Are you facing the challenge of jotting down a rental late fee notice? Crafting the perfect letter can feel daunting, but it doesn't have to be. In this article, we'll walk you through a simple yet effective template that communicates your message clearly and professionally. So, if you're ready to streamline your communication with tenants, let's dive in and explore the details!

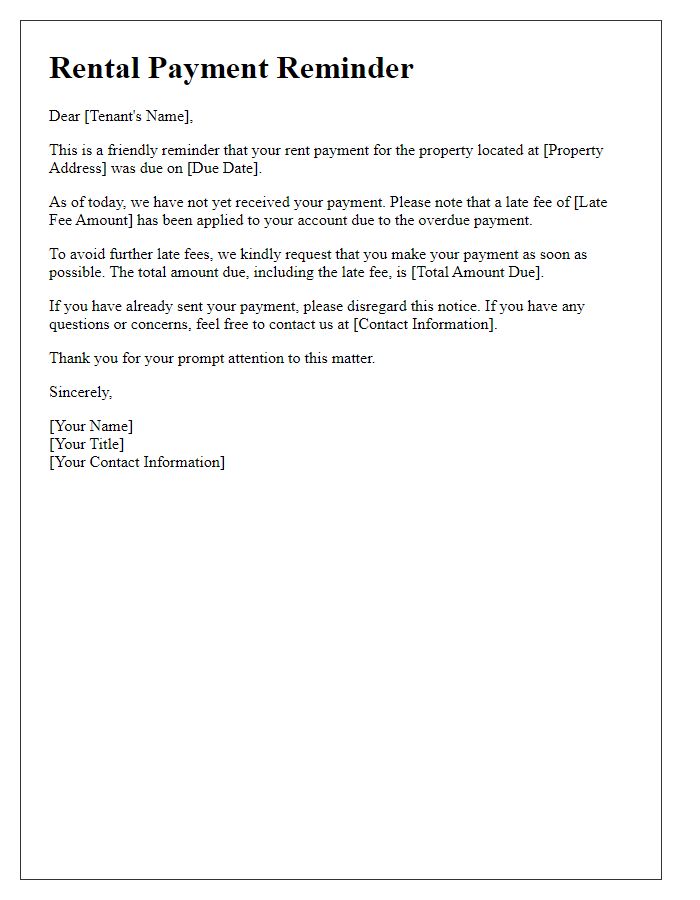

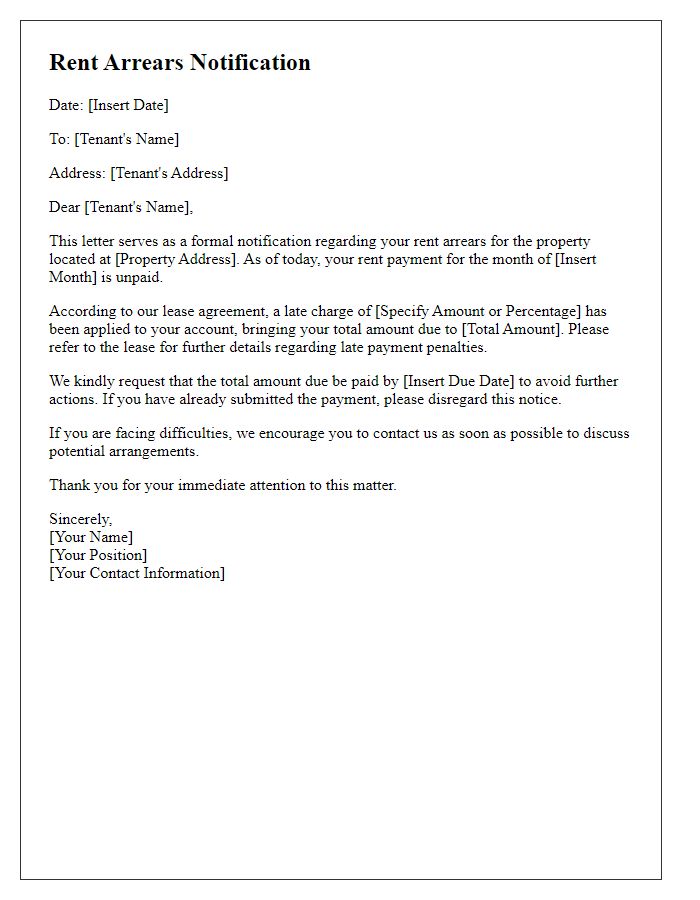

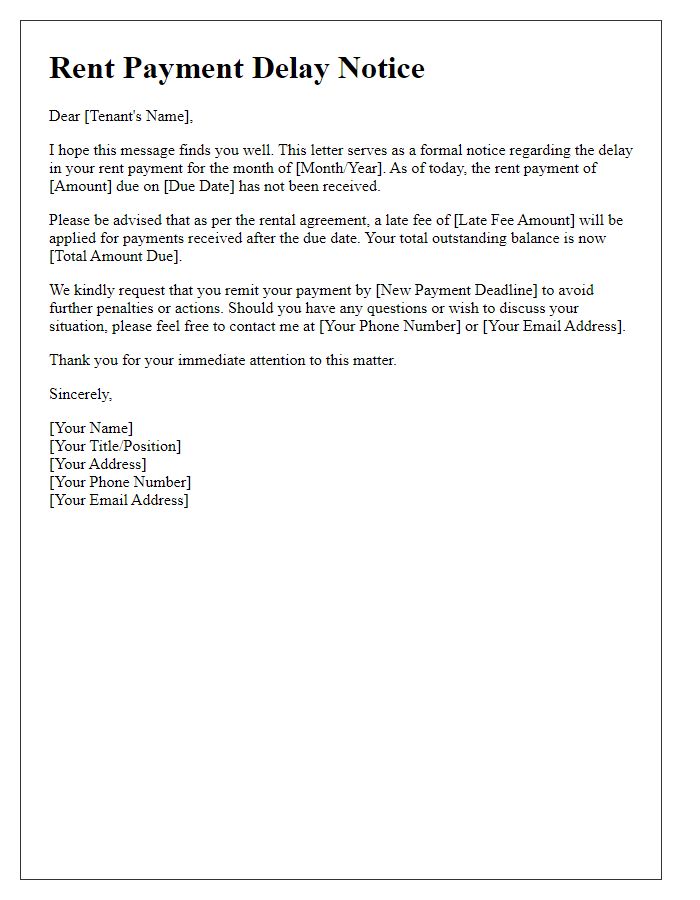

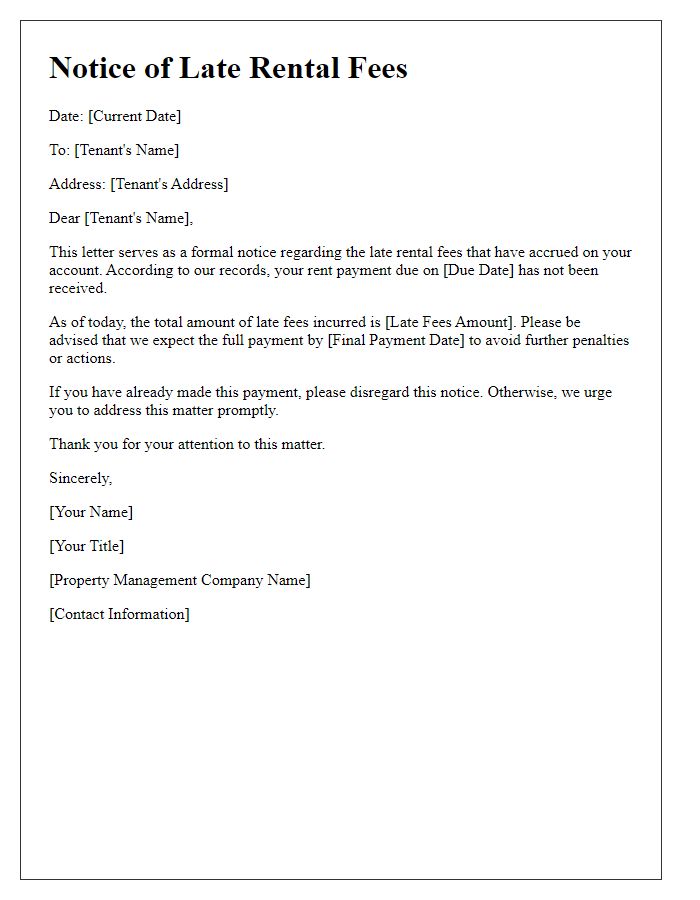

Clear communication of late fee policy.

Late payment on residential leases can incur significant financial implications for both landlords and tenants. A clear late fee policy must specify the grace period, typically between 5 to 10 days after the rent due date (often the 1st of each month). An outlined late fee may include a percentage of the total rent, such as 5% for every month of delay, or a flat fee, for example, $50. This communication should assert the importance of timely payments to maintain positive tenant-landlord relationships and emphasize potential consequences, such as eviction proceedings, if unpaid rent continues. Records should indicate dates of payments received, establishing transparency.

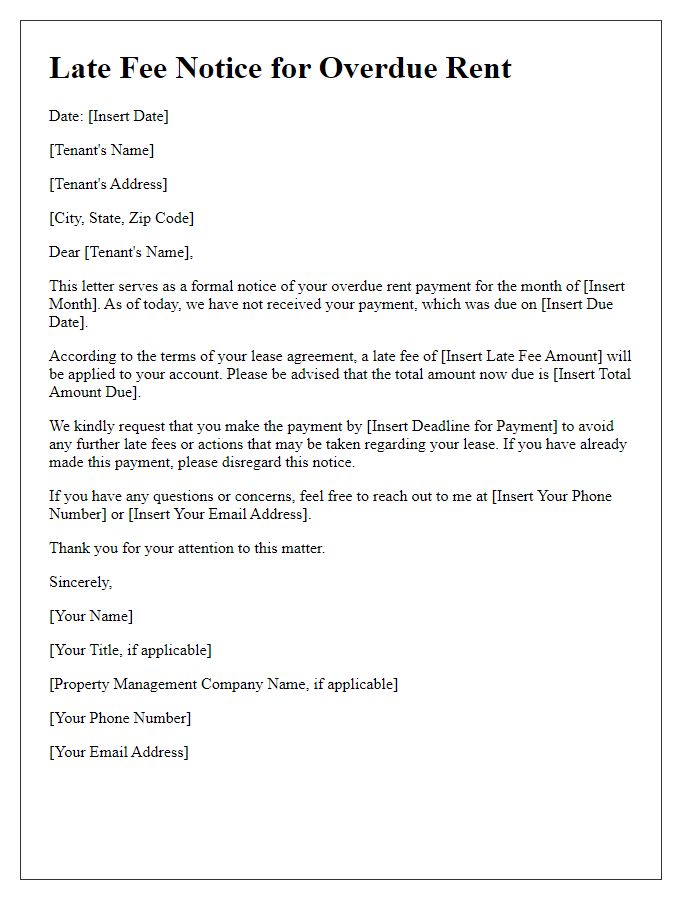

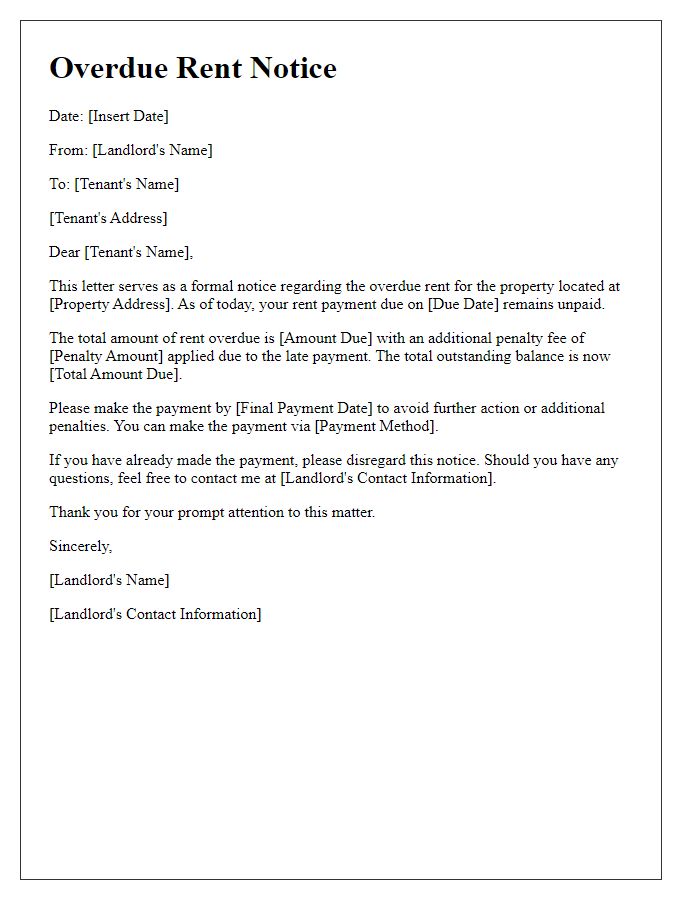

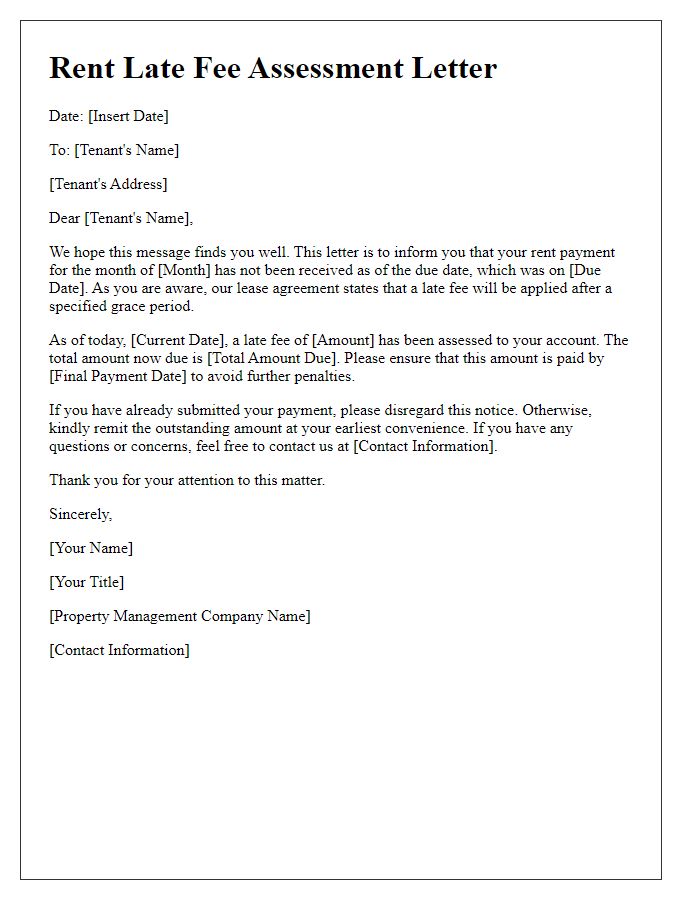

Specific amount and due date of late fee.

When tenants fail to pay their rent on time, landlords often impose a late fee as specified in the rental agreement. The standard late fee can range from 5% to 10% of the monthly rental amount, depending on local regulations. For instance, if the monthly rent is $1,200 and the late fee is set at 5%, the tenant would incur a late fee of $60 if the payment is received after the due date, typically the 1st of the month. The notice should indicate the due date for this fee, often around five days after the rent due date, providing clear communication regarding expectations. Additionally, local laws often mandate that landlords must provide written notice detailing the late fee policy, ensuring transparency and compliance in rental practices.

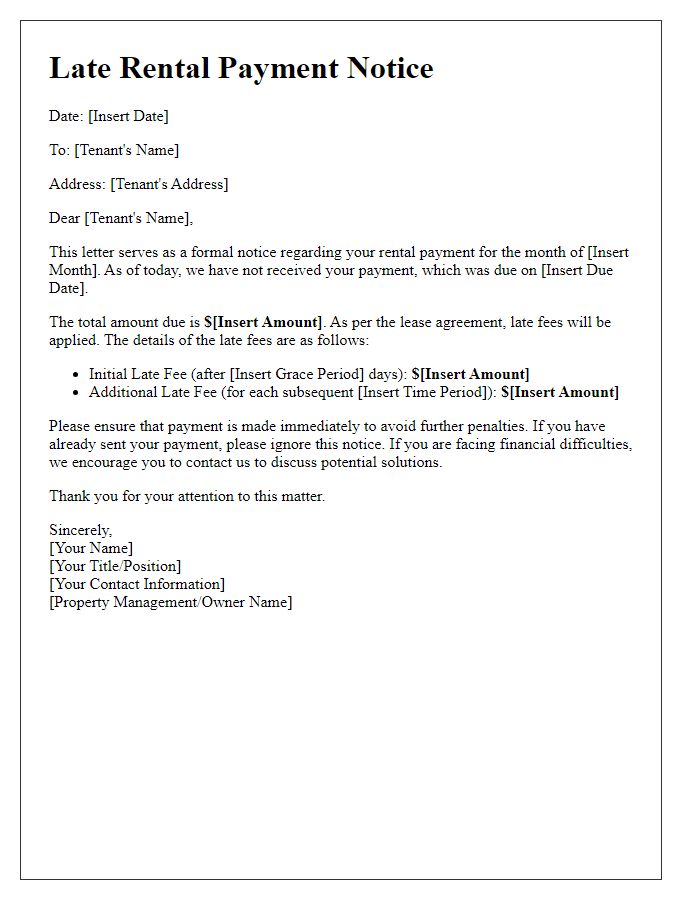

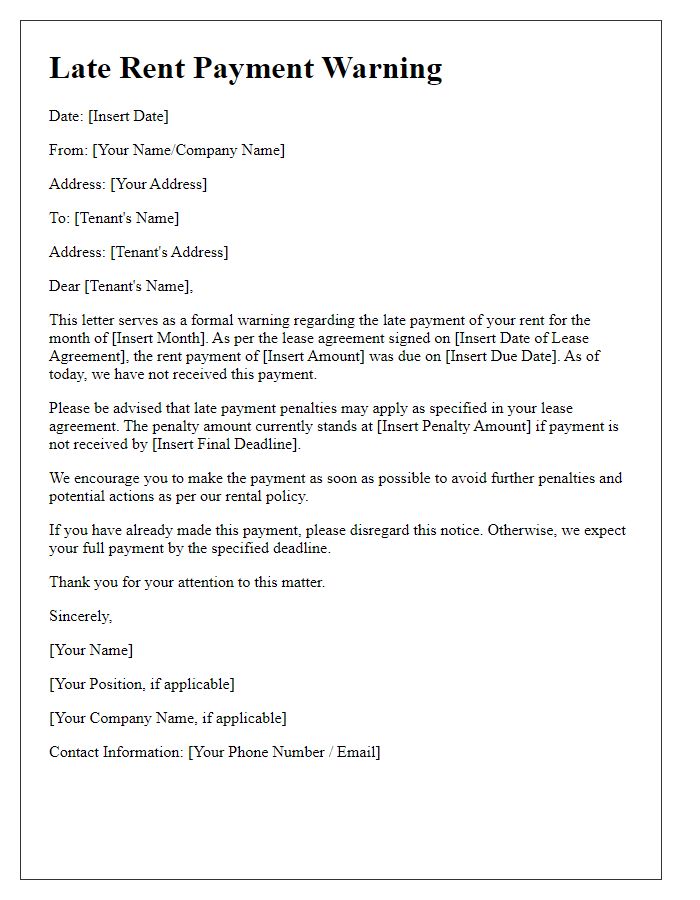

Consequences of continued non-payment.

Continued non-payment of rent can result in significant financial consequences for tenants, including late fees, legal actions, and potential eviction. Landlords typically impose late fees ranging from 5% to 15% of the monthly rent for payments received after the grace period, often defined as the first five days of the month. Failure to remit payment can lead to contractual breaches, triggering lease termination processes as outlined in rental agreements compliant with state or local regulations. Non-payment alerts may escalate to formal eviction notices, which can be filed in local courts, impacting tenants' credit scores and rental history significantly. Additionally, eviction proceedings can incur legal fees, further compounding financial stress for renters in cities like New York or Los Angeles where housing laws dictate stringent compliance.

Contact information for payment inquiries.

Late rental payments can incur additional fees according to lease agreements. Standard late fees typically range from 5% to 10% of the monthly rent. Payment inquiries can be directed to the property management office, located at 123 Main Street, Anytown, USA, open Monday through Friday from 9 AM to 5 PM. Contact number for inquiries is (555) 123-4567. Email inquiries can be sent to payments@rentalcompany.com for quicker responses. Prompt communication regarding payments can help prevent further penalties and maintain good standing with property management.

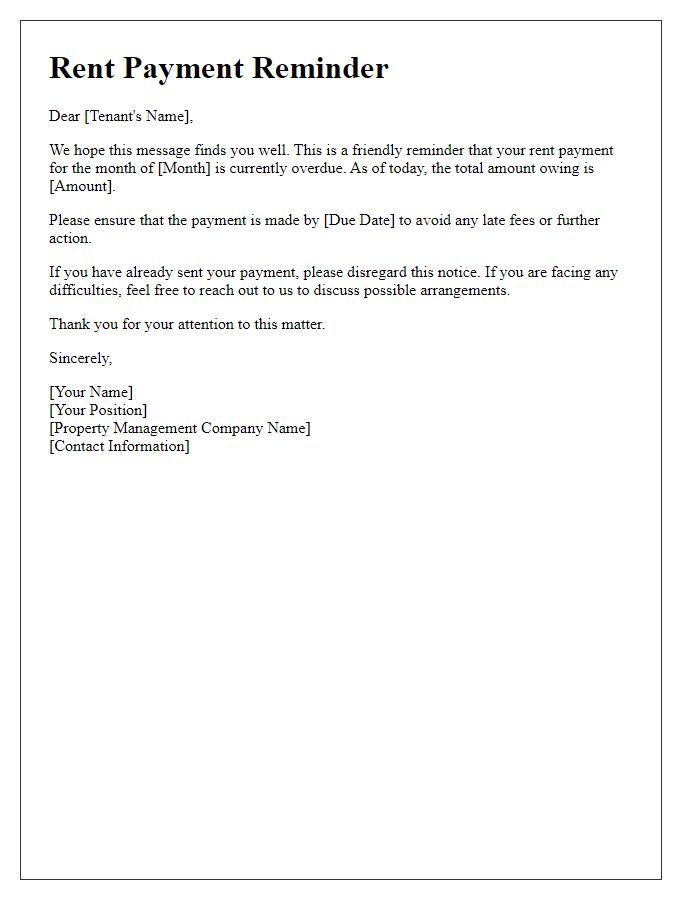

Encouragement to resolve promptly.

Rental agreements often stipulate timely payment schedules, usually on the first day of each month, to ensure a seamless renting experience. When payments are delayed, landlords retain the right to impose late fees, typically ranging from 5% to 10% of the monthly rent, depending on the terms outlined in the lease. This fee serves both as a reminder and an incentive for tenants to fulfill their financial obligations promptly. Effective communication can facilitate timely payments; therefore, sending a late fee notice to tenants encourages them to resolve outstanding balances. Addressing such issues as soon as they arise can help maintain a positive landlord-tenant relationship and prevent future disputes.

Comments