If you've ever navigated the confusing waters of patient insurance verification, you know how daunting it can be. A well-crafted letter can help streamline the process and ensure you get the information you need without unnecessary delays. In this article, we'll explore a simple yet effective template that will make your insurance queries more efficient and hassle-free. Ready to simplify your insurance verification process? Let's dive in!

Patient Information

Proper patient insurance verification is crucial for healthcare providers to ensure timely reimbursement and seamless patient care. Essential personal details include the patient's full name, date of birth, and social security number for accurate identification. Insurance details encompass the policy number, group number, and the name of the insurance provider, such as UnitedHealthcare or Blue Cross Blue Shield. Additionally, understanding the patient's plan type, whether HMO or PPO, informs coverage specifics. Collecting the patient's contact information, including phone number and address, aids in effective communication throughout the verification process. Furthermore, ensuring the patient's consent for sharing information adheres to HIPAA regulations is vital for maintaining confidentiality.

Insurance Company Details

Insurance companies play a crucial role in the healthcare system by providing financial coverage for medical expenses. In the United States, major insurance providers such as Blue Cross Blue Shield, UnitedHealthcare, and Aetna cover various healthcare services, including hospital stays, outpatient procedures, and prescriptions. Verification of benefits often requires specific details like policy number, group number, and the patient's date of birth. Such information ensures accurate processing of claims while confirming the coverage limits and copayment amounts. Essential aspects of the verification process can also include understanding preauthorization requirements for specific treatments or procedures, thereby reducing the likelihood of unexpected out-of-pocket costs for patients.

Policy Number and Coverage Details

Insurance verification is crucial for ensuring patients receive necessary medical services without unexpected financial burdens. Accurate policy numbers (typically consisting of 10-15 alphanumeric characters) and detailed coverage specifications (including deductibles, copayments, and in-network versus out-of-network rates) are essential for processing claims efficiently. For example, patients with Blue Cross Blue Shield may have unique identifiers that align with specific coverage plans, affecting eligibility for treatments and the extent of benefits provided. Timely verification prevents delays in medical care and helps healthcare providers manage billing with insurance companies like Aetna or Cigna. Proper documentation, including the patient's full name and date of birth, streamlines the communication process with insurance representatives, ensuring clarity and efficiency in claim submissions.

Services and Procedures Verification

Insurance verification for medical services is crucial for ensuring coverage and understanding patient responsibilities. Healthcare providers typically require comprehensive information about services and procedures, including codes such as CPT (Current Procedural Terminology) and diagnosis codes (ICD-10-CM). For instance, a routine check-up may involve a specific CPT code, while treatments for chronic conditions like diabetes might have differing codes that affect reimbursement. Verification should include patient demographics, policy numbers, effective dates (often monthly or yearly), and exclusions specific to insurance plans. Additionally, providers often need authorization numbers for particular procedures, especially surgeries, which may involve pre-authorization processes with insurance companies. Regions, such as the Southeastern United States, may have specific regulations governing insurance claims that healthcare providers must adhere to. Accurate verification mitigates billing errors and improves overall patient care satisfaction rates.

Contact Information for Follow-up

Insurance verification is essential for ensuring that patients receive appropriate treatment without unexpected costs. Health insurance companies, such as Blue Cross Blue Shield or UnitedHealthcare, require specific information to process claims. Key information includes the patient's identification number, which typically consists of 9-10 digits, and group policy number that identifies employer plans. Contacting customer service departments via dedicated phone lines, often listed on the back of insurance cards, facilitates efficient resolution of verification issues. Furthermore, timely follow-up, ideally within 24 hours of the initial verification request, ensures that patients have the clarity needed before their appointments, preventing delays in care.

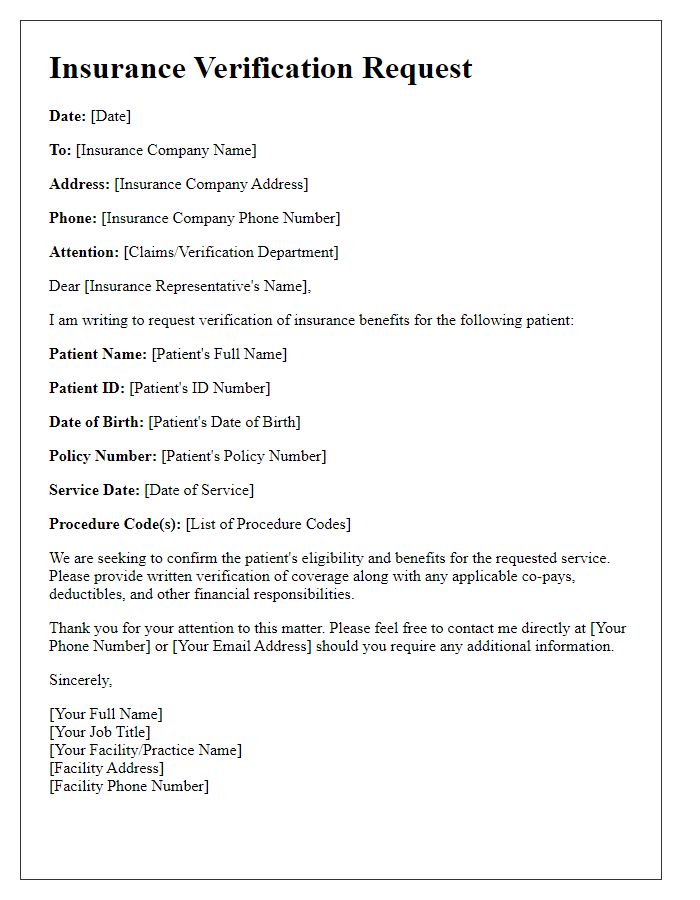

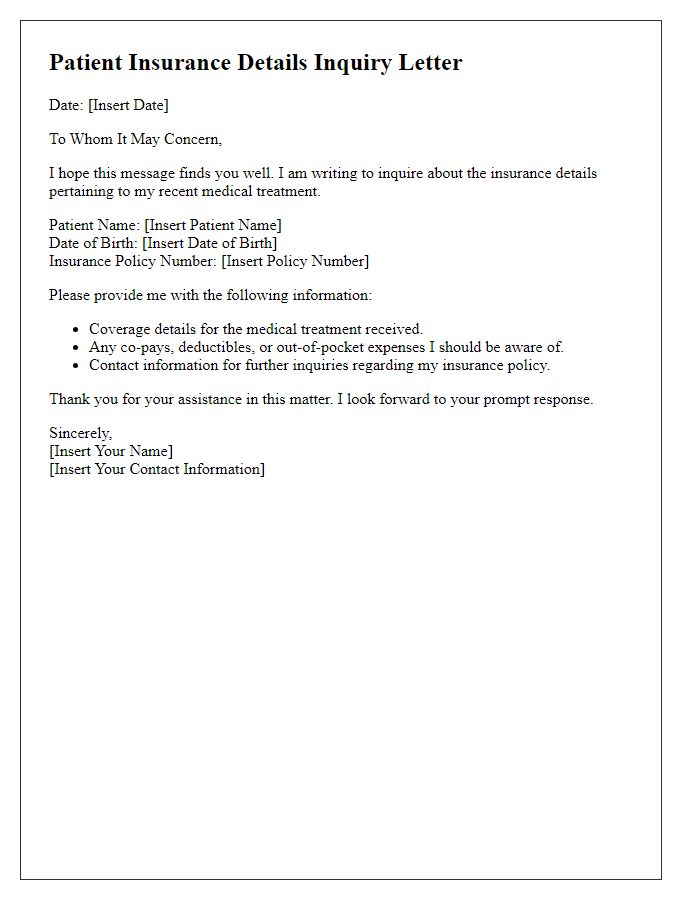

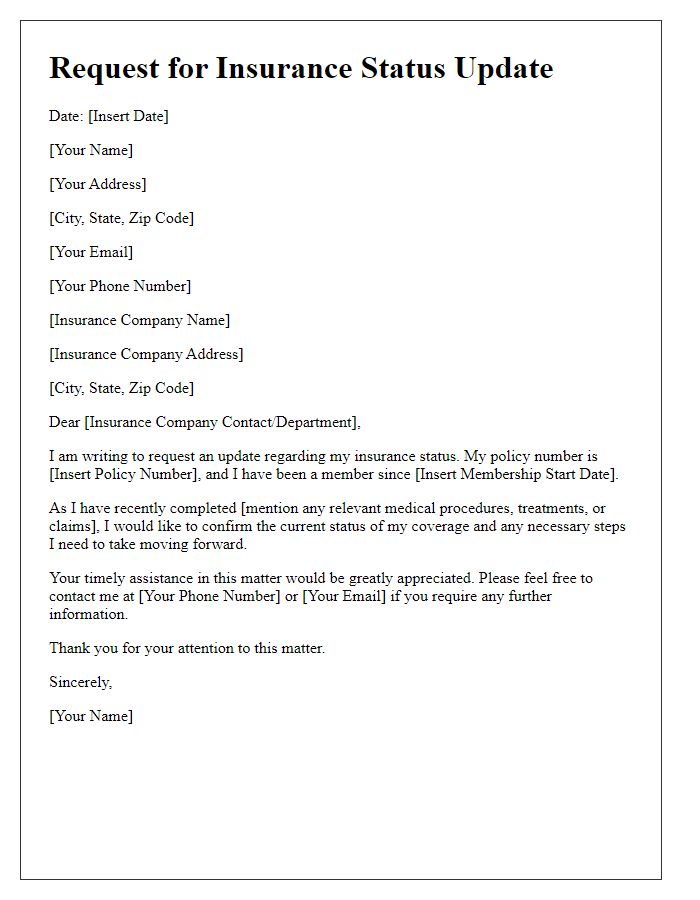

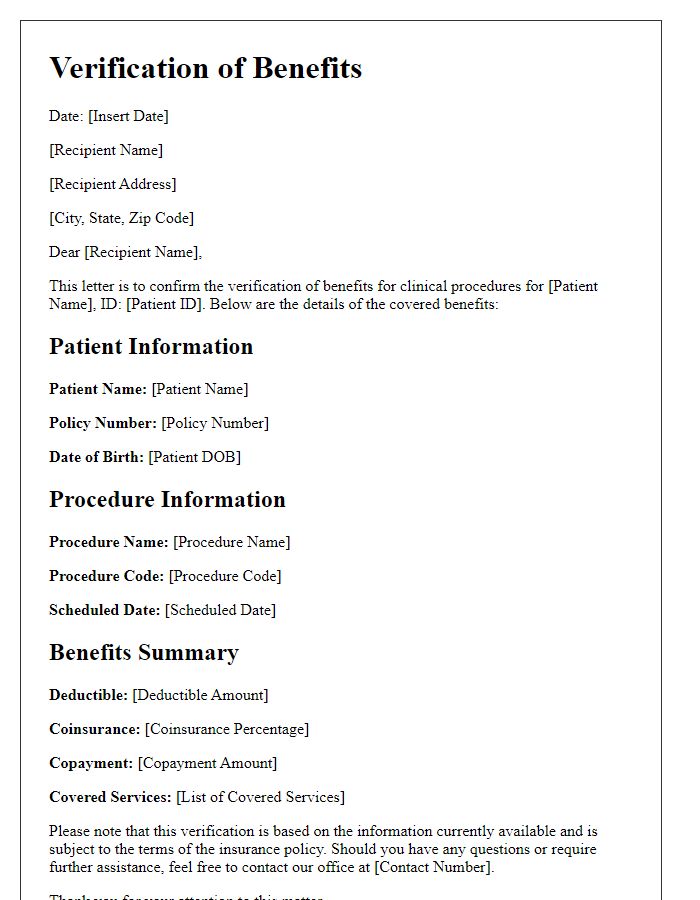

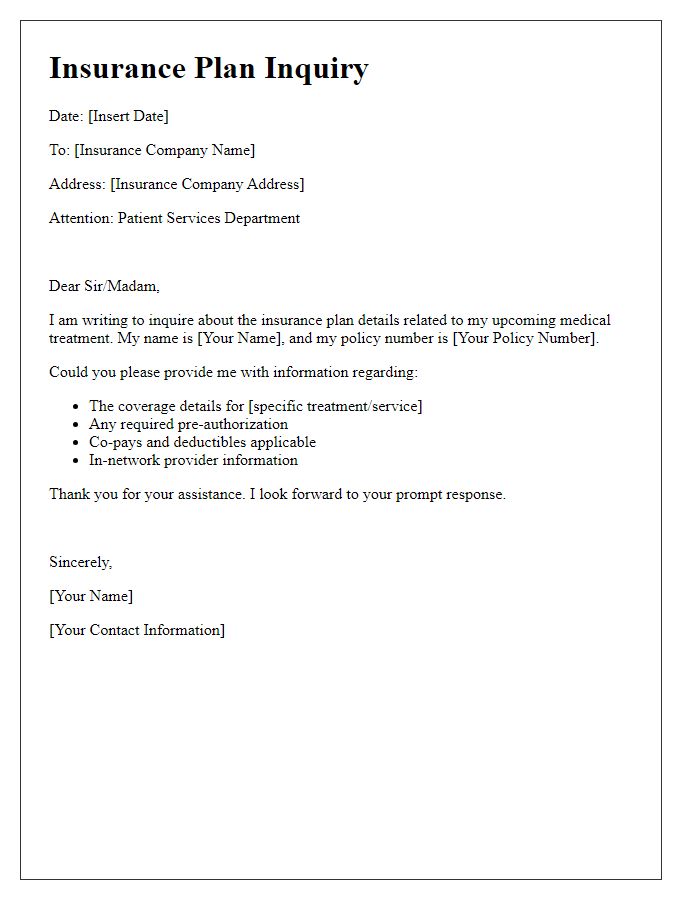

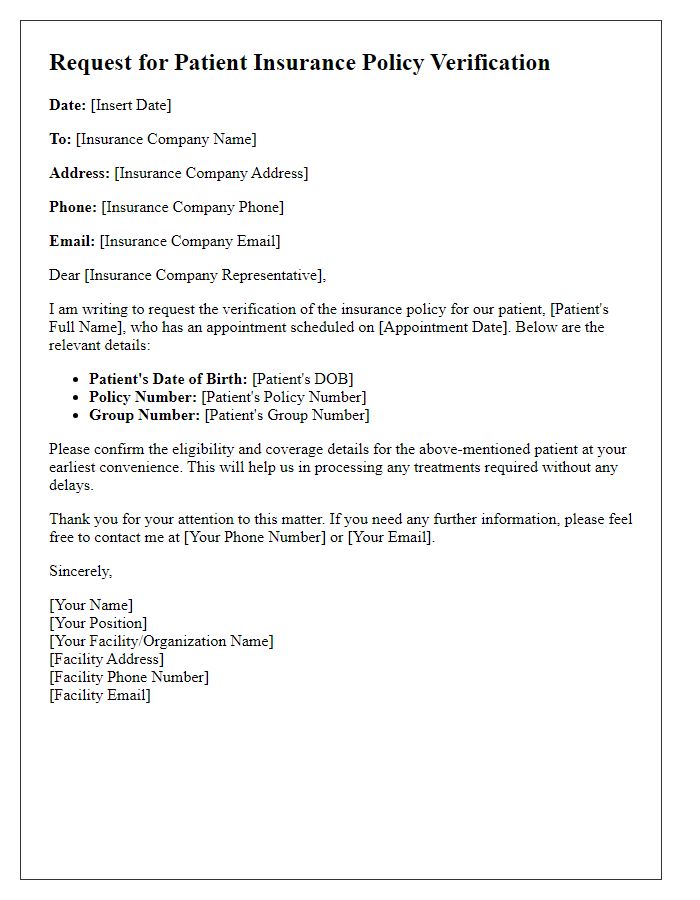

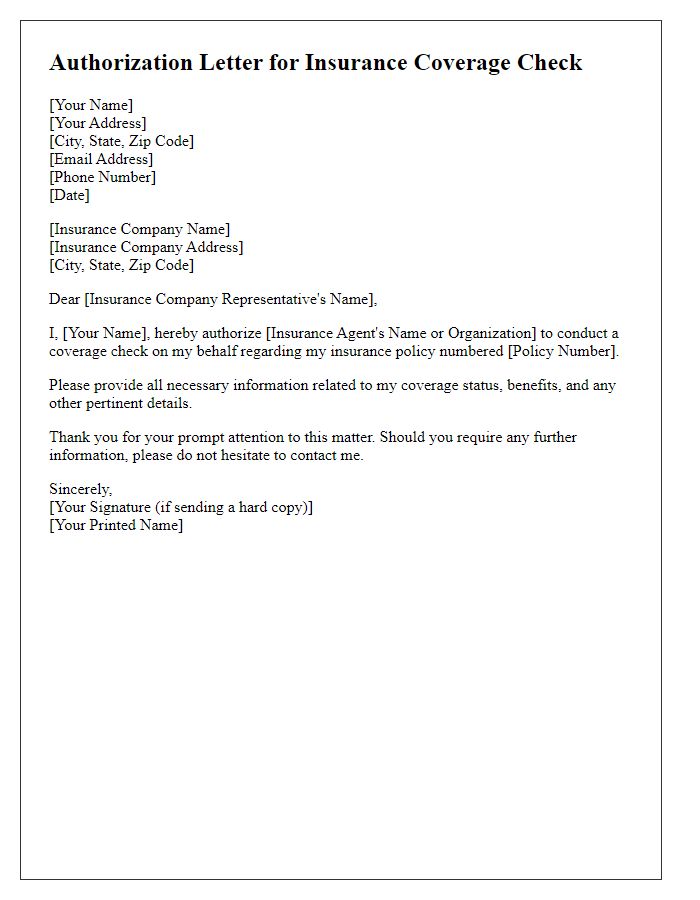

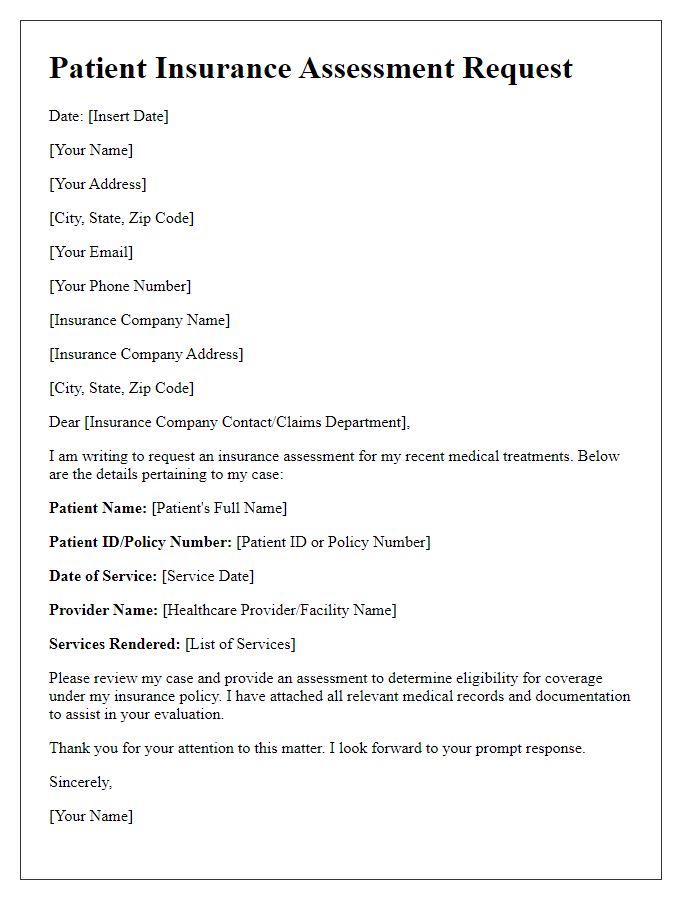

Letter Template For Patient Insurance Verification Samples

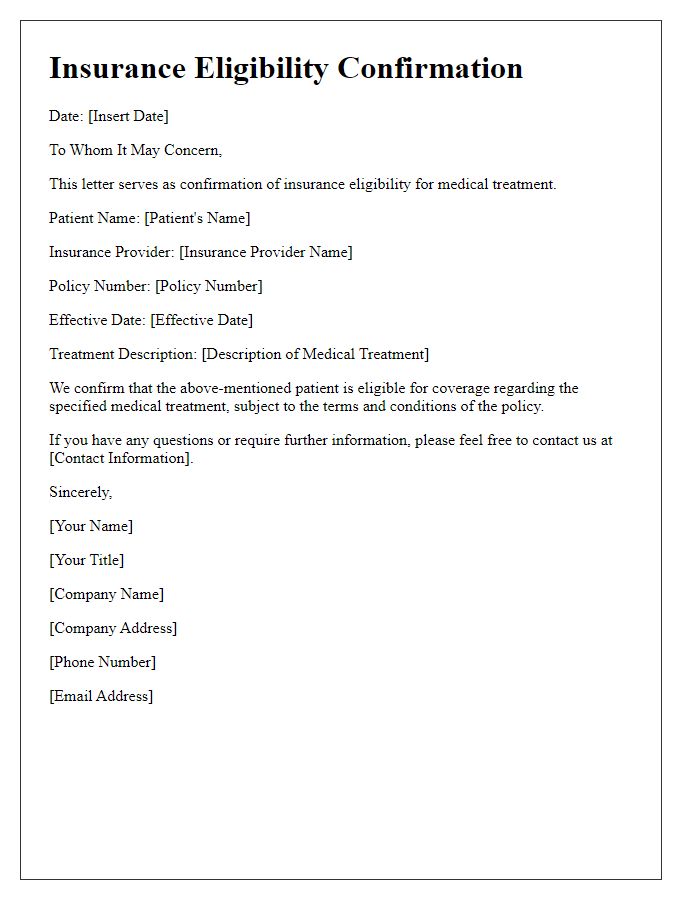

Letter template of insurance eligibility confirmation for medical treatment

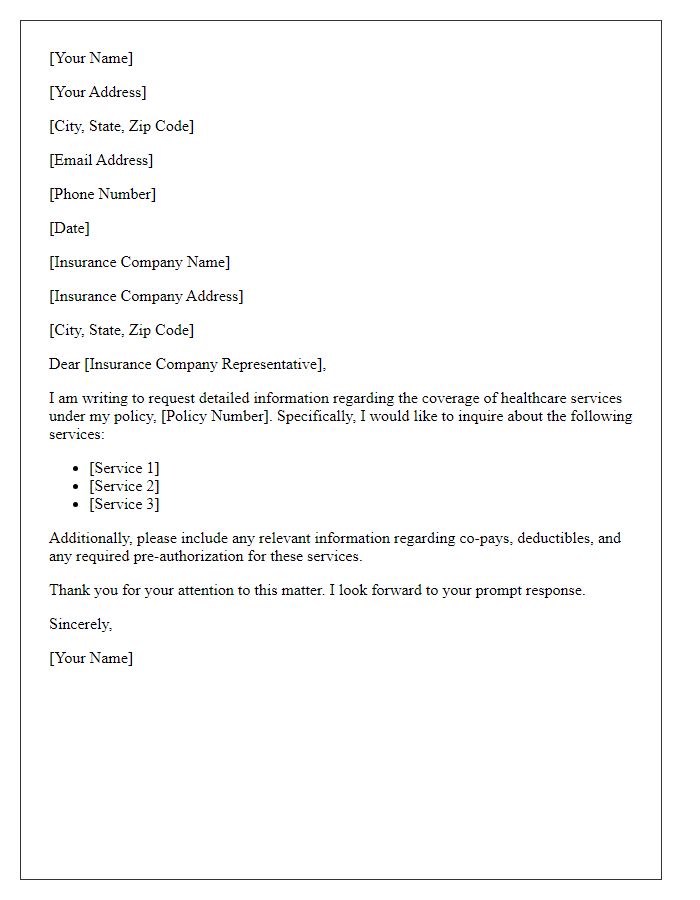

Letter template of request for coverage information for healthcare services

Comments