Are you looking to secure funding for your next big project? Writing a compelling finance proposal letter is your ticket to garnering support and convincing potential backers of the value of your initiative. In this guide, we'll explore essential elements that will help you craft a persuasive proposal, ensuring your ideas shine through. So, let's dive in and unlock the secrets to an impactful finance proposal that brings your vision to life!

Clear Purpose Statement

A clear purpose statement in a finance proposal outlines the primary objective of securing funding for a specific initiative. This statement clarifies the intended impact on stakeholders, such as local businesses, and community development in city projects like infrastructure improvements. For instance, a purpose statement might emphasize the need for a $500,000 investment to launch a renewable energy project within a city, intending to reduce carbon emissions by 30% over five years. This initiative aims to create job opportunities for approximately 100 individuals in the area while also enhancing the local economy by promoting sustainable practices. The clear articulation of purpose ensures alignment between the proposal's goals and the interests of potential investors.

Detailed Financial Overview

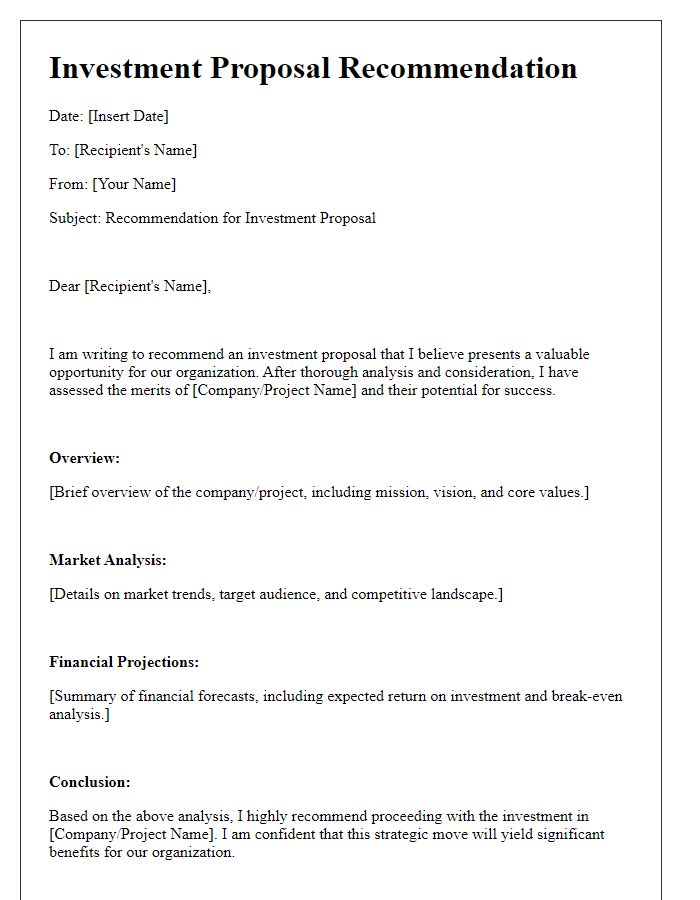

A comprehensive financial overview illustrates the projected economic viability of a proposed initiative in the competitive landscape of the financial industry. Revenue projections, based on historical market trends, indicate a potential increase of 15% annually in the first three years, accounting for a conservative estimate of market growth. Key expense categories encompass operational costs, estimated at $2 million per year, and marketing expenditures expected to reach $500,000 annually, targeting a specific demographic within urban centers such as New York City and San Francisco. Break-even analysis identifies a critical revenue threshold of $3 million, essential for sustainable operation. Furthermore, cash flow projections reveal necessary funding of approximately $1 million over the initial phase to support startup costs and ensure liquidity. Detailed financial projections underscore the strategic allocation of resources, setting the foundation for long-term profitability and growth in alignment with current financial regulations.

Comprehensive Risk Analysis

Comprehensive Risk Analysis provides essential insights into potential financial pitfalls faced by organizations. Factors such as economic volatility, regulatory changes, and market competition significantly impact financial stability. A thorough examination of historical data, like stock performance over the past five years or economic indicators such as GDP growth rates, can reveal trends affecting risk levels. Additionally, regions such as North America or Europe may present unique challenges due to varying economic conditions. Employing advanced modeling techniques, including Value-at-Risk (VaR) calculations, enables businesses to quantify risk exposure and develop strategies to mitigate potential losses effectively. This analysis is crucial for securing funding from potential investors or lenders, ensuring informed decision-making in capital allocation processes.

Credible Supporting Documentation

A finance proposal often requires credible supporting documentation to substantiate claims and enhance trust. Financial statements, such as balance sheets and income statements, provide a clear snapshot of an organization's financial health, detailing assets, liabilities, and net income for the preceding fiscal years, typically spanning three to five years. Cash flow projections outline expected revenues and expenditures, illustrating the liquidity position. Market analysis reports, including industry trends and competitor benchmarking, offer insights into the economic landscape. Personal guarantees from stakeholders add another layer of security, enhancing the proposal's reliability. Additionally, relevant legal documents, such as business licenses and contracts, ensure compliance with regulations and confirm operational legitimacy. These elements collectively fortify the proposal's credibility and persuade potential investors or financial institutions to support the initiative.

Professional Tone and Structure

A finance proposal outlines a structured plan for funding a project or investment opportunity. Essential components include an executive summary, detailing the project's purpose and potential impact, a market analysis, presenting research on target demographics and competitive landscape, a budget overview, breaking down projected costs, and financial projections, showcasing anticipated returns on investment. Additionally, a risk assessment should analyze potential challenges, while the conclusion emphasizes the importance of the proposal and its expected benefits. Financial backing can originate from various sources such as venture capital, private equity firms, or angel investors, each providing diverse funding criteria and expectations.

Comments