Are you looking to navigate the complexities of employee stock options agreements? Understanding this crucial aspect of compensation can empower you and enhance your financial future. In the following sections, we'll break down the key elements that make up a stock options agreement and the benefits it can offer employees. So, let's dive in and explore how you can make the most of this powerful tool!

Basic Definitions and Terms

Employee stock options agreements define the rights granted to employees. Stock options give individuals the choice to purchase company shares (equity) at a predetermined price (exercise price) within a designated timeframe (usually 10 years). Vesting schedule delineates the timeline for when stock options can be exercised, often structured over several years (commonly four years with a one-year cliff). The exercise period specifies the span during which employees can buy stock after their options vest. Fair market value (FMV) reflects the company's stock price on a specific date, crucial for determining tax implications. In the event of company acquisition or merger, change of control provisions may accelerate vesting, allowing employees to exercise options. Additionally, termination terms outline consequences for employees who leave the company before options are fully vested.

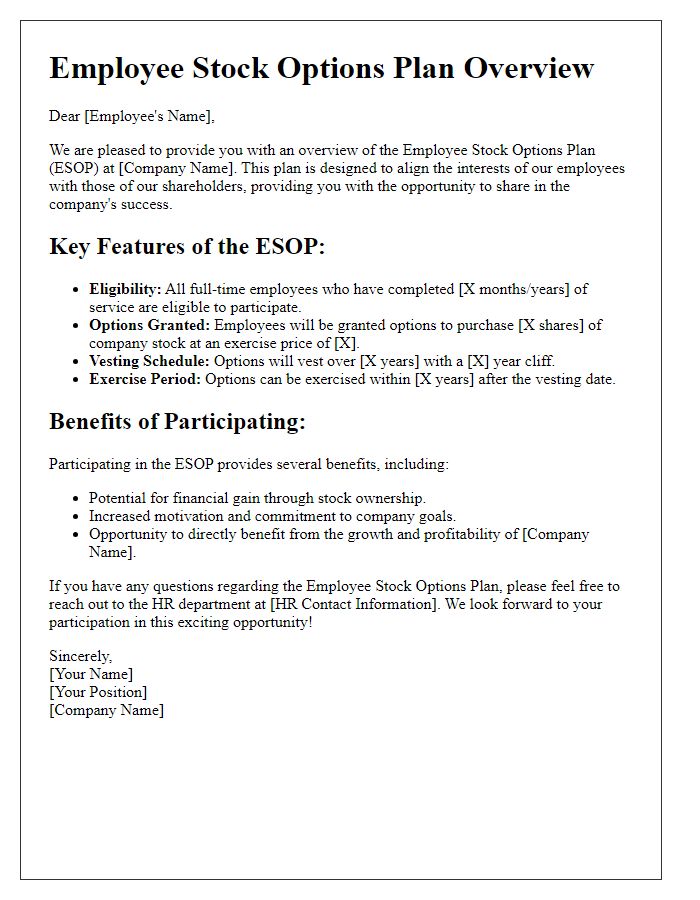

Grant of Stock Options

The Grant of Stock Options represents a significant opportunity for eligible employees within corporate structures, such as publicly traded companies or private firms looking to incentivize performance. This agreement typically details the number of stock options granted (commonly ranging from 100 to several thousand shares), the vesting period--often extending over four years with a one-year cliff--and the exercise price, which is usually set at the fair market value at the time of the grant. Additionally, employees must understand the potential tax implications, including ordinary income tax on the difference between the exercise price and the market value upon exercise. Furthermore, the terms outline any conditions upon termination of employment, ensuring clarity regarding the expiration of unexercised options. This stock options framework fosters a sense of ownership and aligns employees' interests with the company's long-term success, particularly in competitive industries like technology or pharmaceuticals.

Vesting Schedule

An employee stock options agreement outlines a vesting schedule that details the timeline for an employee's right to exercise stock options granted by the company. Typically, a four-year vesting schedule is standard, with a one-year cliff, meaning that the employee must work for the company for at least one year before any options vest. After the cliff period, options usually vest monthly or quarterly over the remaining three years. This means that if an employee receives 1,200 stock options, 300 options will vest at the end of the first year, and the remaining options will vest in equal installments across the next three years. Each option allows the employee to purchase company stock at a predetermined exercise price, promoting alignment between employee performance and company growth. Should the employee leave the company before all options are vested, unvested options will be forfeited, while vested options typically remain exercisable for a set period, often 90 days post-termination.

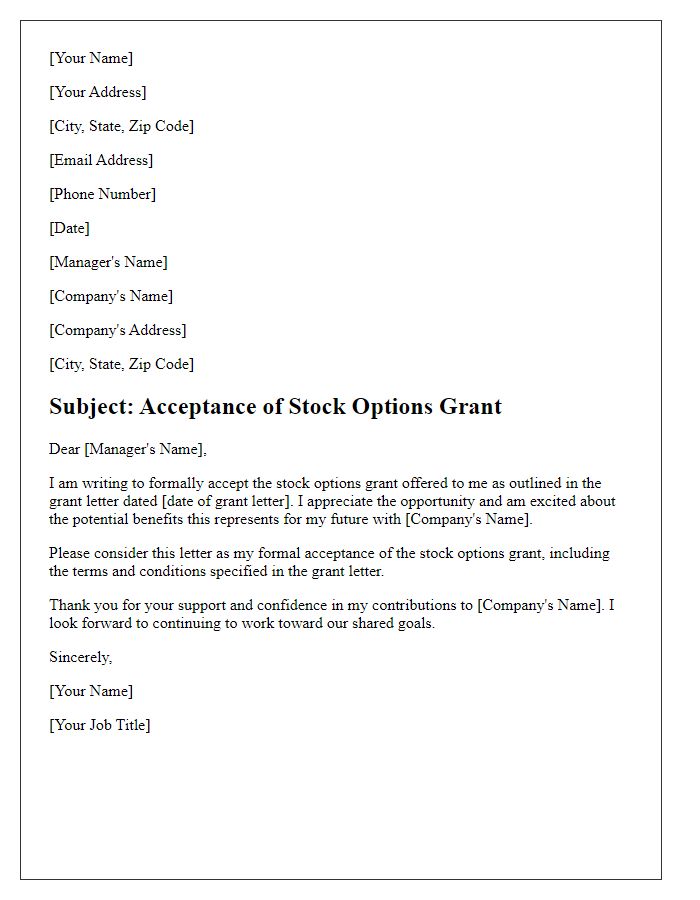

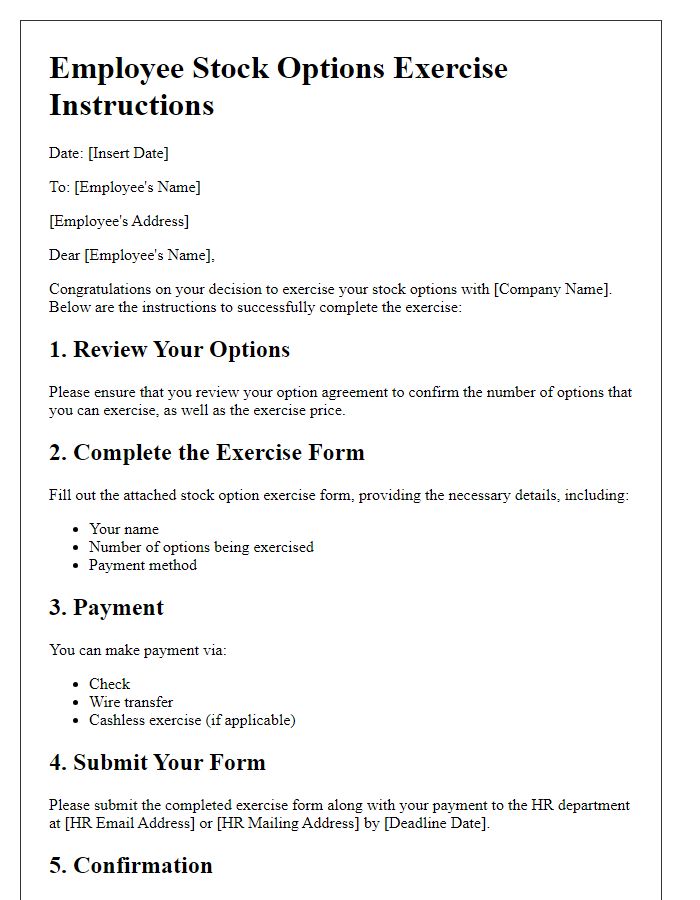

Exercise of Options

Employee stock options represent a valuable benefit for employees, granting them the right to purchase shares of their company's stock at a predetermined price (also known as the exercise price or strike price). Typically, this price aligns with the stock's market value at the time of the options grant, often fostering employee loyalty and investment in the company's success. Employees must consider the exercise period defined in the agreement, which typically spans several years, allowing them to capitalize on favorable market conditions. Tax implications arise upon exercising options, particularly concerning the sale of shares and the recognition of income. Additionally, understanding the company's performance, stock price fluctuations, and the potential impact of market events are critical in making informed decisions about exercising options to maximize financial benefits.

Termination and Forfeiture

Employee stock options agreements serve as a crucial financial instrument for employees, particularly in company environments that encourage equity ownership. Clear termination and forfeiture provisions ensure both parties understand the implications if employment ends. Various termination scenarios exist, including resignation, retirement, or involuntary termination, where options may either fully vest or be forfeited. Specific time frames dictate exercise windows post-termination, oftentimes ranging from 30 to 90 days. Furthermore, terms may differ significantly based on the employee's role, such as executive vs. non-executive, influencing the valuation and timing of options. Compliance with regulations like IRS Section 409A ensures tax implications are addressed, safeguarding both the issuer and the employee from unforeseen taxation issues. Overall, precise language detailing these terms aids in preventing future disputes and fostering a mutually beneficial relationship.

Comments