Hey there! If you've ever found yourself navigating the often confusing world of insurance co-payments, you're in the right place. This article walks you through a handy letter template that simplifies confirming agreements with your insurance company, ensuring that you don't miss out on any crucial details. Ready to take the stress out of paperwork? Keep reading to find out how to make the process seamless and efficient!

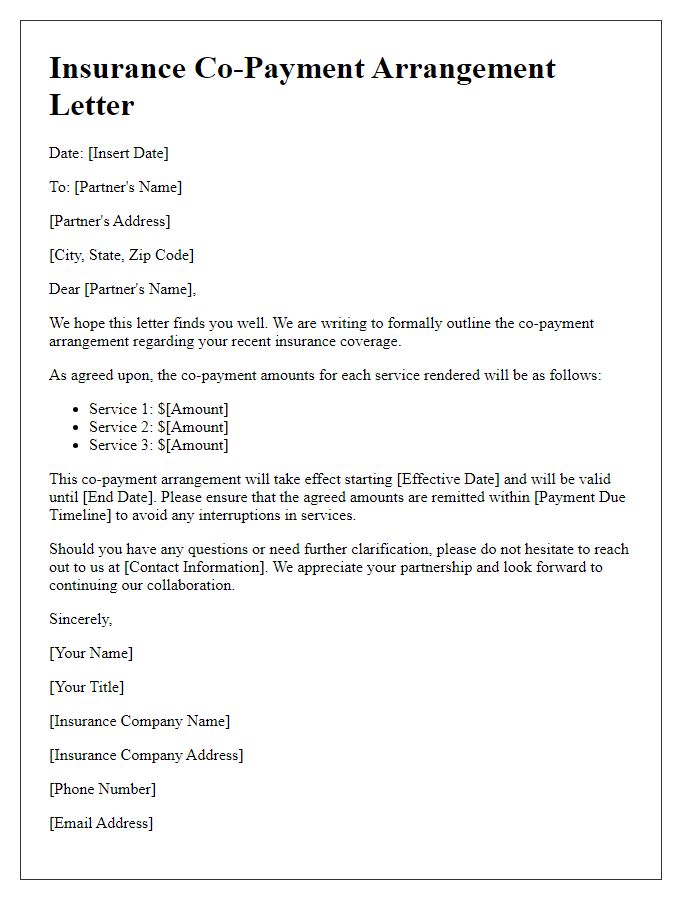

Clear identification of involved parties.

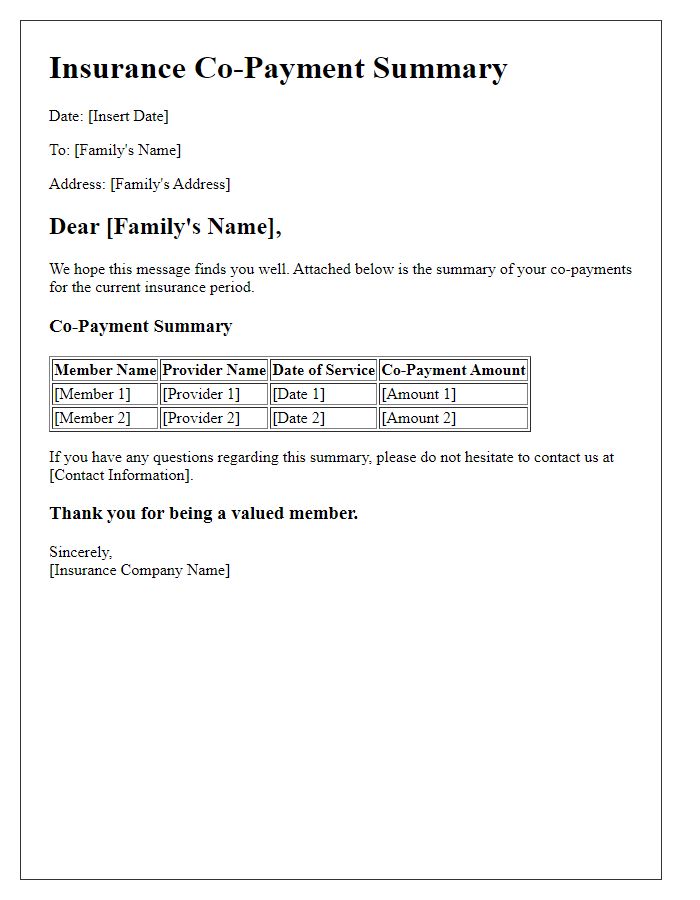

Confirming insurance co-payment agreements requires clear identification of involved parties such as insurance providers, policyholders, healthcare providers, and billing entities. Essential details include the insurance company's name, policy number, and contact information for both policyholder and provider. Additionally, specific co-payment amounts, frequency of payments, and terms of agreement should be documented. Clear communication about the responsibilities regarding payment deadlines and any potential penalties for late payments is crucial. Furthermore, any relevant state regulations or guidelines influencing the agreement's enforcement must be explicitly noted to avoid potential disputes in the future.

Detailed description of insurance coverage terms.

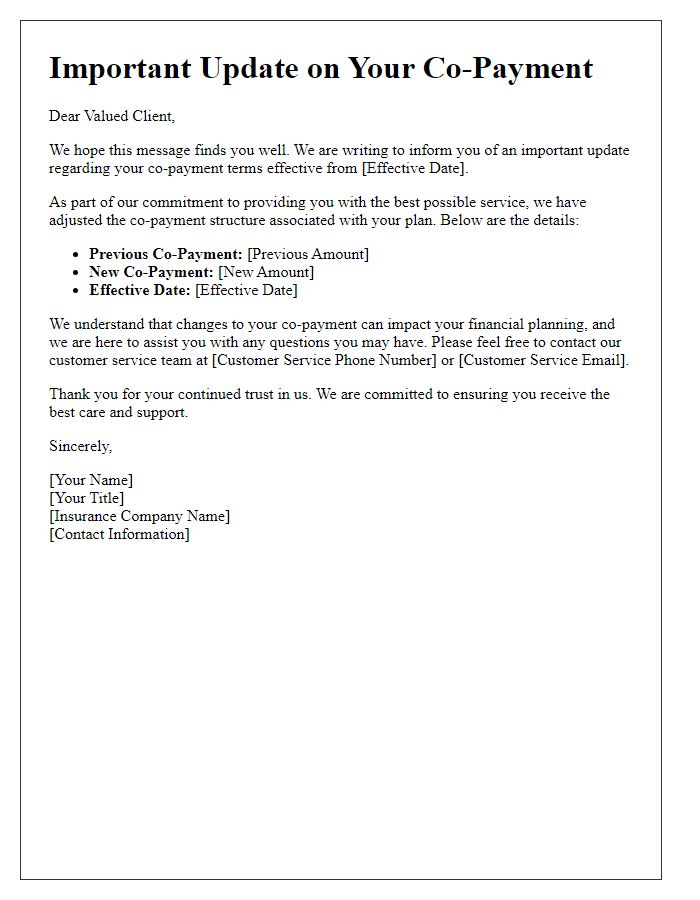

Insurance co-payment agreements establish the financial responsibilities between policyholders and insurers regarding medical expenses. These agreements typically specify the fixed dollar amount (often ranging from $10 to $50) that an insured individual must pay out-of-pocket for each healthcare service, such as doctor visits or specialized treatments. Coverage terms outline the percentage of costs that the insurance company covers after the co-payment is made, often representing 70% to 100% depending on the policy specifics. Furthermore, terms may detail exclusions for certain services, pre-existing conditions, or specific procedures that require prior authorization to avoid unexpected expenses during treatment at network facilities, such as hospitals or clinics within the insurance provider's network. Understanding these key elements helps policyholders navigate their financial obligations effectively.

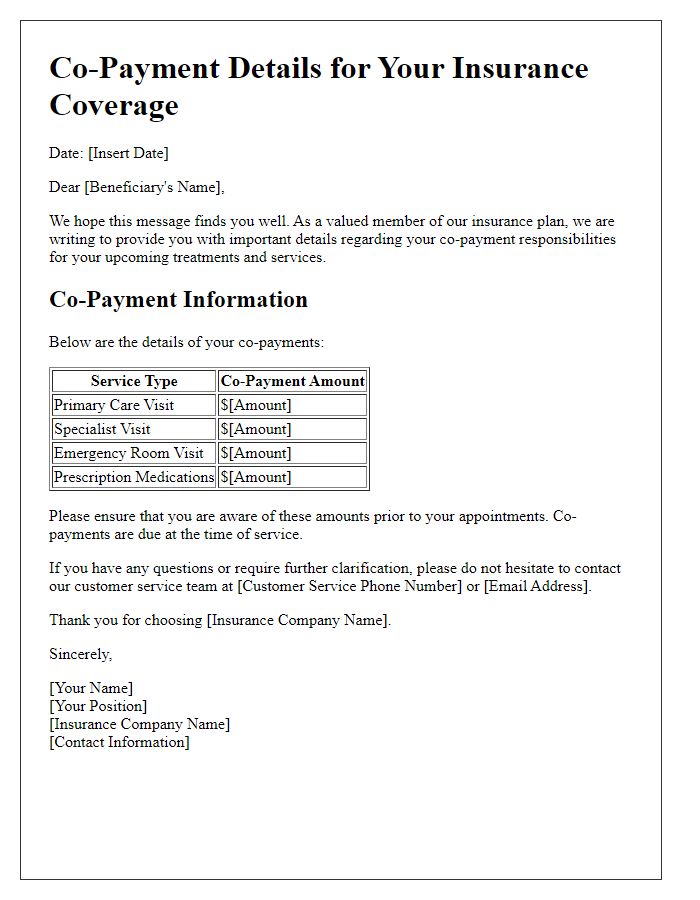

Specifics of the co-payment agreement.

A co-payment agreement in health insurance explicitly outlines the financial responsibilities between the insured individual and the insurance provider, detailing the set amount that the insured must pay per visit or service. These agreements often specify the co-payment amounts for different types of healthcare services, such as $20 for primary care physician visits, $40 for specialist consultations, or $10 for generic prescription medications. The specifics also include information about the limits, stating whether co-payments apply to both in-network and out-of-network providers and identifying any exceptions or additional charges that may arise from particular services. Understanding these details helps individuals to budget for healthcare costs effectively, facilitating financial planning and reducing unexpected out-of-pocket expenses.

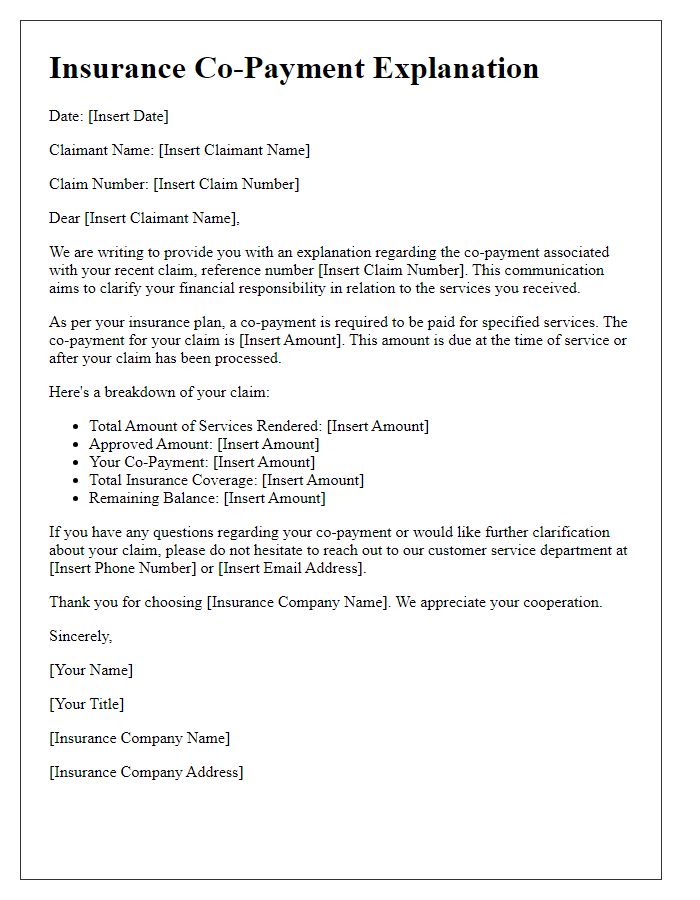

Confirmation of understanding and acceptance.

The confirmation of insurance co-payment agreements is essential for clarity between policyholders and insurance companies. These agreements, often outlined in a policy document, detail the specific percentage or fixed amount that the policyholder must pay out-of-pocket for various healthcare services. Examples include doctor visits, hospital stays, and prescription medications, where co-payments can range from $10 to $50 depending on the type of service. The process usually involves both parties reviewing the terms, which may include deductible amounts (the initial out-of-pocket expense before coverage kicks in) and maximum out-of-pocket expenses (the cap after which the insurance covers 100% of costs). Clear communication ensures that the policyholder understands their financial responsibilities and the insurance provider's obligations, preventing future disputes over medical bills.

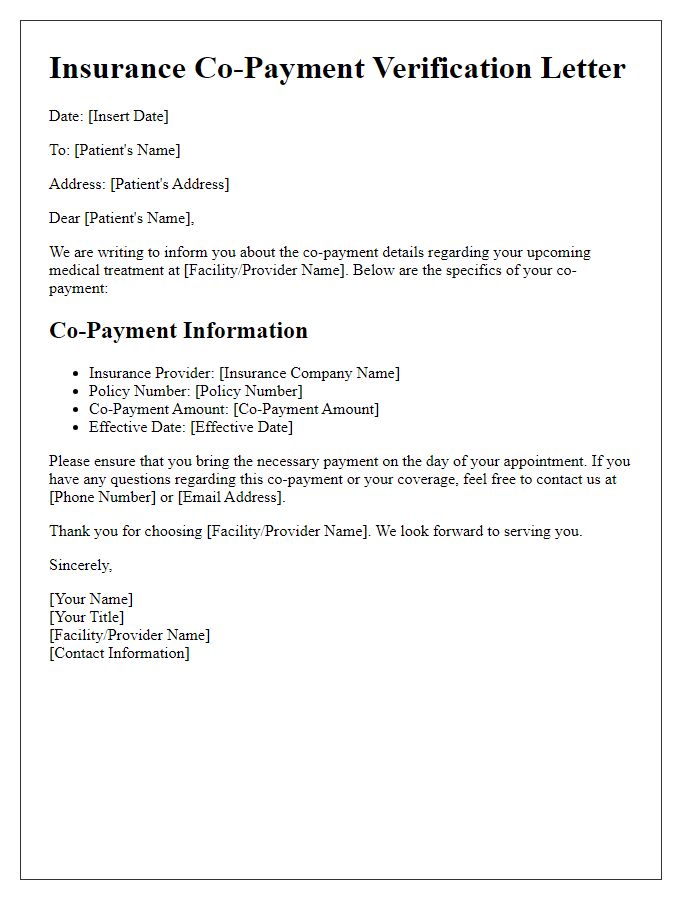

Contact information for further inquiries.

An insurance co-payment agreement outlines the financial responsibilities shared between the insured individual and the healthcare provider. Essential details include the specific percentage or dollar amount required from the insured at the time of service, which typically varies based on the type of medical procedure or visit, such as primary care appointments or specialist consultations. Clients should reference their insurance policy document, usually containing coverage limits and exclusions, when discussing co-payment terms. For further inquiries, individuals can contact the insurance company's customer service department, typically available at the provided toll-free number (e.g., 1-800-123-4567) or through their official website for claim processing and coverage queries.

Letter Template For Confirming Insurance Co-Payment Agreements Samples

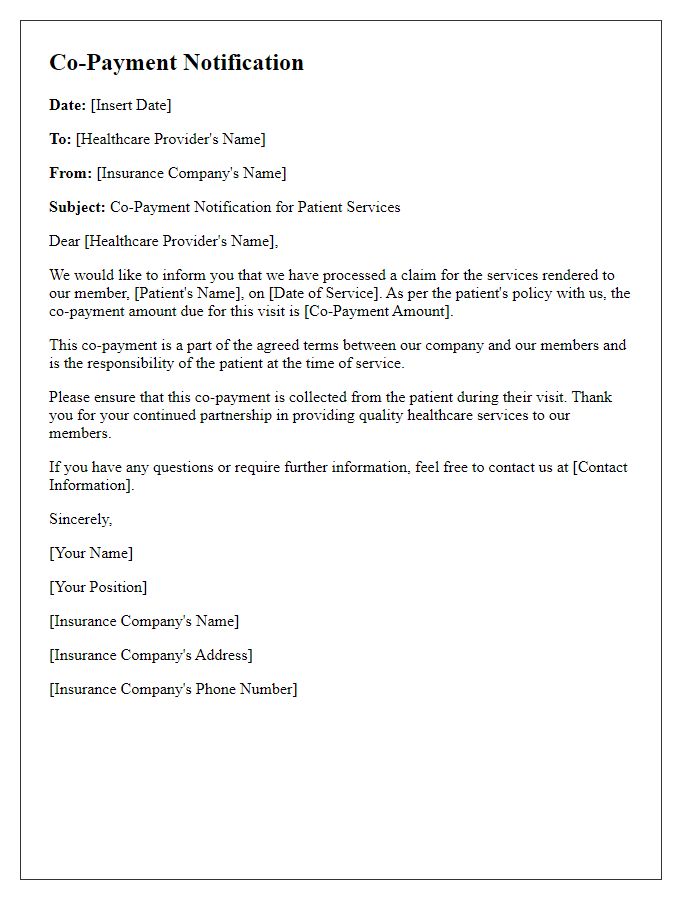

Letter template of insurance co-payment notification for healthcare providers

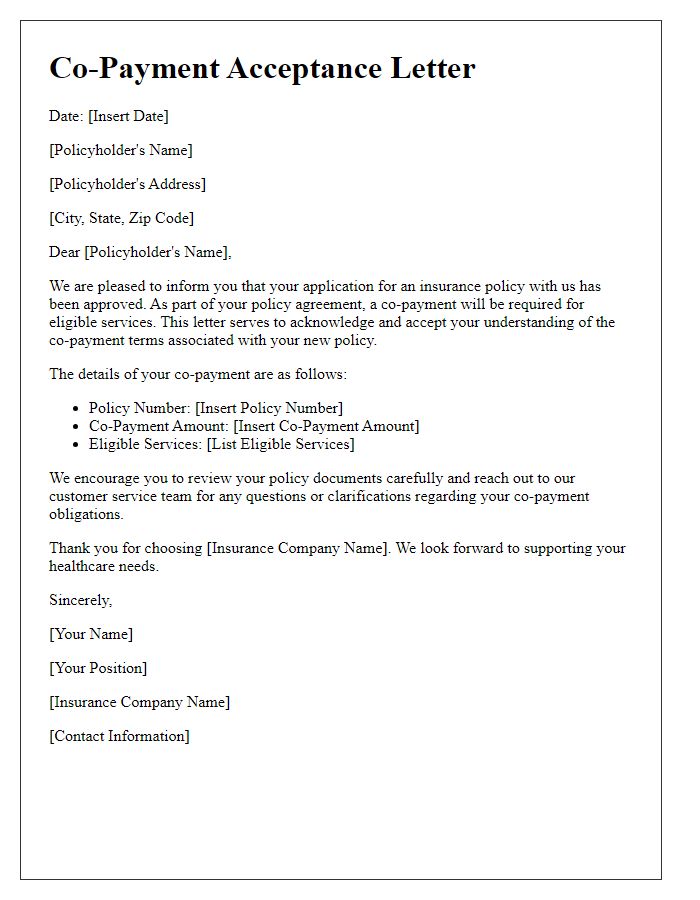

Letter template of insurance co-payment acceptance for new policyholders

Comments