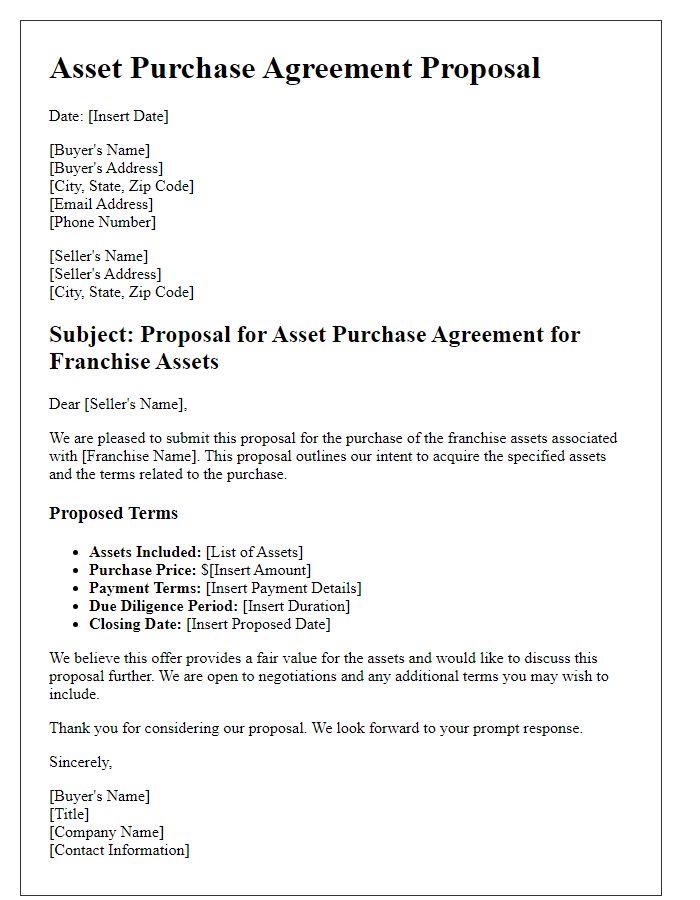

Are you considering making an asset purchase? It's a pivotal step that requires careful planning and clear communication. In this article, we'll explore a well-crafted letter template that will guide you through the process of drafting an asset purchase agreement proposal. Join us as we break it down and provide you with the tools you need to secure a successful transaction!

Parties Involved

In the context of an asset purchase agreement proposal, key parties involved typically include the Buyer and the Seller. The Buyer, an individual or entity, seeks to acquire specific assets, which may include physical property, intellectual property, or equipment, to enhance business operations or expand market reach. The Seller, often a business entity or individual, owns the assets and is willing to part with them, generally due to reasons such as restructuring, liquidity needs, or strategic refocusing. These parties may negotiate terms collaboratively, focusing on price, transfer of ownership dates, and any conditions precedent for the transaction. Understanding the legal and financial implications for both parties is essential for a successful agreement. Proper identification of all parties, through legal names and structures, ensures clarity and can prevent disputes in the transaction process.

Asset Description

The asset description section of an asset purchase agreement proposal must include detailed information about the items being transferred. Specific assets may comprise machinery, intellectual property, inventory, or real estate. Each asset should be identified clearly, including serial numbers, models, and current condition details. For example, a piece of machinery such as a Caterpillar Excavator Model 320D, manufactured in 2018, should include specifications like operating hours and service history. Additionally, intangible assets such as patents, trademarks, or proprietary software must be explicitly stated, along with registration numbers and expiration dates. The physical location of tangible assets, such as a warehouse at 123 Industrial Avenue, Chicago, Illinois, must be provided to clarify where the assets can be inspected before transfer. Providing this information ensures transparency and aids in the evaluation of the asset's fair market value and potential liabilities.

Purchase Price and Payment Terms

The purchase price for the property located at 123 Main Street, Springfield shall be set at $500,000. Payment terms will include a substantial earnest money deposit amounting to 5% of the purchase price ($25,000), due within five business days of the acceptance date of the asset purchase agreement. The remaining balance of $475,000 will be financed through a 15-year fixed-rate mortgage at an interest rate of 4.5%, payable in monthly installments. The closing date for the transaction is proposed for June 30, 2023, contingent upon satisfactory completion of due diligence and any necessary inspections. Additional costs associated with the transaction, such as title insurance and closing fees, will be equally shared by both parties.

Representations and Warranties

The section on representations and warranties in an asset purchase agreement establishes crucial assurances provided by the seller regarding the assets involved in the transaction. Key statements may include the assertion that the seller holds clear title to the assets, free of liens or encumbrances. The seller must confirm compliance with applicable laws, such as local zoning regulations and environmental laws, particularly important in markets like California or New York. Sellers often warrant the condition of physical assets, whether machinery, intellectual property, or inventory, ensuring each asset meets specific quality standards. Financial representations may also be included, detailing the accuracy of financial statements and absence of undisclosed liabilities that could impact valuation. This section safeguards buyers by prompting due diligence and mitigating potential risks associated with undisclosed issues.

Closing Conditions and Date

The asset purchase agreement outlines essential terms for the acquisition of assets from one party to another. Closing conditions typically include satisfactory due diligence results, obtaining necessary regulatory approvals, and securing financing arrangements. A closing date is often stipulated, usually occurring within a specified timeframe following the completion of due diligence, typically ranging from 30 to 90 days. For instance, the proposed closing date may be set for December 15, 2023, contingent upon the successful fulfillment of outlined conditions. Additionally, the agreement should detail potential remedies for failure to meet these conditions, ensuring clarity for both buyer and seller regarding obligations and expectations.

Letter Template For Asset Purchase Agreement Proposal Samples

Letter template of asset purchase agreement proposal for real estate acquisition

Letter template of asset purchase agreement proposal for technology assets

Letter template of asset purchase agreement proposal for manufacturing equipment

Letter template of asset purchase agreement proposal for intellectual property rights

Letter template of asset purchase agreement proposal for business goodwill

Letter template of asset purchase agreement proposal for inventory purchase

Letter template of asset purchase agreement proposal for vehicle acquisition

Letter template of asset purchase agreement proposal for machinery assets

Letter template of asset purchase agreement proposal for retail business assets

Comments