Are you navigating the often complex waters of estate distribution? Creating a clear and legally sound agreement is essential for ensuring that all parties agree on how assets will be divided. With the right letter template, you can streamline this process, making it easier for everyone involved to understand their rights and responsibilities. Dive into our comprehensive guide and discover how to craft an effective estate distribution agreement that best suits your needs.

Introduction and Identification of Parties

An estate distribution agreement binds heirs and beneficiaries in the division of assets from a decedent's estate. Clear identification of involved parties sets the groundwork for transparency throughout the process. Parties typically include the executor, named in the last will or appointed by the probate court, and heirs such as children, spouses, or designated beneficiaries. For instance, John Smith, the executor, a resident of Springfield, and Mary Johnson, the daughter, a resident of Chicago, may outline their respective roles. Proper identification ensures clarity in the legal document, promotes understanding among stakeholders, and assists in averting future disputes regarding the distribution process.

Description of Estate Assets

The estate assets encompass various properties and financial holdings. Real estate includes a three-bedroom family home located at 123 Elm Street, Springfield, valued at approximately $350,000, and a vacation condo in Myrtle Beach, South Carolina, assessed at around $250,000. Personal property includes a vintage car, a 1965 Ford Mustang, appraised at $30,000, and an extensive collection of fine art, estimated to be worth $75,000. Financial assets consist of a savings account at First National Bank with a balance of $50,000, a stock portfolio valued at $100,000 with notable shares in companies like Apple and Tesla, and a life insurance policy with a payout of $200,000. This comprehensive collection of estate assets forms the basis for equitable distribution among the beneficiaries as outlined in the agreement.

Terms and Conditions of Distribution

An estate distribution agreement outlines the terms and conditions governing the distribution of assets belonging to a deceased individual's estate, including bank accounts, real estate properties, personal belongings, and investments. This legal document typically specifies the beneficiaries, including family members and charitable organizations, detailing the proportion of each beneficiary's share. The agreement also includes provisions regarding debts, taxes, and expenses related to the estate settlement process, ensuring all financial obligations are fulfilled prior to distribution. Furthermore, the document may address dispute resolution methods, such as mediation or arbitration, to handle any conflicts that may arise between beneficiaries regarding asset distribution. Additionally, the executor's responsibilities in managing the estate until complete distribution are defined, establishing a clear timeline for the process, often within a specified number of months post-probate court approval.

Signature and Notarization Section

The Signature and Notarization Section of an estate distribution agreement includes essential details to ensure the legality and authenticity of the document. Each party involved, such as heirs and executors, must provide their signatures in designated spaces, confirming their consent to the terms outlined in the agreement. Dates should be clearly marked alongside signatures to establish a timeline of acceptance. A notary public, an authorized individual who verifies signatures and identities, must then notarize the document, affixing their official seal and signature, thus confirming that all parties signed the agreement willingly and without coercion. This added layer of validation enhances the enforceability of the estate distribution agreement in jurisdictions, such as California, ensuring all legal requirements are met for property transfer.

Confidentiality and Dispute Resolution Clause

A confidentiality clause in an estate distribution agreement aims to protect the privacy of the involved parties and the sensitive information regarding asset distribution. It ensures that all individuals participating in the agreement, including heirs and executors, are legally bound to maintain confidentiality about the details of the estate's assets and their distribution process. Breach of this clause can lead to legal repercussions. The dispute resolution clause outlines the process for resolving conflicts or disagreements that may arise during the distribution of the estate, encouraging mediation or arbitration before resorting to litigation. This approach often aims to maintain familial relationships and reduce legal costs. Typically, mediators or arbitrators are selected from a list agreed upon by all parties, ensuring an impartial resolution. The clause may also specify the governing law applicable to the agreement, reinforcing clarity and legal validity.

Letter Template For Estate Distribution Agreement Samples

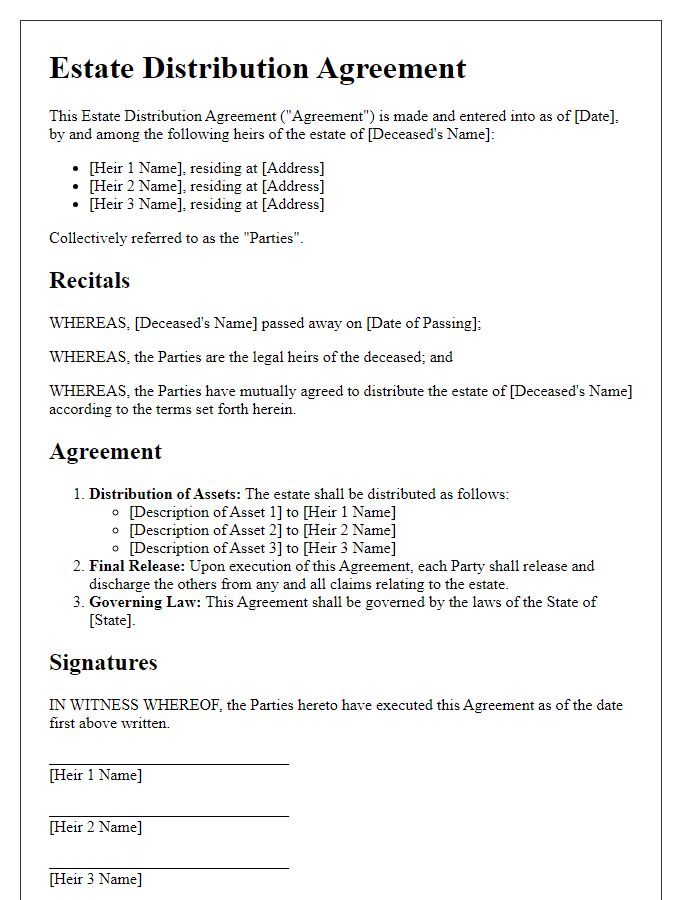

Letter template of estate distribution agreement for mutual agreement among heirs

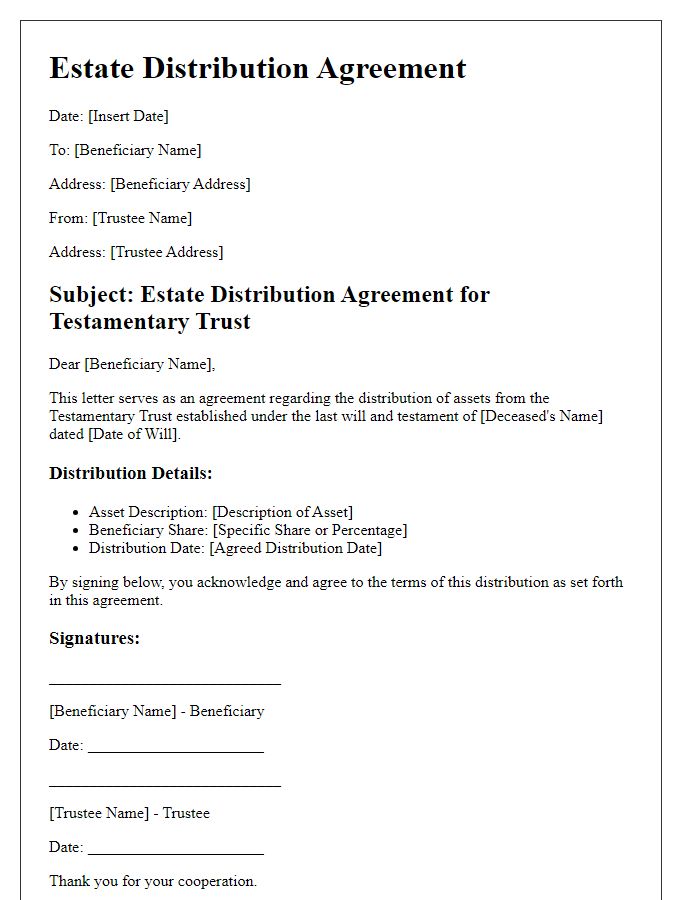

Letter template of estate distribution agreement for testamentary trust beneficiaries

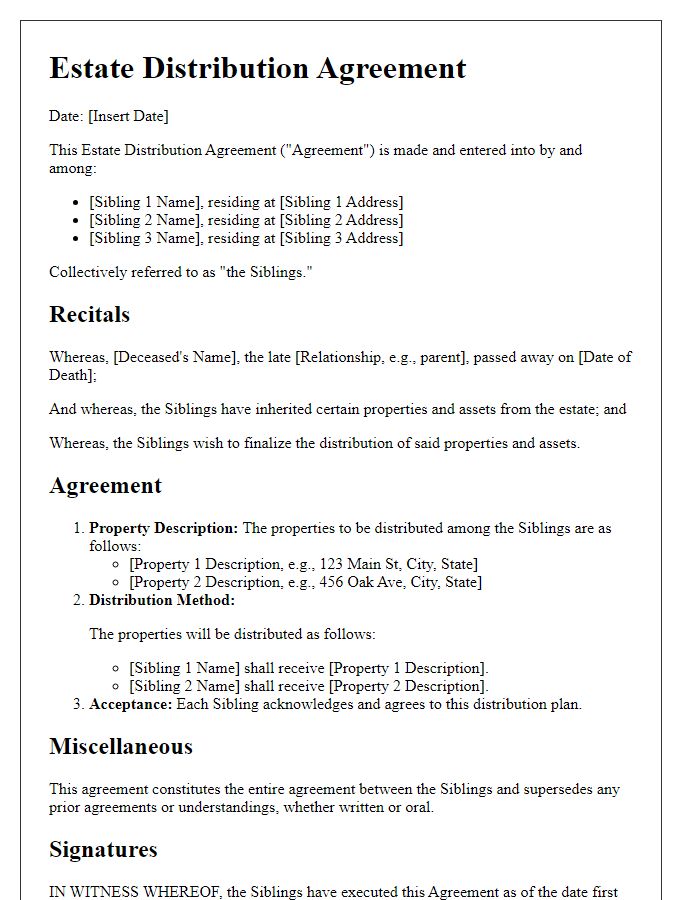

Letter template of estate distribution agreement for property division among siblings

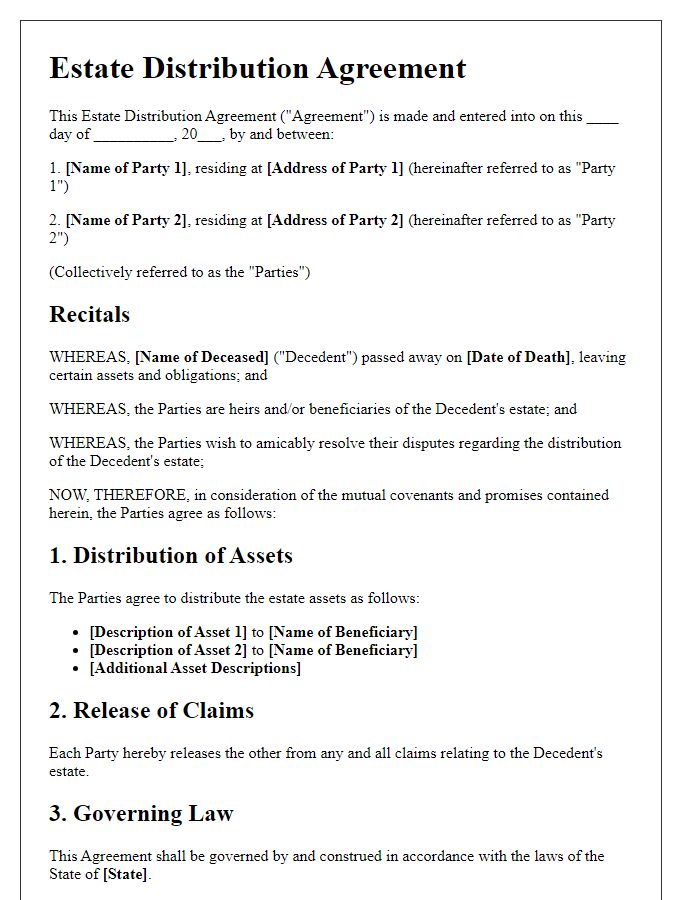

Letter template of estate distribution agreement for amicable settlement of estate disputes

Letter template of estate distribution agreement for executor's report and beneficiaries’ approval

Letter template of estate distribution agreement for real estate asset division

Letter template of estate distribution agreement for liquidating estate assets

Letter template of estate distribution agreement for the allocation of personal belongings

Letter template of estate distribution agreement for final settlement of debts and claims

Comments