Are you contemplating canceling your credit card but unsure how to express your decision? Writing a cancellation letter doesn't have to be intimidating! It's simply a way to communicate your choice clearly and professionally to your card issuer. Stick around to discover a straightforward letter template that will make the process smooth and stress-free!

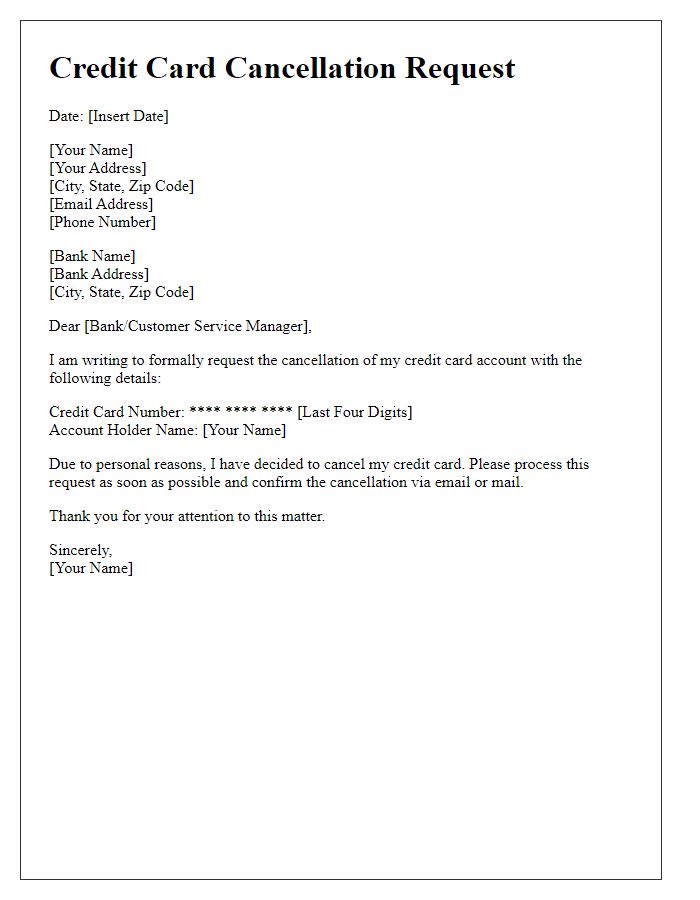

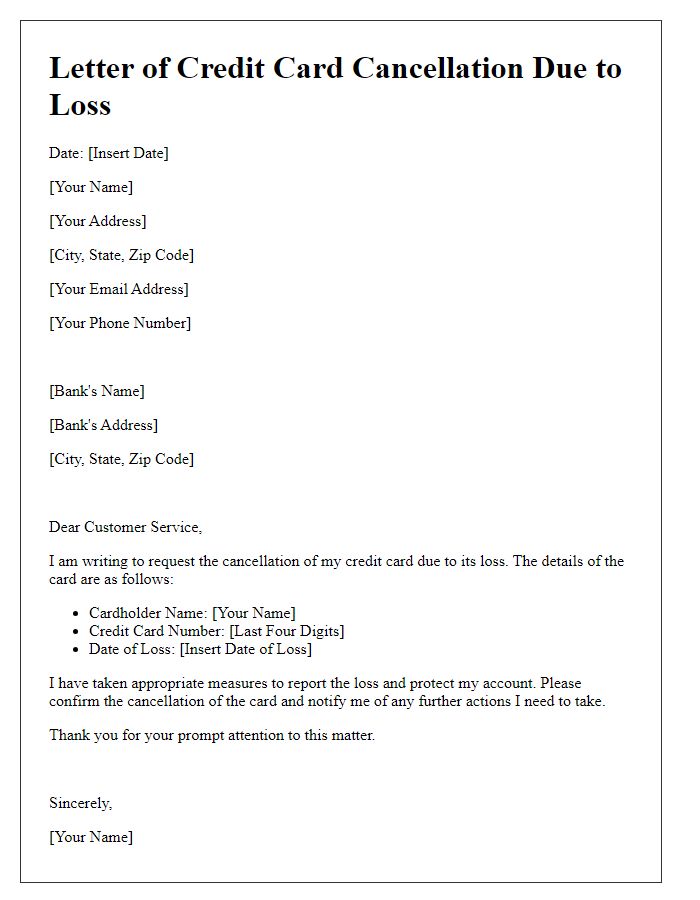

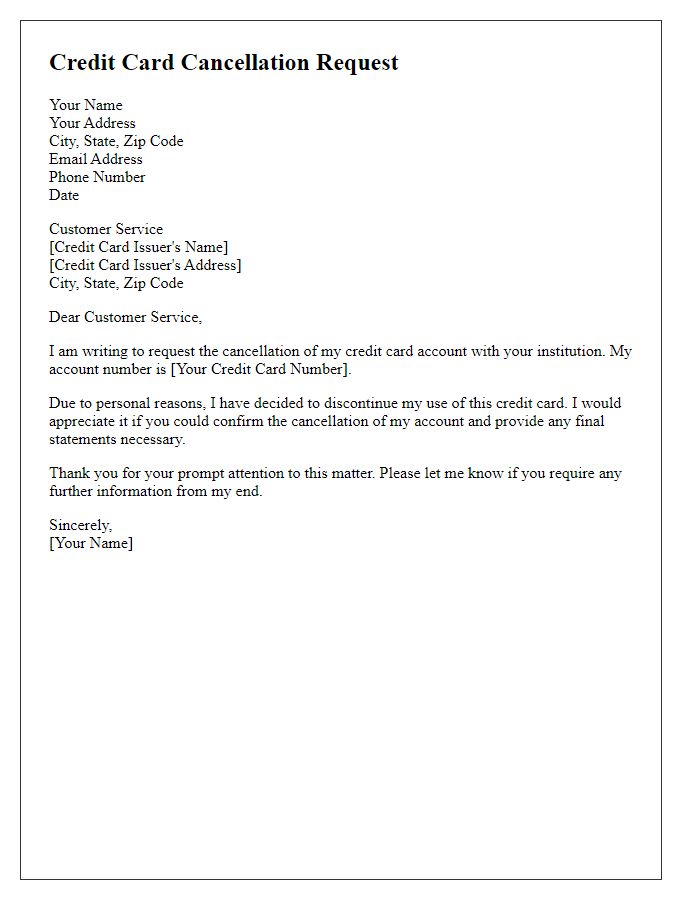

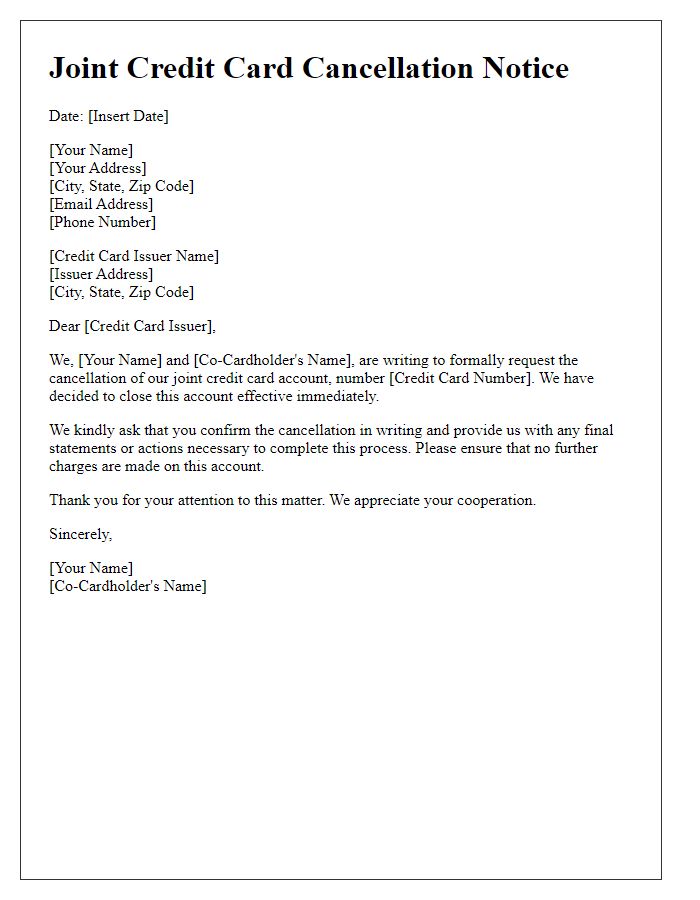

Account Information

Credit card cancellation requests often involve important account information such as the credit card number (16 digits), expiration date (MM/YY format), and the account holder's personal details including full name, address, and contact number. Providing these details ensures proper identification of the account to be canceled. Furthermore, it's advisable to mention the reason for cancellation, such as dissatisfaction with fees, interest rates, or customer service experiences. Additional considerations include inquiring about the effects on the credit score as well as confirming the potential for future account reactivation within a stipulated timeframe established by the issuing bank.

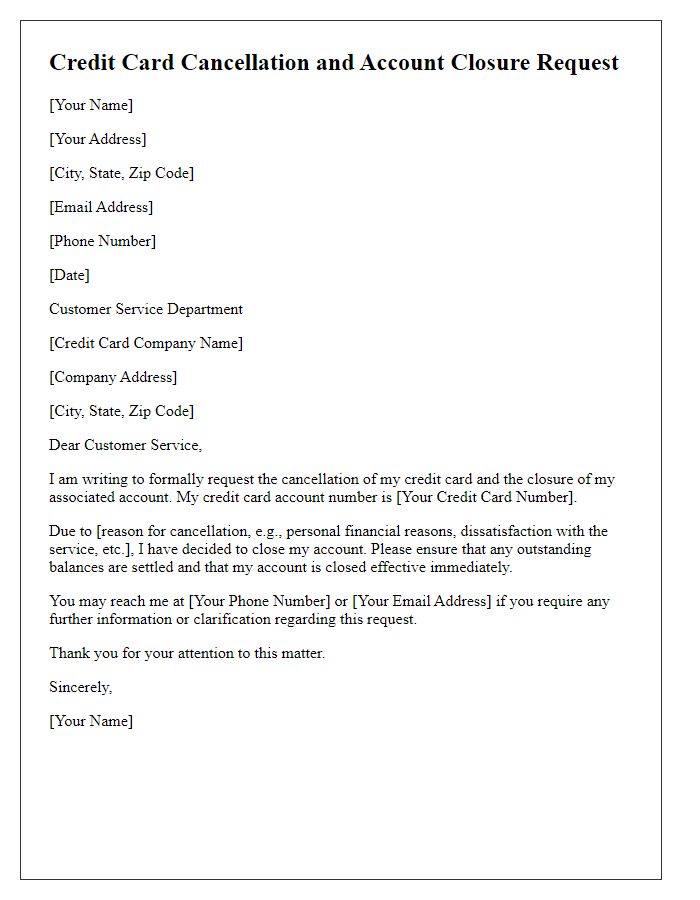

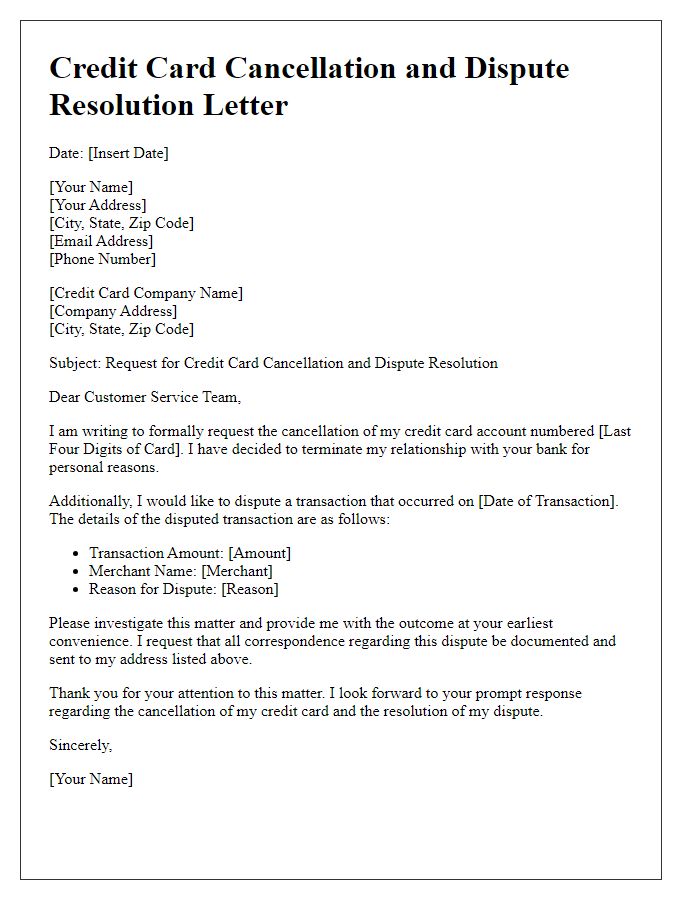

Reason for Cancellation

Cancellations of credit cards can occur for various reasons, such as high interest rates (often exceeding 20% APR), unexpected annual fees (ranging from $75 to $500), or insufficient rewards programs (less than 1% cashback). Some users may also encounter poor customer service experiences, leading to dissatisfaction and considered alternatives. Financial difficulties, like mounting debt, can drive individuals to simplify their finances by eliminating unnecessary credit accounts. Security concerns related to potential fraud or data breaches (with estimated impacts affecting millions annually) can prompt consumers to sever ties with certain credit card issuers. The decision-making process in these situations often includes evaluating credit reports, outstanding balances, and potential impacts on credit scores.

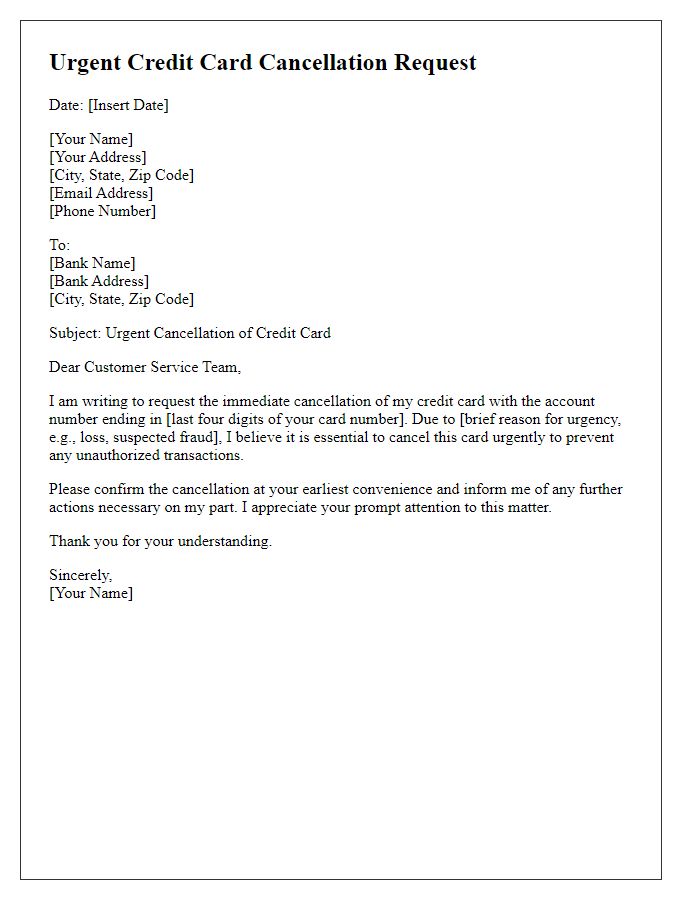

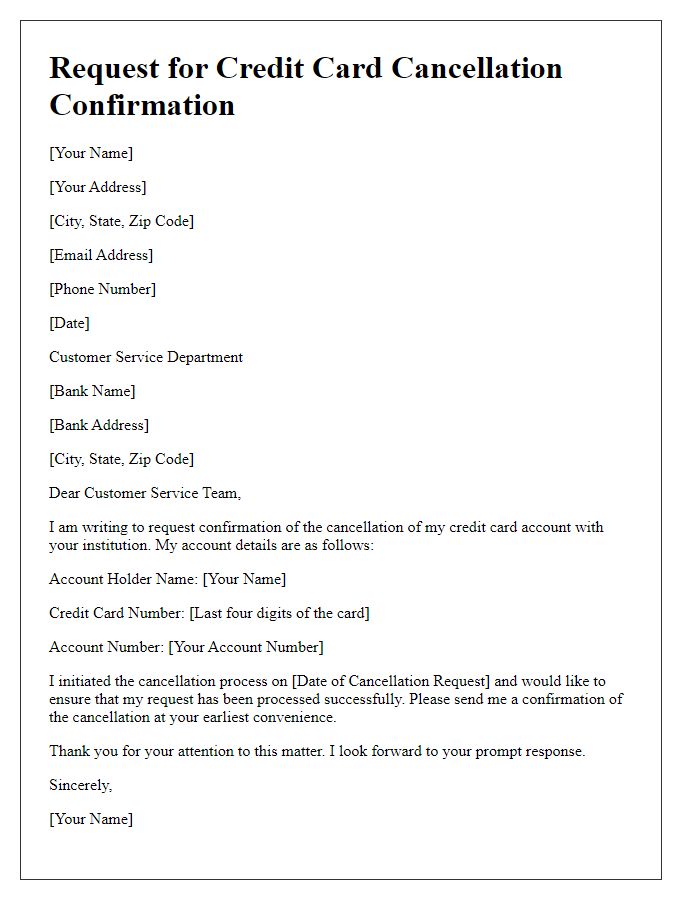

Request Confirmation

Credit card cancellation can lead to account closure and potential impacts on credit scores. Requesting confirmation of cancellation from financial institutions, such as Visa, Mastercard, or American Express, is crucial for record-keeping. Typically, following a cancellation request, financial institutions may take several days to process the request. Ensuring all outstanding payments and balances are settled is essential to avoid future complications, especially if the account was used for recurring payments. Documentation could include cancellation confirmation letters or emails, serving as proof for the account holder.

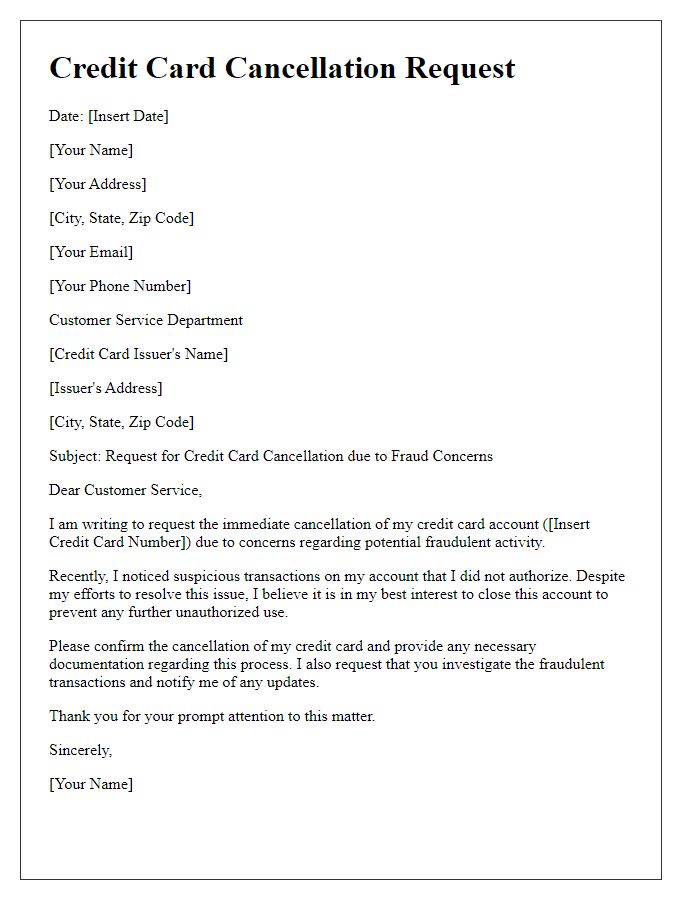

Account Settlement Details

Credit card cancellation can significantly impact an individual's financial situation, especially regarding account settlement details. Canceling a credit card, such as a Visa or MasterCard, may lead to outstanding balances requiring prompt attention. In the United States, the average credit card debt per household is around $8,000, necessitating comprehensive planning for the settlement of any remaining amounts. A proper cancellation process involves contacting the issuing bank, like Chase or Bank of America, to negotiate final payment terms or possible debt forgiveness options. Furthermore, maintaining a written record of the cancellation request is crucial, as it may affect future credit scores, potentially lowering them by up to 100 points after cancellation. Understanding the ramifications of credit utilization ratios and their importance in credit history remains vital during this process.

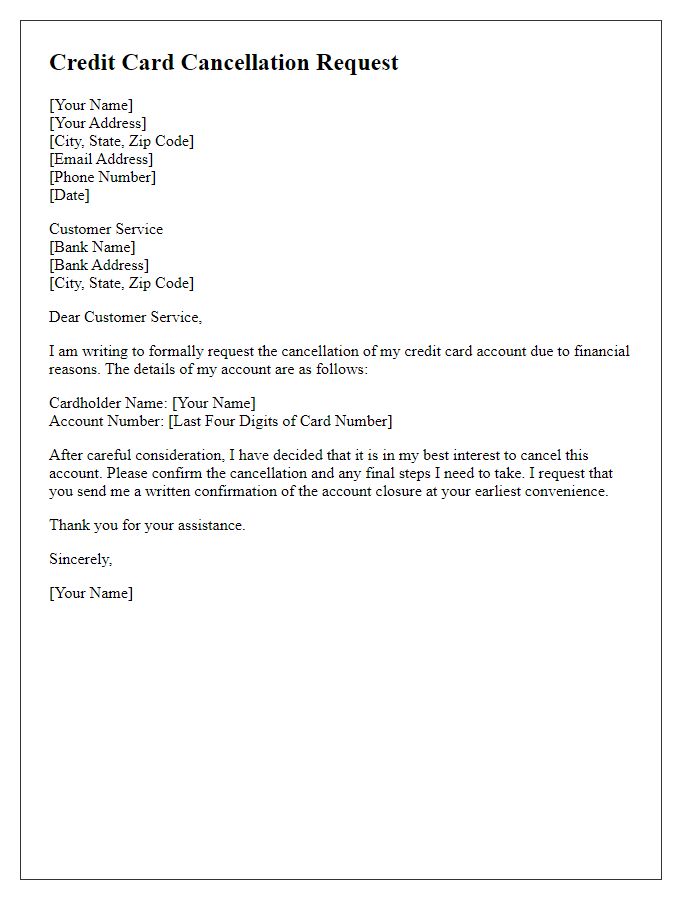

Contact Information

To initiate a credit card cancellation process effectively, include essential contact information. Begin with cardholder's full name, followed by the primary address, which includes the street address, city, state, and ZIP code for verification purposes. Include the primary phone number, typically the one registered with the financial institution, for any follow-up communications. Additionally, provide the email address linked to the account for further correspondence. Include the credit card number (only the last four digits for security) to ensure clarity on which account is being canceled. This comprehensive approach facilitates efficient handling of the cancellation request by the customer service team of the issuing bank or credit card company.

Comments