When life throws unexpected challenges our way, like property damage, it's essential to know how to navigate the insurance claim process smoothly. Crafting a clear and concise letter can make all the difference in ensuring your claim is processed efficiently. In this article, we'll guide you through a straightforward template to help you articulate your situation to your insurance provider. Ready to take the first step toward getting the support you need? Let's dive in!

Policyholder Information

Property damage insurance claims require accurate and detailed information for effective processing. Important elements include policyholder information such as full name (as listed on insurance documents), account number (specific to the policy), date of the incident (e.g., January 15, 2023), property address (including city, state, and ZIP code for proper identification), and contact information (phone number and email address). Additionally, details regarding the specific damage incurred (e.g., water damage from burst pipes, estimated repair costs), and any previous claims (if applicable) help expedite the claim process. Accurate documentation is vital to support the claim and ensure a swift resolution.

Incident Details

During the heavy rainstorm that occurred in Los Angeles on January 15, 2023, significant water damage impacted my property located at 123 Maple Avenue. The intense rainfall (recorded at 4 inches within 24 hours) overwhelmed the drainage system, leading to flooding in the basement level of the house. The floodwaters reached approximately 2 feet in depth, damaging essential electrical wiring and personal belongings, including furniture, electronics, and stored documents. Local emergency services reported similar incidents in the surrounding area, highlighting the extent of the storm's impact. Routine maintenance on the property, including gutter cleaning and drainage inspections, had been conducted just two months prior, emphasizing the unexpected nature of this incident. Immediate action was taken to mitigate further damage by employing a professional water restoration service from Dry-Water Restoration, which commenced on January 16, 2023.

Description of Damage

A severe storm struck New Orleans (Louisiana) on August 29, 2023, resulting in significant property damage. The high winds (exceeding 90 mph) uprooted trees, causing one to crash onto the southeast corner of the house, damaging the roof and creating a substantial hole. Rainfall during the storm measured approximately 12 inches, leading to water intrusion in multiple areas of the home. Additionally, flooding in the basement caused damage to the electrical system, compromising safety and functionality. Structural integrity of the foundation was visibly affected, with noticeable cracks appearing. Furniture throughout the living room suffered extensive water damage, necessitating replacement. Documentation includes photographs of the damage, estimates from contractors in the region, and a detailed report from the local insurance adjuster.

Supporting Documentation

Supporting documentation is critical in property damage insurance claims, ensuring that all relevant evidence is presented to facilitate a thorough evaluation by insurance adjusters. This documentation typically includes photographs capturing the extent of damage to property, such as water-stained walls or broken windows, taken immediately after incidents like storms or fires. Repair estimates from licensed contractors can demonstrate anticipated expenses, with detailed breakdowns of costs for materials and labor. Additionally, receipts for temporary repairs or emergency services, such as water extraction or board-up services, serve as proof of expenditures directly related to damage mitigation. Furthermore, policy details outlining coverage provisions help contextualize claims, making it easier for adjusters to align documented evidence with the terms of the insurance policy. Finally, incident reports from local authorities, like fire departments or police, can corroborate the circumstances surrounding the damage and enhance the credibility of the claim.

Contact Information

Property damage insurance claims require precise contact information to ensure accurate processing. Include the policyholder's full name, ensuring it matches the policy on file. Specify a current address, including street number, city, and ZIP code, for correspondence. List a primary contact number, preferably a mobile or home phone, to facilitate direct communication during the claims process. Provide an email address for digital correspondence and documentation, ideally one that is regularly checked. This information is essential for insurance agents to verify identity, locate the insurance policy, and efficiently address the claim related to the property damage.

Letter Template For Property Damage Insurance Claim Samples

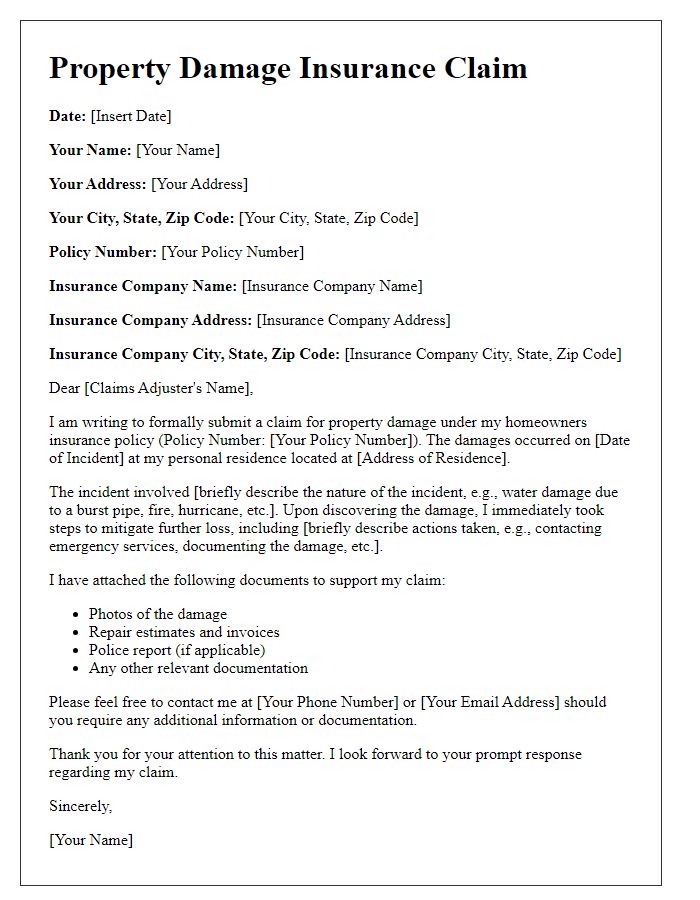

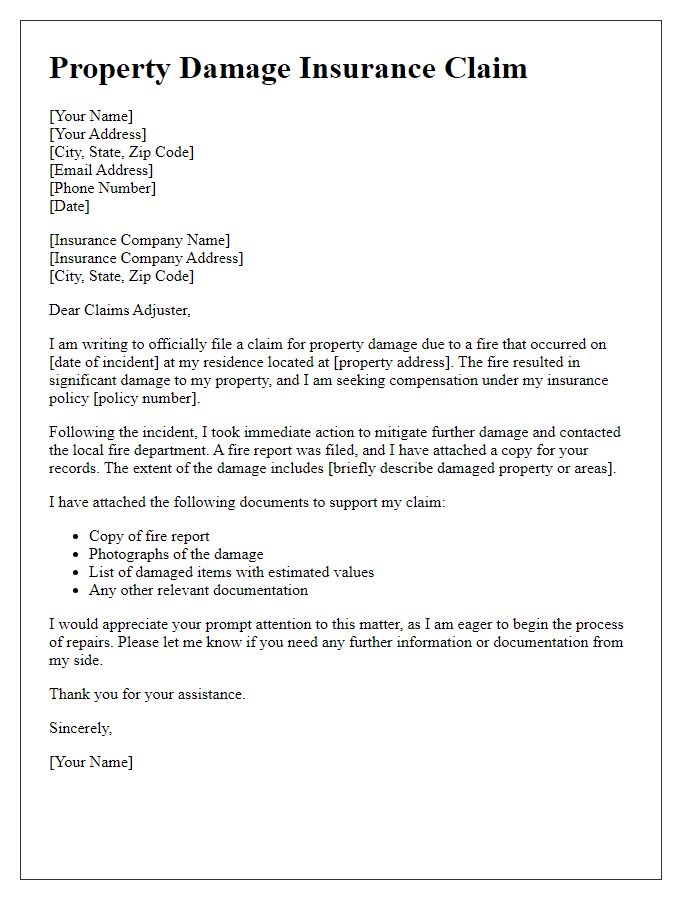

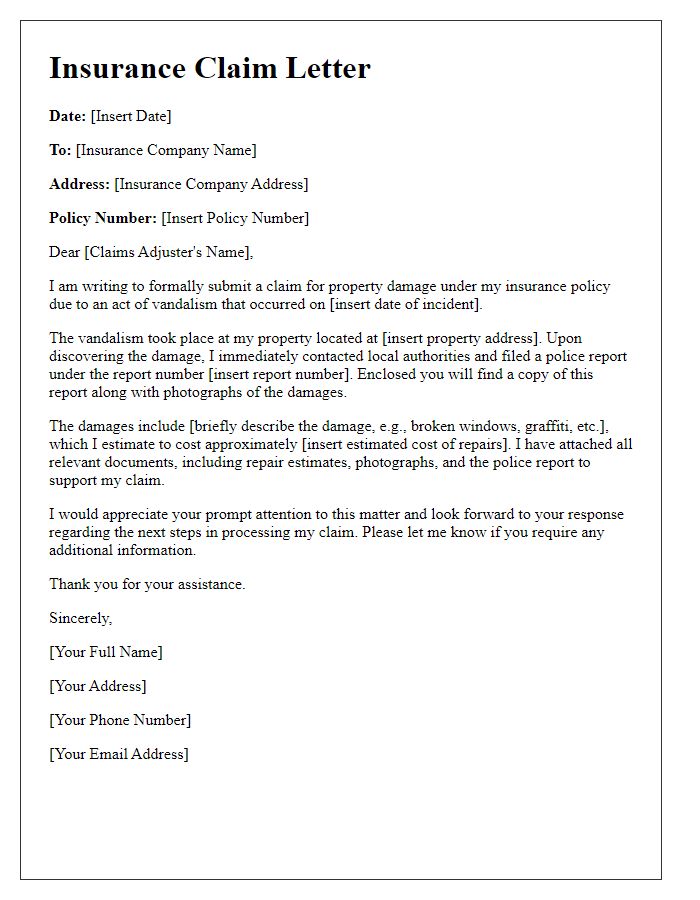

Letter template of property damage insurance claim for personal residence.

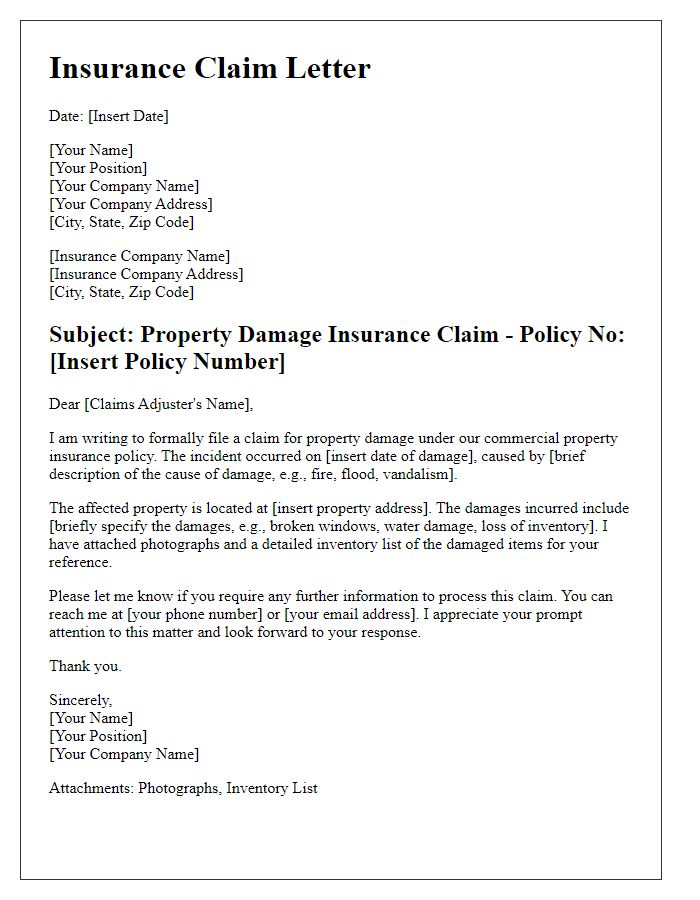

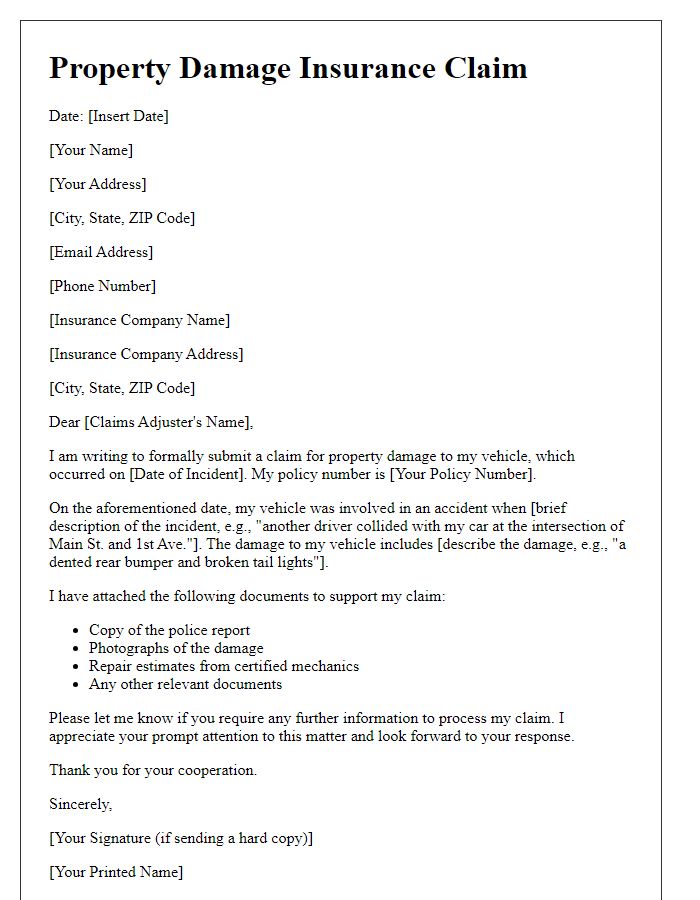

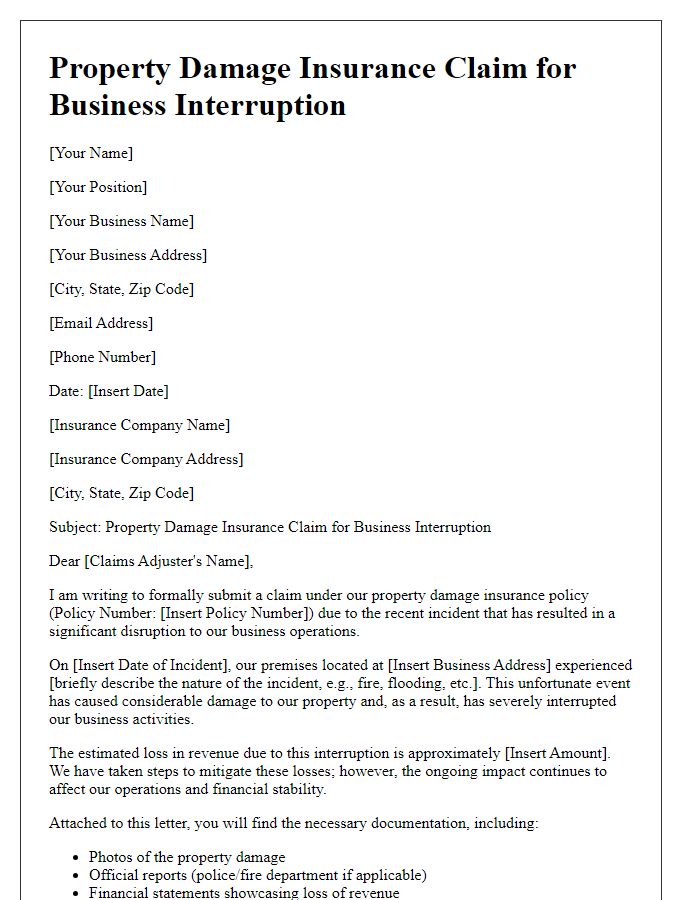

Letter template of property damage insurance claim for commercial property.

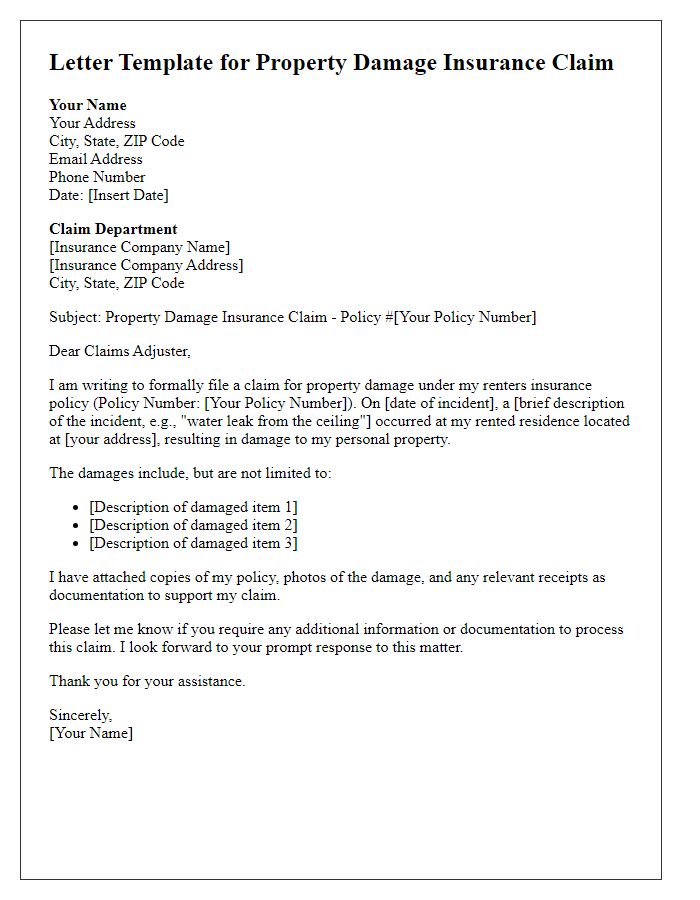

Letter template of property damage insurance claim for renters insurance.

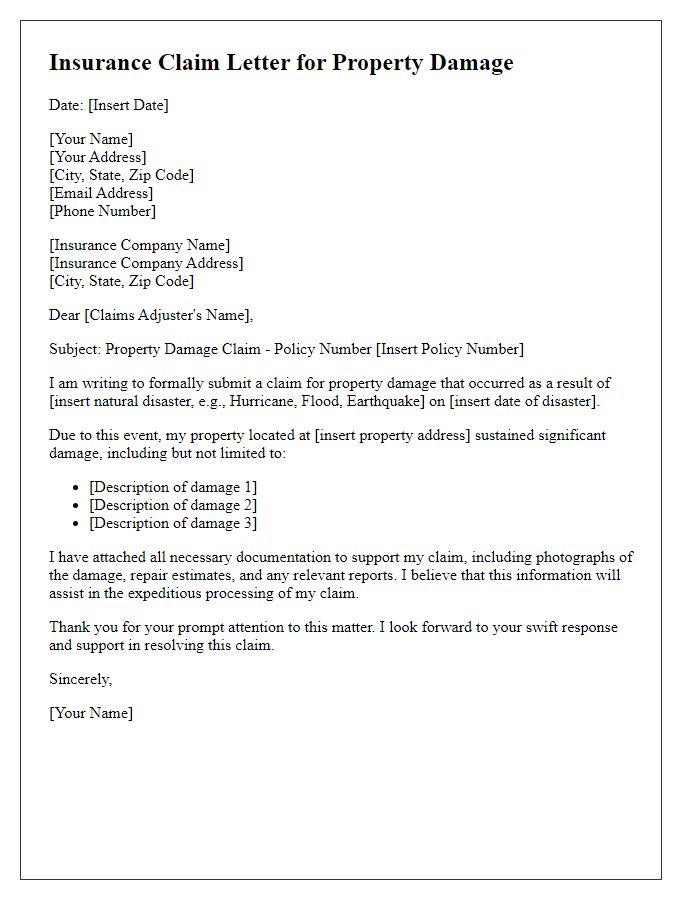

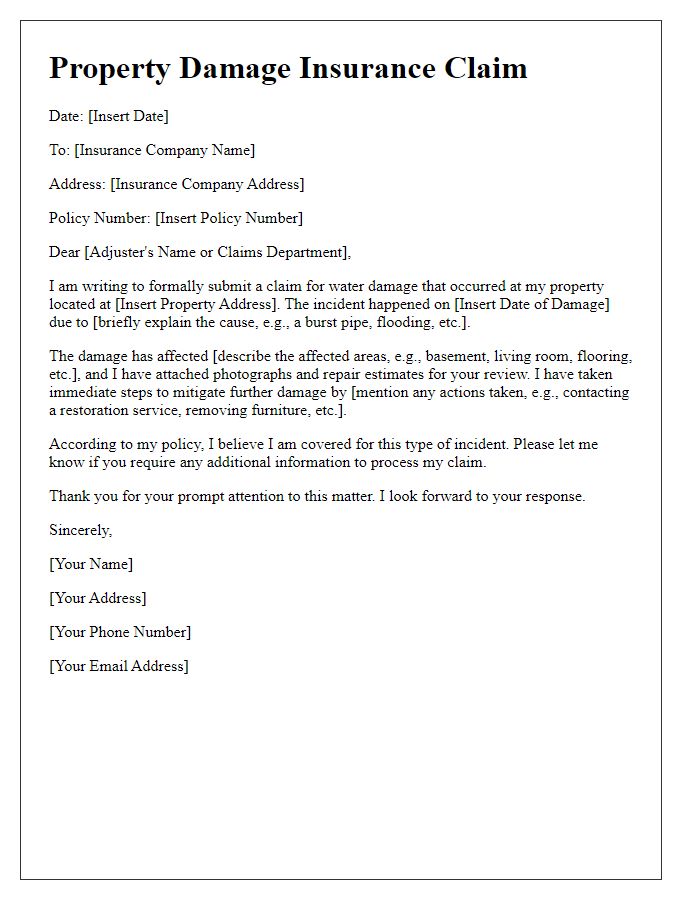

Letter template of property damage insurance claim for natural disaster.

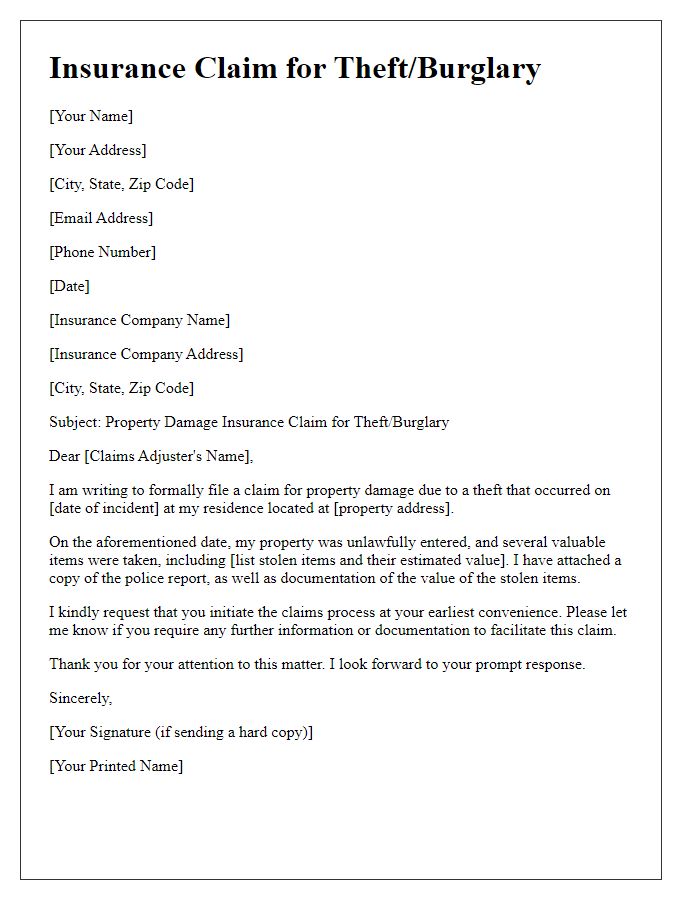

Letter template of property damage insurance claim for theft or burglary.

Comments