Hey there! If you're in the market for a new home or considering refinancing, understanding the importance of a pre-approval mortgage can make all the difference in your journey. A pre-approval not only helps you gauge your budget but also signals to sellers that you're a serious buyer, giving you a competitive edge. Plus, with the fluctuating interest rates, staying informed about your mortgage options can save you time and money. Ready to learn more about securing your pre-approval? Keep reading!

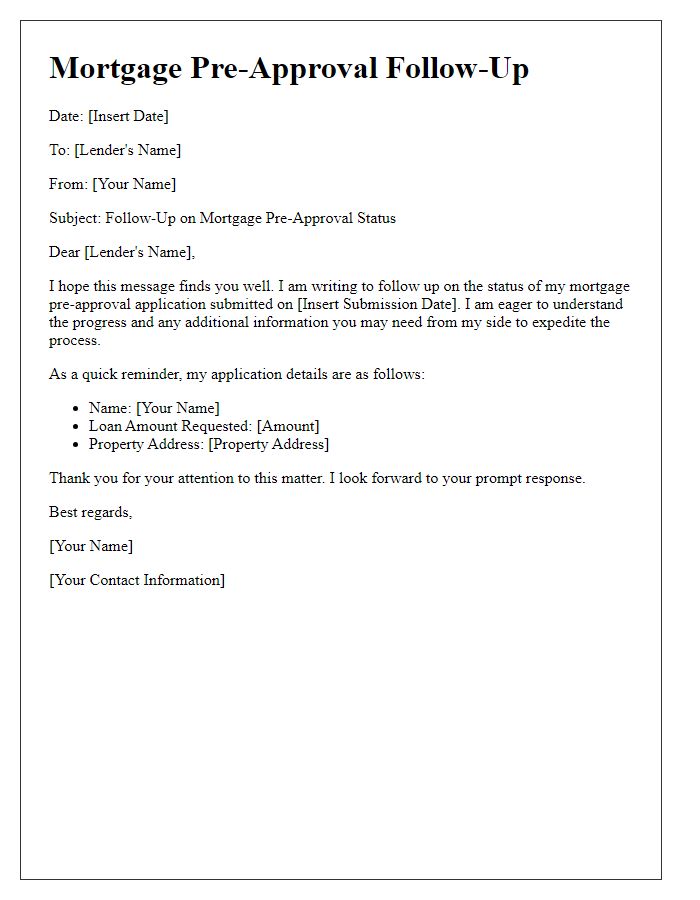

Borrower's personal information

A pre-approval mortgage reminder serves as a notification for potential borrowers to revisit their financial standing and ensure they are prepared for home purchasing. Key factors include the borrower's credit score, which ideally should exceed 700 for favorable rates, and their debt-to-income ratio, generally recommended to remain below 43%. The pre-approval process often involves documentation such as tax returns from the past two years, W-2 forms, and bank statements, specifically covering the last two months. Lenders will need to verify employment status and income stability, often requiring an employment verification letter from employers. Additionally, borrowers should note that pre-approval letters typically have expiration dates, often around 60 to 90 days, after which the financial situation must be reassessed to obtain updated approval. This reminder enhances awareness of ongoing financial readiness as borrowers proceed in the competitive housing market.

Pre-approval expiration date

A pre-approval mortgage serves as an essential foundation in securing financing for real estate purchases, with a typical expiration period ranging from 60 to 90 days, depending on lender policies. As the expiration date approaches, borrowers should be reminded of the impending deadline, which can significantly impact their ability to make offers on properties. For example, if the pre-approval issued by a lender such as Chase or Wells Fargo is set to expire on April 30, 2023, borrowers must take action promptly to either renew their pre-approval or expedite their home-buying process. Timely communication regarding these details is crucial for ensuring a smooth transition into the home financing process, especially in competitive real estate markets like San Francisco or New York City.

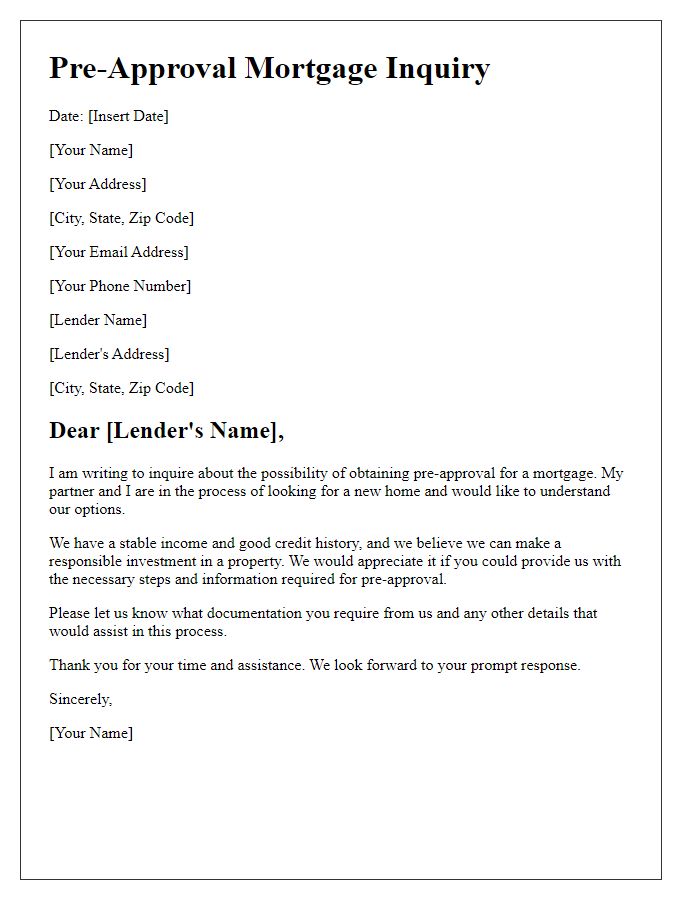

Loan amount and interest rate

Mortgage pre-approval helps potential homeowners secure favorable loan conditions. A typical loan amount for first-time buyers often ranges from $150,000 to $500,000, depending on various factors such as income and location. Interest rates fluctuate based on market conditions, with current averages hovering between 3% and 4.5% as of October 2023. Maintaining a good credit score (generally above 700) can significantly lower these rates, impacting total repayment costs. Remember to review your pre-approval details periodically, as rates and lending criteria may change.

Property details

A pre-approval mortgage reminder is essential for potential homebuyers navigating the competitive real estate market, particularly in areas like San Francisco, California, where housing demand remains high. Property details, such as the address (123 Main Street, San Francisco, CA), square footage (1,800 square feet), and year built (2010), are critical in the pre-approval process as they determine the property's value. Mortgage lenders consider key factors like the local market trends, comparable sales in the neighborhood, and the buyer's financial profile to finalize pre-approval amounts. Prospective buyers should also be aware of interest rates, currently ranging from 3% to 4%, which greatly influence monthly payments and total mortgage costs. Documenting essential details like the intended purchase timeline, estimated closing costs, and income verification documents is advisable to maintain momentum in the mortgage approval journey.

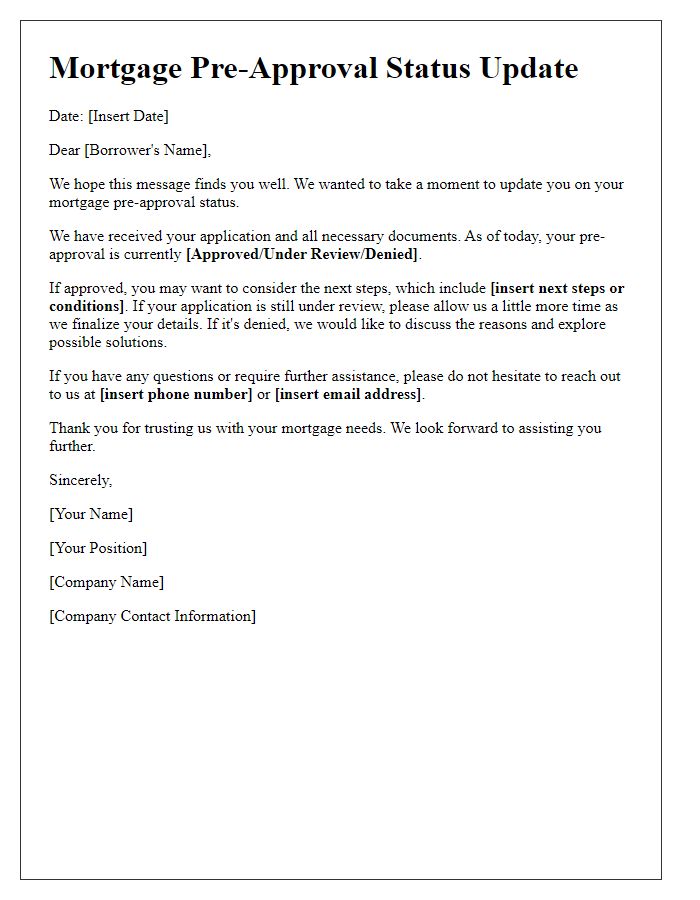

Contact information for follow-ups

A pre-approval mortgage reminder ensures timely communication for prospective homebuyers. The pre-approval process typically involves a comprehensive review of financial documents, such as income statements and credit reports, by financial institutions including banks and mortgage lenders. Important timelines often span a few weeks, during which crucial matters like interest rates and loan amounts are finalized. Accurate contact information is essential for follow-ups; standard details include current phone numbers, email addresses, and mailing addresses often provided by the borrower. Regular reminders serve to reinforce commitment and keep the mortgage pipeline moving efficiently toward loan approval and eventual property acquisition.

Comments