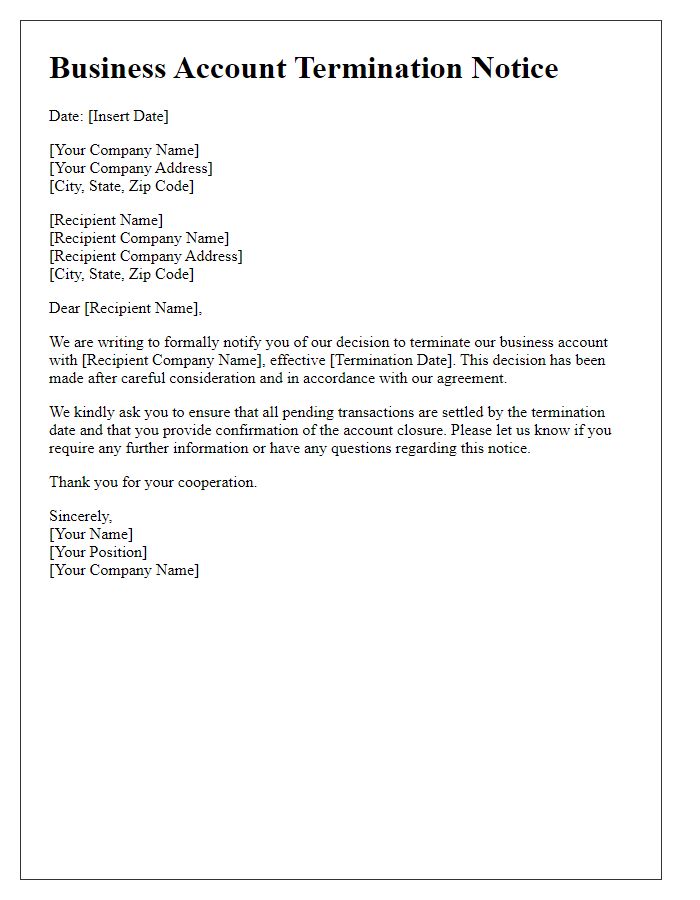

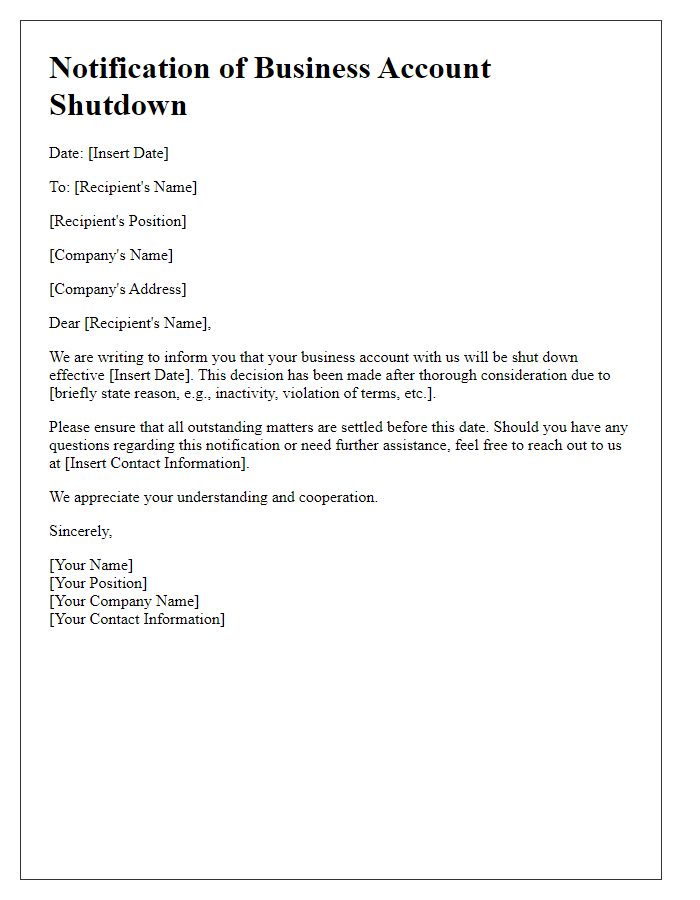

Closure Request Statement

Closure of a business account can involve several important considerations. A business owner may express the intent to close a specific bank account, such as a corporate checking account at a prominent institution like Bank of America, due to changes in operational strategies or financial management. The closure request should include account details, including the account number, associated business name, and contact information, ensuring the bank can process the request efficiently. Additionally, settling any outstanding balances or pending transactions prior to the closure will prevent complications. A formal request may also include instructions for any remaining funds, such as transferring to a designated account or issuing a check. It is crucial to follow the bank's specific procedures for account closure, which may vary between institutions, and to keep records of all communications for future reference.

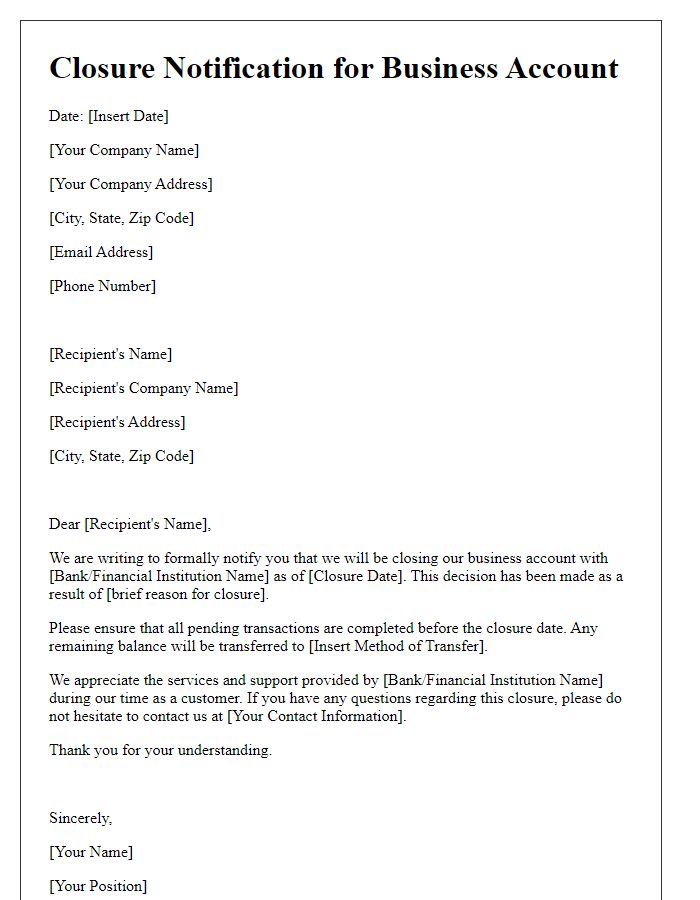

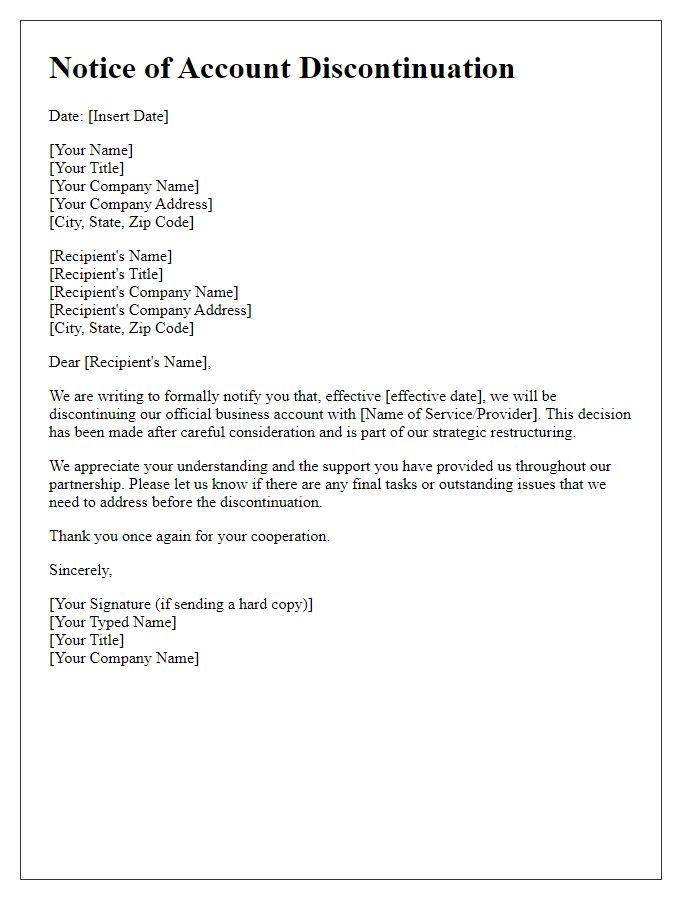

Reason for Closure

A business account closure can be associated with various reasons ranging from financial instability to strategic realignment. Common motivations for closing a business account include the decision to consolidate finances by transferring funds to a different financial institution, the inability to maintain minimum balance requirements, or changes in business structure that necessitate a reassessment of banking options. Additionally, businesses may face external pressures such as increased fees or subpar customer service from their current bank, prompting a shift to a more competitive financial partner that offers better rates or tailored services. In some scenarios, the closure could be part of a wider exit strategy, where businesses evaluate market conditions and decide to cease operations entirely or pivot to new ventures.

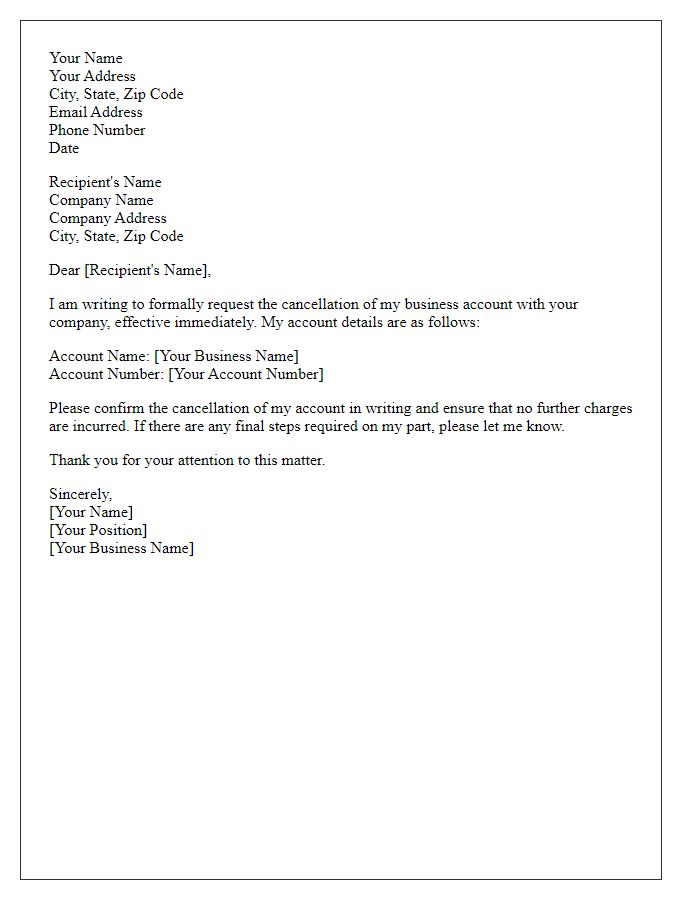

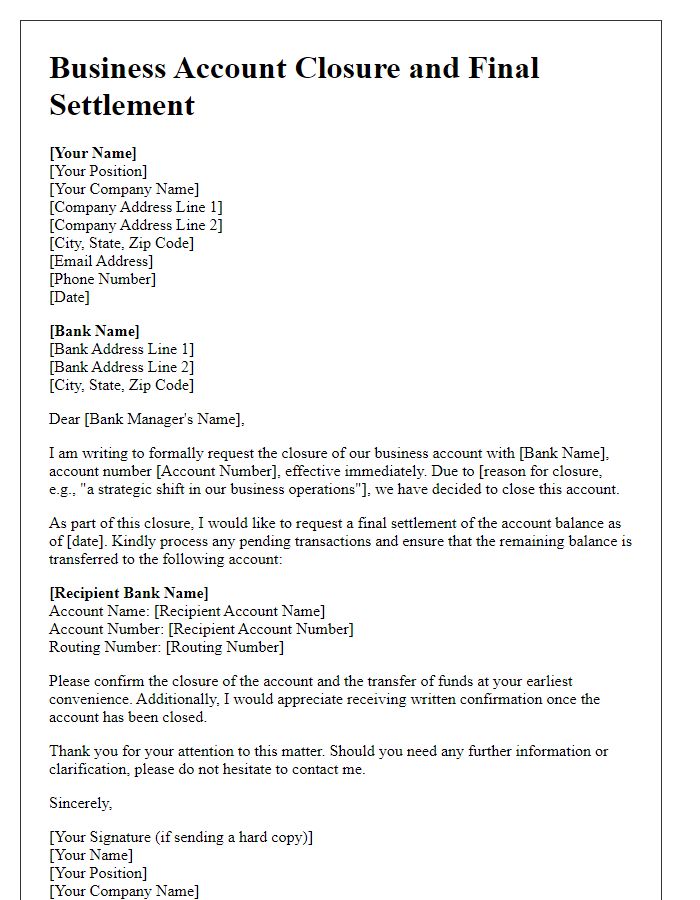

Final Transaction Instructions

Account closure requests require careful attention to detail, ensuring all final transactions are managed efficiently. Customers must submit the official account closure request to their financial institution, providing essential identifiers like account number and customer name for verification. Businesses are advised to clear any outstanding balances or debts before initiating closure; typically, this should be completed by the last business day of operations. Final transactions can include transferring remaining funds to a designated external account or liquidating any held assets. Notifications regarding the closure should be sent to all relevant parties (e.g., clients, vendors), ensuring a seamless transition without disruption. Documentation confirming the closure date and final account statement is crucial for record-keeping purposes.

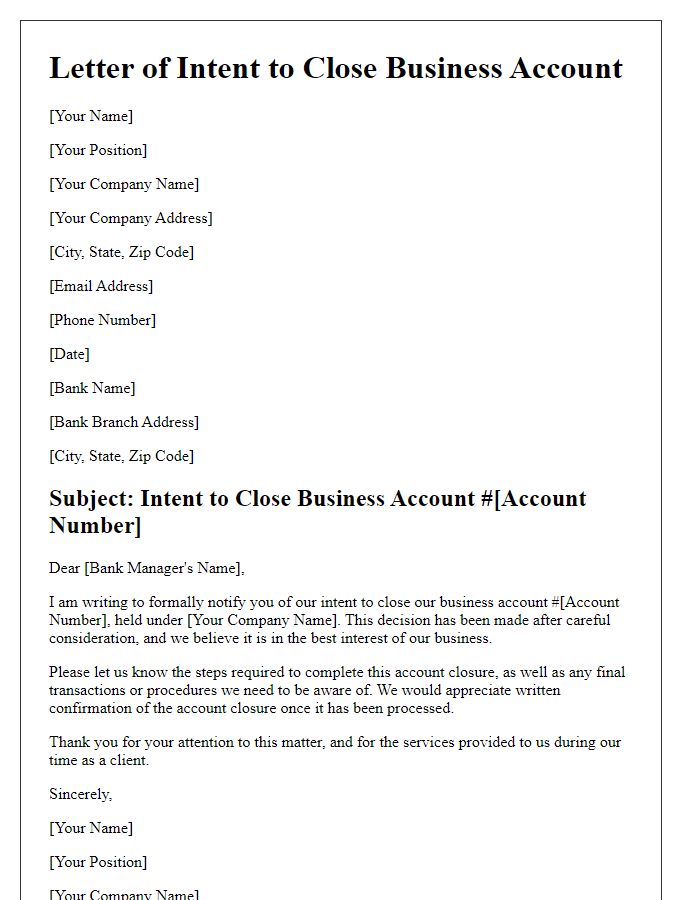

Contact Information and Signature

Business account closure requires careful attention to contact information and signature details. Accurate contact information includes the company name, associated account number for immediate identification, and the current address where correspondence will be sent. Additionally, incorporating a dedicated email address and a phone number ensures efficient communication during the account closure process. A formal signature, preferably from an authorized signatory or company representative, authenticates the closure request. This signature must be legible, potentially accompanied by the print name and title of the signatory, establishing authority in the matter. Clear documentation assists in a seamless account closure experience.

Comments