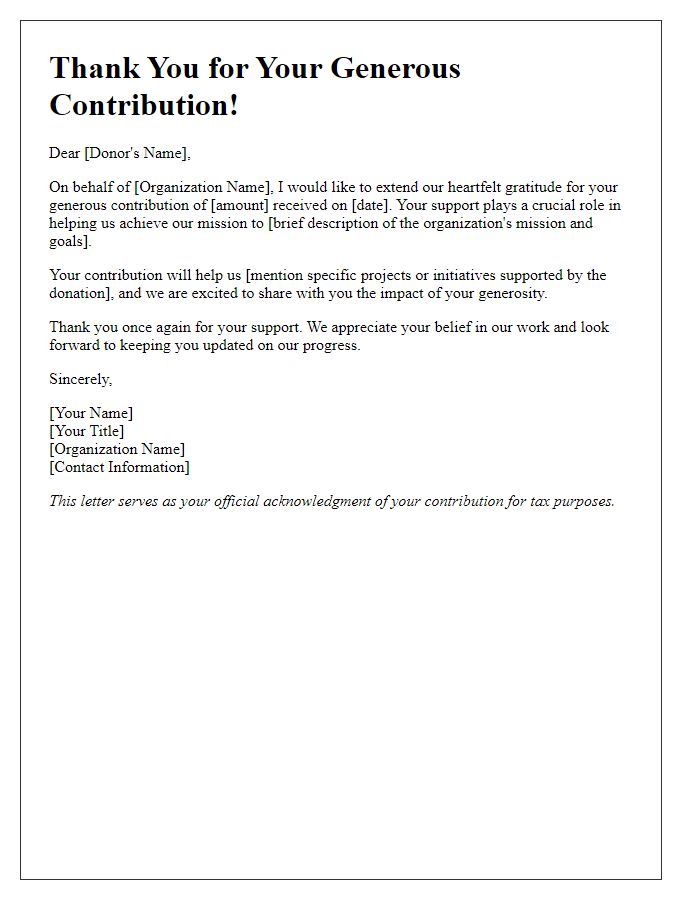

Thank you so much for your generous contribution! Your support truly makes a difference, and we want to ensure that you feel appreciated for your kindness. This acknowledgment receipt is a way for us to formally recognize your gift and share the impact it has on our mission. We invite you to read more about how your donation is making a change in our community!

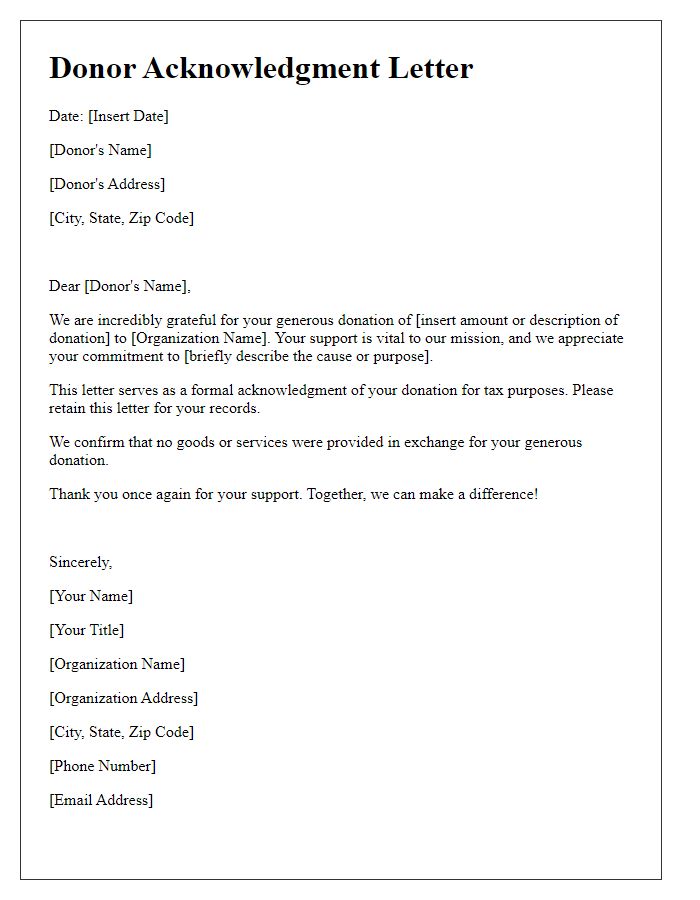

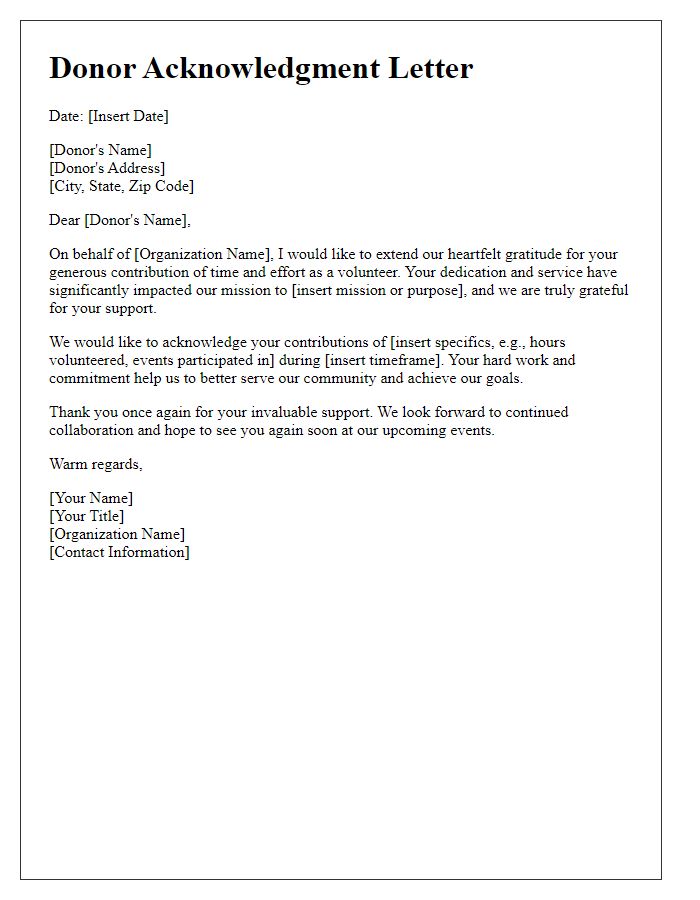

Donor's name and contact information

Donor acknowledgment receipts are essential documents that provide recognition for contributions, ensuring transparency and compliance with tax regulations. These receipts typically include the donor's full name, such as John Smith, along with detailed contact information, including a physical address like 1234 Elm Street, Springfield, and an email address, john.smith@email.com. The acknowledgment should also specify the date of the contribution, for example, March 15, 2023, the amount donated, say $250, and a brief description of how the contribution will be utilized, like funding community outreach programs. Additionally, including the organization's name, such as The Helping Hands Foundation, and tax identification number enhances credibility. For record-keeping, a unique receipt number may also be assigned for future reference.

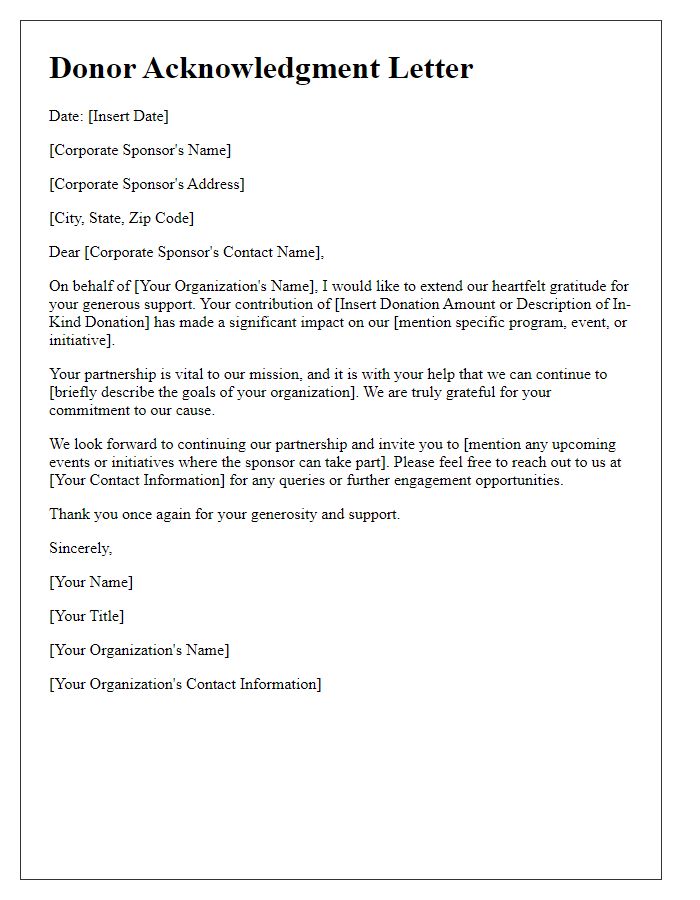

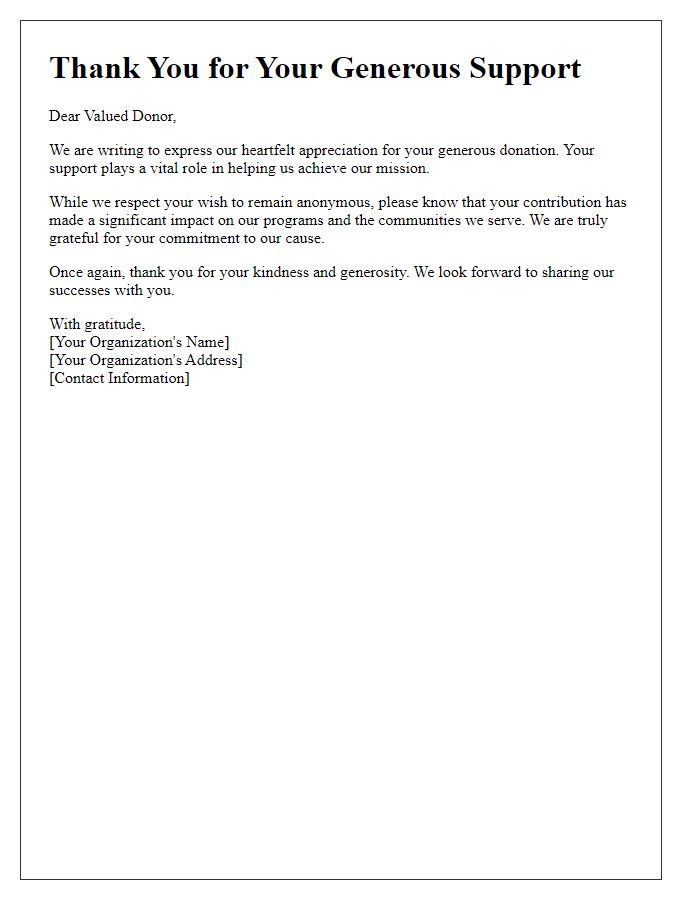

Official charity or organization name and details

Acknowledgment of donation is vital for maintaining transparency and gratitude between charities and their supporters. Such a receipt typically includes the official name of the charity organization, such as "Hope for Tomorrow Foundation," which may be registered under tax-exempt status 501(c)(3) in the United States. Essential details encompass the donor's name, donation date, and the specific amount contributed--$100 on March 15, 2023, for example. Inclusion of the charity's physical address, such as "123 Charity Lane, Springfield, USA," and contact information like support@hopefortomorrow.org enhances authenticity. The statement should affirm that the contribution is tax-deductible according to IRS guidelines, ensuring compliance with legal standards. Furthermore, details about how the funds will be utilized, such as supporting educational programs for underprivileged children, provide context and reinforce the impact of the donor's generosity.

Donation amount and brief description

A formal acknowledgment receipt for a donation signifies gratitude and provides essential details to the donor. This document typically includes the donation amount, such as $500, along with a brief description of the purpose, for example, community outreach programs supporting underprivileged families in Chicago, Illinois. Including the date of the transaction, such as November 10, 2023, and the nonprofit organization's name and Tax ID number is crucial for the donor's tax deduction purposes. A personal touch, such as a handwritten note expressing heartfelt appreciation for the donor's commitment to social change, enhances the acknowledgment's meaningfulness.

Date of donation and receipt issuance

Thank you for your generous donation of $500 received on October 15, 2023, to support our community outreach programs. This acknowledgment serves as documentation for your tax-deductible contribution for the fiscal year 2023. Your support empowers us to provide essential services to individuals in need throughout Springfield, allowing us to impact over 1,000 lives annually. We appreciate your commitment to our mission.

Tax-exemption status and acknowledgment statement

The donor acknowledgment receipt serves as an important document for nonprofits and charitable organizations, confirming the receipt of contributions. Organizations must include specific details such as the donor's name (John Doe), date of the donation (October 1, 2023), donated amount ($500), and the organization's name (Helping Hands Charity). Furthermore, clearly stating the tax-exempt status (501(c)(3) designation) is essential for the donor's tax reporting purposes. An acknowledgment statement should specify that no goods or services were provided in exchange for the donation, ensuring compliance with IRS regulations. This information allows donors to claim their contributions as tax-deductible, fostering transparency and trust between the organization and its supporters.

Comments