Are you looking to maximize your savings while maintaining strong relationships with your suppliers? Requesting an early payment discount can be a smart strategy that benefits both parties, helping you save on costs while ensuring your vendors receive timely cash flow. In this article, we'll walk you through a practical letter template that makes your request clear and professional. So, let's dive in and discover how to craft an effective letter that can pave the way for those valuable discounts!

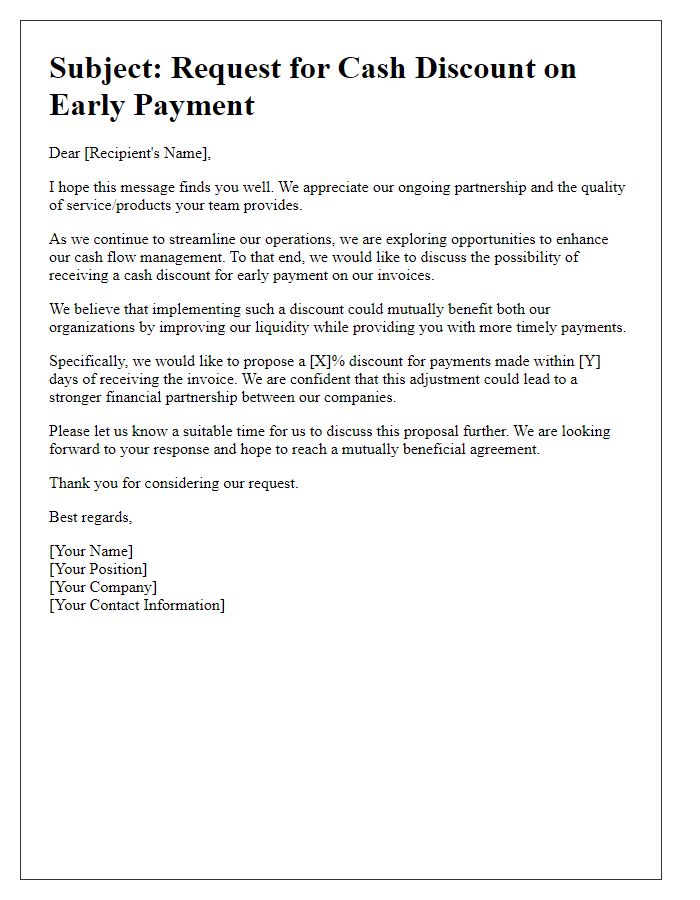

Polite and Professional Tone

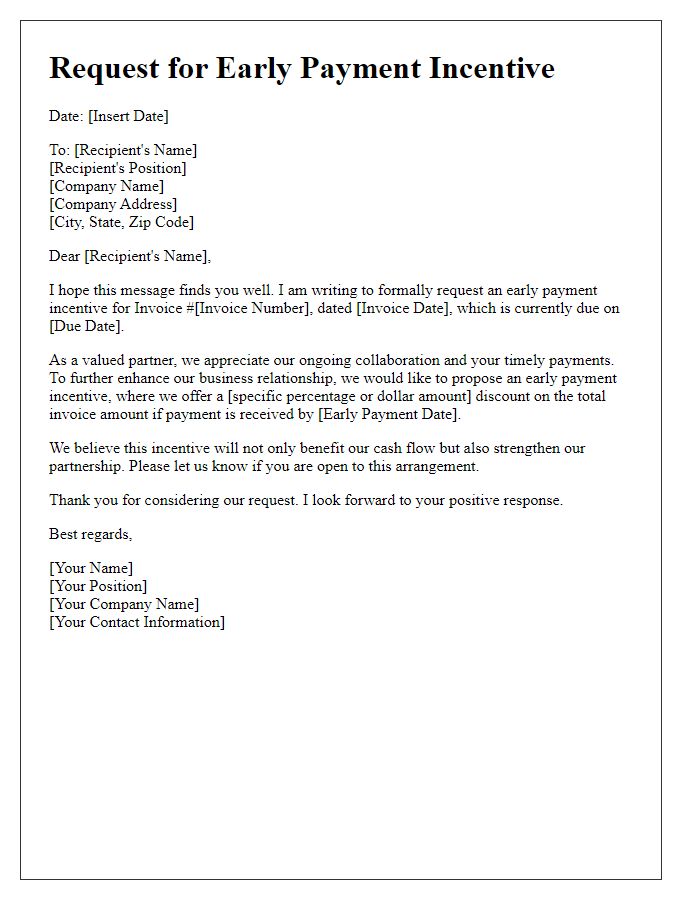

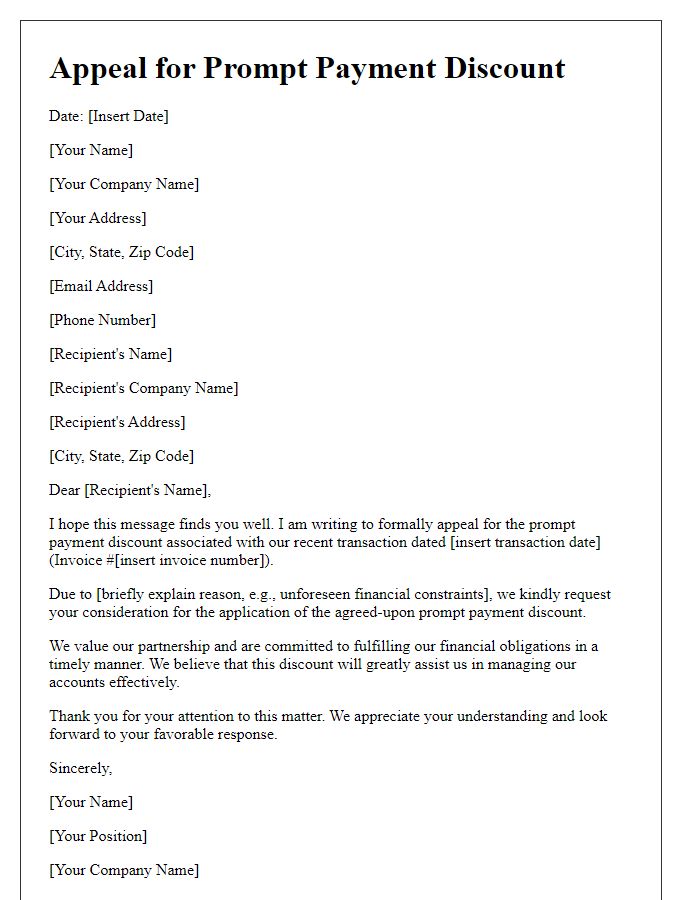

In the realm of financial transactions, an early payment discount serves as an incentive for clients to settle invoices ahead of schedule, contributing to improved cash flow for businesses. Such discounts typically range from 1% to 5% of the total invoice amount, depending on the payment timeline agreed upon. For example, a company may offer a 2% discount if payment is received within 10 days instead of the standard 30-day period. Proper documentation, including clear terms on invoices, can facilitate this process. Additionally, maintaining a polite and professional tone in communication enhances relationships, encouraging timely payments and fostering cooperation. Regularly assessing customer payment behaviors may also reveal opportunities to implement early payment incentives effectively.

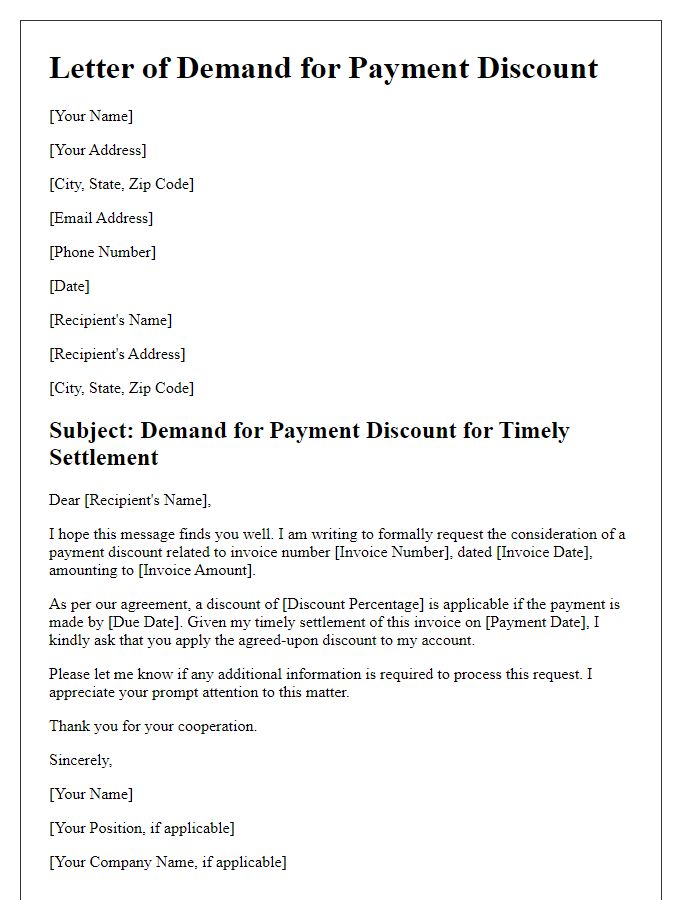

Clear Request for Discount Terms

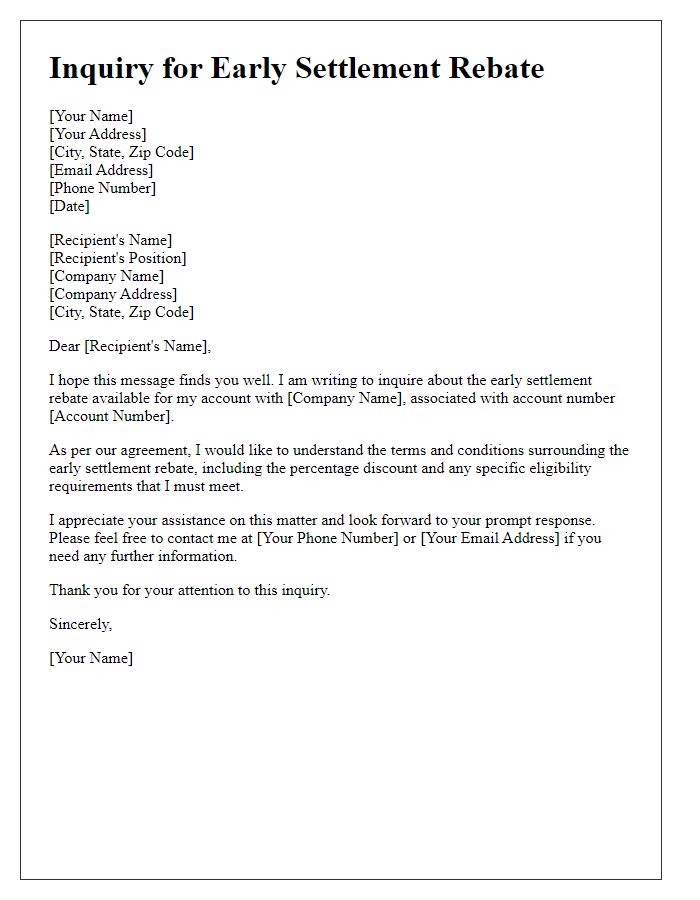

Requesting an early payment discount can significantly improve cash flow for businesses. Clear communication regarding discount terms, such as a percentage off the invoice total for payment made within a specified timeframe (commonly 2% off if paid within 10 days), can foster great relationships between suppliers and clients. This arrangement can be especially beneficial for both parties during peak financial periods, such as the end of the fiscal quarter or holiday seasons when cash management is critical. Implementing such terms can also incentivize prompt payments, enhancing liquidity. Clear documentation of expectations, payment processes, and timelines can prevent misunderstandings and ensure smooth transactions.

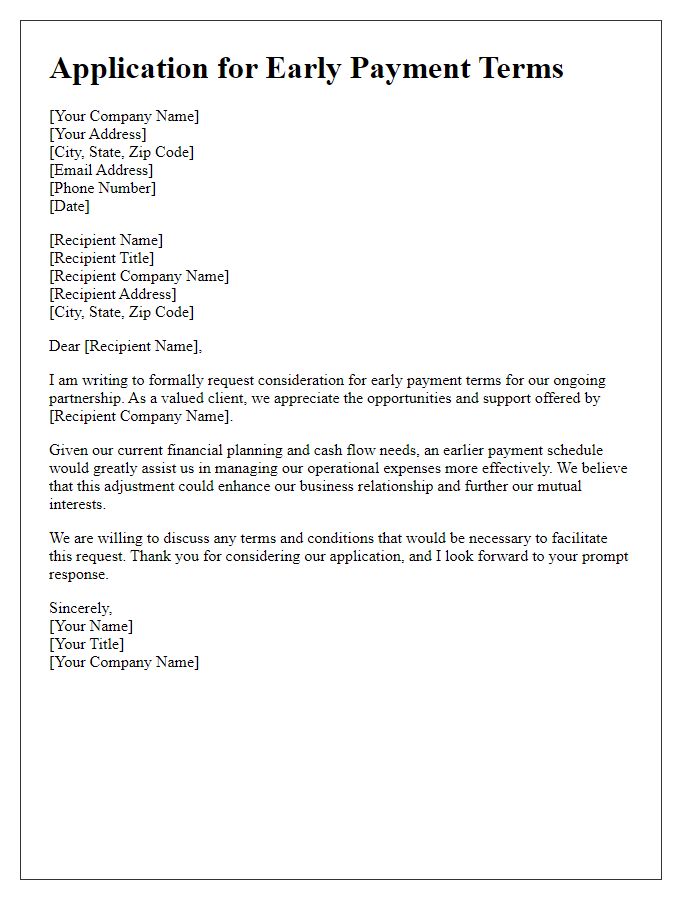

Justification of Early Payment Benefits

An early payment discount presents significant advantages for businesses by enhancing cash flow efficiency, which is crucial for operations. Prompt payments can reduce outstanding accounts receivable numbers, minimizing the risk of defaults. For instance, a typical business might benefit from a 2% discount for payments made within 10 days instead of the standard 30-day term. This strategy not only cultivates stronger supplier relationships, like those with local manufacturers in New York, but also allows companies to reinvest savings into their operations. Additionally, accelerated payments can help organizations meet financial obligations sooner, preventing late fees and accruing interest charges, ultimately contributing to healthier financial stability.

Specific Invoice or Transaction Details

An early payment discount can significantly enhance cash flow for businesses, especially when dealing with specific invoices like Invoice #12345 from ACME Corp. This invoice, dated March 15, 2023, amounting to $10,000, highlights the importance of maintaining strong supplier relationships. By offering a 2% early payment discount, the total payable could decrease to $9,800 if settled by March 30, 2023. Prompt payment also assures continued supply of goods and services while strengthening commitment to timely cash management practices. Establishing terms like this fosters a beneficial partnership, encouraging prompt payments in future transactions.

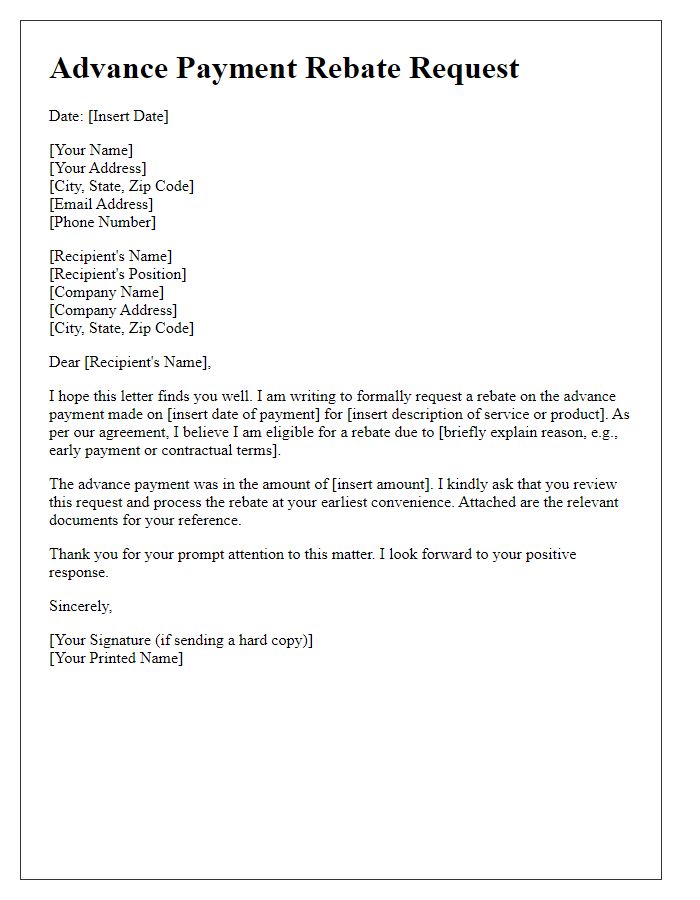

Contact Information for Follow-up

Requesting an early payment discount can significantly improve cash flow for businesses. A well-structured request highlights the benefit of timely payments, such as improved business relations and consistent service. Important details include the specific percentage discount being sought, terms of payment, invoice numbers related to past transactions, and a deadline for the discounted payment. Including company contact information, such as phone number or email address, ensures seamless follow-up communication. Providing a clear and concise summary emphasizes mutual benefits, fostering a collaborative approach with clients and suppliers.

Comments