Are you looking to keep your insurance policy up to date? Writing a letter to update your policy details doesn't have to be a daunting task. In just a few simple steps, you can ensure that your provider has all the necessary information to provide you with the best coverage possible. Ready to learn how to craft the perfect letter? Keep reading to find out more!

Policyholder Information

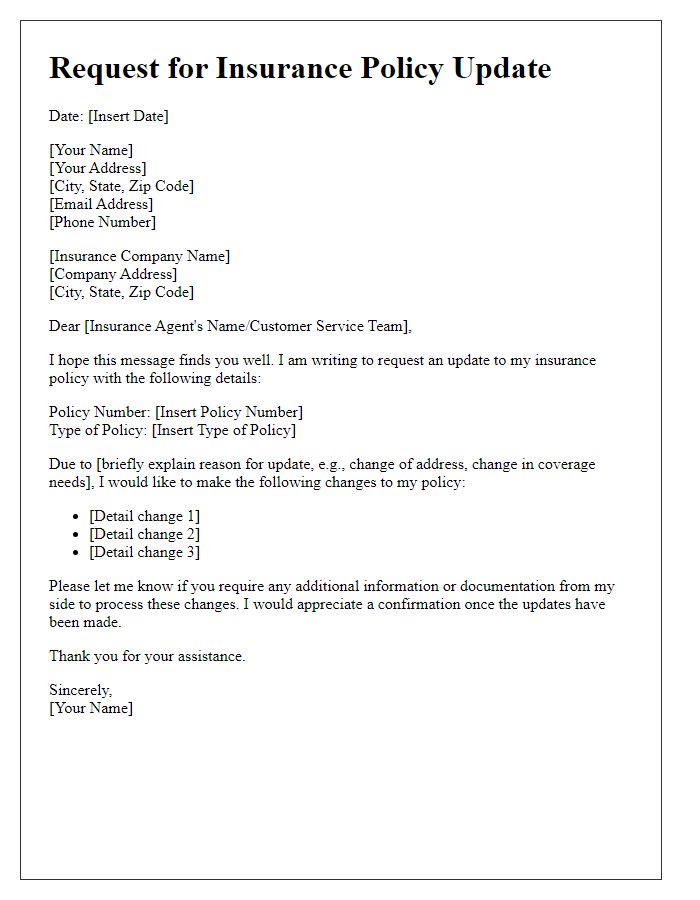

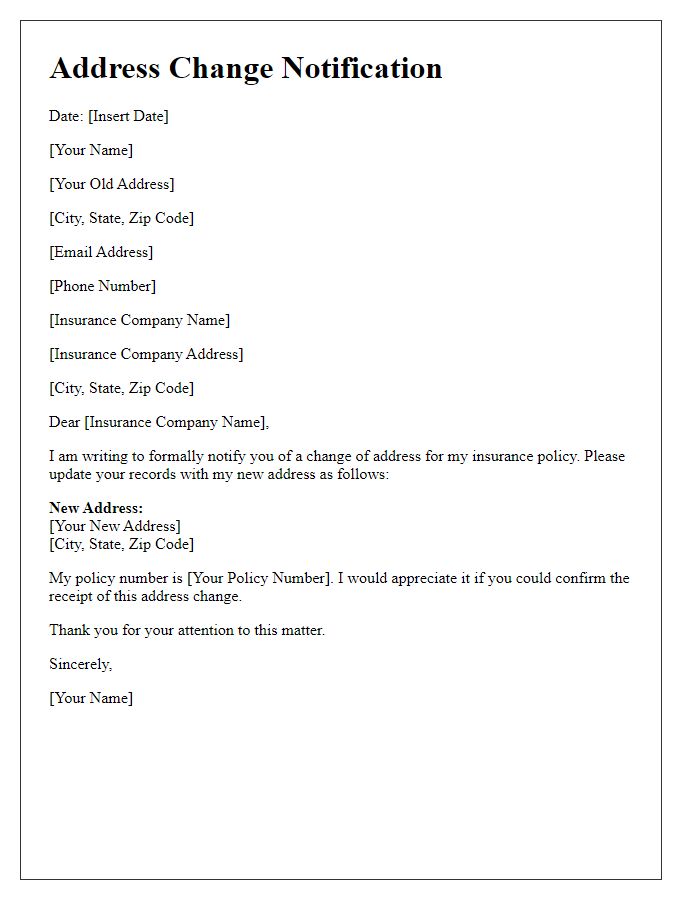

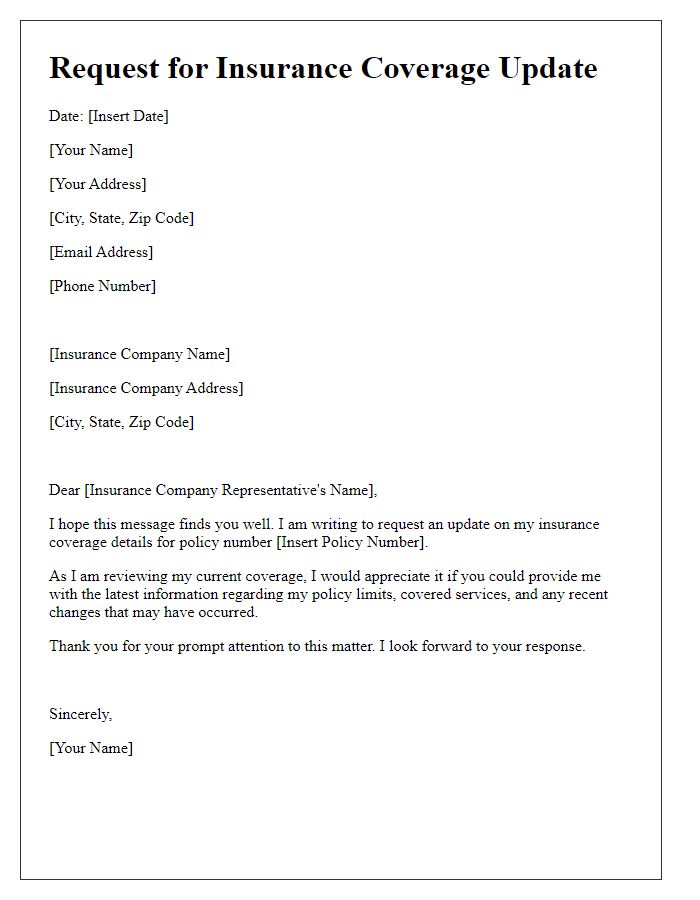

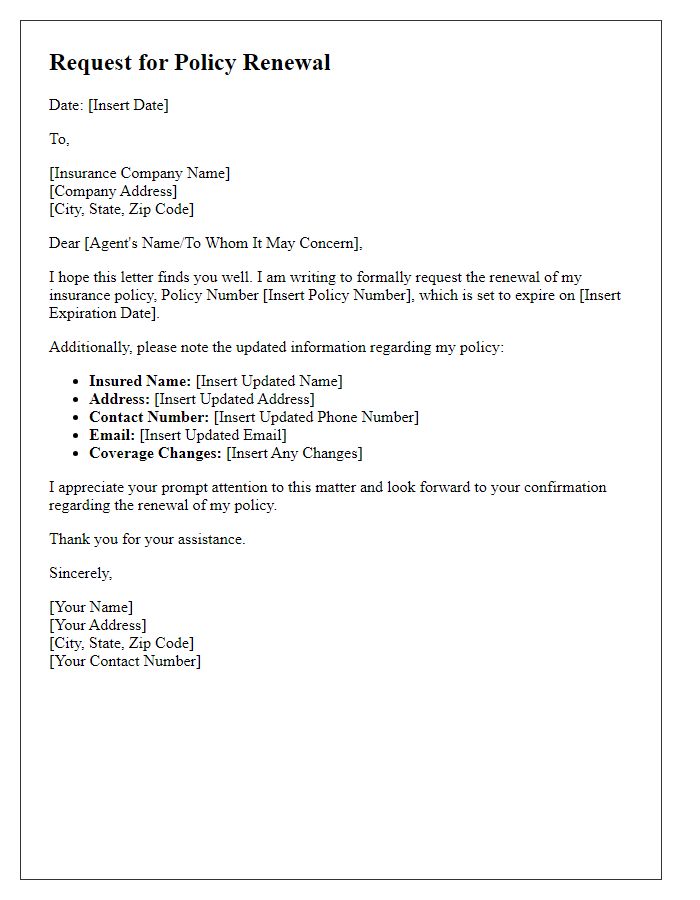

Updating insurance policy details requires accurate and complete policyholder information. Ensure that the policyholder name matches the name on the policy documents. Include a valid policy number that uniquely identifies the insurance contract. List relevant contact details such as a phone number, email address, and mailing address for effective communication. Indicate specific changes requested, such as alterations in coverage limits, beneficiary information, or address changes. Specify effective dates for these updates to ensure timely processing. Providing current financial information may also be required, particularly in cases involving premium adjustments. Ensure that any supporting documents are attached for verification and expedite the update process.

Policy Details and Reference Number

Insurance policies require regular updates to maintain accuracy and relevance. For instance, an auto insurance policy might need updates when a driver's license number changes, or if there is a change in vehicle details, like the addition of a new SUV such as the 2022 Honda CR-V. Policyholders might also need to adjust coverage limits after significant life events, such as purchasing a new home in areas like San Francisco, where property values are markedly higher. Reference numbers, which can be a unique string of digits, play a crucial role in identifying specific insurance accounts and ensuring that changes are correctly processed by the insurance provider. Having this information clear and current helps facilitate efficient communication with agents and ensures that all amendments reflect accurately in the insurance documentation.

Description of Required Updates

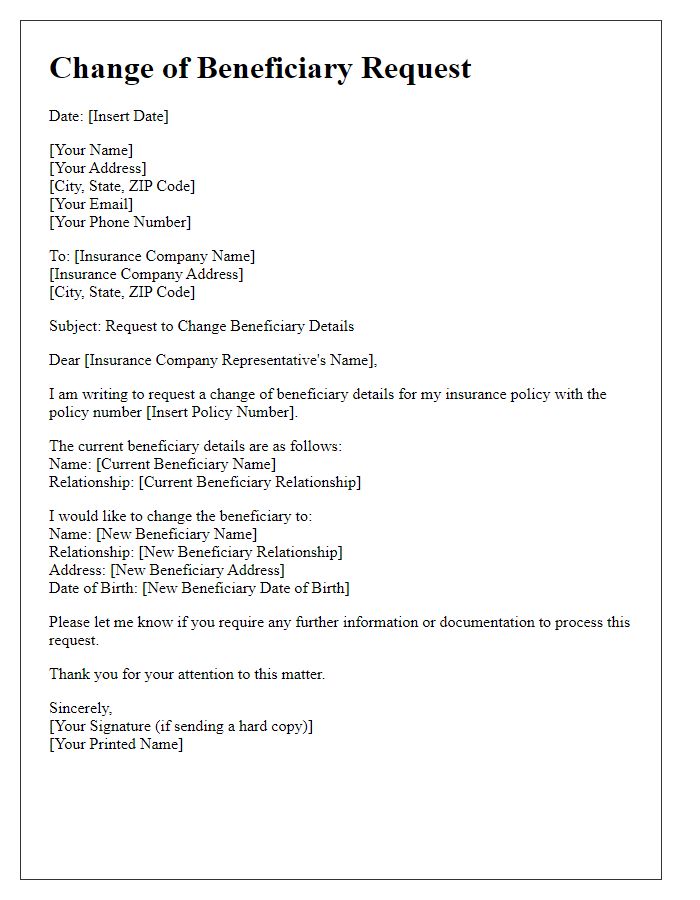

Updating insurance policy details is crucial for maintaining accurate coverage information. Policyholders must provide specific updates, such as changes to personal information like address or contact details, which may affect communication with the insurer. Additionally, alterations in coverage types, such as adding new vehicles or properties, require immediate notification to ensure proper protection against potential risks. Changes in beneficiaries, especially after life events like marriage or divorce, must be addressed to reflect the current intentions of the policyholder. Moreover, adjustments in premium payment methods or amounts should be communicated to avoid lapses in coverage. Regular updates enhance policy accuracy, ultimately securing financial stability in unforeseen circumstances.

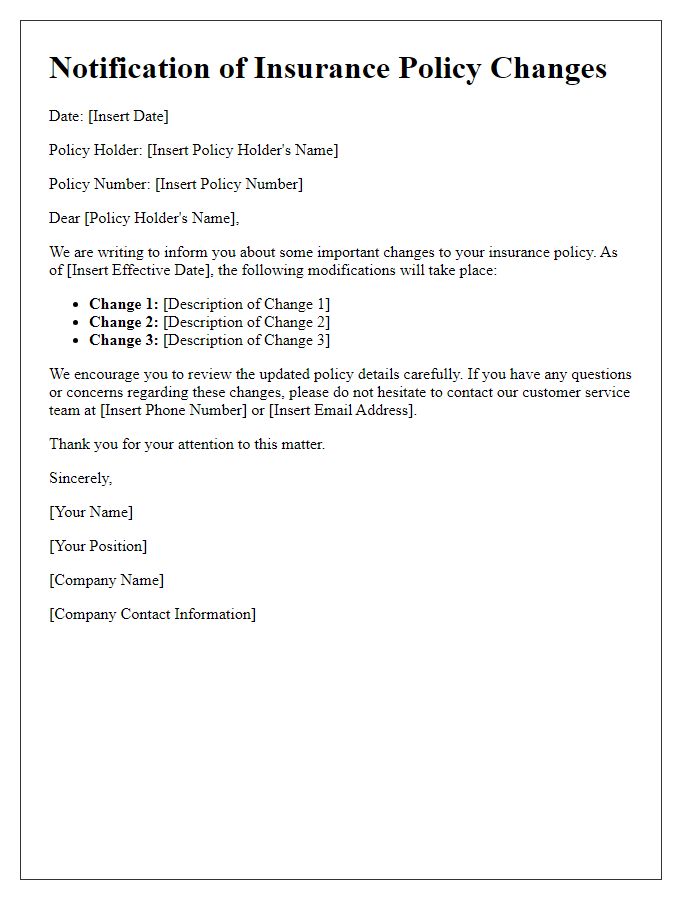

Supporting Documentation

Insurance policy updates require comprehensive documentation to ensure accuracy. Key details include policyholder's name, policy number, and contact information for clarity. Supporting documents may consist of a government-issued ID, proof of address (current utility bill or lease agreement), and any relevant forms from the insurance provider outlining the changes requested. Accurate submission of details such as effective dates for changes is critical to avoid coverage lapses. Additional information like a claims history report can enhance the request. Timely submissions before deadlines, usually within 30 days of any significant life change, support seamless updates.

Contact Information for Follow-up

Updating insurance policy details is crucial for maintaining active coverage with your provider, such as State Farm or Allstate. Accurate contact information, including phone numbers (e.g., 1-800-STATEFARM) and email addresses (e.g., customer.service@allstate.com), ensures efficient communication regarding any changes. Policyholders might need to provide updated information about their address, which can affect premium calculations, or correct vehicle details, such as VIN (Vehicle Identification Number) for auto insurance. Additionally, documenting any significant life events, like marriage or purchasing a new home, is essential for ensuring that coverage aligns with current needs. Staying connected via designated customer service representatives can facilitate smooth updates.

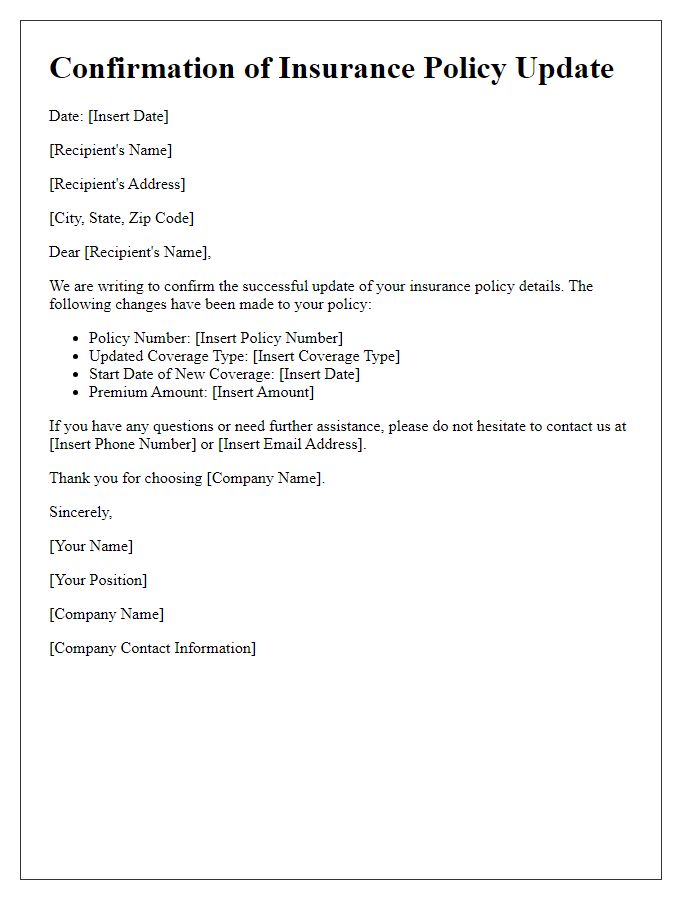

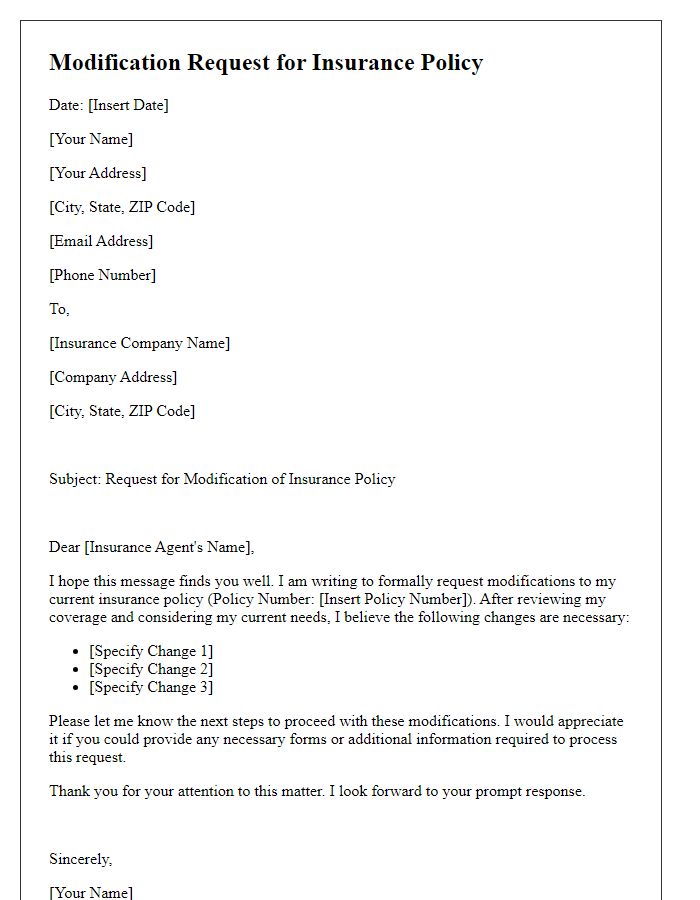

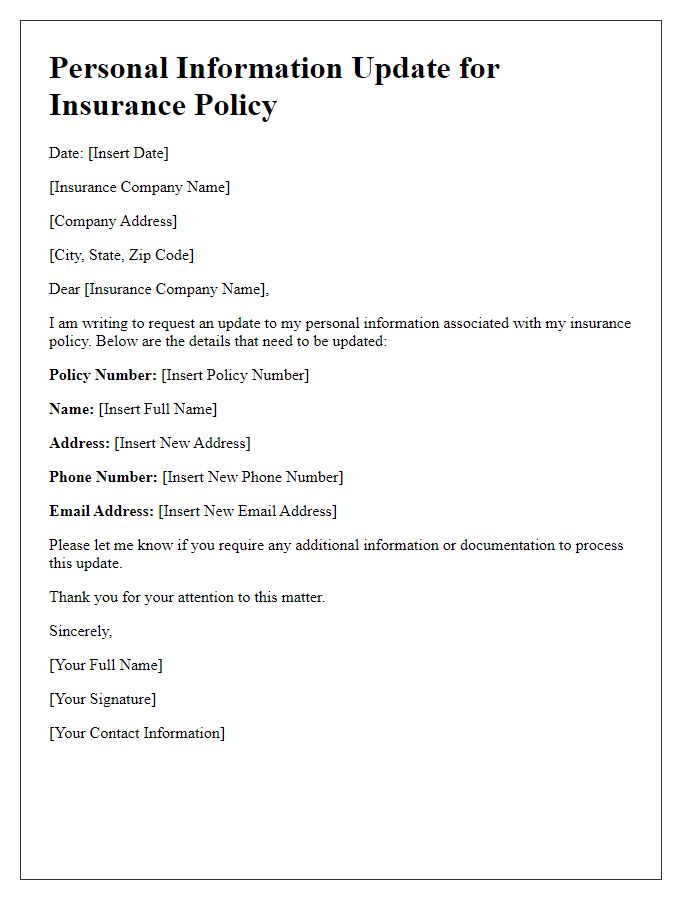

Letter Template For Updating Insurance Policy Details With Provider Samples

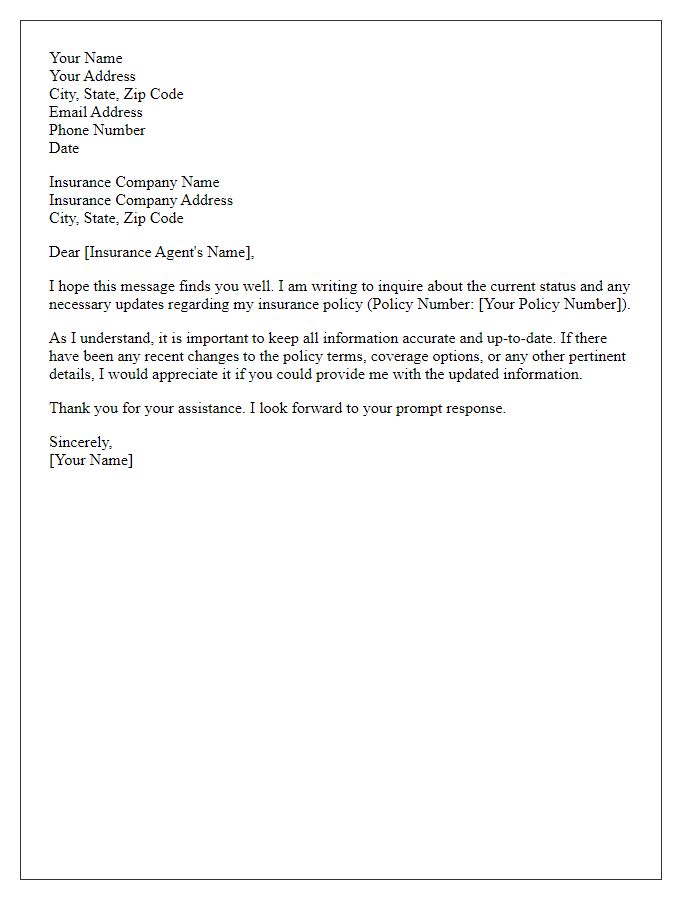

Letter template of inquiry regarding insurance policy information update.

Comments