Hey there! If you're facing the hassle of managing outstanding balances, you're not alone. Many people find themselves in similar situations, and addressing these financial concerns can seem daunting. In our article, we'll equip you with a clear and effective letter template for notifying individuals about their outstanding balances, making the process smoother and less stressful. Interested in finding the perfect wording for your notice? Keep reading!

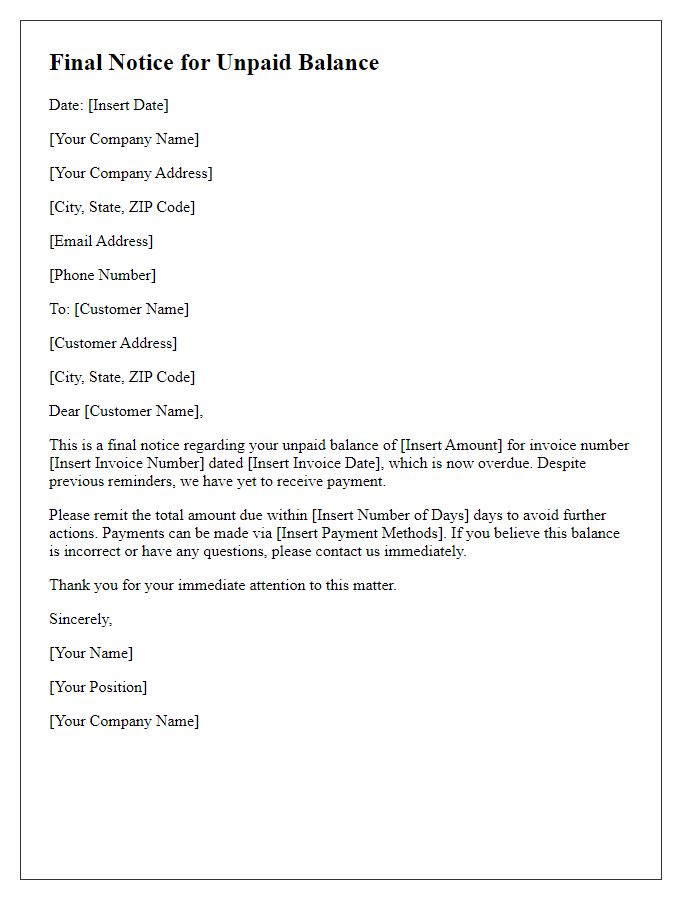

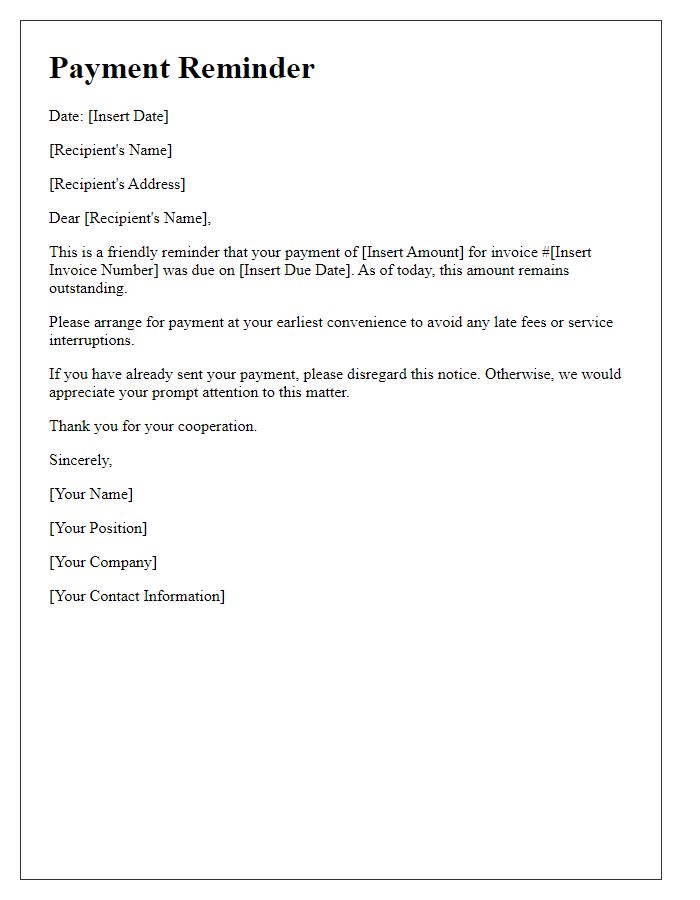

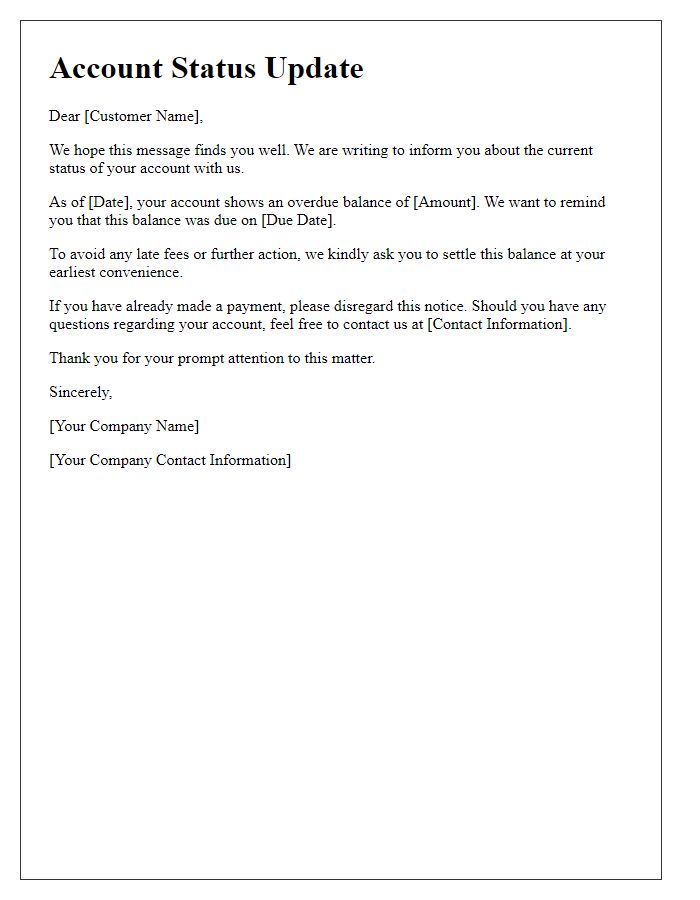

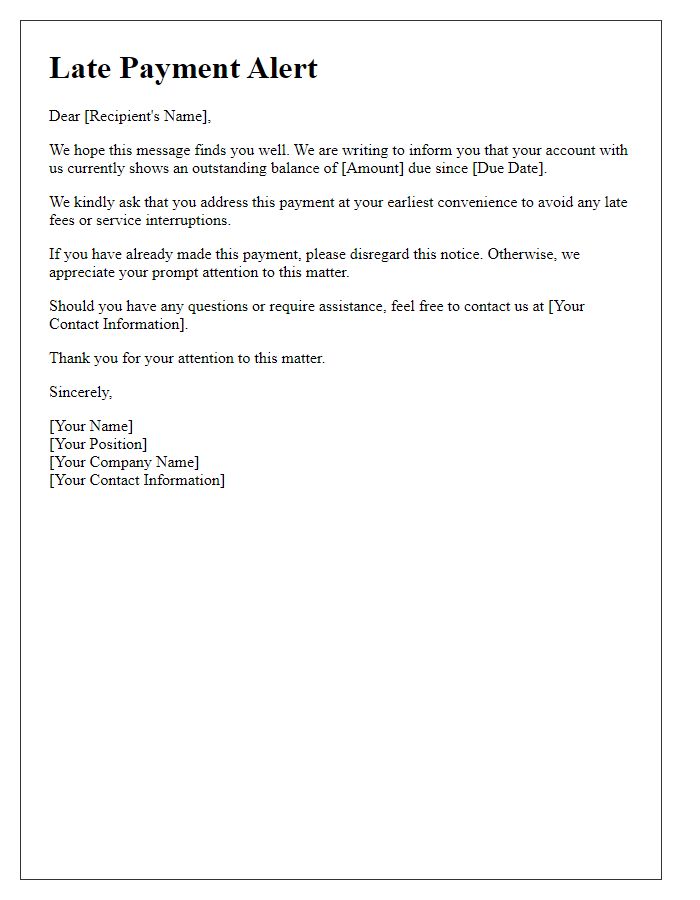

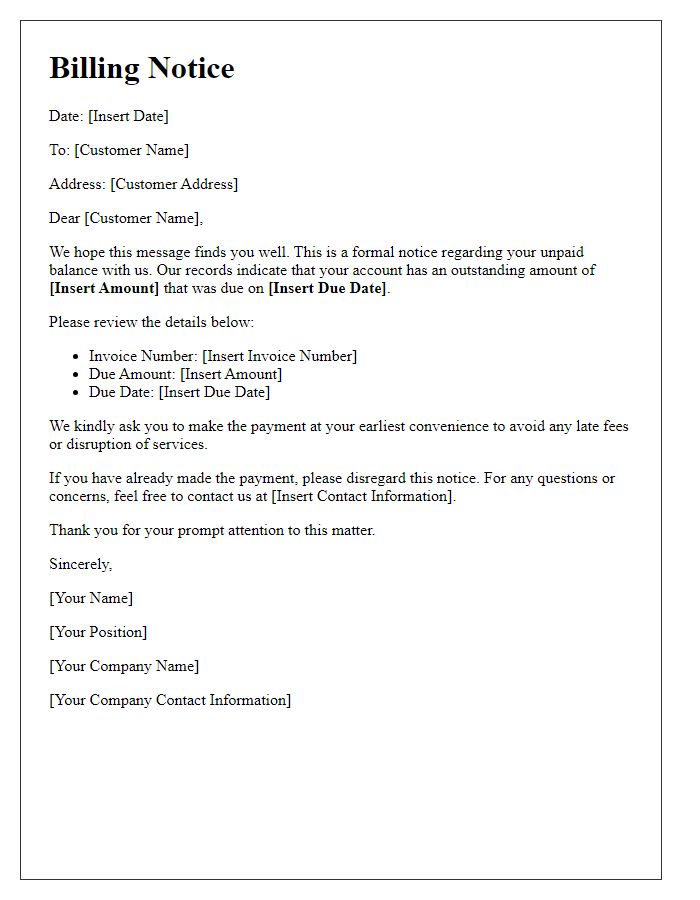

Clear subject line

Outstanding Balance Notice: Action Required for Account #123456 This notice serves as a reminder regarding the outstanding balance of $500 on your account #123456. The due date for payment was October 15, 2023, and failure to settle this amount may incur late fees or account restrictions. To avoid any adverse effects on your credit score and maintain account integrity, please remit payment as soon as possible. For your convenience, multiple payment options are available, including online payments via our secure portal, bank transfers, or checks sent to our billing address at 123 Finance Street, Payment City, CA 90001. Contact our billing department at (555) 123-4567 for any inquiries or clarification.

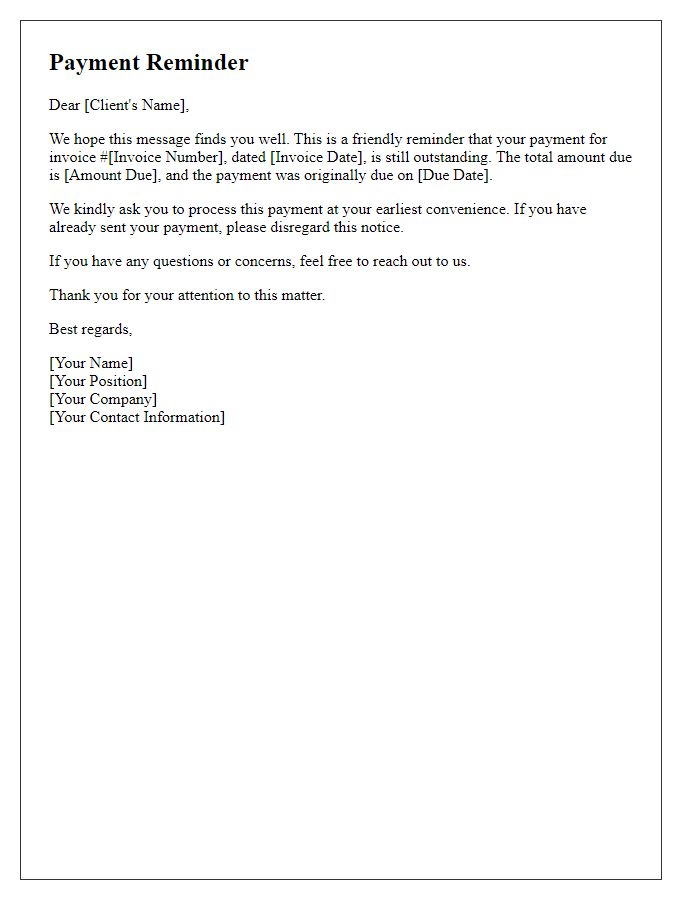

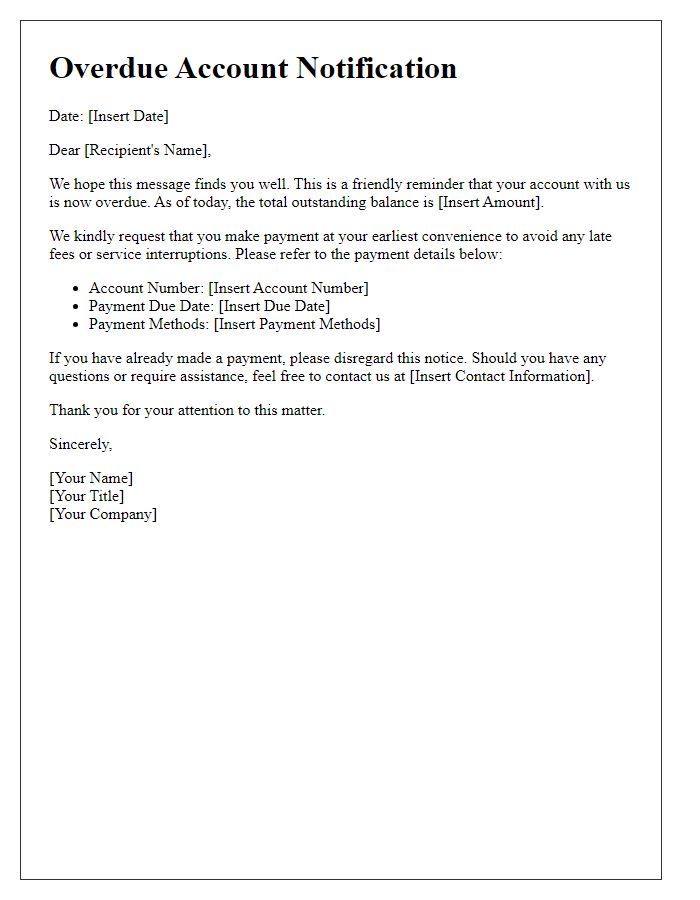

Recipient's contact details

Outstanding balances on accounts can create financial stress for both businesses and individuals. Account holders may face penalties or interest rates due to unpaid invoices. A typical outstanding balance notice includes recipient contact details for clarity and prompt communication. This information typically comprises the full name, address (including city, state, and zip code), phone number, and email address. Clear identification helps ensure the notice reaches the correct person, facilitating efficient resolution of the outstanding balance. Accurate recipient details minimize delays in payment processing, aiding in maintaining healthy cash flow for organizations.

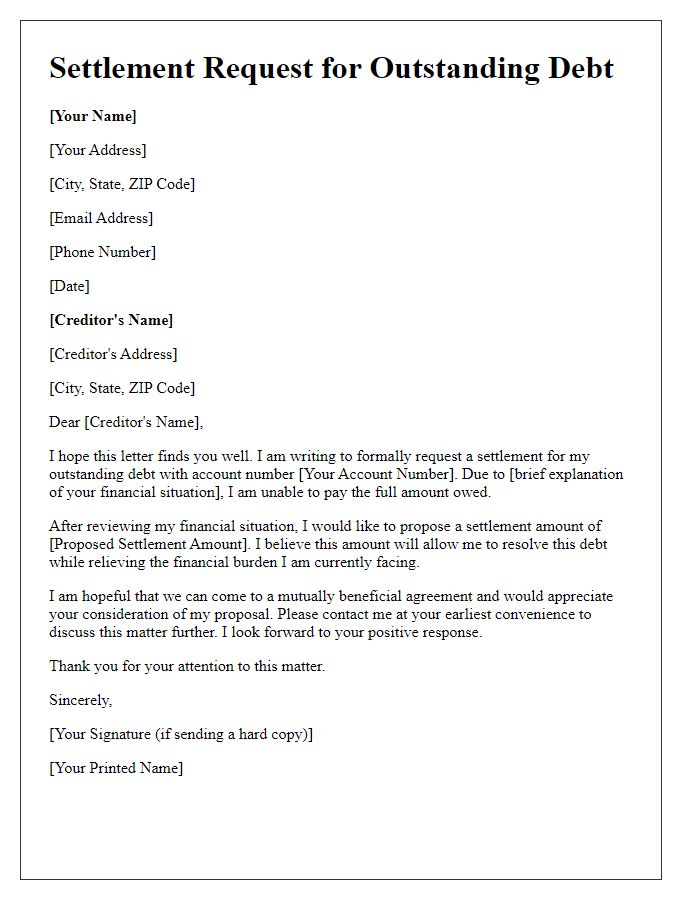

Outstanding amount details

An outstanding balance represents an amount owed that has not been paid within the stipulated timeframe. Typically, outstanding balances can arise from various transactions, such as credit card expenditures, utility bills, or loan repayments. In many cases, businesses or service providers send notifications to remind customers of overdue amounts. For instance, a credit card company may notify a customer of an outstanding balance of $1,250, which is past due by 30 days, potentially accruing interest at an annual percentage rate of 18%. Notifications often include critical details: due date (such as October 15, 2023), payment options (online credit card payment or bank transfer), and consequences of non-payment (such as service interruption or credit score impact). Such notices aim to encourage prompt resolution to maintain positive financial standing.

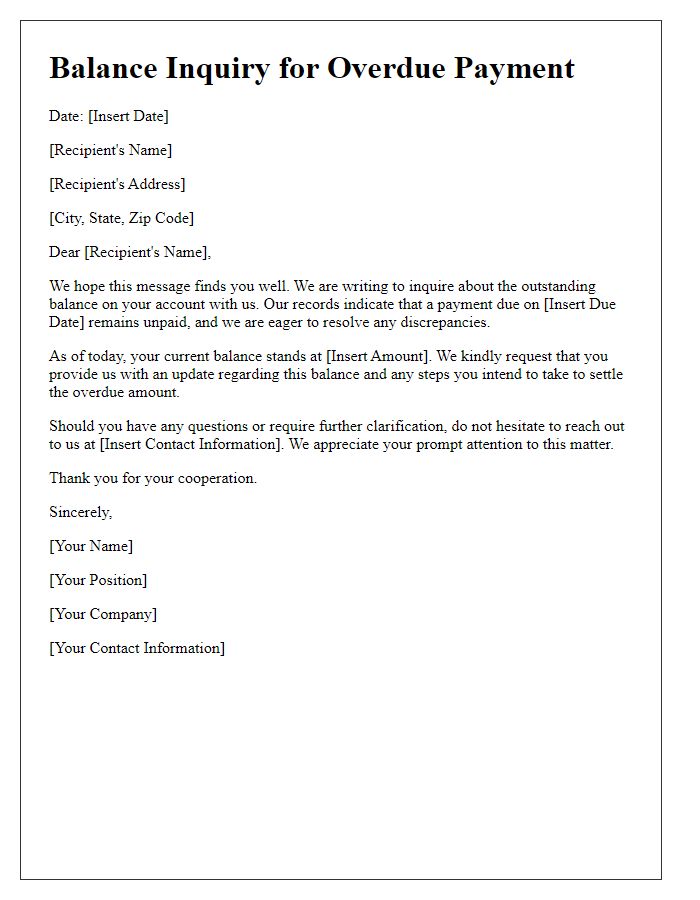

Payment instructions and deadline

Outstanding balances can have significant implications for individuals and businesses. Timely payment of debts is crucial to maintaining financial health. For example, a notification regarding an outstanding balance, potentially over $500, may require prompt attention to avoid late fees. Clear payment instructions, including methods such as bank transfers or online payment platforms, should be outlined. If a deadline of 30 days from the notice date is set, individuals must prioritize settling the balance to prevent further complications, such as credit score impacts from unpaid debts. Additionally, understanding the terms and conditions of the outstanding balance, including interest rates, can aid in effective financial management.

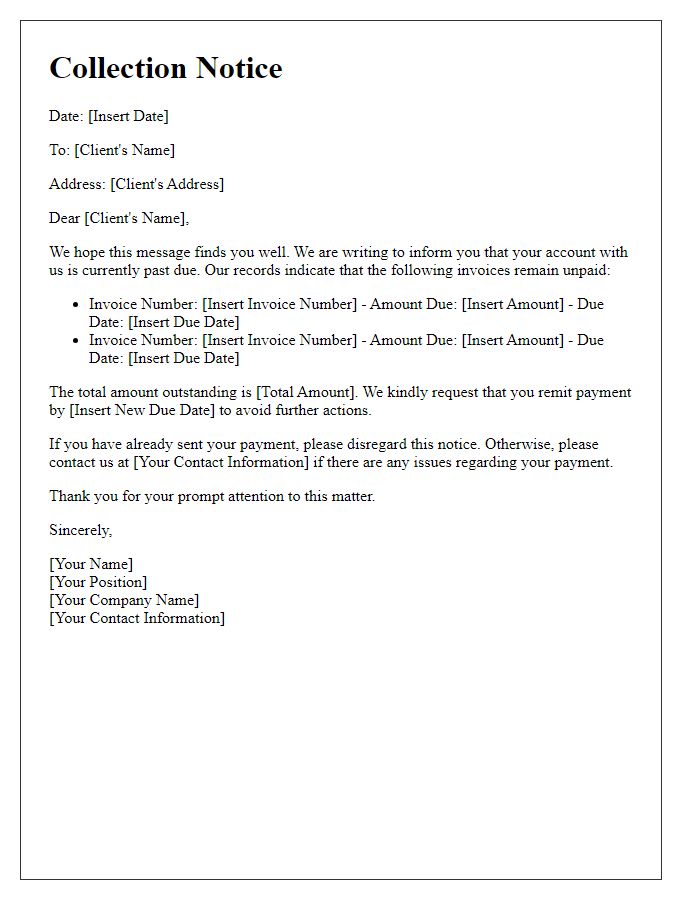

Contact information for inquiries

Outstanding balances on credit accounts can significantly impact credit scores and financial health. Regularly monitoring statements from institutions like Visa and Mastercard facilitates early detection of discrepancies. Timely payment of these balances, which can accrue additional fees and interest rates of up to 29.99 percent annually, is crucial to avoid further complications. For inquiries or disputes regarding outstanding amounts, customers can contact the financial institution's customer service department, typically available via dedicated phone lines (often 24/7) or online chat through their official websites. Documenting communications and referencing account numbers during these interactions enhances efficiency and resolution clarity.

Comments