We've all been thereâsometimes, life gets in the way, and bills slip through the cracks. If you find yourself needing to apologize for a late payment, a heartfelt letter can go a long way in mending relationships and fostering understanding. It's important to express genuine regret while also reassuring the recipient that you're taking steps to resolve the issue. Curious about how to craft the perfect late payment apology letter? Let's dive in!

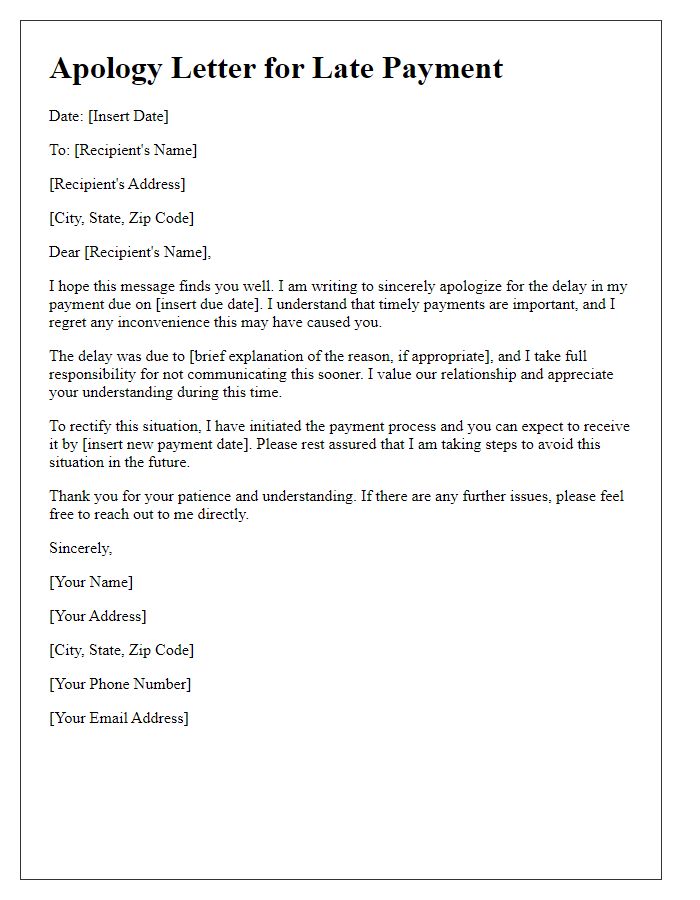

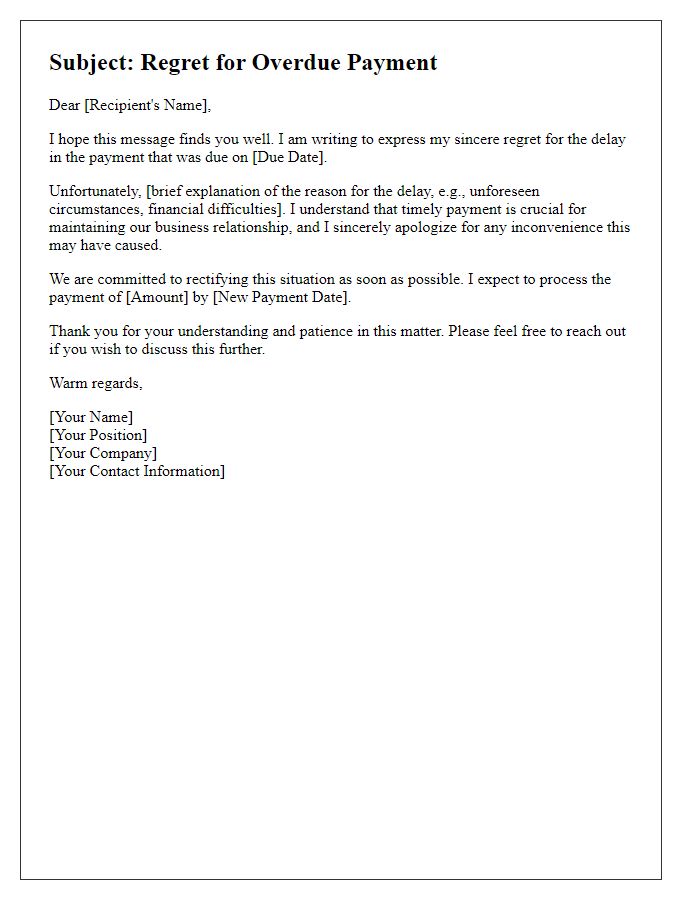

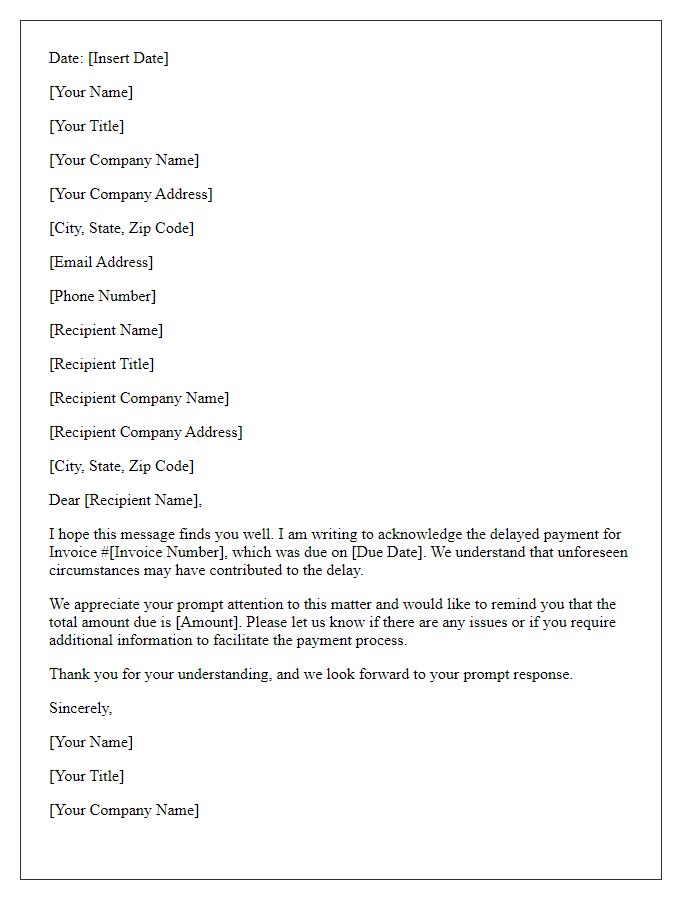

Acknowledgment of Delay

Apologizing for a late payment reflects a commitment to responsibility and integrity in financial transactions. Acknowledgment of the delay demonstrates respect for the terms set forth in the invoice dated February 15, 2023, for the services rendered by ABC Consulting, totaling $1,250. Such delays can strain relationships with vendors or service providers, like those operating in the competitive tech industry, where timely payments are crucial for maintaining cash flow and trust. A sincere acknowledgment of the delay addresses not only the breach of the agreed terms but also conveys the importance of the relationship built over the years, especially considering the ongoing partnership valued at over $50,000 annually. By openly recognizing the oversight, businesses can pave the way for reinstating trust and ensuring future compliance with payment schedules.

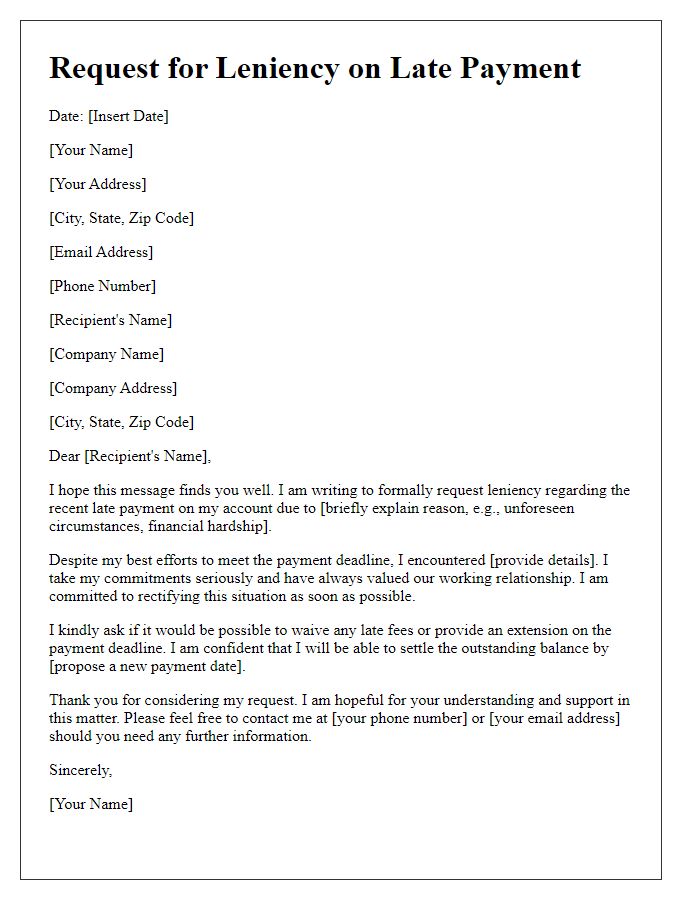

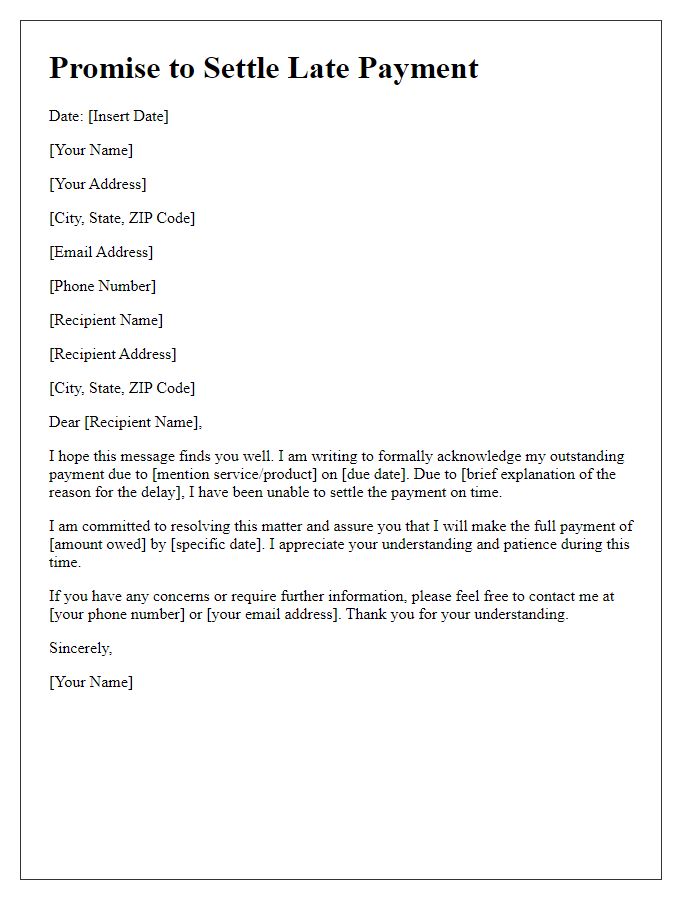

Specific Reason for Late Payment

A specific reason for late payment, such as unexpected medical expenses, can significantly impact an individual's financial stability. For instance, the sudden need for a medical procedure could result in costs exceeding $10,000, diverting funds away from regular payment obligations. Additionally, the timing of these expenses may coincide with fixed payment schedules, complicating cash flow management. As a result, this unanticipated burden can extend the payment timeline, affecting relationships with creditors or service providers. Addressing these situations with clear communication and proposed solutions is essential for maintaining trust and understanding in financial relationships.

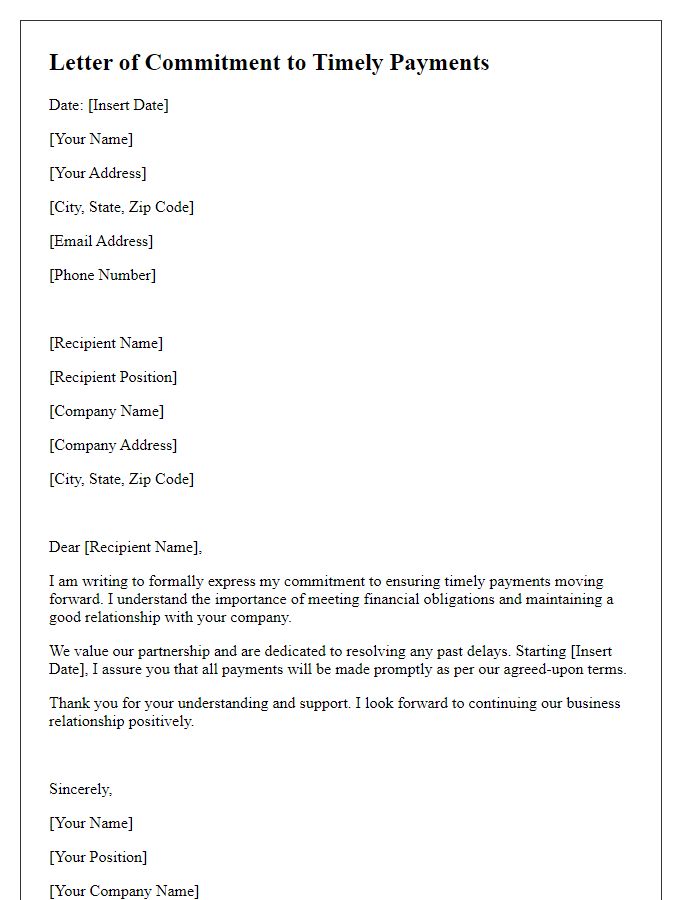

Assurance of Payment

Apologizing for late payments can greatly impact business relationships. Delayed payments can occur due to unforeseen circumstances such as cash flow issues, administrative errors, or unexpected expenses. It's vital to acknowledge the impact on both parties, as timely payments are essential for maintaining trust. Assuring prompt payment is crucial; specifying a date for fulfillment adds clarity, such as promising to settle by the end of the month. Additionally, expressing gratitude for understanding reflects a commitment to maintaining a positive relationship. Keeping communication open and transparent fosters goodwill and can prevent future delays.

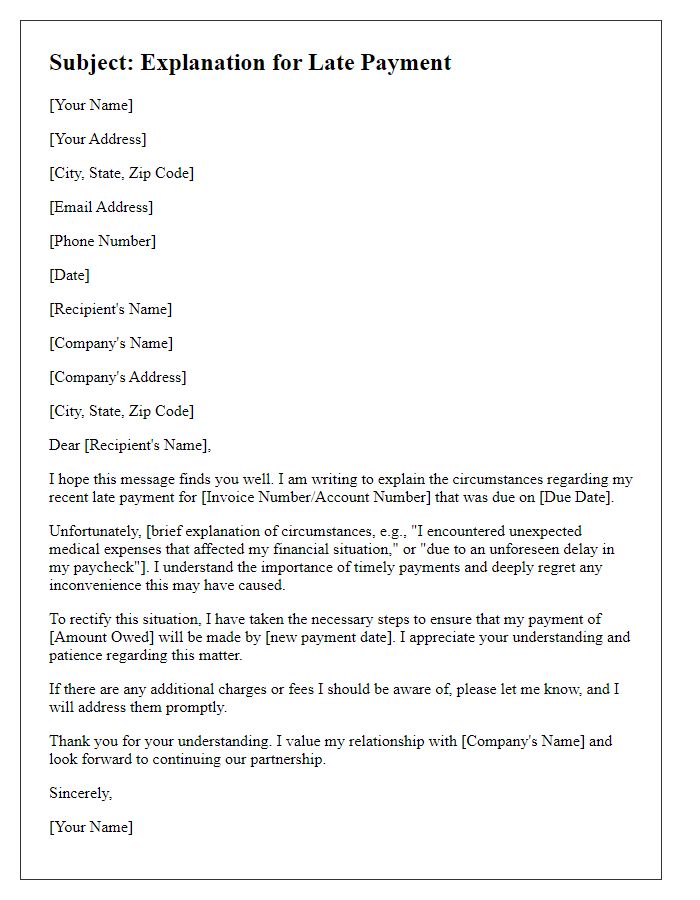

Outline of Steps to Prevent Recurrence

Late payment can impact supplier relationships and financial reputation, leading to fees or disruption of services. To prevent recurrence, implementing several key steps is essential: establish a clear payment schedule, adopting tools like automated reminders, enhances visibility of upcoming due dates while maintaining accountability. Conduct regular audits (possibly monthly) of outstanding invoices ensures timely processing and identifies potential delays. Communication with suppliers, for instance, a periodic check-in (every quarter) to discuss terms or issues foster transparency and strengthen relationships. Utilize financial management software, such as QuickBooks or FreshBooks, to track expenses and cash flow effectively, ensuring sufficient funds are available for payment. Finally, maintaining a contingency fund, approximately 10-15% of monthly expenses, provides a buffer for unexpected costs, ensuring that payments remain timely and reducing future risks.

Expression of Gratitude for Understanding

Delayed payments can create challenges for both individuals and businesses. Apologizing for the inconvenience caused due to a late payment demonstrates respect and professionalism. Acknowledging the recipient's understanding fosters goodwill. Expressing gratitude for their patience can strengthen relationships, particularly in ongoing business arrangements. A specific reference to the amount owed (for instance, $500) or the payment due date (such as September 15, 2023) emphasizes accountability. Including assurance of timely future payments can reinforce trust and commitment to maintaining a positive rapport.

Comments