Are you on the journey to secure a housing loan but unsure where to start? Crafting the perfect letter to your lender can significantly boost your chances of approval. This simple yet effective template will guide you through the essential elements to include, ensuring your application stands out. Ready to take the next step in your homeownership journey? Read on to discover how to write a compelling housing loan approval letter!

Applicant's personal information

The housing loan approval process requires comprehensive information about the applicant, such as the individual's full name, current residence address, and date of birth. Applicants must provide their Social Security number (for identity verification) and contact details, including phone number and email address. Additionally, financial status is critical; details regarding monthly income, employment history, and existing debts should be included for accurate assessment. Documentation, such as recent pay stubs, bank statements, and tax returns, may be requested to verify financial legitimacy and creditworthiness, influencing loan approval decisions.

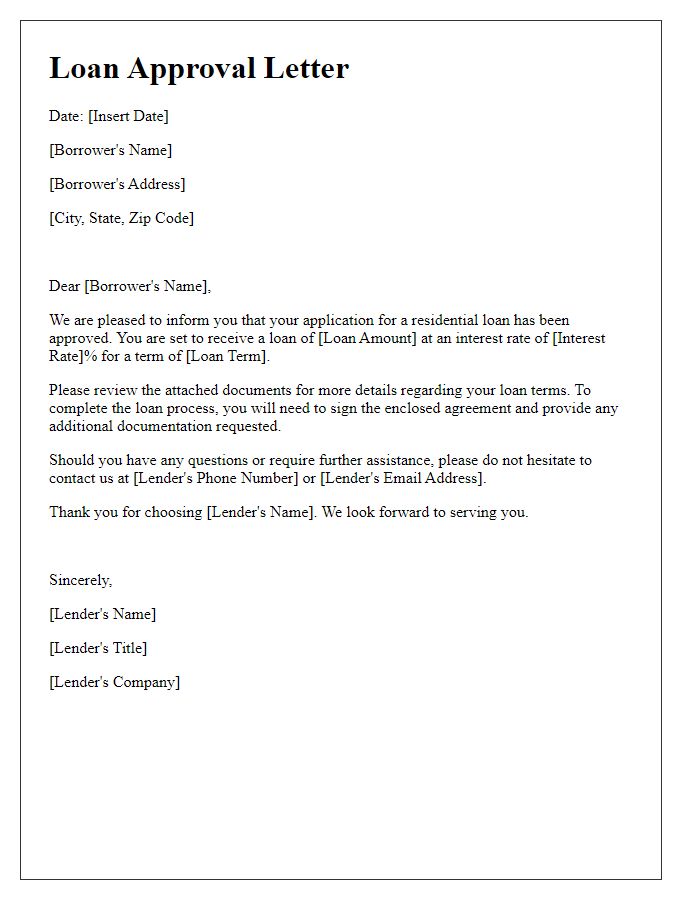

Loan details and conditions

Loan approval for housing often includes specific details and conditions that are critical for understanding the financial commitment involved. The total loan amount typically ranges from $100,000 to $500,000, depending on creditworthiness and property value. Interest rates can vary, commonly between 3% and 7%, influenced by market conditions and the borrower's financial profile. The loan term is usually set for 15 to 30 years, with monthly payments structured to include both principal and interest. Additionally, conditions might require homeowners insurance to protect the property and a down payment ranging from 3% to 20%, depending on the loan type. Prepayment penalties should also be noted, as they may apply if the loan is repaid before the end of the term. It's essential to review all terms meticulously to ensure understanding and compliance throughout the loan duration.

Property details and valuation

The housing loan approval process involves critical property details and valuation factors. Property type (single-family home, condominium, or townhouse) significantly impacts the loan amount, as lenders assess market stability. Location is essential, with urban areas like New York City or San Francisco often yielding higher valuations due to demand, while rural areas may present lower values. Comparative market analysis (CMA) helps in determining fair market value based on recent sales (within the last six months) of similar properties in the vicinity. Additionally, appraisal fees typically range from $300 to $500 and provide an in-depth report on property condition, amenities, and neighborhood characteristics. Documentation of property taxes, zoning regulations, and homeowners association fees (if applicable) also plays a vital role in the loan approval process.

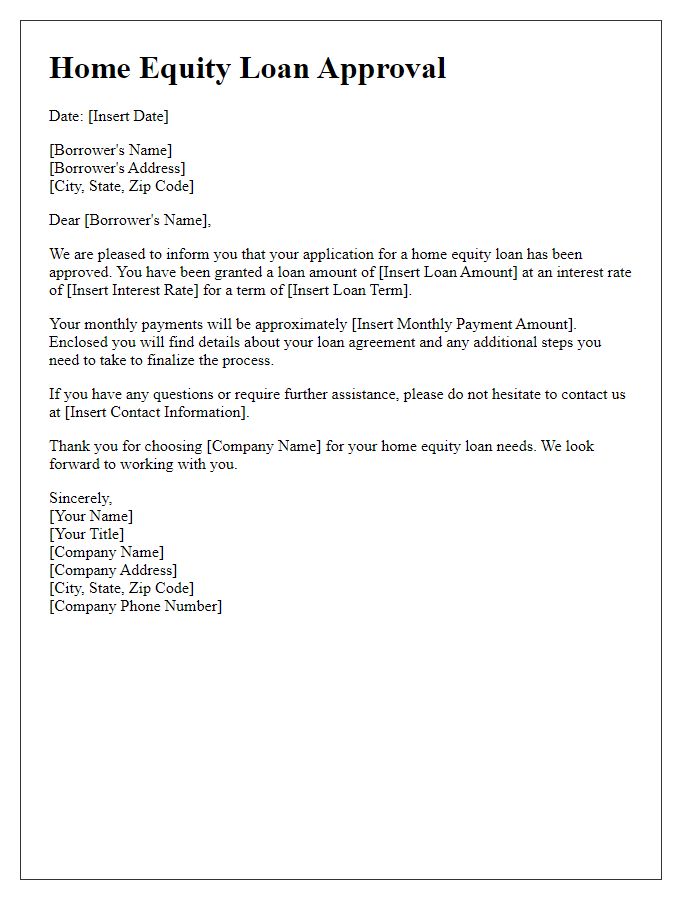

Approval terms and duration

Housing loan approval entails specific terms and durations that borrowers must understand. Approval terms often include interest rates (annual percentage rate), repayment duration (typically ranging from 15 to 30 years), and monthly payment amounts. Borrowers may also encounter requirements such as down payment percentage (commonly 3% to 20% of the home purchase price) and credit score thresholds (usually a minimum of 620 for conventional loans). Duration of the approval process can vary based on lender efficiency, ranging from several days to a few weeks, with necessary documentation such as proof of income, tax returns, and employment verification needed for final approval. Understanding these elements is crucial for borrowers navigating the housing market effectively.

Contact information and next steps

Housing loan approval is a pivotal milestone in the home-buying journey, often coming from banks such as Wells Fargo or Bank of America. By receiving the approval, potential homeowners can access significant amounts of financing, typically ranging from $100,000 to over $500,000, depending on property value and creditworthiness. Borrowers are often required to provide documentation, including income verification, credit reports, and personal identification. The next steps post-approval commonly involve reviewing loan terms, such as interest rates (averaging around 3% to 4% as of early 2023), and deciding on loan duration (15 to 30 years being the most common). After these steps, borrowers can prepare for closing costs, which can range from 2% to 5% of the loan amount, ensuring all conditions are satisfied before finally securing their home purchase.

Comments