Are you considering making a charitable donation but unsure how to formalize your generosity? Crafting a clear and effective donation agreement is essential to ensure that your contribution is used as intended. A well-structured letter not only outlines the specifics of your donation but also fosters a transparent relationship between you and the charity. Dive in to learn more about creating a donation agreement that reflects your values and intentions!

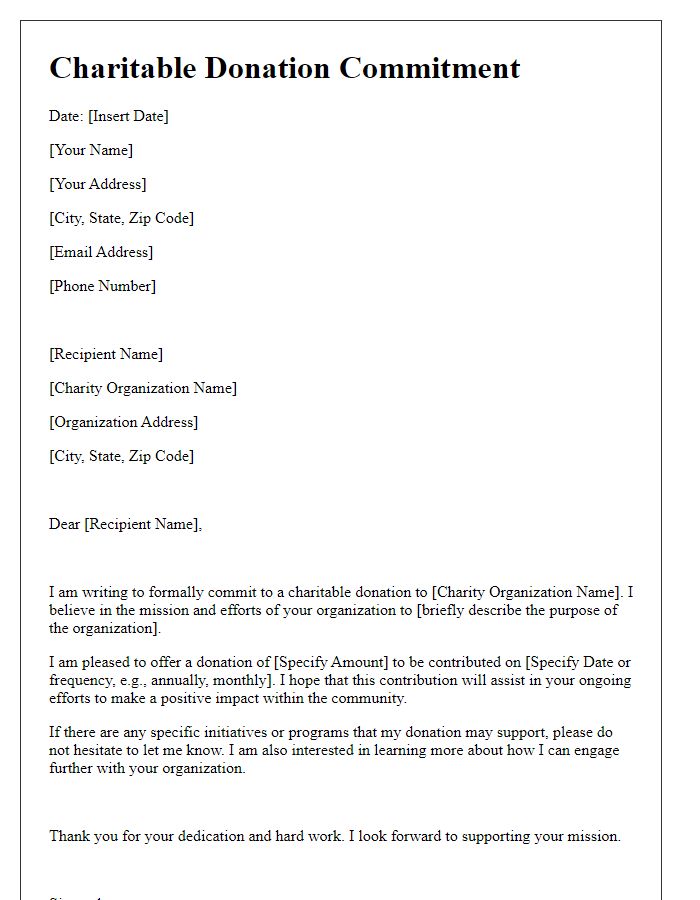

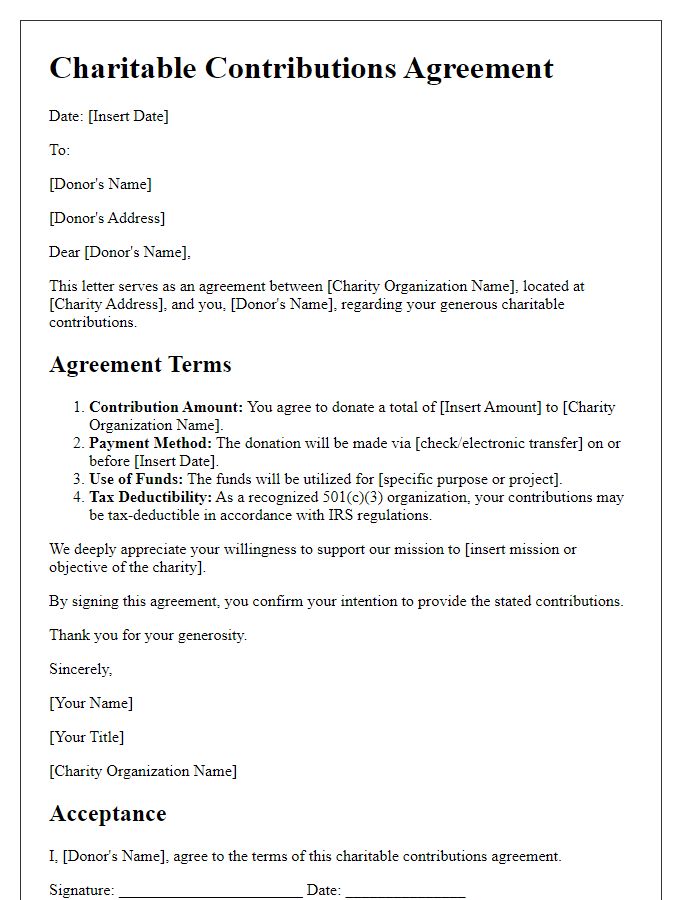

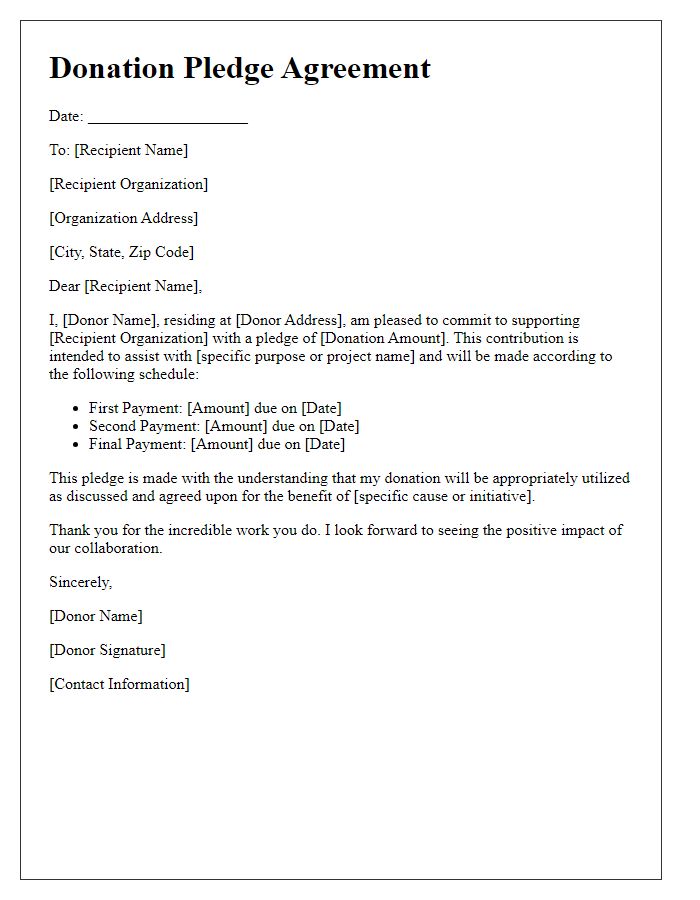

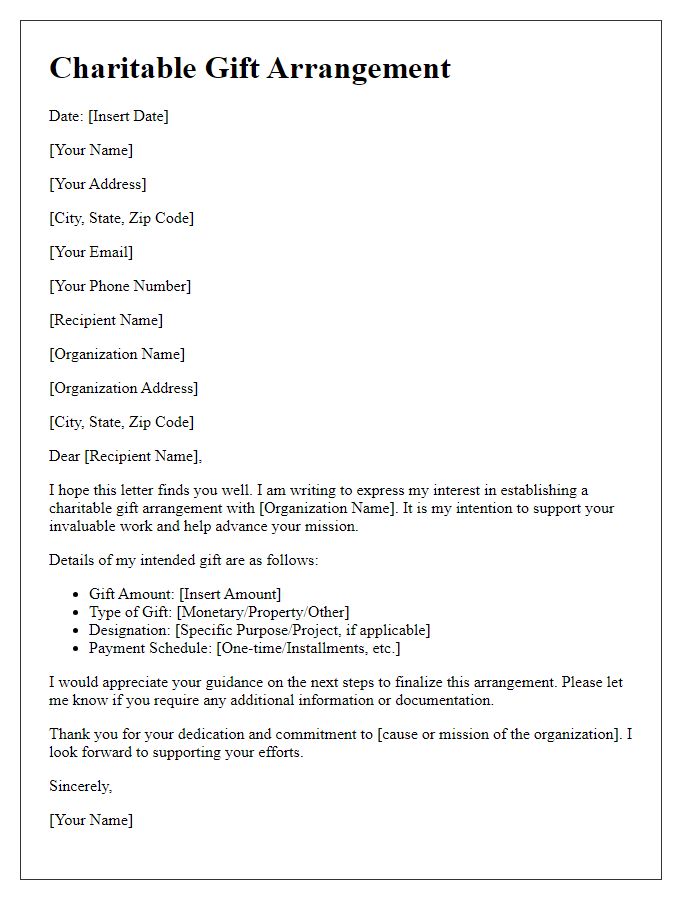

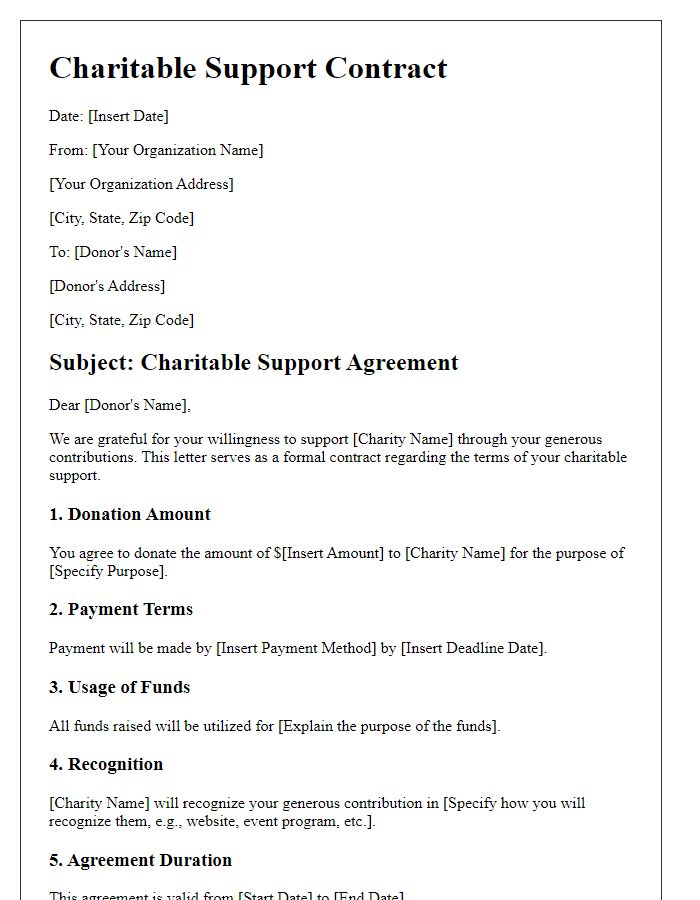

Donor and Recipient Information

The charitable donation agreement outlines essential details of the arrangement between the donor and recipient organizations. The donor, typically an individual or entity, contributes financial resources or goods to support a particular cause or non-profit initiative. The recipient organization, often a registered non-profit or charity, is designated to utilize these contributions for specific projects, community programs, or relief efforts. Clear identification of both parties, including legal names, registration numbers, and contact information, is vital for transparency. Recording the purpose of the donation, whether it be for educational programs, healthcare initiatives, or disaster relief, provides a framework for accountability and ensures that the funds serve the intended mission effectively. Additionally, including provisions for tax-deductible status under IRS guidelines enhances the donor's incentive to contribute.

Donation Description and Value

Charitable donations often involve specific descriptions and valuations to ensure transparency and compliance with legal requirements. A donation description should include the item or service being offered, along with its condition and any applicable restrictions. For example, a donation of art could be described as a "framed oil painting titled 'Autumn Landscape' by local artist Jane Doe, measuring 24 x 36 inches, in excellent condition." The value of the donation should be assigned based on a fair market assessment, as determined by appraisers or industry standards. For the aforementioned painting, an estimated value of $500 may be provided based on recent sales of similar works by the artist. This detailed approach helps both donors and charities maintain accurate records for tax purposes and ensures clarity in the donation process.

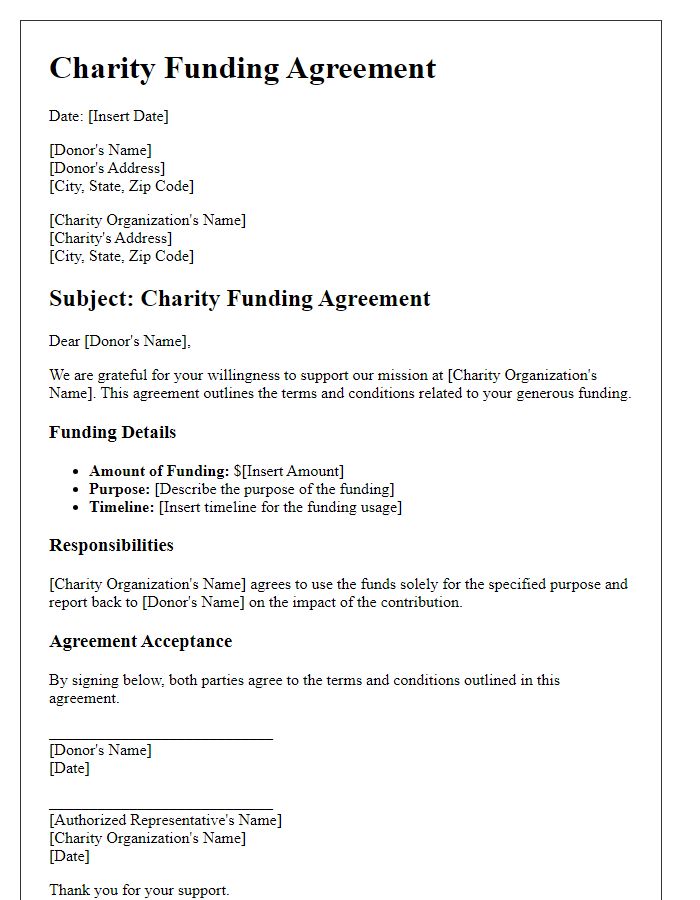

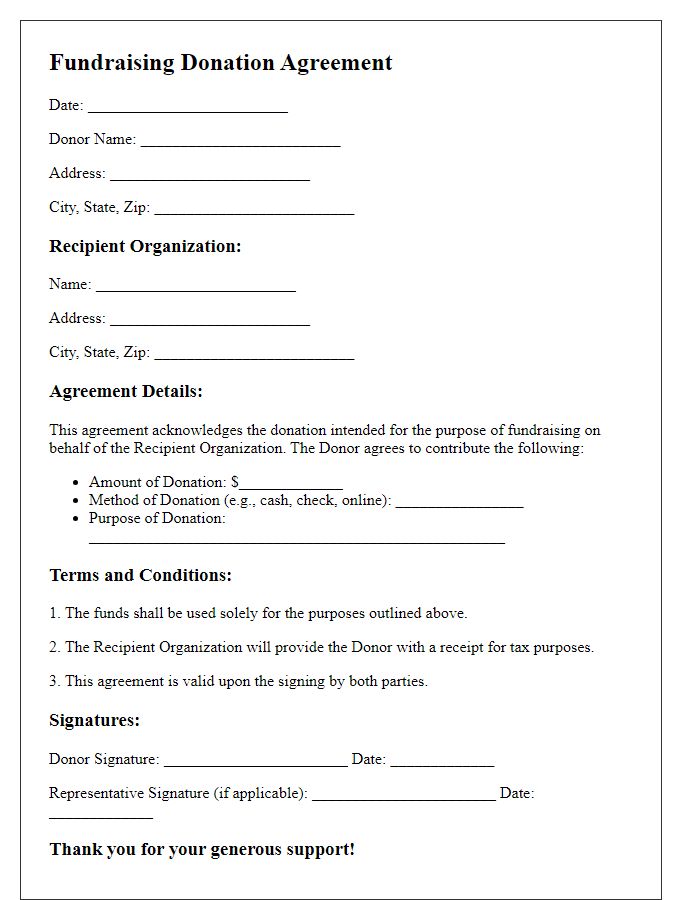

Terms and Conditions

Charitable donation agreements establish the framework for contributions made by donors to nonprofit organizations, ensuring both parties understand their rights and responsibilities. Contributions often range in value, with percentages allocated to various programs such as education, healthcare, or community services. Nonprofit organizations, registered under Section 501(c)(3) of the Internal Revenue Code, must adhere to specific regulations governing the use of donated funds. Donors can specify the intended use of their contributions, impacting initiatives like food programs for underprivileged communities or scholarship funds for deserving students. Additionally, tax deductibility of donations is a significant factor, as individuals and businesses may receive tax benefits based on the value of their contributions. Clear documentation of the donation terms, including payment schedule, allocation of funds, and reporting obligations, enhances transparency and fosters trust between the donor and the charitable organization.

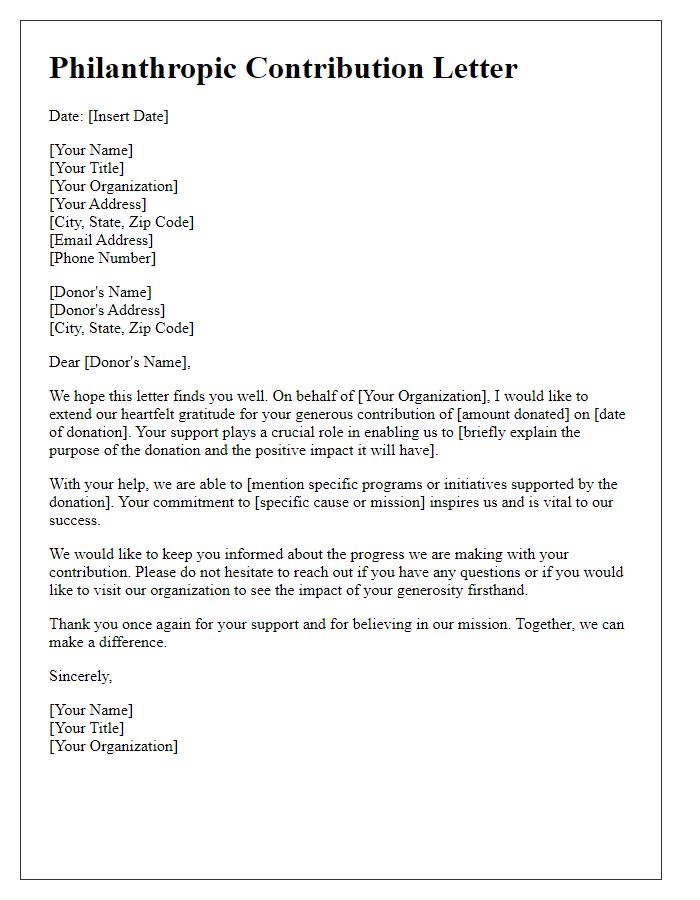

Purpose and Use of Donation

Charitable donations play a crucial role in supporting various causes, organizations, and communities in need. Donations, whether monetary or in-kind, are intended to fulfill specific purposes such as funding public health initiatives, providing educational materials, or supporting disaster relief efforts globally. The intended use of these donations should be clearly defined, with recipients outlining the allocation towards operational expenses, program development (including outreach and service delivery), and community engagement activities (aimed at raising awareness or fostering participation among beneficiaries). Furthermore, transparency in reporting the allocation of funds ensures trust between the donor and the receiving organization, fostering long-term partnerships for continued impact.

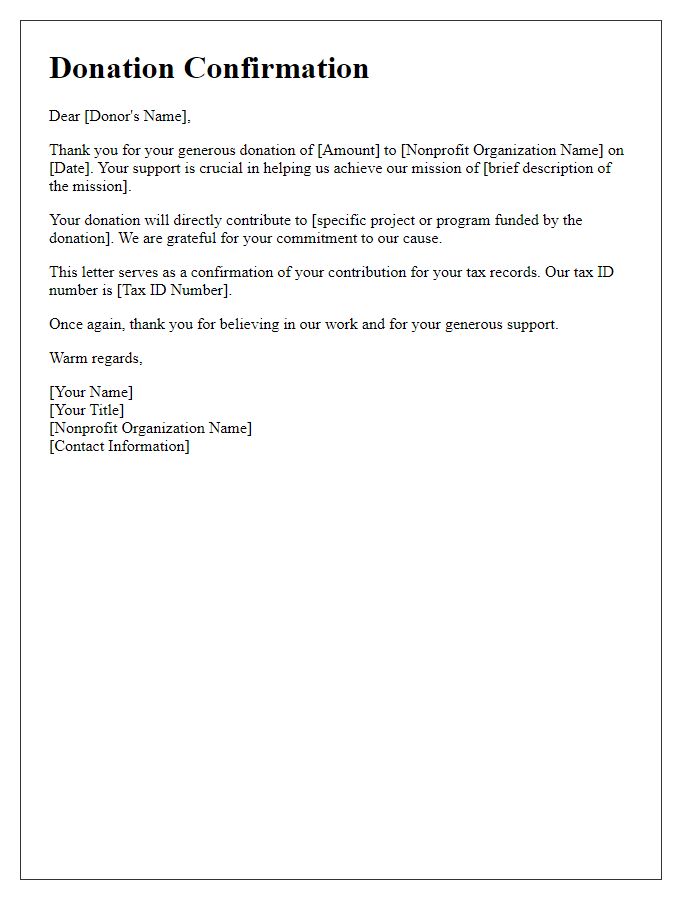

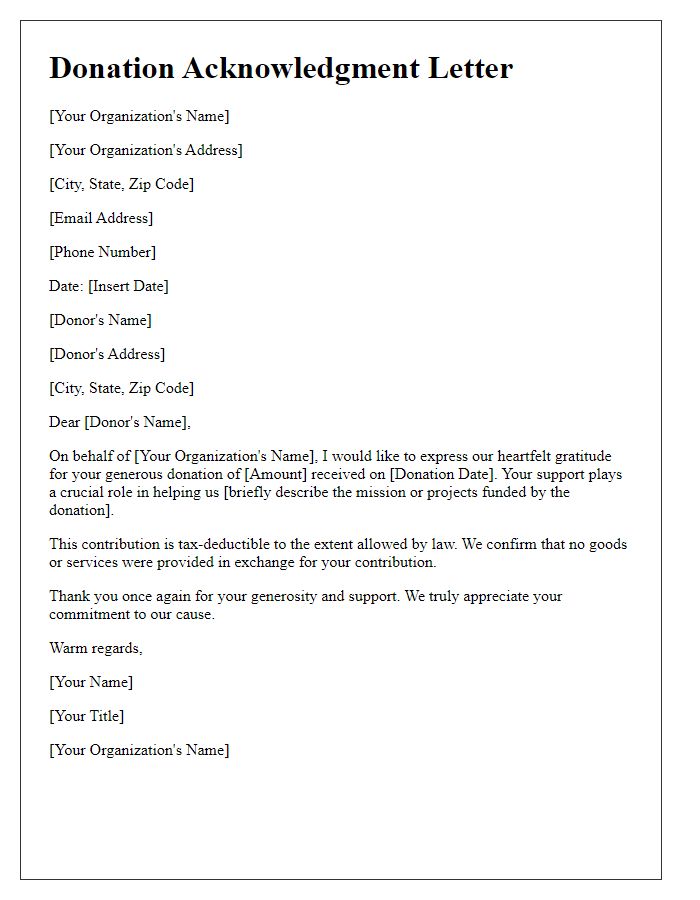

Acknowledgment and Receipts

Charitable donation agreements play a crucial role in formalizing contributions to nonprofit organizations and establishing clear communication between donors and recipients. An acknowledgment letter serves as a critical document, showcasing both appreciation for the donor's generosity and providing necessary details for tax purposes. Key elements include the donor's name, address, and the IRS tax-exempt status of the organization, often designated as 501(c)(3), ensuring that the donation is eligible for tax deductions. Specifics of the donation, including the amount, date, and purpose, must be outlined to maintain transparency. Receipts typically contain unique identifiers or serial numbers, benefits for the donor, and guidelines on how funds will be utilized within the nonprofit's mission, such as education or healthcare initiatives. These documents not only strengthen relationships but also encourage sustained giving by demonstrating accountability and impact.

Comments