Are you feeling frustrated after having your insurance claim denied? You're not alone; many people face this challenging situation and wonder what steps to take next. Crafting a well-structured appeal letter can be the key to getting the coverage you deserve and understanding the reasons behind the denial. Join me as we explore how to effectively appeal an insurance claim denial and increase your chances of a positive outcome!

Clear identification of the policyholder and policy details

In an insurance claim denial appeal, it is essential to clearly identify the policyholder, including full name, address, and contact information. The policy details must include the policy number, type of coverage (such as auto, home, or health), and the date the policy became effective (often noted in initial policy documentation). Important dates related to the claim, such as the date of the incident and the date the claim was filed, should be highlighted for reference. Any relevant claim numbers provided by the insurance company during initial correspondence should also be included, allowing for streamlined communication regarding the appeal process. It's crucial to maintain a professional tone and ensure all necessary identifiers are explicitly stated, helping the insurance provider quickly locate the pertinent information related to the appeal.

Concise explanation of denial reasons

Insurance claim denials often stem from various reasons. Common factors include insufficient documentation, where policyholders may fail to provide necessary evidence for claims; policy exclusions, which refer to specific scenarios or items not covered under the policy; and claim limits, where the requested amount exceeds the coverage limits set in the policy agreement. Additionally, delays in filing claims can lead to automatic denials, as many insurance providers require prompt reporting following an incident. Understanding these denial factors is essential for appealing decisions effectively.

Presentation of supporting evidence and documentation

Filing an insurance claim denial appeal requires a meticulous approach, emphasizing the presentation of supporting evidence and documentation. Essential documents, such as the original claim form submitted (date of submission), the insurance policy outlining coverage details (policy number), and any previous correspondence with the insurance company (dates of letters or emails) are crucial. Additionally, medical records (including dates of treatments and providers), bills or invoices from healthcare services, and witness statements form a strong foundation for the appeal. Photographic evidence of property damage or loss, along with repair estimates or receipts, further substantiates claims, demonstrating validity and urgency. Each piece of evidence must be clearly labeled and referenced, ensuring that it aligns with the specifics of the denied claim. Attention to detail in organizing these documents enhances the likelihood of a successful appeal, encouraging a thorough reassessment by the insurance adjuster.

Articulation of facts and circumstances

An appeal for an insurance claim denial requires a clear presentation of facts regarding the incident and the reasons for the claim. The denial letter from XYZ Insurance Company, dated June 15, 2023, cited insufficient documentation and lack of coverage under policy number 987654321 as the basis for denial. The event occurred on May 20, 2023, when a severe storm caused significant damage to the roof of my property located at 123 Main Street, Springfield. All relevant documents, including photographs of the damages and a detailed repair estimate from ABC Contractors, totaling $15,000, were submitted on May 30, 2023. According to the policy details, coverage for storm damage was included, specifically for wind and water-related incidents, which distinguishes it from typical wear and tear not covered under the contract. An additional review of the terms clearly outlines that claims arising from natural disasters initiate a claim process regardless of prior documentation. This appeal seeks to rectify the misunderstanding and provide further evidence of coverage pertinent to the claim, ensuring fair treatment for the damage incurred.

Request for reconsideration and next steps

Submitting an insurance claim appeal involves a structured approach to challenge a denial effectively. Key elements of the appeal letter include a detailed explanation (180 days after receiving the denial notice) outlining the specific reasons for the original claim (policy number, date of service, and claim number). It's essential to reference pertinent documentation (such as medical reports or accident reports) that support the claim's validity. Emphasizing the policy coverage aspects clarifies how the claimed expenses align with the contracted services. Making a clear request for reconsideration, by addressing the letter to the designated claims department (such as Claims Review Unit of the insurance provider), can facilitate a thorough review process. Additionally, outlining potential next steps, such as seeking mediation or an independent review if the appeal is denied again, ensures a robust strategy for pursuing the claim further.

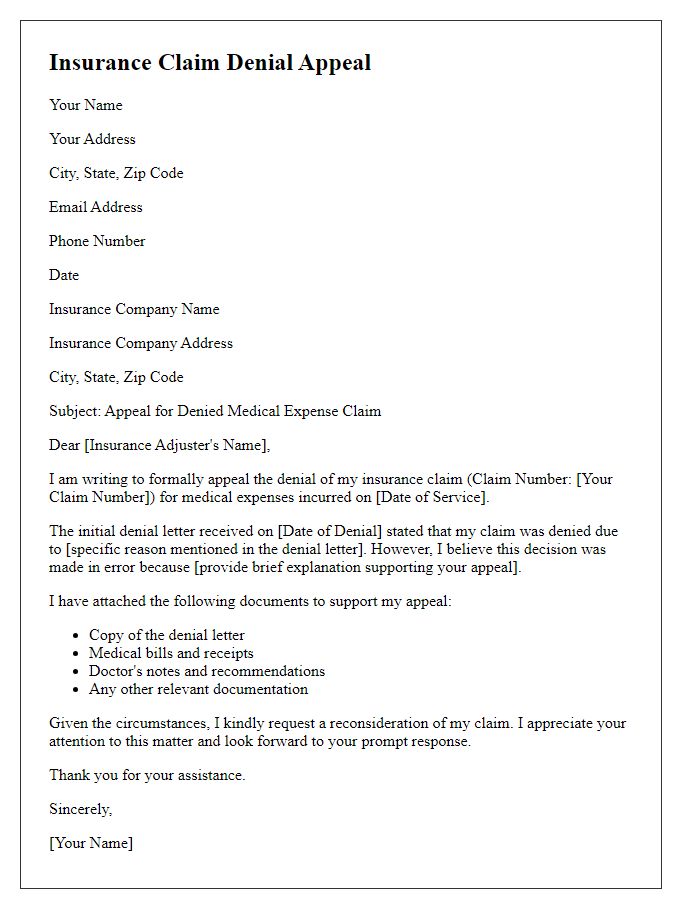

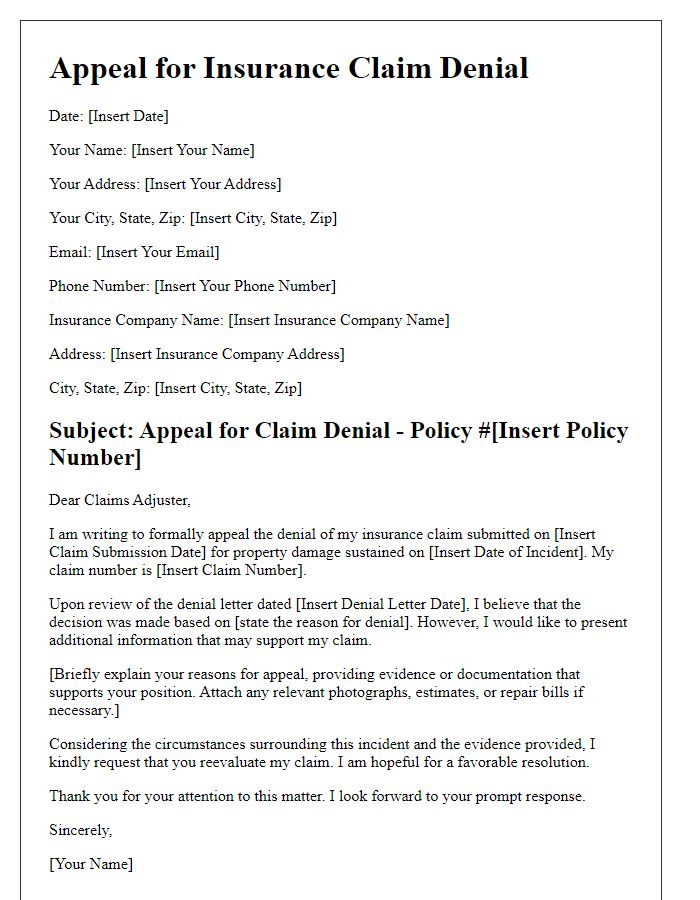

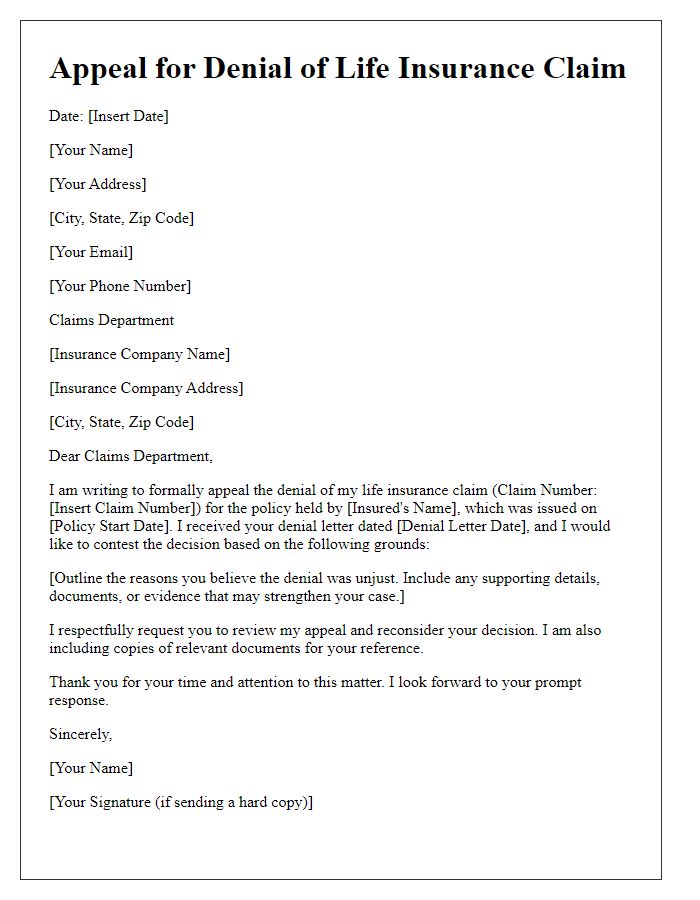

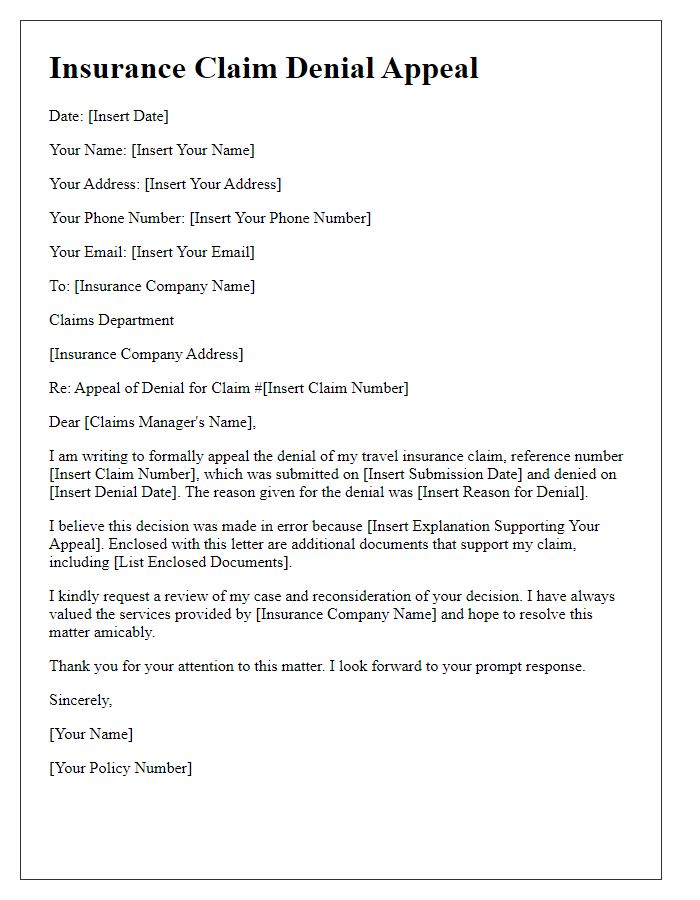

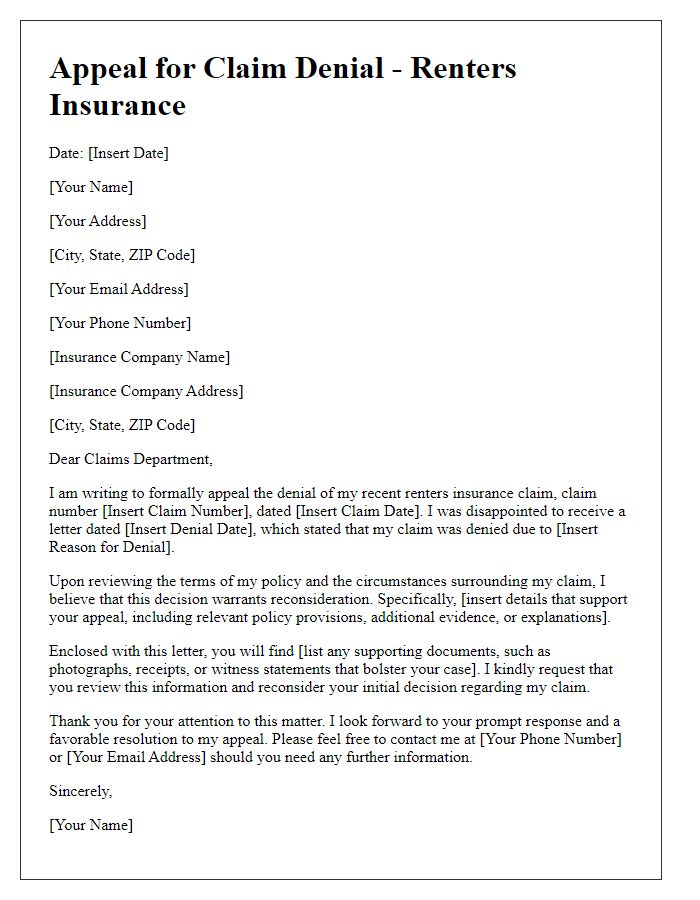

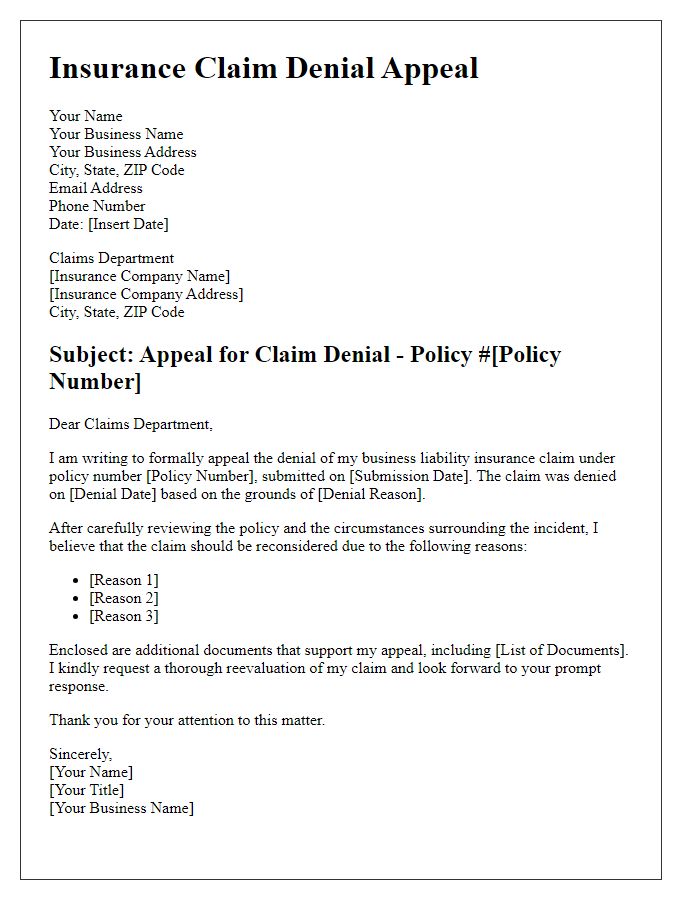

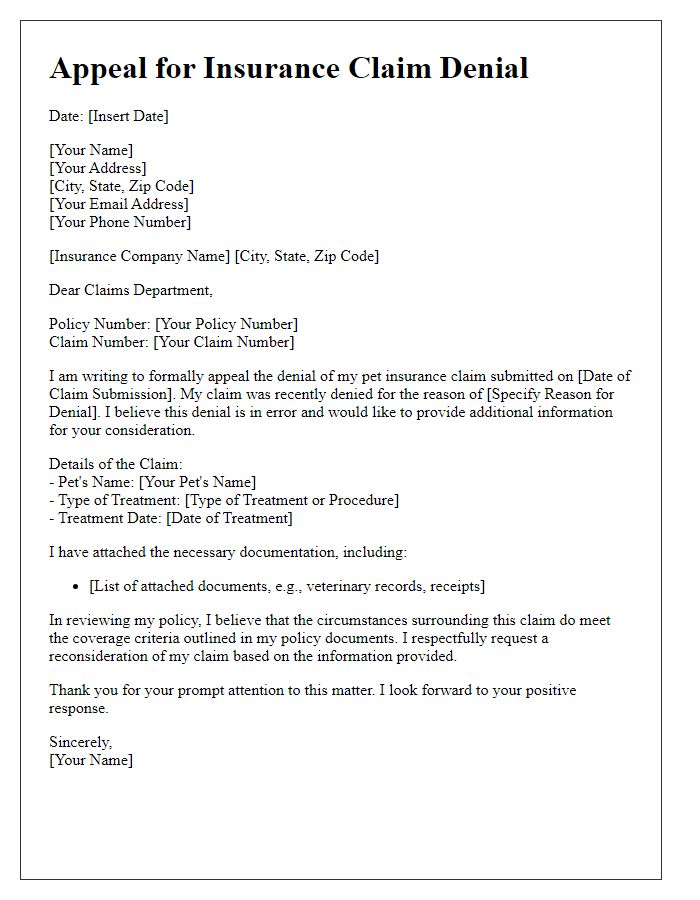

Letter Template For Insurance Claim Denial Appeal Samples

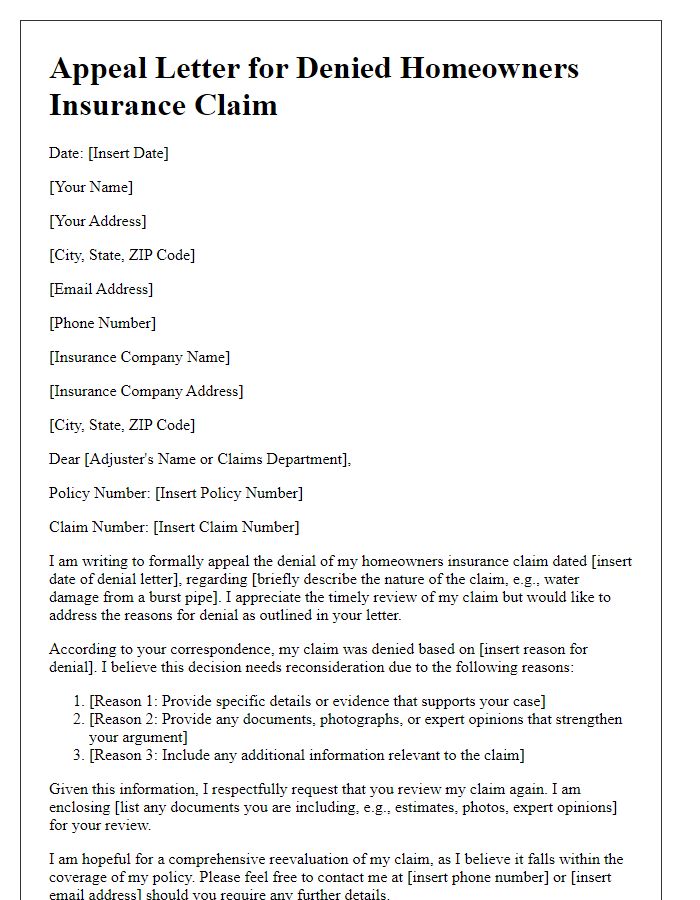

Letter template of insurance claim denial appeal for homeowners insurance

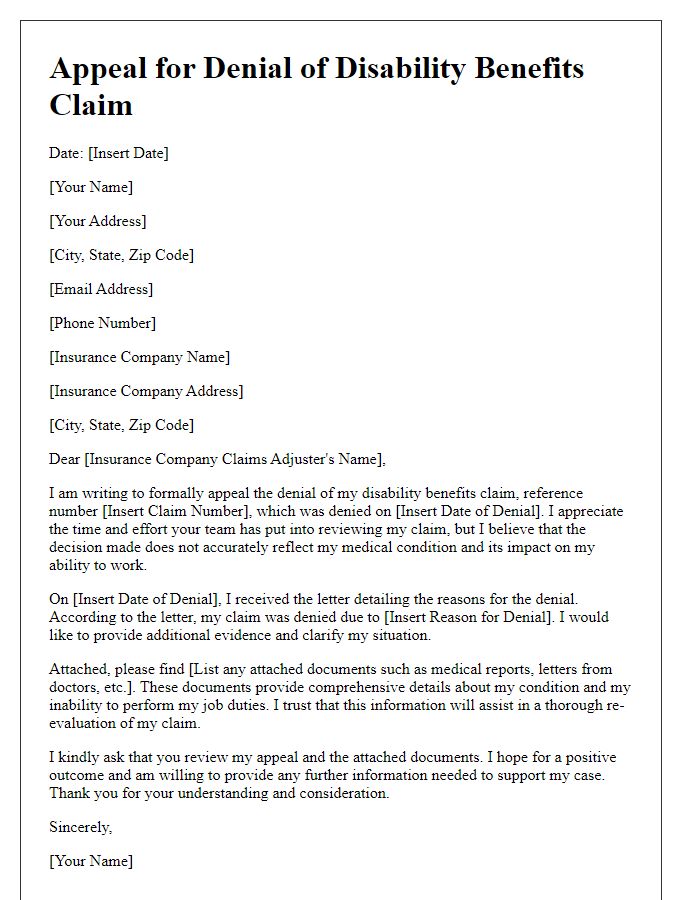

Letter template of insurance claim denial appeal for disability benefits

Comments