Are you looking to strengthen the financial integrity of your partnership? A timely and effective financial audit notice can be the key to ensuring transparency and trust among partners. This vital communication not only sets the stage for a thorough review of your financial records but also fosters an environment of collaboration and accountability. Ready to dive deeper into the specifics of crafting the perfect audit notice?

Auditor's contact information

A partnership financial audit notice serves as an essential communication tool between partnership entities and their auditors. Each notice typically includes specific details about the financial audit proceedings, including the auditor's contact information. For example, the contact information may consist of the auditor's name, firm name (such as Anderson & Co.), address, phone number (like +1 (555) 123-4567), and email address (for instance, audit@andersonco.com). This ensures that partners can reach out securely for clarifications or inquiries during the audit process, which is critical in maintaining transparency and accountability in financial matters. Clear communication channels foster smoother audits and greater collaboration amongst all parties involved in the financial assessment.

Recipient's address and contact details

The financial audit notification for partnerships hinges on meticulous attention to detail. Regulations urge partners to provide comprehensive addresses, clearly outlining the specific suite numbers or unit designations within the complex. Full names, including middle initials where applicable, alongside accurate phone numbers and email addresses serve as vital references for communication during the audit process. Recognizing the partnership's official registered address, often cited in legal documents, ensures that all involved parties maintain transparency and accountability. Proper documentation, including tax identification numbers, can significantly streamline correspondence and compliance with the requirements set by regulatory bodies such as the Internal Revenue Service (IRS) or relevant state agencies.

Purpose of the audit

The purpose of a partnership financial audit involves evaluating the financial statements of the partnership (usually a business entity where two or more individuals manage and operate a business for profit) to ensure accuracy and compliance with established accounting standards. This systematic examination provides insights into the organization's financial health, identifying discrepancies in revenue reporting or expense management. Accounting practices are scrutinized to mitigate risks of fraudulent activities, fostering transparency among partners. Typically, audits occur annually, aligned with fiscal year-end dates, to enhance trust and accountability within the partnership. External auditors may be utilized, enhancing credibility and providing an objective analysis of financial operations.

Scheduled date and time

The scheduled financial audit for partnership entities, set for April 15, 2024, at 10:00 AM, will take place at the main office located in downtown Chicago. This audit aims to thoroughly examine financial records from fiscal year 2023, focusing on key documents such as income statements, balance sheets, and cash flow statements. All partners are encouraged to prepare relevant documentation, including bank statements and expense reports, to ensure a smooth and efficient audit process. Timely attendance and cooperation during this period are crucial for compliance with regulatory requirements and to uphold transparency within the partnership.

Required documentation and information

A partnership financial audit necessitates precise documentation and relevant information to ensure transparency and compliance with accounting standards. Essential documents include the partnership agreement outlining profit-sharing ratios and responsibilities among partners, financial statements like income statements and balance sheets for the fiscal year, and bank statements from all partnership accounts, which should align with reported figures. Tax returns filed with the IRS, detailed ledgers that track all transactions, including invoices and receipts, as well as payroll records if applicable are critical for assessing operational costs. Furthermore, reports on any outstanding loans or liabilities should accompany these documents to provide a complete financial picture. Specific industry regulations, such as those set by the Financial Accounting Standards Board (FASB), must also be complied with, providing a framework for accurate and fair reporting.

Letter Template For Partnership Financial Audit Notice Samples

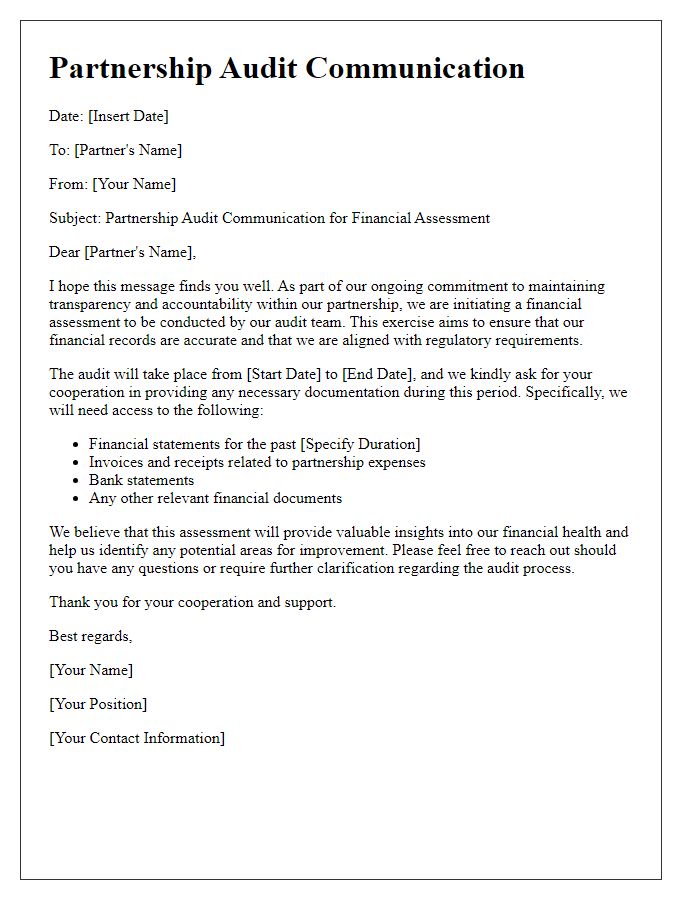

Letter template of partnership audit communication for financial assessment.

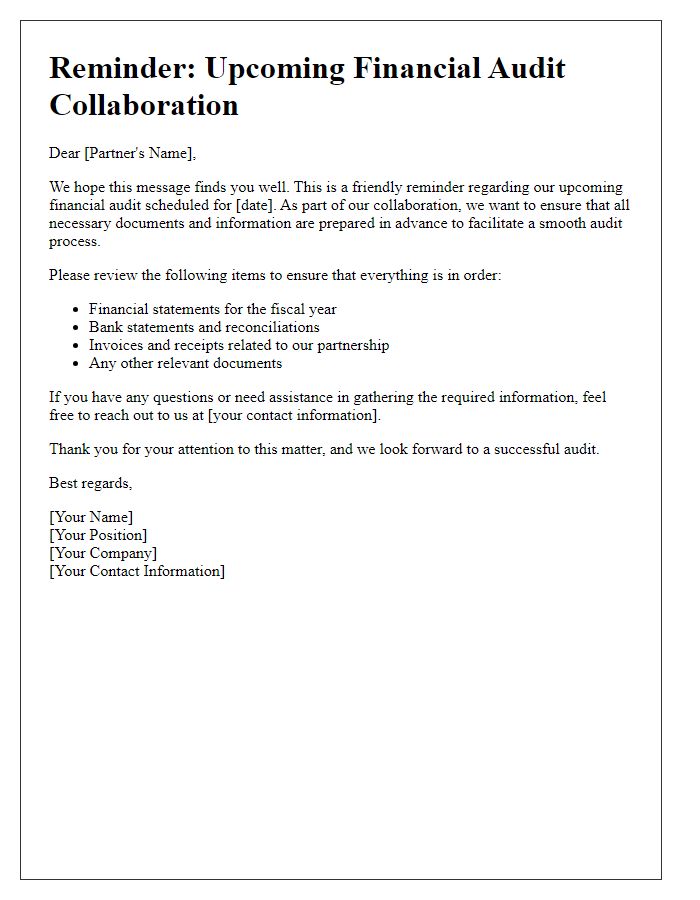

Letter template of partnership financial audit reminder for collaboration.

Comments