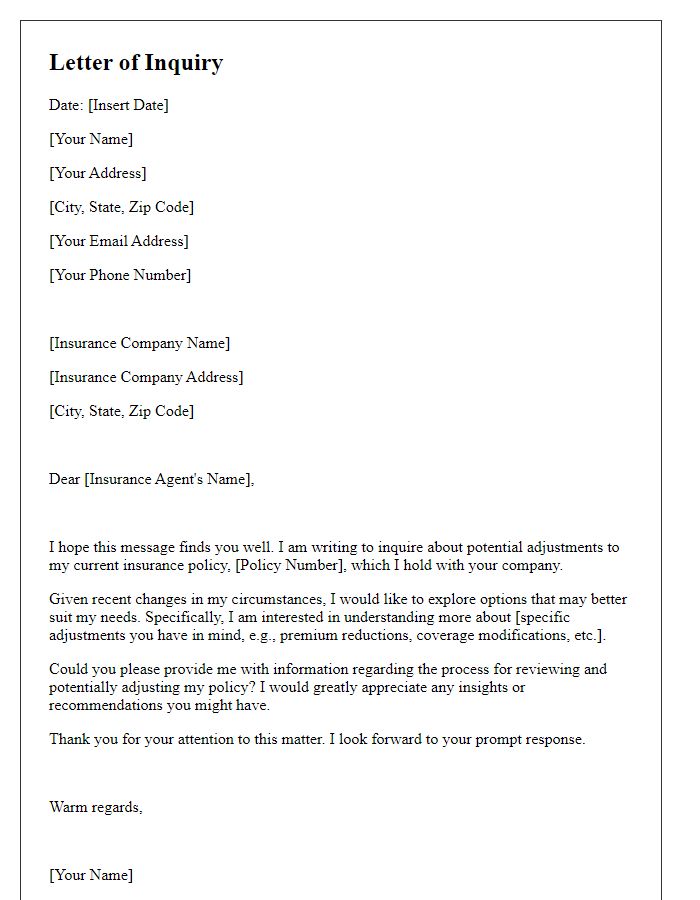

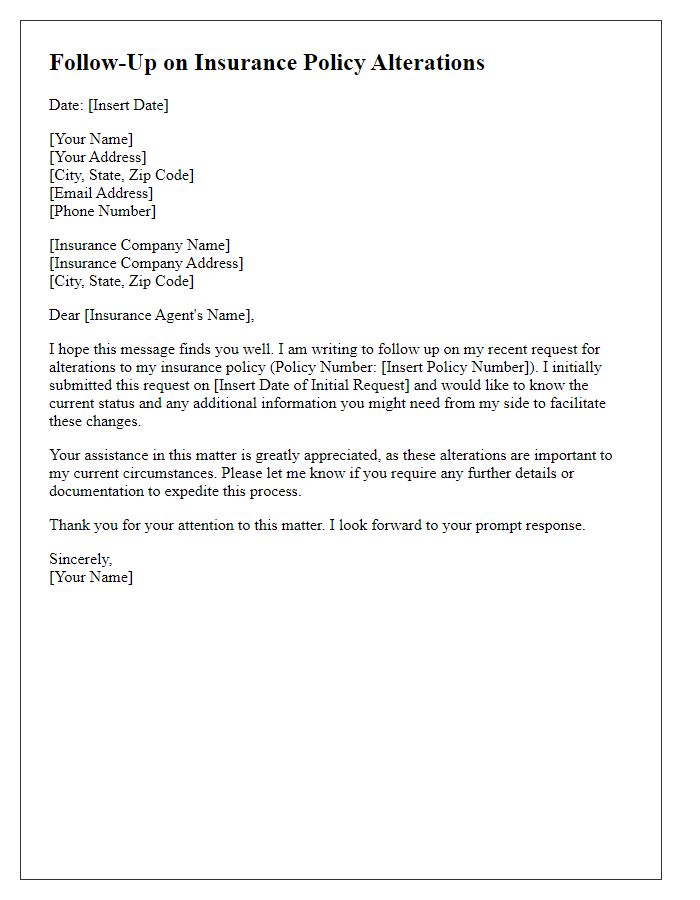

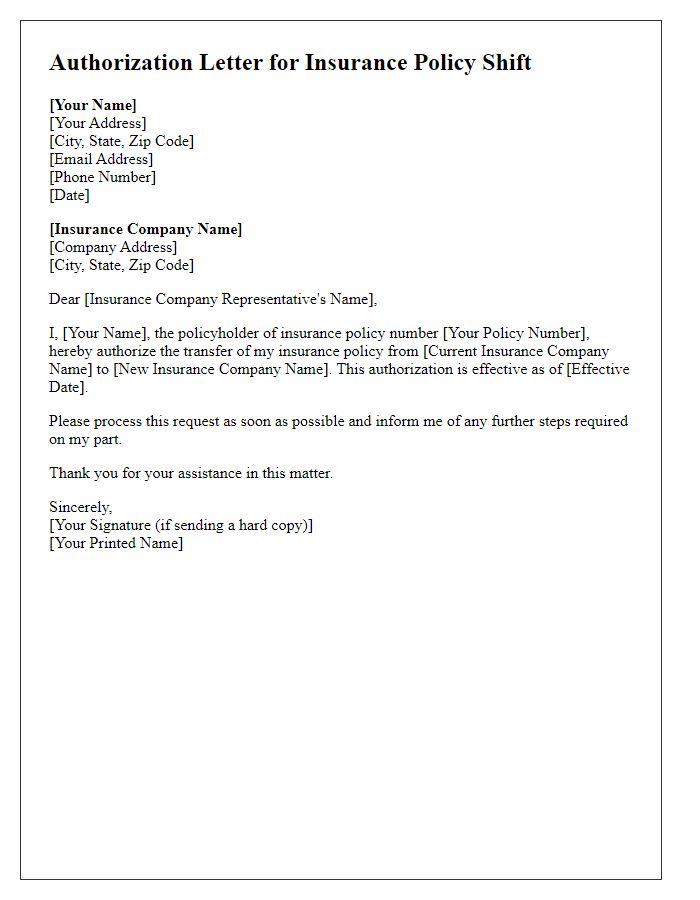

Are you considering making changes to your insurance policy? Whether you need to adjust your coverage, add new beneficiaries, or update your contact information, it's essential to understand the best practices for communicating these changes. Navigating the details can be tricky, but with the right letter template, you'll ensure your requests are clear and concise. Let's dive into the specifics and explore how you can effectively craft your letter.

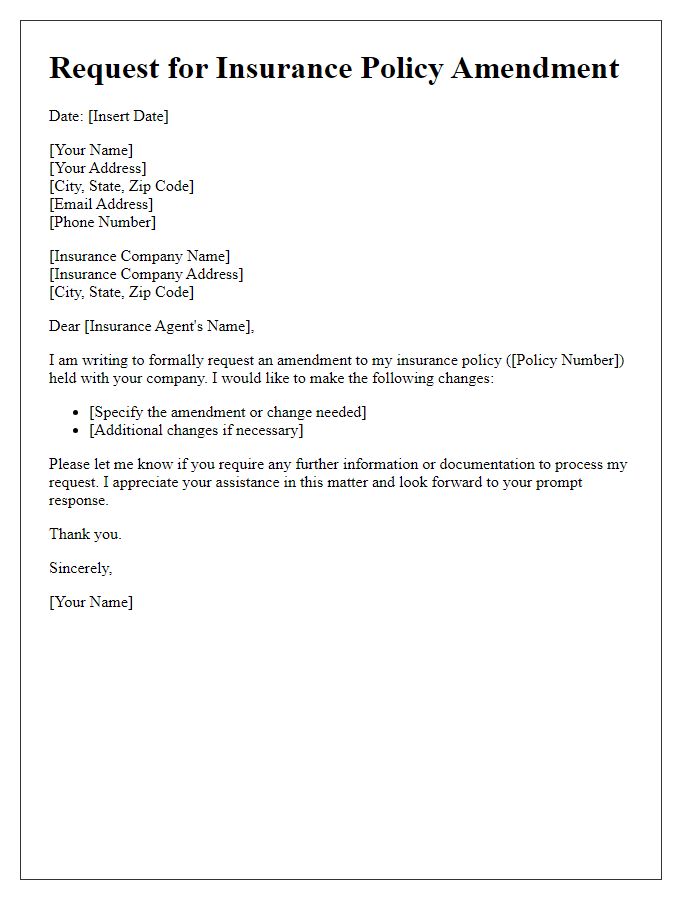

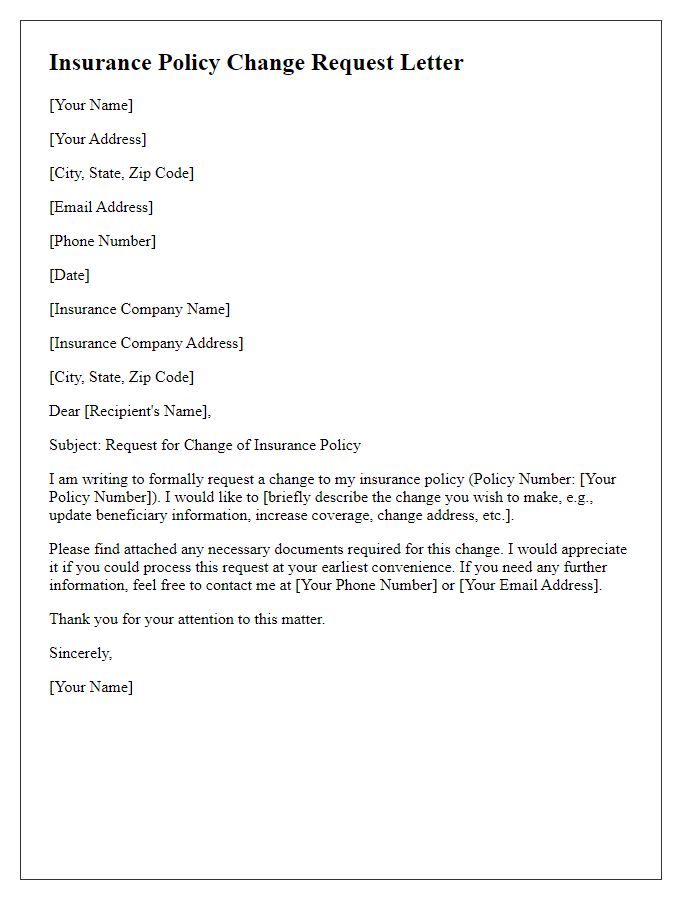

Policyholder Information

Policyholder information includes essential data such as the policyholder's full name, address, and contact number. Accurate details ensure effective communication and proper documentation of changes in insurance policies. Policy numbers (unique identifiers assigned by the insurance company), effective dates (the start date of coverage), and types of coverage (such as health, auto, or home insurance) highlight the scope of insurance protection. Additional elements like beneficiaries (individuals designated to receive benefits) and premium amounts (costs associated with maintaining the policy) further clarify the policyholder's coverage landscape. Regular updates to this information are crucial for maintaining coverage and ensuring timely claims processing.

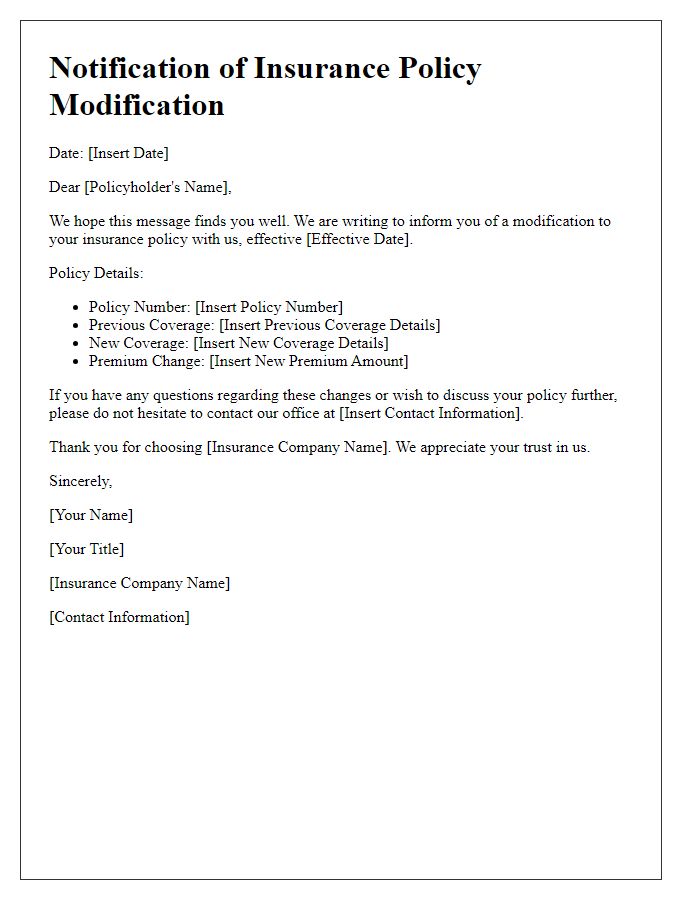

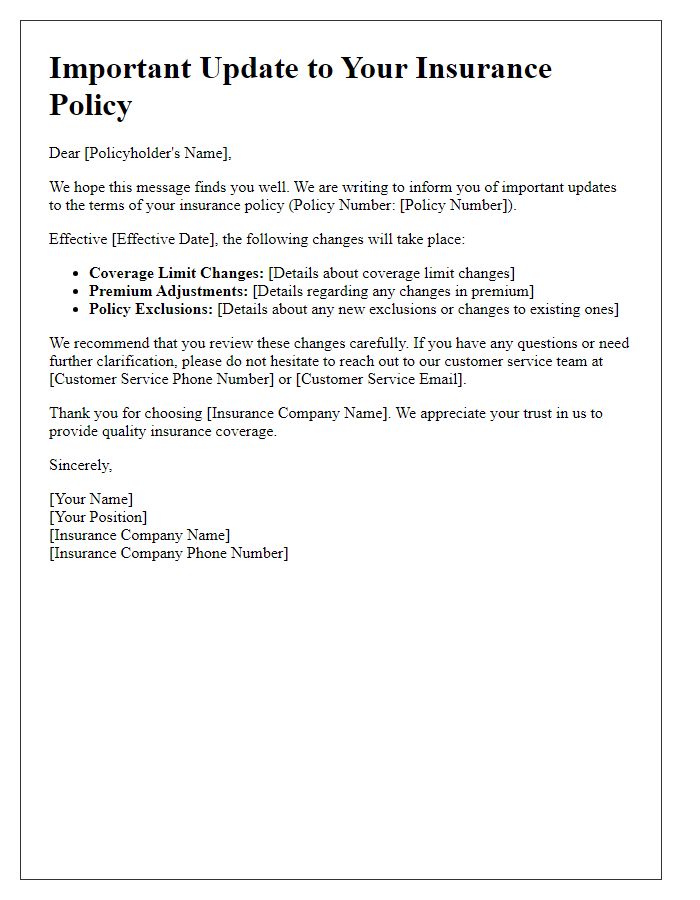

Current Policy Details

Current policy details refer to the existing insurance coverage parameters established under a specific contract. Insurance policies typically contain essential information such as the policy number, which uniquely identifies the agreement. Coverage limits define the maximum financial protection for various risks, like property damage or liability claims. Premium amounts indicate the cost paid regularly for the policy, while the deductible represents the out-of-pocket expenses required before benefits are accessed. Additionally, the insured parties must be named explicitly to outline who is covered under the policy. Policy terms also specify the effective date, marking the beginning of coverage, as well as renewal conditions, which determine how and when the policy can be extended. Understanding these details is crucial for any modifications to ensure that new coverage adequately meets the needs of the policyholder.

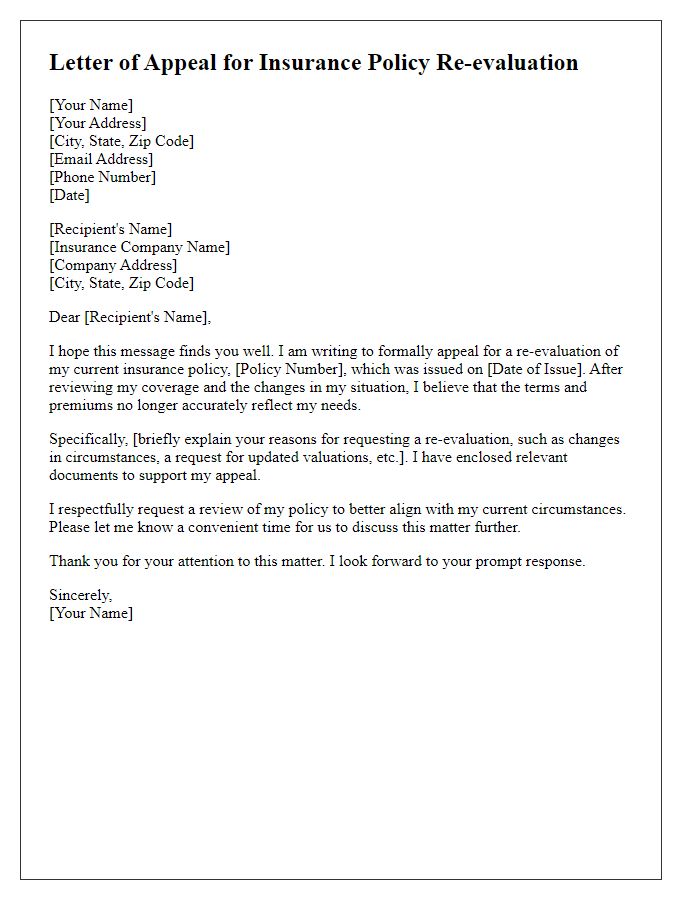

Requested Changes

Insurance policy modifications can have significant implications for coverage and premiums, especially in comprehensive plans offered by major companies like State Farm or Allstate. Important changes may include adjustments to personal liability limits, which can affect financial protection during unforeseen events, or alterations in deductibles (the amount paid out of pocket before coverage kicks in). Adding endorsements or riders enhances specific protections such as travel insurance or personal property coverage, which is essential for high-value items like jewelry or electronics. Policyholders should be aware of the effective date of changes, as well as any adjustments to premium costs, ensuring they maintain an adequate level of protection while aligning with their financial situation. Clarity in understanding renewal terms, particularly at the end of the policy term, can prevent lapses in coverage and ensure continuous protection.

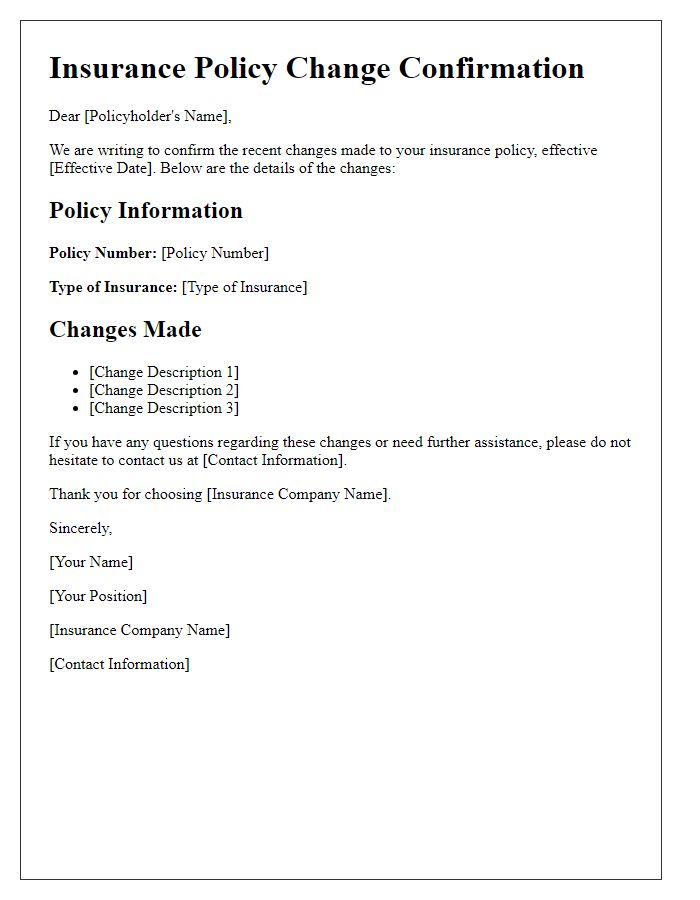

Effective Date of Changes

Insurance policy changes often require clear communication to ensure the policyholder understands the effective dates and implications. The proposed alterations should include details like the policy number, the specific changes being made (such as coverage limits, premiums, or deductibles), and the effective date of these changes (which can be a specific date, often the start of a new billing cycle). It's crucial to highlight any potential impacts on coverage, including exclusions or additions, and how these changes align with state regulations, ensuring compliance with laws effective in October 2023. Policyholders should be informed of any options available for reviewing or disputing changes, providing a clear path for further inquiry or clarification.

Contact Information for Clarification

Insurance policy adjustments often require clear communication to ensure proper understanding and resolution. Policyholders may need to reach out to the customer service department of their insurance provider, typically available via phone at a dedicated helpline number, such as 1-800-123-4567. Alternatively, email correspondence can be directed to support@exampleinsurance.com for inquiries or clarification regarding changes to coverage, premiums, or specific benefits. In many cases, policies are issued by well-known companies, such as Allstate or State Farm, which provide additional resources on their official websites. Accessing the FAQ section may also offer helpful insights into common concerns related to policy modifications.

Comments