Are you tired of sending reminders for overdue payments without getting the response you need? Crafting the right message can make all the difference in getting your dues collected efficiently. In this article, we'll explore effective letter templates that not only convey urgency but also maintain professionalism. Join us as we dive deeper into strategies to secure timely payments from your clients!

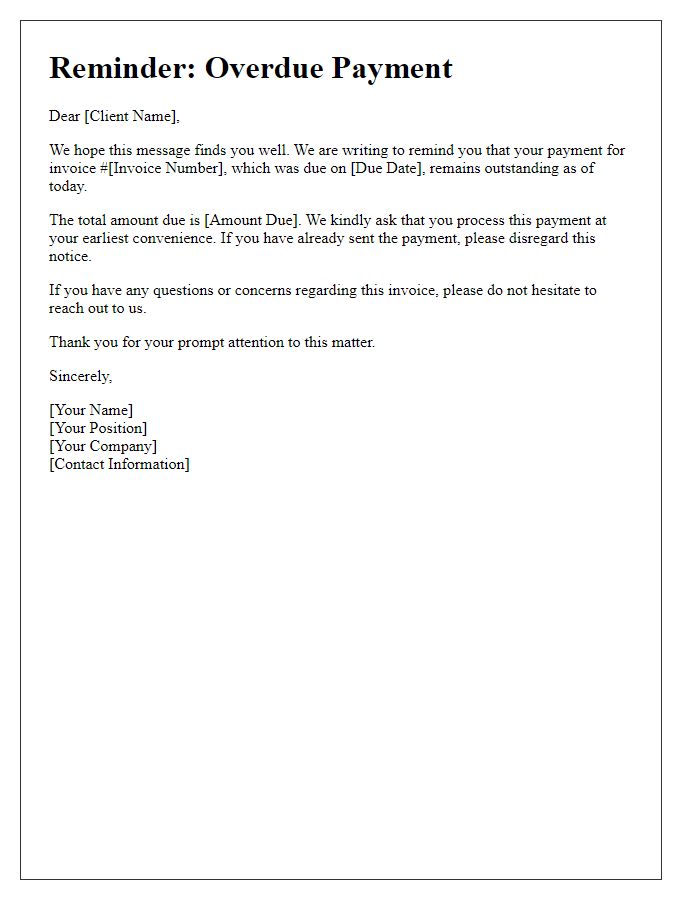

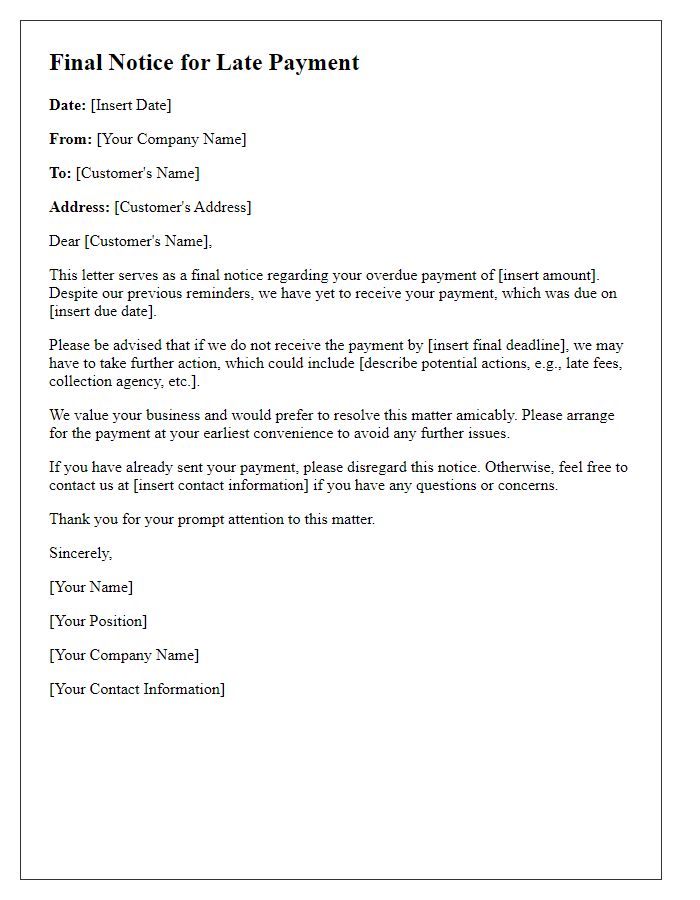

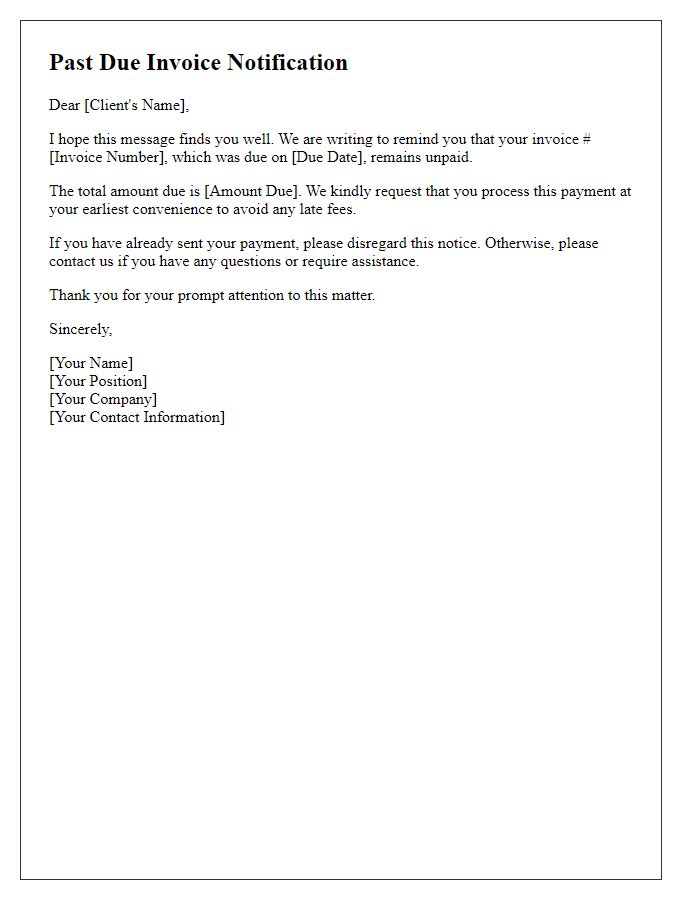

Clear subject line

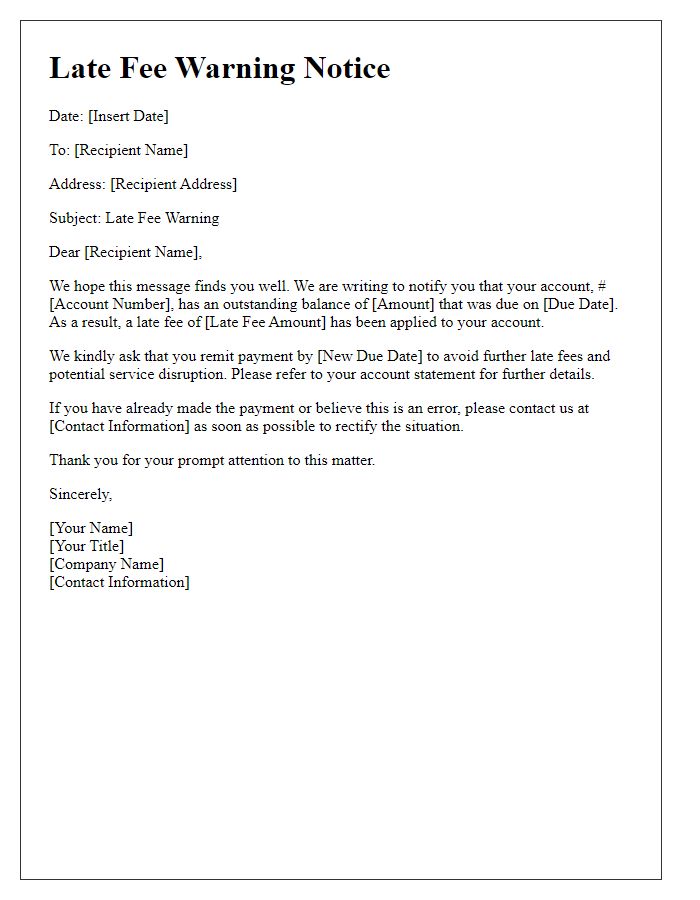

An overdue payment notice serves to notify individuals or businesses about unpaid invoices, typically highlighting critical details. This notice includes an explicit subject line, stating "Overdue Payment Notification - Invoice #12345", facilitating immediate recognition of its purpose. It typically references the due date (such as September 30, 2023), the total amount owed (for instance, $500), and any late fees (like a 5% penalty after 30 days) that may apply. The notice often encourages payment via specified methods, such as bank transfer or credit card, while also providing contact information for inquiries or further discussions regarding the outstanding balance.

Polite tone

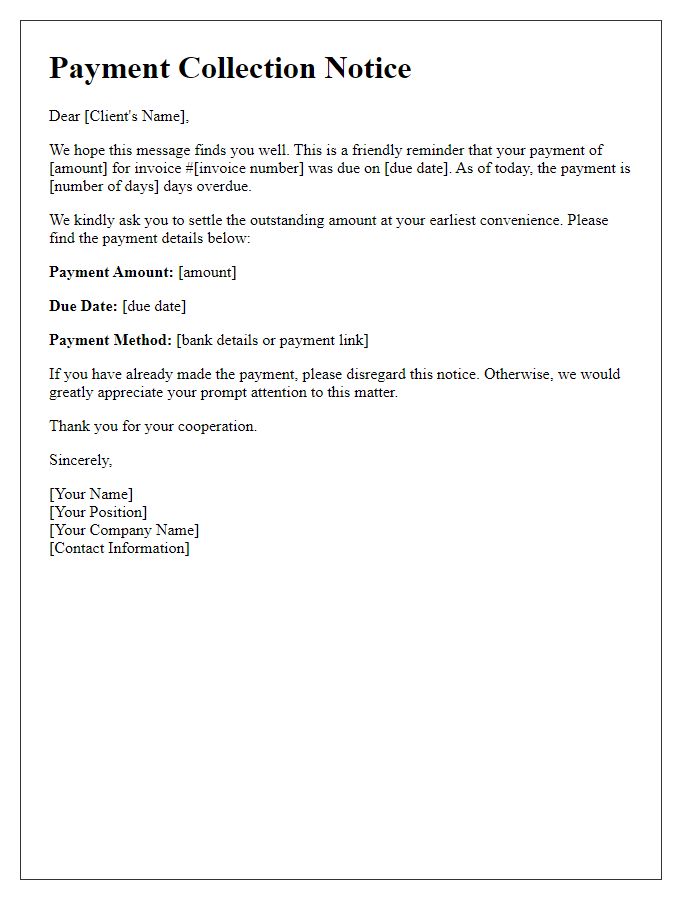

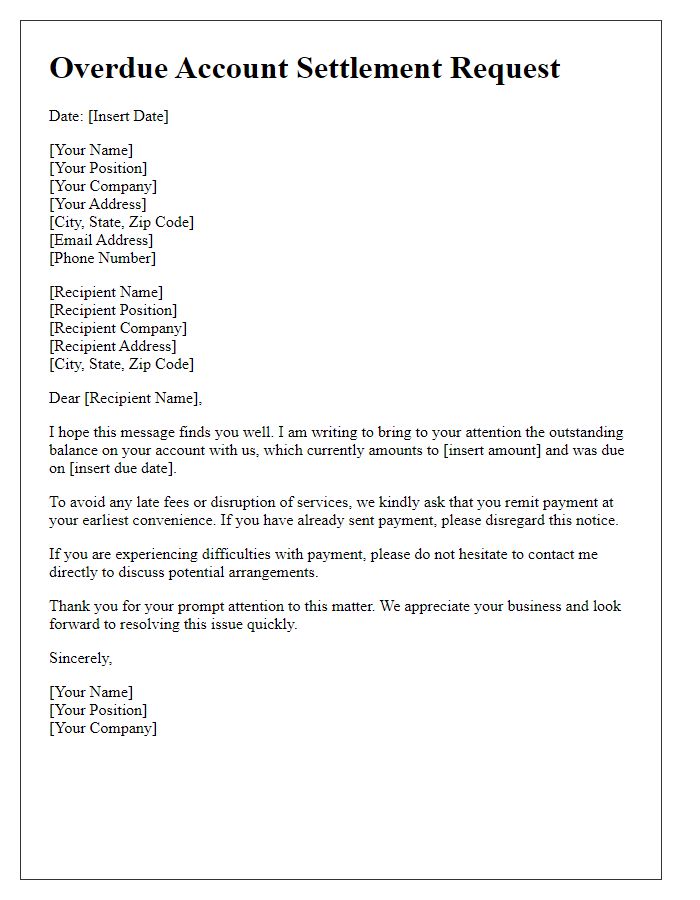

Overdue payments can significantly impact business operations and cash flow. Clients who receive payment reminders often have outstanding invoices that are typically 30, 60, or 90 days past their due date. Effective communication is essential when addressing overdue accounts, using a courteous tone while conveying the urgency of the matter. Including details such as invoice numbers, original due dates, and the total amount outstanding can aid in clarity. Maintaining a professional demeanor encourages prompt resolution, fostering positive client relationships while ensuring financial stability.

Invoice details

An overdue payment notice typically includes specific invoice details to ensure clarity and prompt resolution. The invoice number, a unique identifier for tracking purposes, should be clearly stated. The due date, which signifies the deadline for payment, is critical and often emphasizes the gravity of the situation. A detailed description of the services or products provided, along with their individual costs, helps the recipient understand what they are being charged for. The total amount due, reflecting any late fees or penalties, provides a clear overview of the payment required. Contact information for customer support, including phone numbers or email addresses, ensures that recipients know how to reach out for questions or payment arrangements. This structured communication facilitates the timely collection of overdue payments and maintains professional relationships.

Payment options

Overdue payments can significantly impact cash flow for businesses, causing potential disruptions. Various payment options such as credit cards, electronic fund transfers (EFT), or installment plans provide flexibility to clients facing financial challenges. For example, offering a 30-day grace period may encourage prompt payment while convenience fees for late transactions might dissuade continued delays. The inclusion of reminders via email or SMS can also enhance collection efforts, ensuring clients remain informed about their outstanding balances. Utilizing automated payment systems can streamline this process, reducing administrative burdens and improving overall efficiency.

Contact information

An overdue payment notice template should include your organization's name, prominent address (including city and ZIP code), phone number for inquiries, and a dedicated email address for communication regarding the payment. Additionally, specify the date of the notice to maintain clarity on the timeline of the payment due. It is crucial to mention any relevant account or invoice numbers to help the recipient easily identify the overdue amount. Clear contact information fosters direct communication, allowing for timely resolution.

Comments