Are you looking to take your investment strategy to the next level? In today's dynamic financial landscape, the right partnership can unlock incredible opportunities and maximize your returns. We invite you to consider this investment proposal, crafted with innovative ideas and solid forecasts tailored specifically for your needs. Join us in exploring the potential for growthâread on to discover how we can work together for lasting success!

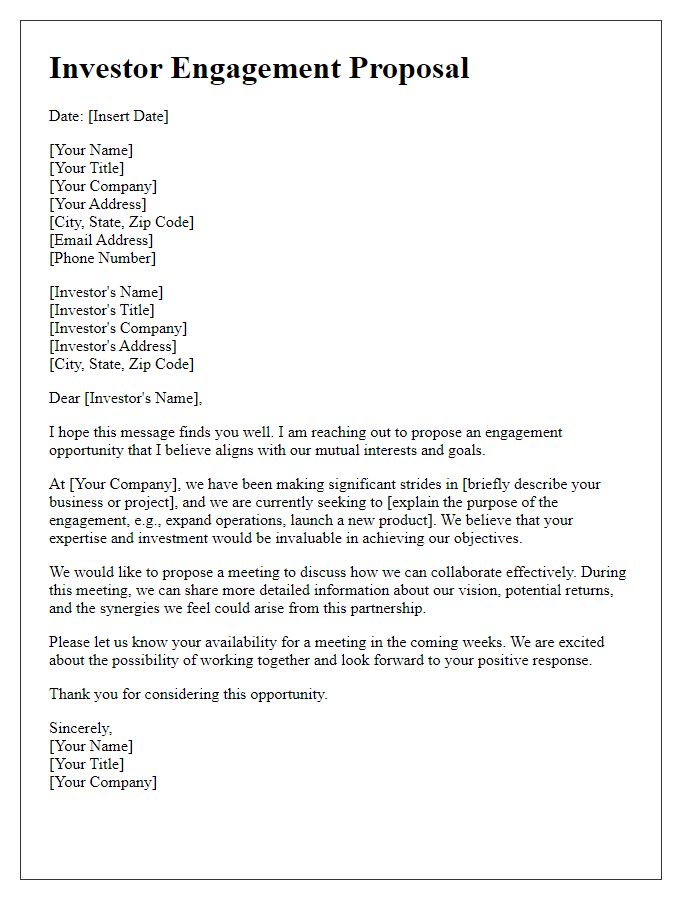

Clear Objective Statement

A clear objective statement is essential for effectively communicating the purpose of an investment proposal. This statement should succinctly convey the specific goals of the investment opportunity, defining the anticipated outcomes and the strategic vision for growth. For instance, an objective statement for a startup may emphasize the goal of raising $500,000 for product development, aiming to capture a 10% market share within three years in the renewable energy sector. Furthermore, including details about expected returns, timeframe for investment recovery, and the competitive landscape can strengthen the statement, ensuring potential investors have a clear understanding of the investment's value proposition.

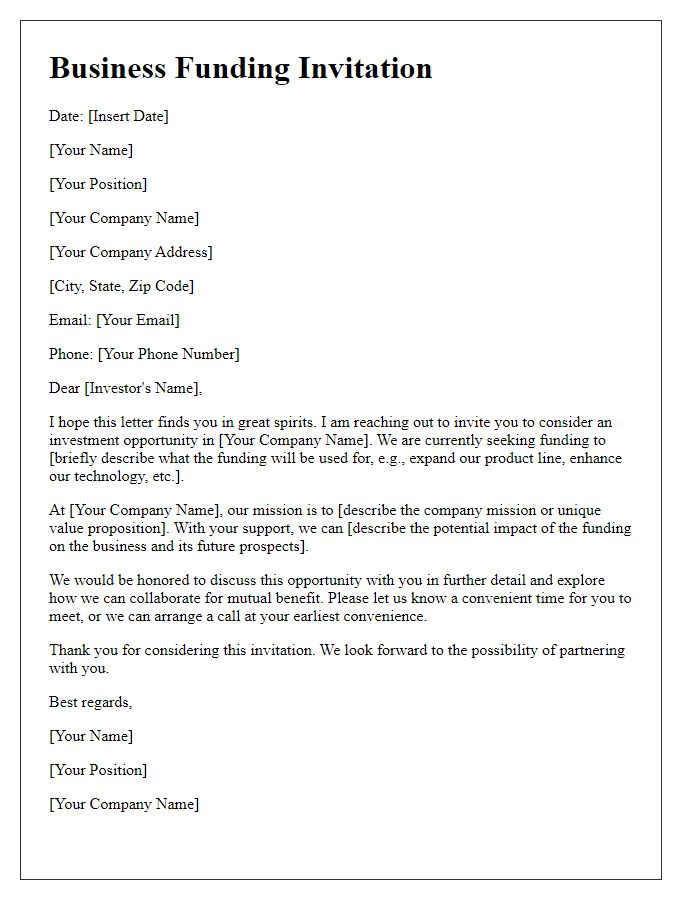

Comprehensive Business Overview

A comprehensive business overview provides critical insights into a company's operations, financial health, and growth potential. This overview typically includes key elements such as revenue streams, target market demographics, and competitive landscape analyses, essential for potential investors assessing risk and opportunity. For instance, a tech startup may highlight its annual revenue growth rate of 20% and a user base expansion from 10,000 to 50,000 in just two years. Additionally, understanding market trends such as the projected increase in the global smartphone market size, expected to reach $1 trillion by 2026, can further enhance attractiveness to investors. In-depth discussions of innovative product offerings or unique selling propositions offer further context on how the business differentiates itself within a saturated market, ultimately aiding in attracting investment partners interested in long-term profitability.

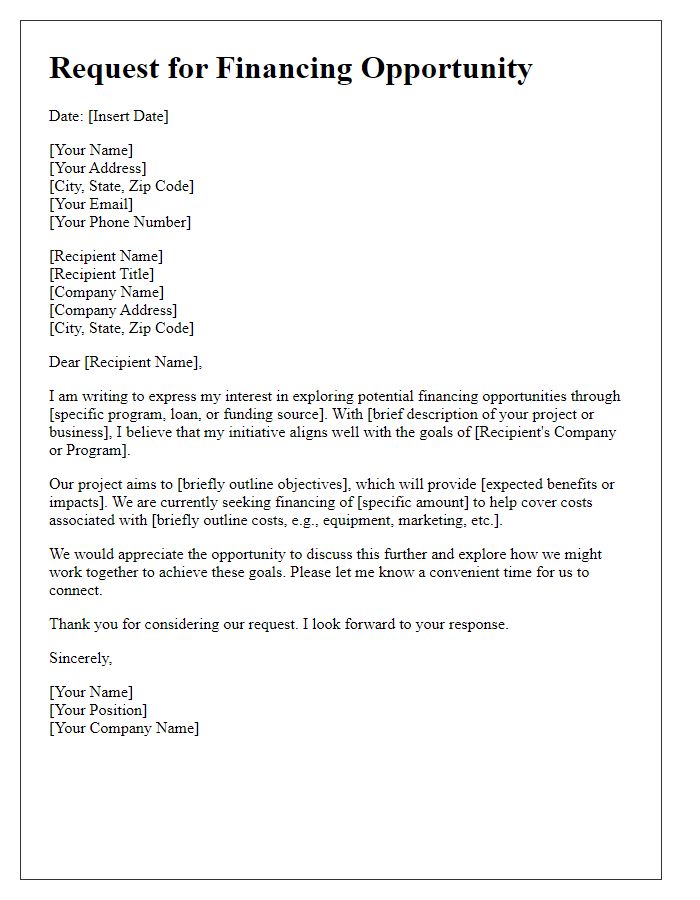

Detailed Financial Projections

Creating a detailed financial projection is crucial for an investment proposal, as it provides potential investors with insights into expected revenue, expenses, and profitability over a specified period. A comprehensive financial projection typically spans three to five years and includes key elements such as projected income statements, balance sheets, and cash flow statements. For instance, the income statement may forecast revenues from sales (with estimated growth rates) and outline operating expenses (like salaries, rent, and marketing at projected annual increases). The balance sheet projections should reflect anticipated assets, liabilities, and equity, showcasing the company's financial health. Cash flow statements detail the expected inflow and outflow of cash, highlighting critical funding requirements and timing for capital investment. Accurate metrics, such as break-even analysis, internal rate of return (IRR), and net present value (NPV), further enhance the financial projections. Regular revisions based on market trends, economic conditions, and actual performance can optimize the financial outlook presented to potential investors.

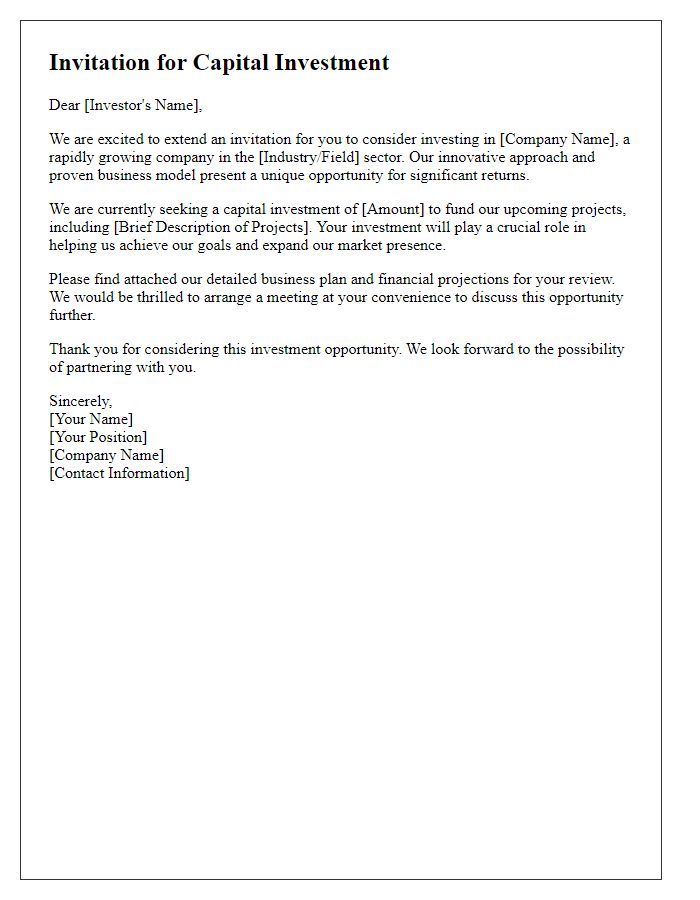

Investment Opportunity Highlights

The investment opportunity highlights showcase the unique potential of the innovative startup, EcoTech Solutions, located in Silicon Valley. This company specializes in sustainable energy technologies aimed at reducing carbon emissions and promoting renewable resources. With projected annual growth rates of 25% over the next five years, EcoTech Solutions seeks to raise $2 million to expand product lines, enhance research and development, and scale up manufacturing capabilities. The investment offers early access to cutting-edge technology, strong market positioning, and the potential for substantial returns. Notable partnerships with organizations such as the United Nations Development Programme further bolster the credibility and reach of EcoTech Solutions within the green tech sector. The upcoming investor presentation on January 15, 2024, will provide detailed insights into the financial projections, market analysis, and strategic roadmap.

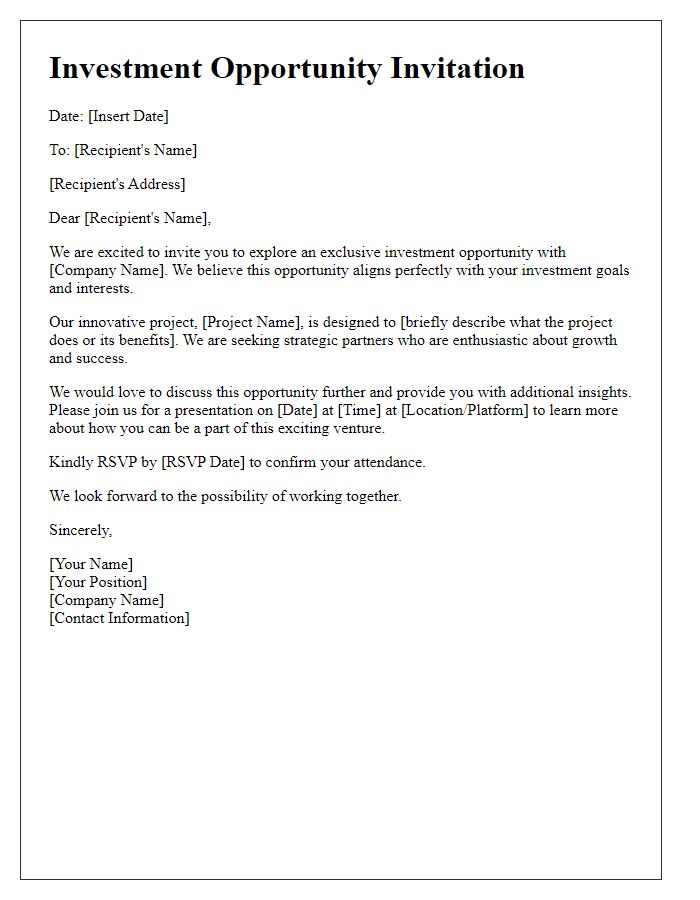

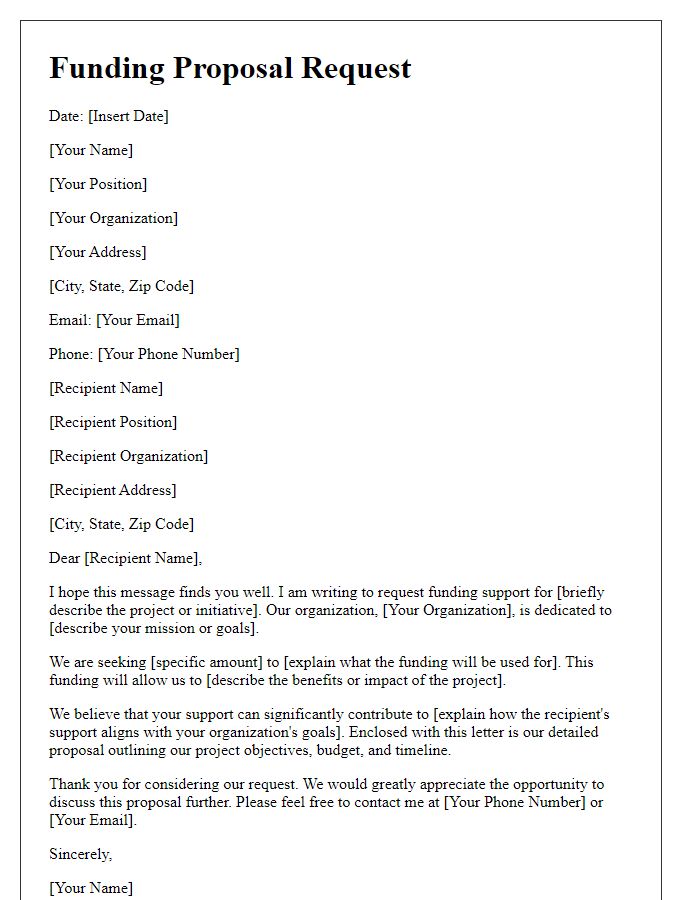

Call to Action and Contact Information

Investment proposals can be pivotal opportunities for financial growth and partnership. Engaging stakeholders requires clear communication and urgency. Highlighting relevant details about projected returns, market analysis, and strategic goals can help capture interest. Providing precise contact information, such as a direct phone number (e.g., +1-555-123-4567) and email address (e.g., info@investmentfirm.com), facilitates immediate follow-up. Encouraging recipients to respond within a specified timeframe, such as 14 days from receipt, reinforces the importance of the proposal and promotes timely decision-making.

Comments