When it comes to negotiating payment terms, clear communication is key to finding a mutually beneficial agreement. Whether you're a business owner looking to manage cash flow or a vendor seeking prompt payment, understanding each other's needs can lead to a stronger partnership. It's essential to approach the conversation with flexibility and a willingness to explore various options. Curious about effective strategies and templates to facilitate this discussion? Keep reading to discover tips that can make your negotiation process smoother!

Clear Introduction and Purpose

Negotiating payment terms is crucial for maintaining healthy cash flow in business transactions. Clear payment terms can enhance transparency between parties, minimizing misunderstandings. Businesses, such as startups in technology sectors, may require extended payment terms (like net 60 days) to manage operational expenses while established firms may prefer shorter terms (such as net 30 days) to ensure rapid turnover of cash. These negotiations typically occur during contract discussions, where objectives, payment milestones, and conditions for payments, such as project completion or delivery confirmation, are clearly defined. Establishing mutual agreement on payment schedules fosters trust, contributes to successful partnerships, and supports a sustainable financial model for growth.

Reference to Existing Agreement

Negotiating payment terms related to an existing agreement often involves reviewing the stipulations outlined in the original contract, such as payment due dates, interest rates on late payments, and any penalties for non-compliance. Clear communication regarding the current financial climate may necessitate a revision of terms, including potential installment payment plans or extended due dates. In discussions, it may be useful to reference specific sections of the agreement to support proposals, creating a foundation for ongoing collaboration while accommodating changing circumstances. Establishing mutual understanding and trust can lead to a more favorable outcome for both parties.

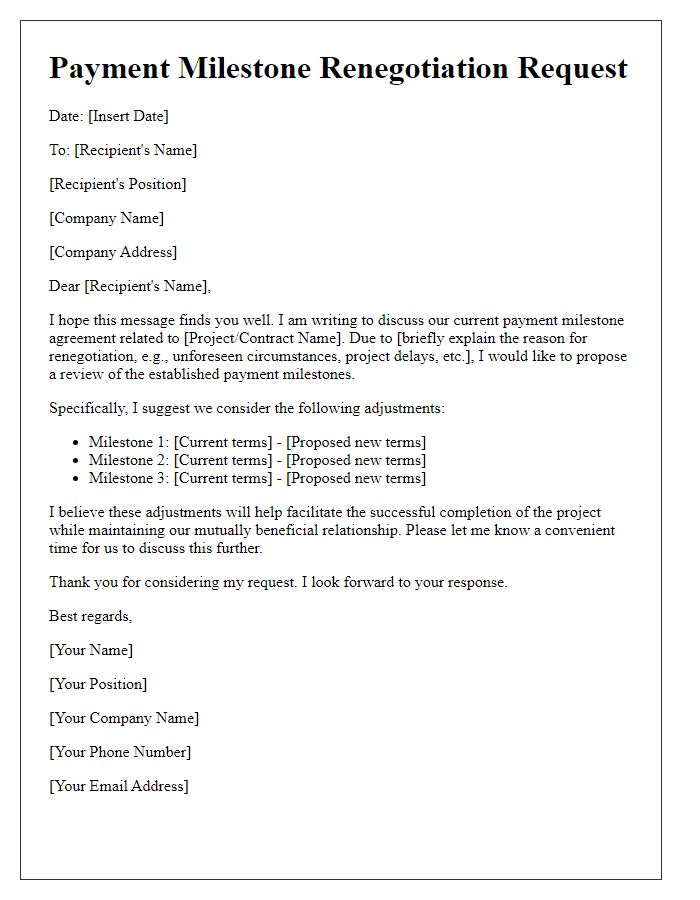

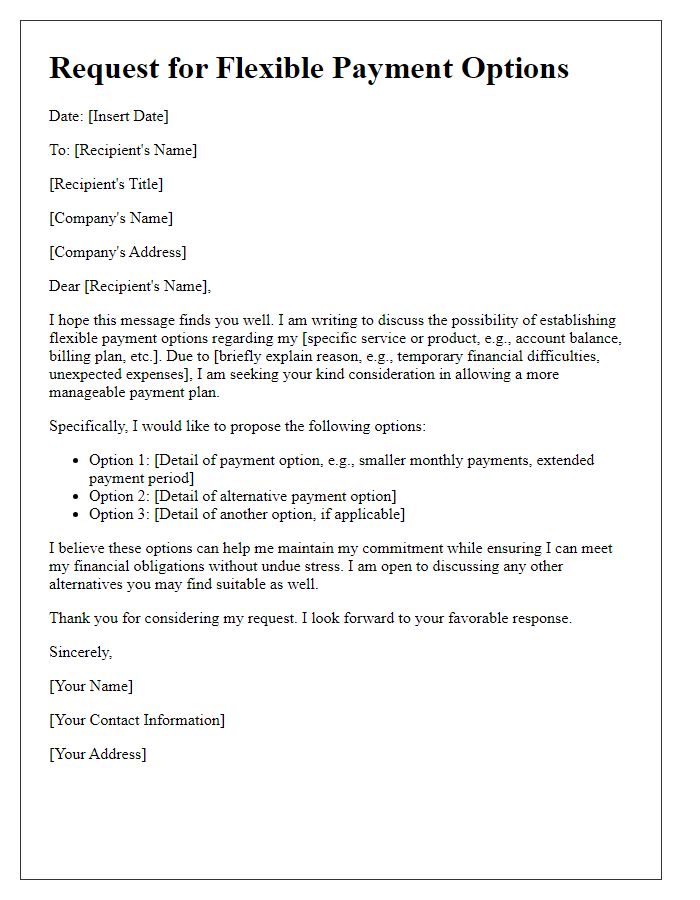

Specific Payment Term Proposals

In business transactions, specific payment terms proposals play a crucial role in ensuring clarity and mutual agreement between parties. Payment terms, such as Net 30, outline that the buyer must settle the invoice within thirty days of receipt. Early payment discounts, like 2/10 Net 30, incentivize timely payments with a 2% discount if paid within ten days. Payment methods can vary, with options such as bank transfers, credit cards, and checks, each having its processing time. Additionally, milestone payments may be stipulated for larger projects, establishing payment at key project phases, ensuring cash flow throughout the engagement. Specific proposals can also address late payment penalties, which provide a percentage fee for overdue invoices, enhancing accountability. Clear documentation and mutual understanding of these terms can prevent misunderstandings and disputes between partners.

Justification for Requested Changes

Negotiating payment terms is crucial for maintaining healthy cash flow in businesses. Extended payment terms, such as 60 to 90 days instead of the standard 30 days, can provide the necessary liquidity for operational expenses. For example, small to medium enterprises (SMEs) often need more time to manage incoming receivables while covering overhead costs. Additionally, incorporating early payment discounts, such as 2% off if paid within 10 days, incentivizes prompt payment and benefits both parties. Addressing specific payment cycles, like monthly invoicing aligned with customer sales cycles, can optimize cash flow management. Adjusting these terms fosters a mutually beneficial relationship, leading to sustainable growth and increased trust over time.

Open Invitation for Feedback and Discussion

Negotiation of payment terms can significantly impact cash flow and financial planning for businesses across various industries. For example, adjusting payment terms from net 30 days to net 60 days may provide suppliers more time to manage their receivables, while simultaneously allowing buyers additional flexibility in their purchasing decisions. These discussions often occur during contract renewals, typically scheduled annually in larger corporations. Offering open invitations for feedback creates opportunities for collaboration between stakeholders, ensuring that both parties' needs and expectations are aligned for mutual benefit. Effective communication in these negotiations may involve detailed financial analysis, considering variances in customer payment behaviors or industry standards, ultimately fostering a healthier business relationship.

Comments